Understanding Mutual Fund Factsheets for Smarter Investing

Know what to look for in a Mutual Fund factsheet such as fund performance and risk profile to make informed investment decisions.

Know what to look for in a Mutual Fund factsheet such as fund performance and risk profile to make informed investment decisions.

The information in a Mutual Fund factsheet can be a powerful tool to help you assess the viability of investing in it.

Mutual Fund are an attractive asset class for individual investors. They give investors exposure to a wide range of underlying assets with initial investment as little as USD 1,000 while offering them the opportunity to spread out their investment risk.

Before investing in a mutual fund, you should first study its factsheet. The factsheet reflects the personality of the fund – its objective, performance, risk profile and costs. The qualitative and quantitative data in factsheets can sometimes be overwhelming, so here are some key terms to look out for.

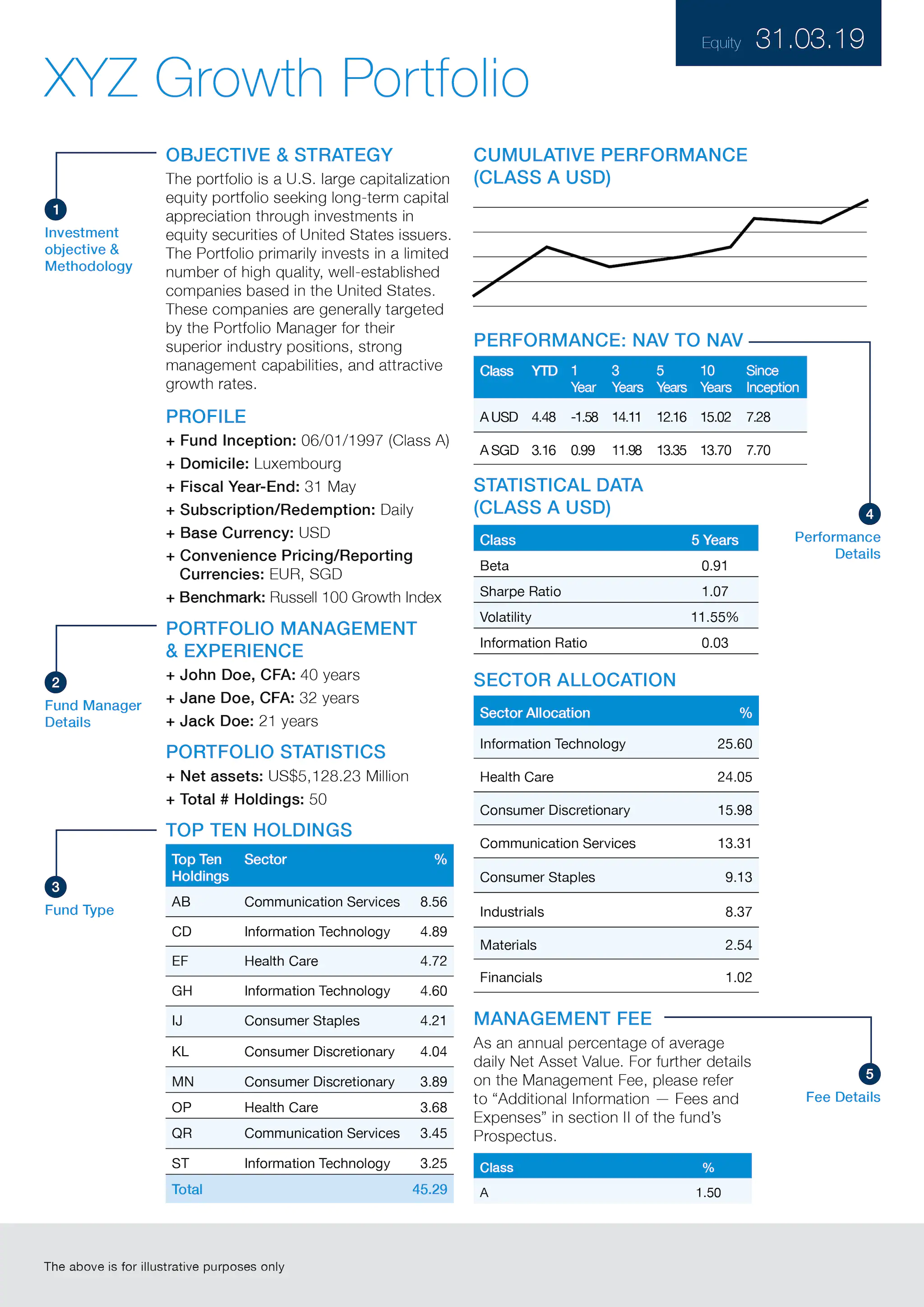

Get a better understanding of the fund’s characteristics, what it strives to achieve and the investment strategy it plans to adopt to meet its goals. Make sure the fund’s investment objective and methodology align with your risk appetite and desired return to avoid investing in a product that does not suit you.

When you invest in a mutual fund, you are essentially handing over your money to fund managers. Therefore, be sure to gather information about the credibility of the people who will be managing your hard-earned money, by studying the performance of past investments that the fund manager has run.

Funds differ in the way they are invested into and the way they generate income.

Asset allocation: Certain funds invest exclusively in equity or only in debt while others may adopt a more balanced approach by having a mix of both equity and debt. Along with this information, the factsheet will also highlight the industry-wise breakdown of where your money is being invested and the fund’s top 10 holdings.

Income feature: The factsheet can also tell you whether the mutual fund has an accumulation feature where the dividend/interest generated is reinvested, or a payout feature where this income is distributed to the investor.

While past performance of a mutual fund is no guarantee of its future performance, it is still useful to compare a fund’s performance with its peers’. Returns are typically shown over one-year, three-year, five-year and 10-year terms.

You can also look out for statistics such as Sharpe ratio and standard deviation. Sharpe ratio depicts risk-adjusted returns — the higher the ratio, the better. Standard deviation reflects the volatility of the fund over time — the lower the number, the better.

When you purchase a mutual fund, you accrue an annual fee that covers management charges, administrative charges and operating costs. Some factsheets show this as the Total Expense Ratio (TER) which measures what it costs the fund manager to operate the fund.

Generally speaking, Funds with higher assets under management (AUM) tend to have a lower TER.

Any investor who’s interested in mutual funds as an investment avenue should familiarise themselves with the factsheets to make better informed investment decisions.

For more information on our Wealth Management Solutions, get in touch with us now.

This article is brought to you by Standard Chartered Bank (UAE) Limited. All information provided is for informational purposes only. This information is neither an offer to sell, purchase or subscribe for any investment nor a solicitation of such an offer. This information is general and does not take into account a person’s individual circumstances, objectives or needs. Investments carry risk and values may go up as well as down. Standard Chartered is not liable for any informational errors, incompleteness, delays, or for any actions taken in reliance on information contained herein.