Table of Contents

In a rush? Read this summary:

- Critical illness insurance offers a lump sum payout to cover treatment, recovery, and living expenses—so you can focus on healing, not bills.

- With affordable premiums and easy claims, it’s a smart extension to have on top of a regular health insurance plan.

- Choosing the right plan means checking illness coverage, payout flexibility, and global treatment access for complete peace of mind.

Are you still wondering if it is worth getting critical illness insurance? Medical treatment can be prohibitively expensive—treating cancer, heart disease, or dozens of other serious illnesses can involve hospital visits, tests and even surgery, and the expenses can quickly add up.

With that in mind, the benefits of health insurance are undeniable. The increasing prevalence of lifestyle diseases leads us to seek advanced medical care and critical illness coverage helps ensure we can manage the cost of treatment, recovery, and daily expenses without any financial strain.

What is critical illness insurance

A critical illness insurance plan offers financial protection to a person who is diagnosed with major critical illnesses like cancer, stroke, renal failure, etc.

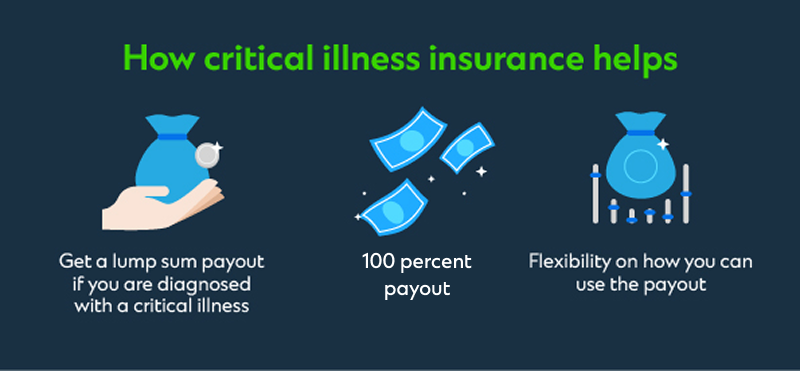

If somebody is diagnosed with such a disease, a critical illness protection plan offers a lump sum amount that covers:

- Medical treatment expenses

- Living expenses like rent, children’s education, loans

- Different liabilities

In short, health insurance benefits include safeguarding a person’s health and that of their family’s financial well-being. One can simply focus on recovery instead of worrying about financial strain and economic burden.

Benefits of critical illness insurance

Many people, especially the younger generations, still wonder if it is worth getting critical illness insurance. For those still in doubt, it helps to understand exactly the extent of coverage provided by critical illness insurance, which can be seen as an extension of one’s health insurance. Check out the details below.

- Financial protection: In case someone gets diagnosed with a critical illness mentioned in the insurance plan, like cancer, organ failure, stroke, etc., one can concentrate on healing instead of financial safety. One will receive the cost of treatment and diagnosis expenses and smoothly recover from his health issues.

- Lump-sum payment: The insured receives a fixed lump sum amount that can cover the treatment cost. Additionally, the person can utilise the lump sum however they see fit. For example, it can be used for medical expenses, household expenses, or alternative treatments.

- Short waiting periods: Critical illness insurance plans usually come with shorter waiting periods, unlike regular-term plans. Therefore, the insured receives the necessary financial assistance promptly.

- Affordable premiums: Compared to other insurance types, critical illness insurance offers good coverage at an affordable premium. Affordability helps people to protect themselves from expensive medical treatment costs.

- Easy claim process: Leading insurance companies offer a straightforward claim process with minimal paperwork and expedited access to funds. It’s a simplified approach that helps ensure a smooth process for dealing with the claim.

How to pick a suitable critical illness insurance policy

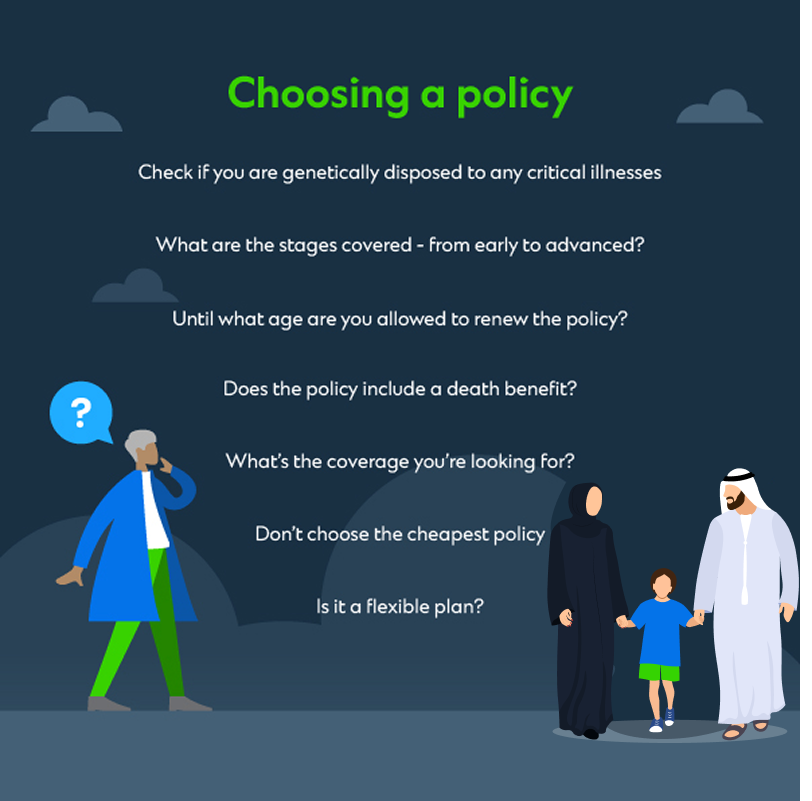

Are you convinced that you need a critical illness insurance plan , or are you still asking if it’s worth getting critical illness insurance? Probably by now, you have already understood health insurance’s meaning and its crucial benefits. Now, let’s explore key factors to consider when evaluating a critical illness insurance plan.

- Check the coverage amount: Does it cover your three to five years of income?

- Check covered illnesses: Does it include critical illnesses such as cancer, stroke, and heart disease?

- Check premium amount: Is your policy cost affordable? Will you be able to give a premium on a long-term basis?

- Check the payout flexibility: Will you be able to use the money as you see fit?

- Check the claim process: Is your chosen policy easy to claim?

- Check policy compliance: Is the insurer licensed by the UAE Central Bank and regulated by the Insurance Authority? This ensures that your policy is legally valid and protected.

- Check access to global treatment: Does the plan allow you to seek treatment internationally? Many UAE-based insurers offer access to a global medical network for critical illnesses.

Critical illness insurance is critical to safeguard your financial future

Critical illness can have a catastrophic effect on one’s life and puts a strain on the family’s finances. With the UAE experiencing rising cancer rates in recent years, according to The National , the least you can do is to protect yourself from its financial consequences as health challenges often strike when we least expect them to.

Speak to Standard Chartered’s relationship managers or contact us to learn more about our insurance offerings in the UAE.