Emerge Stronger

3 Strategies to Build Financial Cushions now and Emerge Stronger for the Next Recession

3 Strategies to Build Financial Cushions now and Emerge Stronger for the Next Recession

The COVID-19 crisis has definitely taught us a number of life lessons. One key takeaway is no one can say that they are fully protected for certain — whether from the virus or from the economic effects of a major financial downturn.

For those of us fortunate enough to still have our health, jobs, and maintain our lifestyles, we have survived this financial downturn relatively unscathed thus far, but what can we do to prepare for and protect ourselves from the next one? How do we emerge stronger from COVID-19’s lessons?

The answer is to build a financial cushion for you and your family’s needs and requirements.

With or without COVID-19, markets are cyclical, and economies go through boom-and-bust cycles, with major regional or global financial downturns happening every decade or so.

When a recession strikes, it is often accompanied by industry disruptions. And despite our best efforts towards continuous learning, certain job families could soon become irrelevant. Studies predict that by 2030, as much as 20 million jobs could be replaced by robots. This includes jobs in the manufacturing, cash services and food & beverage sectors, as companies increasingly rely on industrial robots and automation.

Roles in the knowledge industry are not spared either. Roles in legal, accounting and finance, amongst many others, are also at high risk of being replaced by artificial intelligence^.

When redundancy occurs, we may not have enough savings to tide us through prolonged unemployment. To make matters worse, the value of our investments may have plummeted, and cashing them out would be of little use.

Knowing this, we should prepare financial safety nets that can cushion our fall even in times of volatility. So, besides cash savings and investments, what are our other options? This may come as a surprise to some, but could be the answer.

Here are three cushioning strategies that may suit different financial profiles.

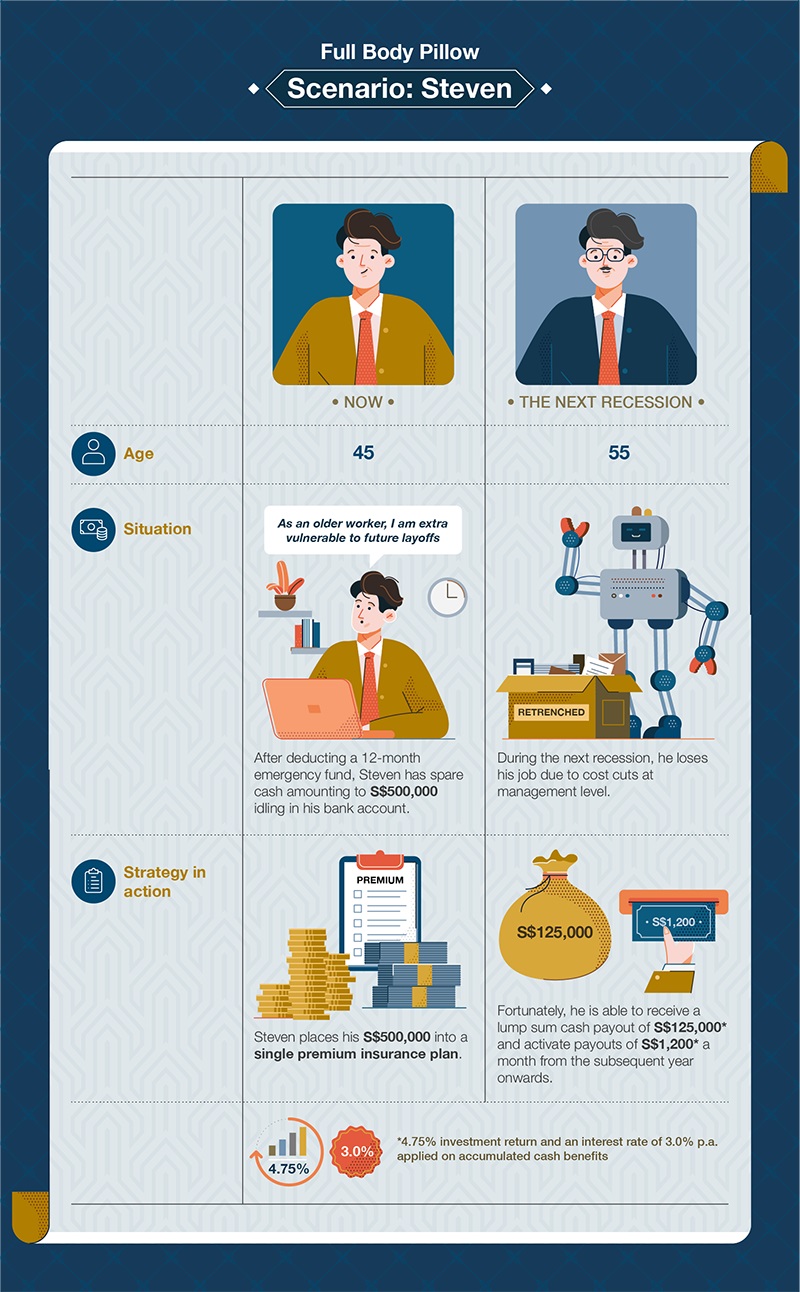

The strategy: Imagine an immensely plush, deluxe, full-body cushion to land on if you fall. Reassuring, isn’t it?

How it works: Deploy your savings to maximum effect by getting a single premium insurance plan offering either a guaranteed lump sum payout or recurring income in the future. Or, opt for a tactical combination of both! Timed well, these plans can pay out when the next recession hits, so that you can receive an income even during a downturn.

Who is it suitable for: Those with sufficient spare cash idling in their bank accounts. Ideally, you would want to secure a future payout high enough to sustain your needs and lifestyle, and that typically requires a significant sum as the premium.

Why is this a good strategy: This is the most comfort that money can buy, because you pay a single amount upfront and will not need to be concerned about setting aside money for future payments, yet get financial security for your future. Furthermore, it may be an effective way to put your savings to work, rather than leaving the cash idle in your bank accounts.

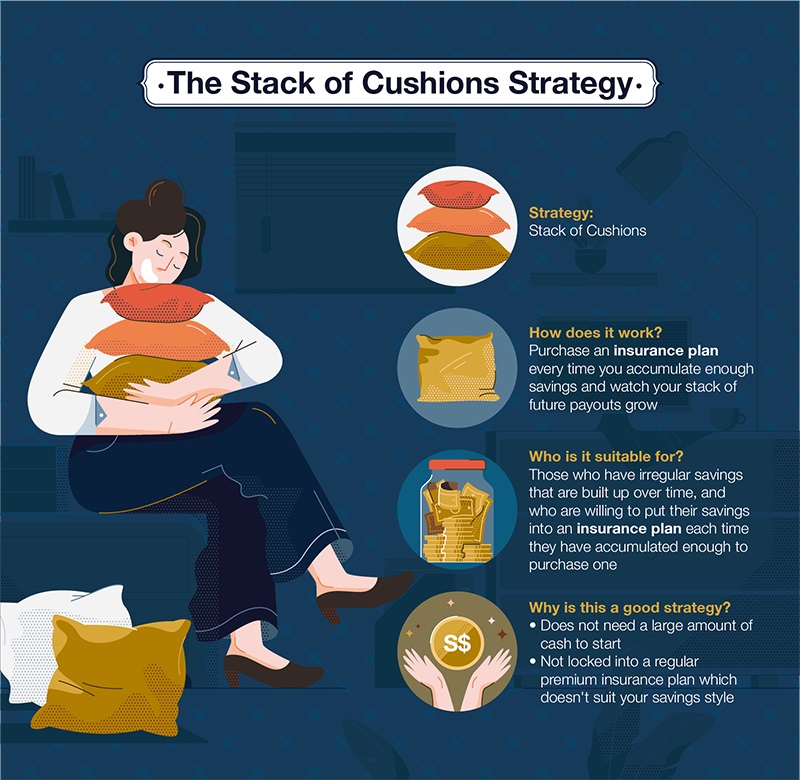

Scenario: Elaine, 40, is looking to build up her cushion while balancing the needs of her family and small home business. She is unable to commit a large lump sum upfront like Steven, but every time she manages to save up a bit of money, she puts it in an insurance plan. Over the years, she progressively builds up a “stack” of such plans. The next recession, these plans may reach their respective maturities and she can receive payouts.

The strategy: Imagine a small trickle of stuffing, filling up a cushion slowly. Initially, the cushion starts out thin, but over time it becomes much thicker and plusher. That’s how you afford financial cushioning in a slow and steady way.

How it works: Choose a regular premium insurance plan that you can contribute to in small monthly payments (premiums can be as low as S$80/month!) for a continuous period of several years. As long as you faithfully contribute that small amount each month to your insurance plan, your savings will gradually compound into a sufficient buffer against financial setbacks.

Who is it suitable for: Those with little savings at the moment but who wish to build up a financial cushion over time without taking on hefty commitments immediately. Think of this as a monthly subscription to your future financial security!

Why is this a good strategy: By forcing yourself to set aside a small amount of money each month, this strategy results in “paying your future self, first” before your funds flow into other wants and needs. With minimal intrusion on your current monthly cashflow, this strategy allows you to maintain a healthy emergency fund yet continue saving for big ticket items.

Scenario: Elaine, 40, is looking to build up her cushion while balancing the needs of her family and small home business. She is unable to commit a large lump sum upfront like Steven, but every time she manages to save up a bit of money, she puts it in an insurance plan. Over the years, she progressively builds up a “stack” of such plans. The next recession, these plans may reach their respective maturities and she can receive payouts.

The strategy: Imagine a small trickle of stuffing, filling up a cushion slowly. Initially, the cushion starts out thin, but over time it becomes much thicker and plusher. That’s how you afford financial cushioning in a slow and steady way.

How it works: Choose a regular premium insurance plan that you can contribute to in small monthly payments (premiums can be as low as S$80/month!) for a continuous period of several years. As long as you faithfully contribute that small amount each month to your insurance plan, your savings will gradually compound into a sufficient buffer against financial setbacks.

Who is it suitable for: Those with little savings at the moment but who wish to build up a financial cushion over time without taking on hefty commitments immediately. Think of this as a monthly subscription to your future financial security!

Why is this a good strategy: By forcing yourself to set aside a small amount of money each month, this strategy results in “paying your future self, first” before your funds flow into other wants and needs. With minimal intrusion on your current monthly cashflow, this strategy allows you to maintain a healthy emergency fund yet continue saving for big ticket items.

Scenario: Mark, 35, is a first-time father and is excited about his new phase of life. But he is unsure of his future commitments. He decides to put aside S$500 every month (a comfortable amount) into a regular premium plan, steadily growing his financial cushion. The next recession, he is the breadwinner supporting 3 growing kids and facing imminent pay cuts in his company. But thanks to the cushion he built up over a decade, he has a financial buffer which he can withdraw should he need it.

Financial cushions should be accessible to everyone, regardless of financial circumstances.

You don’t have to commit a huge sum immediately to enjoy financial cushioning; small amounts spread out over time can also contribute to a safety net. There is a strategy for everyone — you simply need to find your fit.

If you are unsure, reach out to us at Standard Chartered and we’ll help personalise a strategy that works for you.

As the saying goes, “If you get tired, learn to rest, not to quit.” Rest on your financial cushions and emerge stronger from this crisis!

The content on this page is for general information only and it does not constitute an offer, recommendation or solicitation of an offer to enter into any transaction or adopt any hedging, trading or investment strategy, in relation to any securities or other financial instruments. It has not been prepared for any particular person or class of persons and does not constitute and should not be construed as investment advice or an investment recommendation. It has been prepared without regard to the specific investment objectives, financial situation or particular needs of any person or class of persons.

You are fully responsible for your investment decision, including whether the investment is suitable for you. You should seek advice from a licensed or an exempt financial adviser on the suitability of a product for you, taking into account these factors before making a commitment to purchase any product or invest in an investment. Potential investors are required to complete a client risk profiling assessment to understand their risk appetite before taking up any investment products. Clients wishing to understand market trends can also speak to our in-house Investment Counsellor.

Standard Chartered Bank Brunei (“SC BN”) and Standard Chartered Securities (B) Sdn Bhd (“SCSB”) make no representation or warranty of any kind, express, implied or statutory, regarding this content or any information contained or referred to in this article. It is distributed on the express understanding that, whilst the information in it is believed to be reliable, it has not been independently verified by us, and we will not accept any responsibility or liability of any kind with respect to the accuracy or completeness of information in this article.

Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. Standard Chartered Securities (B) Sdn Bhd is incorporated in Brunei Darussalam with limited liability by the Registrar of Companies Reference Number RC20001003 and is licensed by the Brunei Darussalam Central Bank and authorised to conduct investment business (including Islamic investment business through an Islamic window).