Achieve long-term financial success

Our portfolio approach improves your potential of achieving your wealth goals

Our portfolio approach improves your potential of achieving your wealth goals

Constructing your portfolio

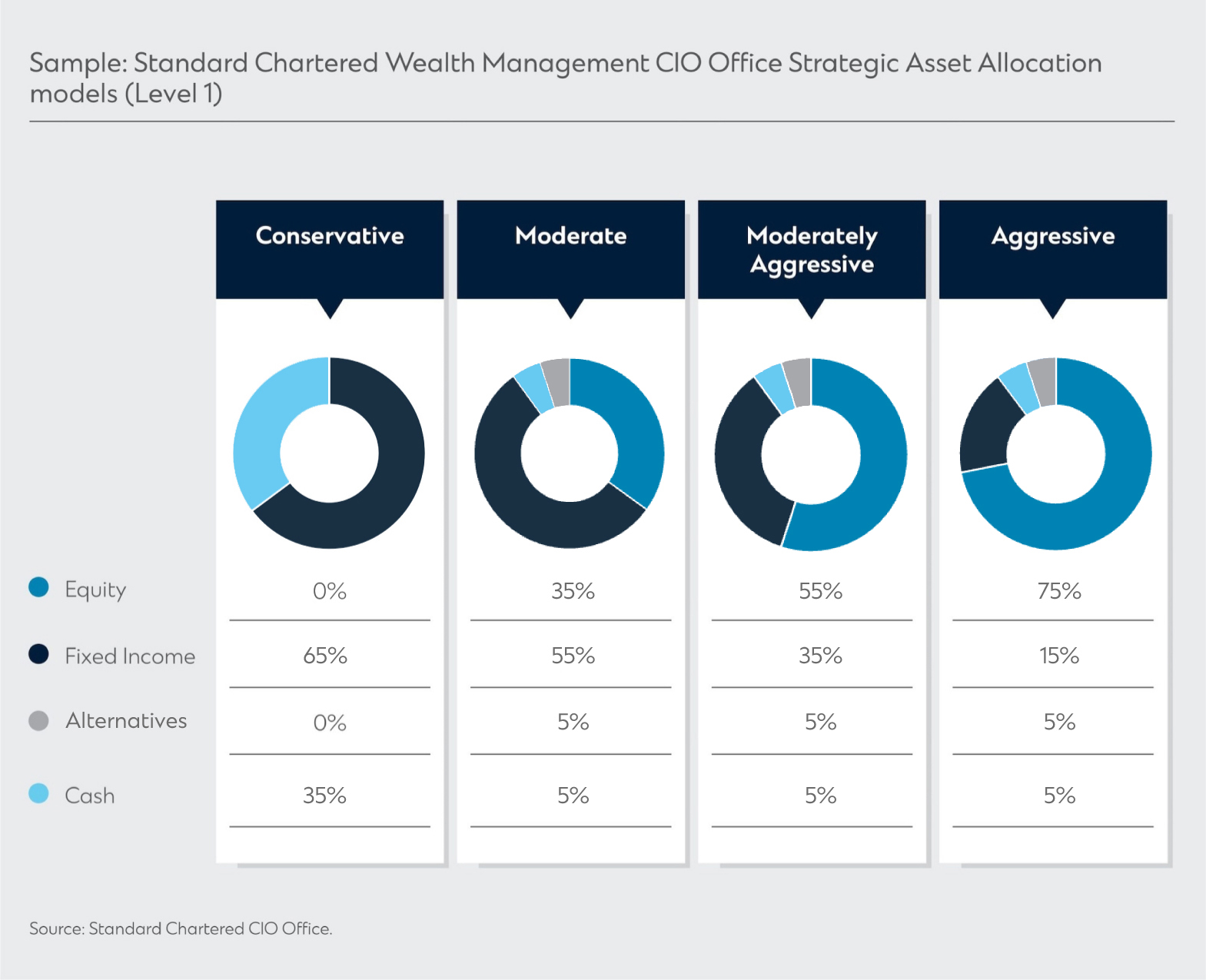

Using 7 year capital market assumptions, we derive optimal allocations to asset classes delivered through our Strategic Asset Allocation (SAA) models.

SAA models are then adjusted to incorporate our 6-12 month CIO house views to form the Tactical Asset Allocation (TAA) models.

Tactical Asset Allocation:

Tactical over or under-weight tilts are made to the SAA to take advantage of market trends or expectations to create our TAA.

This enhances returns and can reduce volatility by providing an active overlay to fine-tune asset allocation.

Strategic Asset Allocation (SAA) is an important determinant of long-term expected returns, especially in a long-only portfolio. It also offers a structured way to investing, guiding the allocation to each asset class, which helps to mitigate certain behavioural biases, such as over trading, excessive euphoria or pessimism. Our SAA models are diversified with the aim of producing a reasonable risk and return trade-off over a full business cycle. They are targeted to be efficient and produce the highest estimated return per unit of risk assumed, based on the long-term Capital Market Assumption’s (CMA) risk and return assumptions.

Tactical Asset Allocation (TAA) value-adds to enhance returns or reduce portfolio volatility by providing an active overlay to adjust or fine-tune asset allocation, taking advantage of market trends expected to play out over the next 6-12 months. Investors can take advantage of opportunities in assets which are experiencing extreme pessimism to tactically increase allocation, while taking profits during periods when assets are experiencing euphoria.

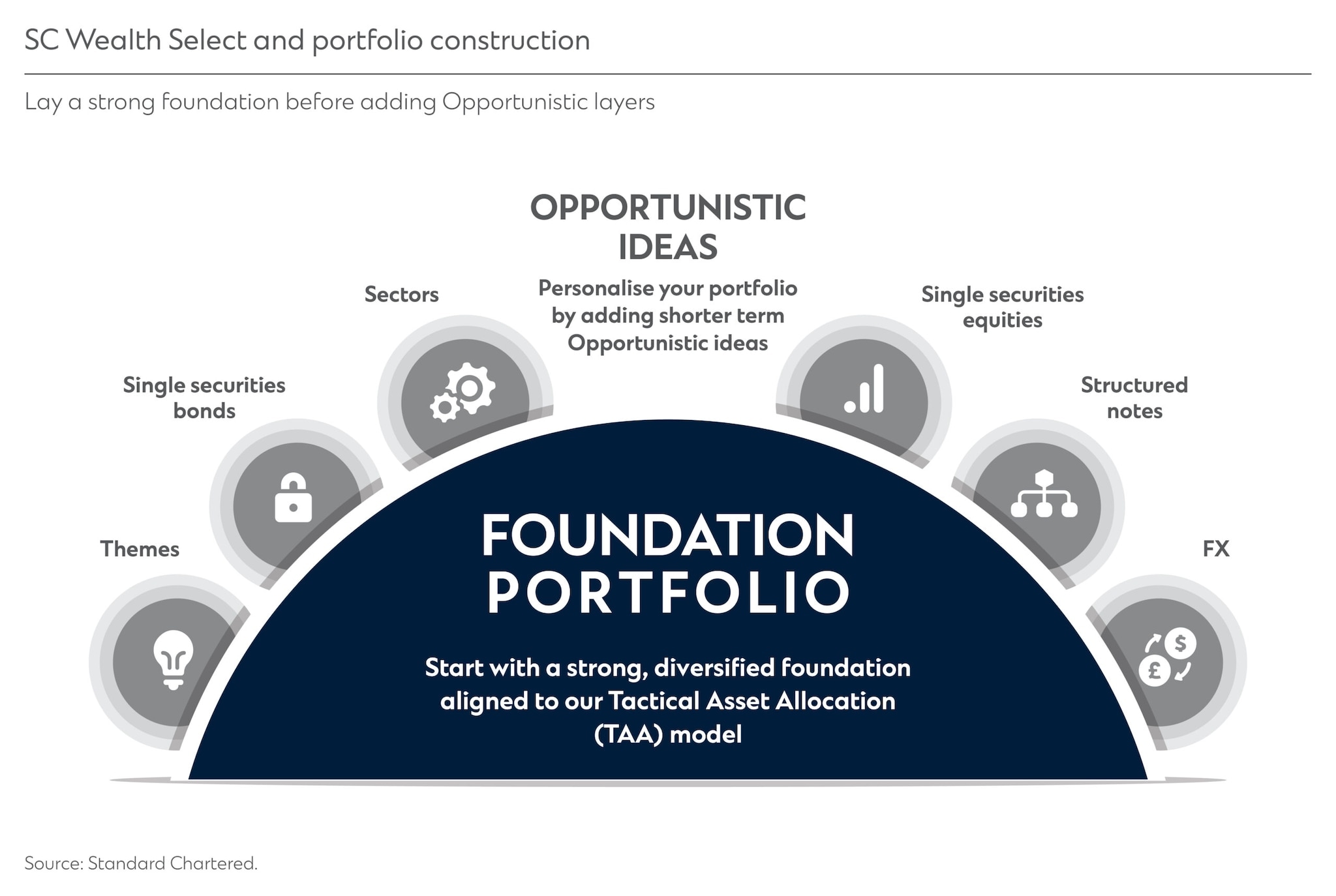

We believe every investor, when building their portfolio, should start with a strong Foundation Portfolio.

A Foundation portfolio is robust, stable and diversified. It is tailored to your circumstances and goals, and delivers returns through investment cycles.

We build Foundation Portfolio’s using our Tactical Asset Allocation (TAA) as a guide.

Opportunistic ideas are narrower in focus and shorter term. They are used to add income, diversify or take advantage of short term moves in markets.

How much to allocate to Foundation vs Opportunistic ideas is unique to each investor. At different life stages, your risk appetite and investment preferences may change, which our investment approach is flexible to accommodate.

We also acknowledge that at different life stages, your risk appetite and preference for certain asset allocations may change.

The decision of how much to allocate to Foundation versus shorter term Opportunistic ideas is unique to each investor.

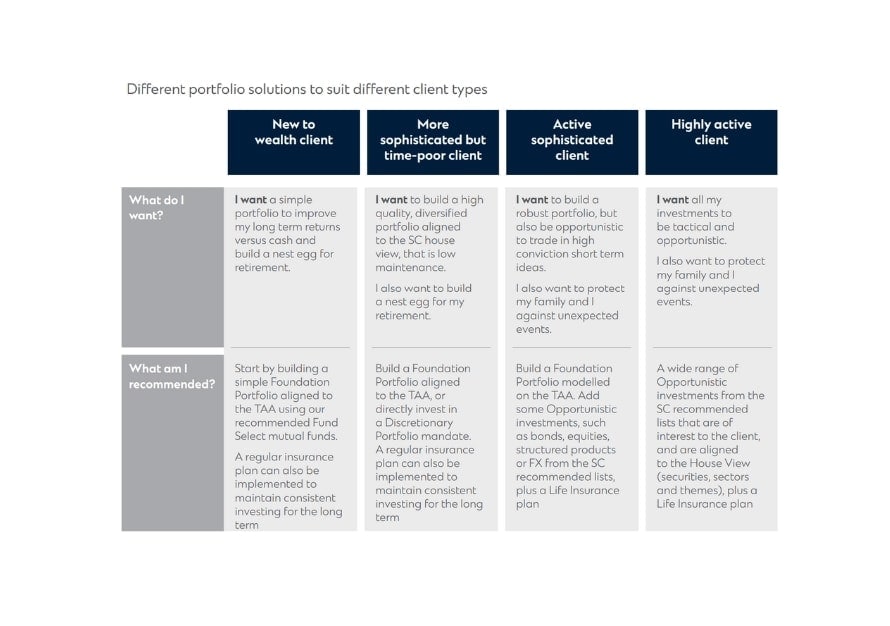

The table provides indicative allocations & depends on the type of investor you are, level of activity you wish to undertake on your portfolio, risk appetite & goals

A good protection plan should not only protect your wealth today, but also consider the value of your future earnings over your lifetime, in today’s terms. It should provide a safety net, shielding both your wealth and future earnings capacity, ensuring that your financial goals are not side-tracked or delayed due to unforeseen life events. And it is also a great tool to ensure systematic planning for future needs, including leaving behind a legacy for your loved ones.

Environmental, social and governance (ESG) is a way of investing, which considers potential ESG risks and opportunities, alongside traditional financial analysis. It can be applied in both the Foundation portfolio and Opportunistic investments. In terms of allocations in your Foundation, there are ESG integrated funds which can be either multi-asset, equities or fixed income focused. These funds take into consideration material environmental, social and governance factors. In terms of Opportunistic ESG investments, these fall under sustainable thematic ideas, such as climate change, water, electric vehicles. There are also single securities available which have a high ESG score.

Investing in overseas assets generates diversification benefits, but also means investors become exposed to currency risks of their assets relative to their future liabilities. The impact of this exposure is factored into the SAA construction process.

When deciding whether to hedge the currency exposure, it is important to understand the implications on the potential volatility of the holdings in local currency terms. Our recommendation for bonds, absent a strong view on currency performance, is generally to hedge the currency exposure, where FX moves can easily dominate realised returns. However, for equity holdings, we would generally leave the currency exposure unhedged.

Employing leverage has the potential to increase returns on an asset or a portfolio if the return is above the client’s funding cost. However, leverage can magnify losses as well. If the value of the investment holdings declines, then leverage magnifies the portfolio loss. As such, employing leverage increases the overall volatility of the portfolio.

There are 4 considerations when it comes to employing leverage and to what extent. These relate to both the nature of the asset or portfolio being leveraged and the client’s ability to weather different outcomes:

Know more about wealth portfolio approach

PURPOSE

PRINCIPLES

This is to inform that by clicking on the hyperlink, you will be leaving www.sc.com/bh and entering a website operated by other parties:

Such links are only provided on our website for the convenience of the Client and Standard Chartered Bank does not control or endorse such websites, and is not responsible for their contents.

The use of such website is also subject to the terms of use and other terms and guidelines, if any, contained within each such website. In the event that any of the terms contained herein conflict with the terms of use or other terms and guidelines contained within any such website, then the terms of use and other terms and guidelines for such website shall prevail.

Thank you for visiting www.sc.com/bh