Compound interest (or compounding interest) on a deposit or loan is the interest calculated on both the initial amount plus interest accumulated from previous periods. Compound interest can be thought of as the interest on interest.

Example: If you have an initial sum of AED 100 and it earns compound interest at 2% per year (compound period = yearly):

After 1 year you will have AED 102 in total

After 2 years – AED 104.

After 3 years – AED 106.1

After 4 years – AED 108.2

After 5 years – AED 110.4

After 6 years – AED 112.6

After 7 years – AED 114.9

After 8 years – AED 117.2

Figures rounded to 1 decimal place: Note that the interest added each year is not simply AED 2 (that would be simple interest). It is more than this, because the interest earned from previous years is added to each new year’s total before the new compound interest is calculated.

So the amount added each year does not stay the same, it increases. Depending on the interest rate (in this case 2%), the total grows slowly at first, but grows faster over time. It grows faster than simple interest, which is calculated only on the initial amount.

Compound interest can significantly boost investment returns over the long term. While an AED100,000 deposit that receives 5% simple interest would earn AED50,000 in interest over 10 years, compound interest of 5% on AED100,000 would amount to AED 62,889.46 over the same period. A difference of nearly AED 13,000. Most savings accounts pay compound interest. Fixed-income deposits pay simple interest.

Compounding Periods: When calculating compound interest, the number of compounding periods makes a significant difference. The basic rule is that the higher the number of compounding periods, the greater the amount of compound interest. The most commonly used compounding schedule for savings accounts is daily.

For home mortgage loans, or credit card accounts, it is monthly. Interest on an account may be compounded daily but only credited (added to the existing balance) monthly. It is only when the interest is actually credited that it begins to earn additional interest in the account.

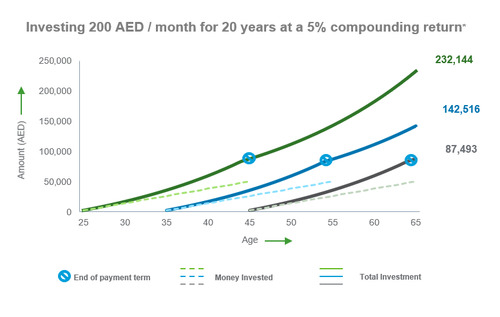

It is never too late to start investing!

Let the magic of compounding take care of your future

Invest AED 200 / month for only 20 years

Total Investment – AED 48,000

- Start at age 25 and get 384% return at age 65

- Start at age 35 and get 197% return at age 65

- Start at age 45 and get 82% return at age 6

* Please note that these are examples only and any potential returns set out herein are not indicative of actual returns that may be achieved in any investments that you may decide to make.