Incentivising change with sustainability-linked loans

As environmental and social concerns strengthen their grip on finance, companies around the world are gravitating toward sustainability-linked loans—a behaviour-based debt instrument that incentivises borrowers to make good on their ESG targets.

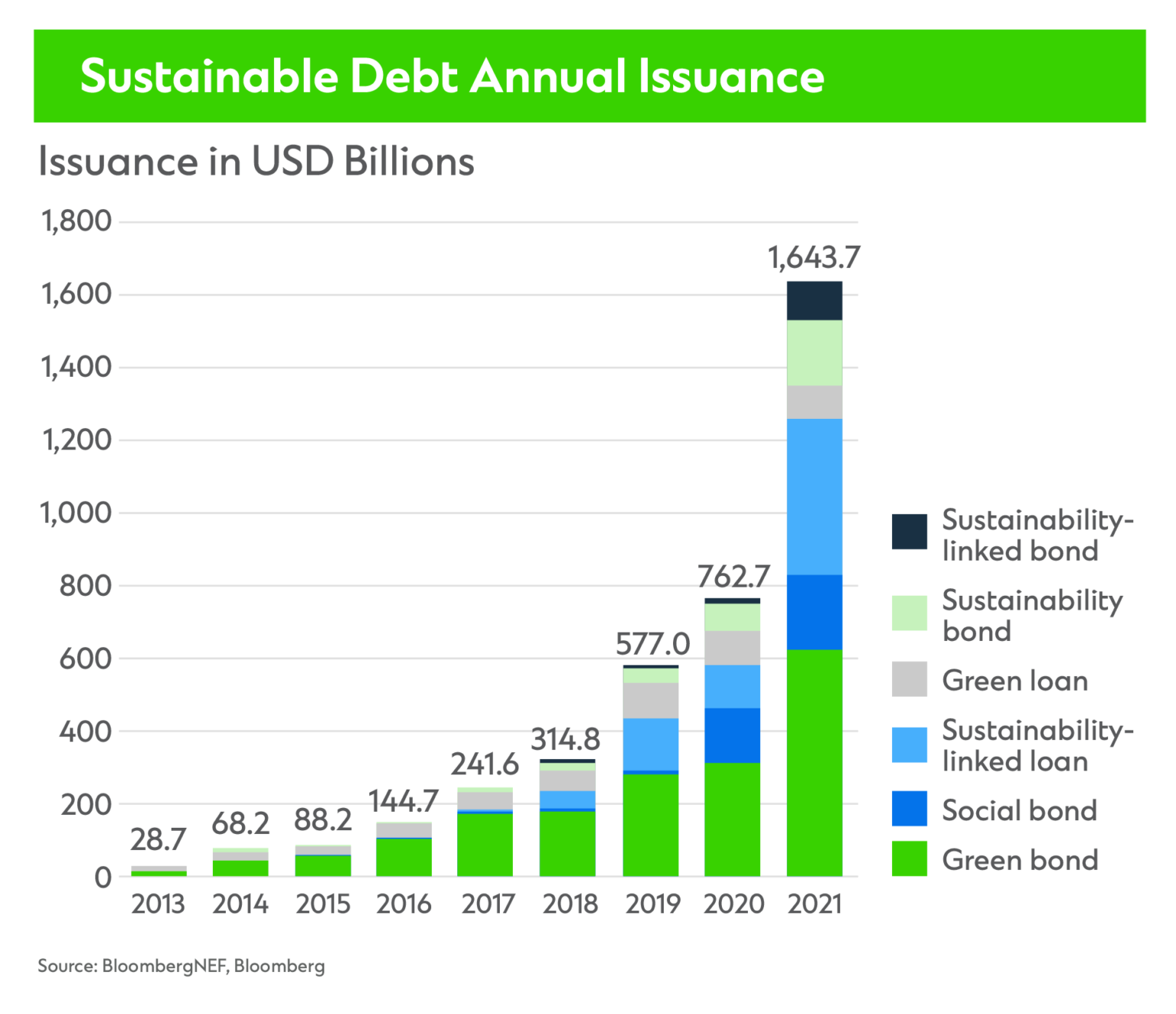

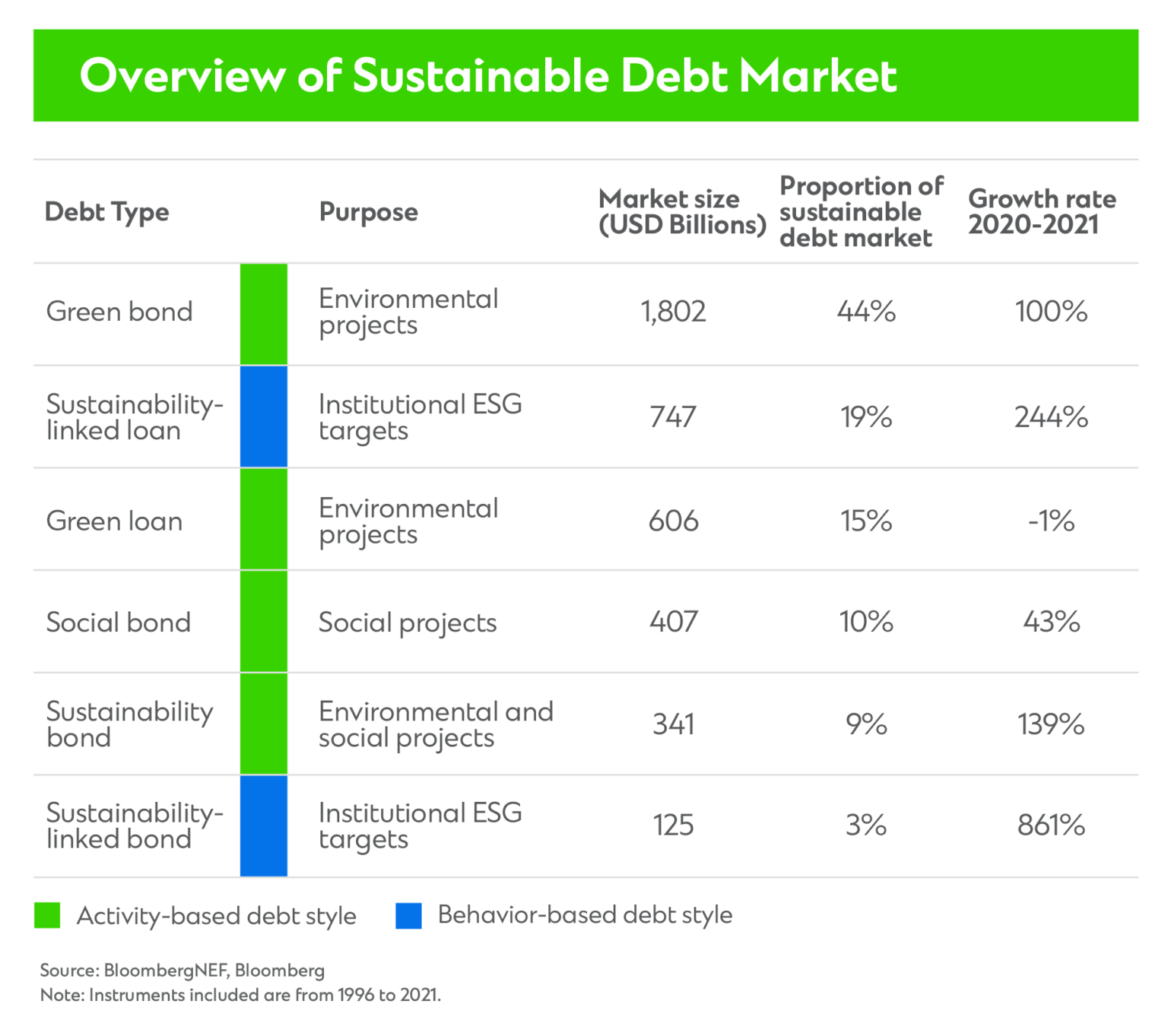

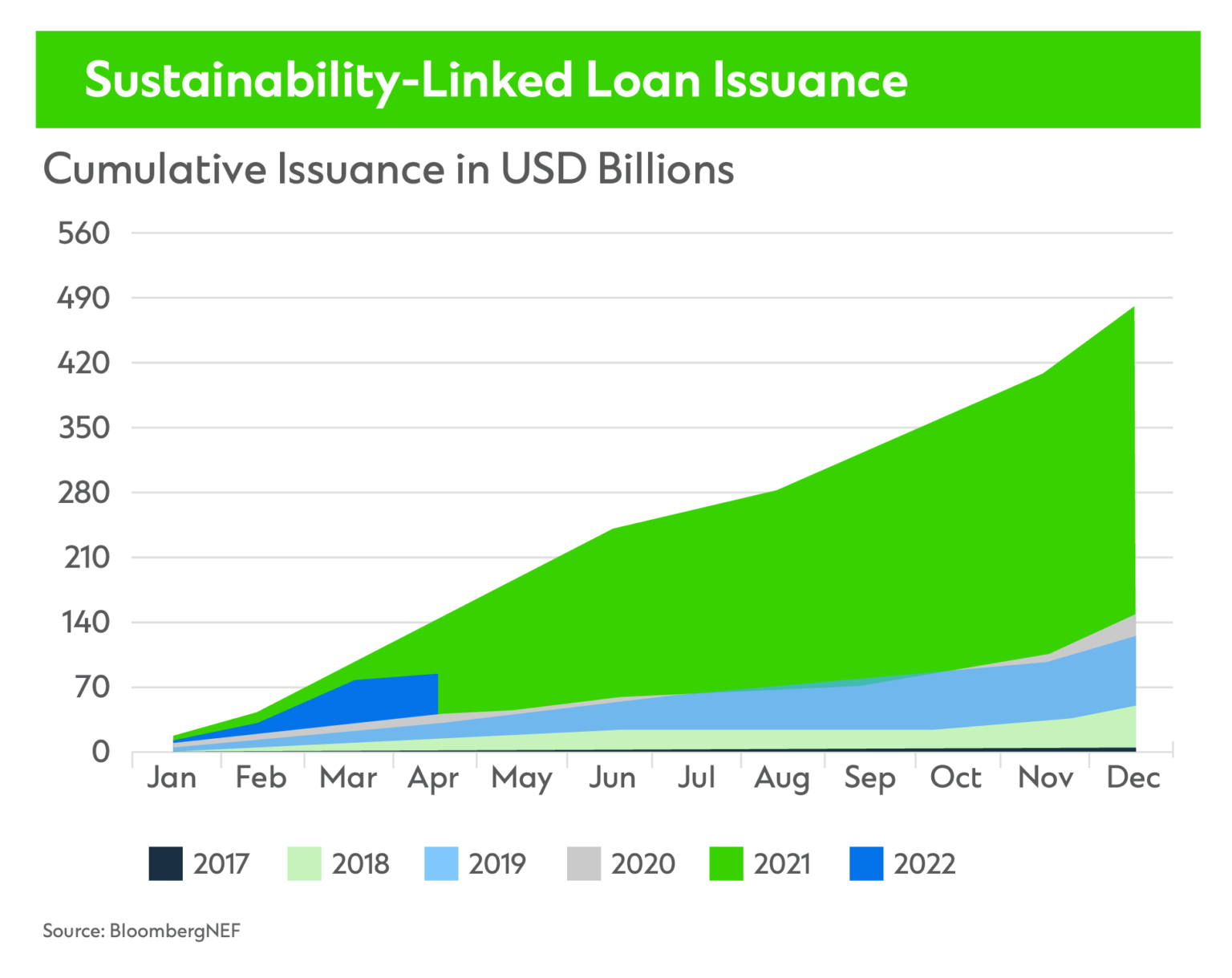

Sustainability-linked loans (SLLs) have gained considerable interest from borrowers and investors since their 2017 market debut. Issuance grew 244% last year,1 pushing the SLL market to USD747 billion and making it the second-largest asset class within sustainable debt after green bonds.

The rapid embrace of SLLs is due in large part to the additional flexibility they offer borrowers to allocate funds. Unlike many other forms of sustainable debt, borrowers are not restricted to invest in green or social projects only. In turn, SLLs appeal to a broader range of borrowers.

“The sustainability-linked structure moves away from use of proceeds by setting Sustainability Performance Targets at the company level” says Tracy Wong Harris, Head of Sustainable Finance Asia, Standard Chartered. “It’s a great tool for articulating a company’s sustainability ambitions because the deal structure requires borrowers to set key performance indicators up front and puts incentives and penalties in place to keep them on track.”

A single SLL deal structure can integrate several Sustainability Performance Targets. For instance, a borrower can set targets to reduce their greenhouse gas emissions by 4% per year over the duration of financing, improve its water efficiency by 5% and increase the number of women on its board. Every year, the company would need to show lenders how it performed against those targets.

If a borrower fails to meet their targets, it triggers a step-up in the interest rate. Meeting or exceeding those targets results in a step-down. This creates an effective reward-punishment mechanism, but only if the shift in interest repayment is substantial.

“If you hit the target, I give you a pricing incentive,” Harris says. “If you miss it, you have to pay a penalty. However, there are regional differences. Sustainability-linked loans are still relatively new in Asia, so most of them do not yet include penalties. Still, strong incentives go a long way in addressing environmental, social and governance concerns. As the market matures in this region, penalties will likely become more common.”

Reducing greenhouse gas emissions has proven the most popular Sustainability Performance Target for SLLs to date. In the first half of 2021, around USD96.5 billion worth of SLLs were tied to a borrower reducing emissions.2 Renewable energy, waste and water were also common focus areas. Broadly, environmental concerns accounted for nearly USD140 billion of SLL volume in the first half of 2021, social accounted for USD44.3 billion and governance made up USD20.5 billion.

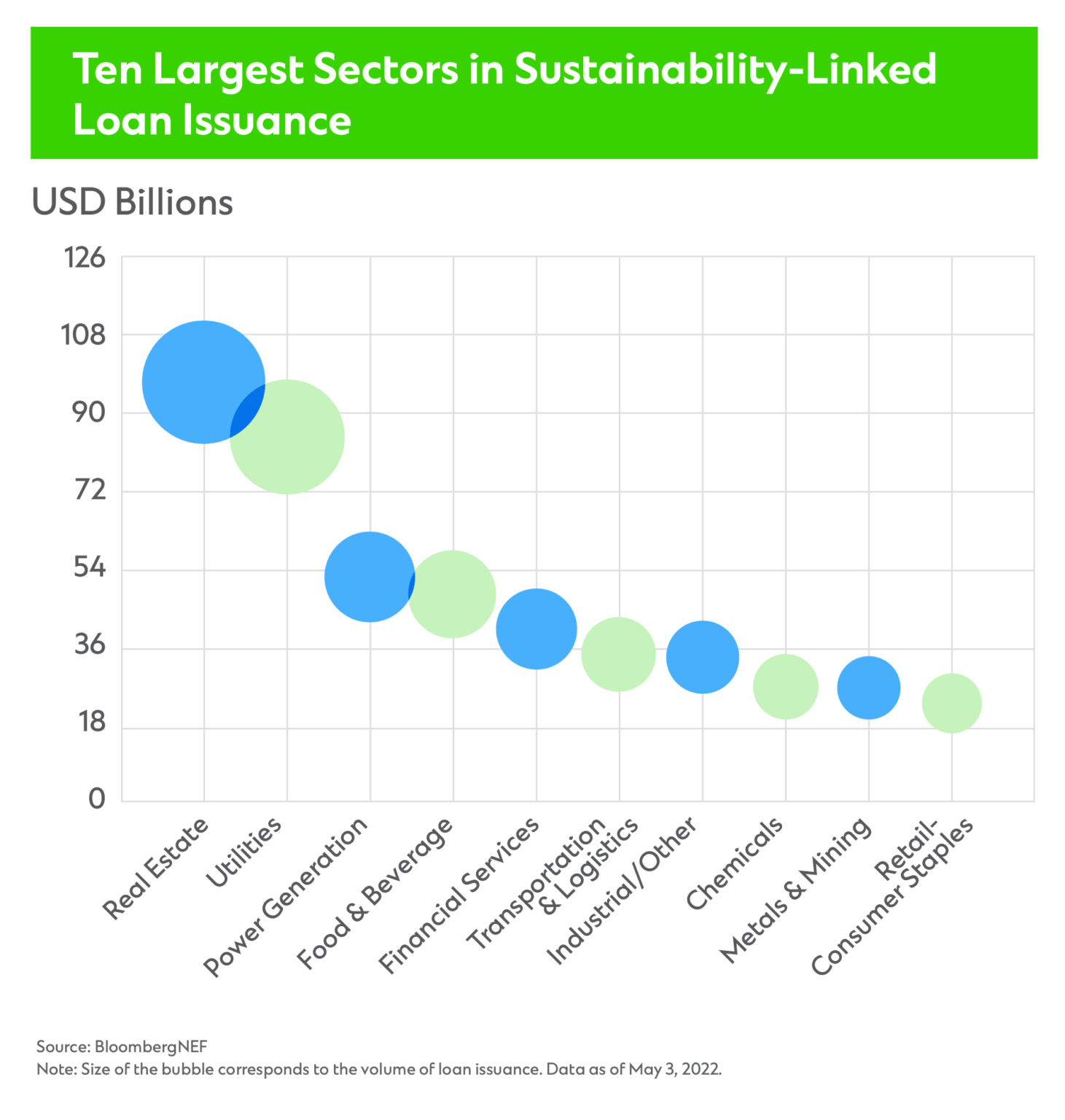

Given their broad appeal, the sectoral distribution of SLL borrowers is more evenly spread compared with green loans,3 showcasing their potential to reach hard-to-abate sectors.

Real estate companies lead the SLL market with USD97 billion worth of issuance as of May 2022, followed by utilities with USD84 billion.4 Yet other sectors including transportation and logistics, metals and mining, and chemicals are not far behind and account for a much greater share of total issuance than they do in the green loan market.

“Conventional companies from hard-to-abate sectors that struggle to tap the green-use-of-proceeds debt market can instead leverage sustainability-linked financing structures,” Harris says. “This creates an opportunity for meaningful change. By embedding decarbonisation and social targets into deal structures, we can hold borrowers accountable for their behaviour, putting them on course for a just transition.”

Beyond decarbonisation, versatility makes SLLs an ideal choice for borrowers who are keen to make a positive social impact. Such was the case with the West Kowloon Cultural District Authority (WKCDA)—the startup developing 40-hectares of cultural facilities in Hong Kong. As this project shifted from construction to operations, WKCDA needed a loan to meet its cashflow needs.

“There is a sustainability element to almost everything that we do, from preserving cultural heritage to driving economic sustainability,” says Carmen Lee, Chief Financial Officer, West Kowloon Cultural District Authority. “As a startup, we need to build our institutional knowledge to drive our ESG agenda, from structuring our plan and deliverables in a very robust way. In many ways, we are really using this major transaction as a catalyst really to accelerate our ESG efforts.”

With guidance from Standard Chartered, WKCDA issued a HKD4 billion SLL. Under the arrangement, the WKCDA will receive a tiered discount rate on the interest margin throughout the loan tenure if it achieves pre-agreed Sustainability Performance Targets.5 The targets include achieving green building certification, offering accessibility services to persons with disability and underprivileged groups, and providing arts and cultural learning programmes to the youth.

“Measuring green building certification is straightforward,” Lee says. “Measuring art accessibility is much more challenging as there aren’t standards in place around accessibility. We were the first to do this, which made defining our KPIs challenging in the certification stage. But by going through this journey, we can make it easier for similar organisations to do follow this path, which will help the whole industry make a positive social impact on accessibility.”

Another deal structured by Standard Chartered shows the potential for SLLs to make a positive impact on a diverse group of portfolio companies. In October 2021, the bank helped Baring Private Equity Asia (BPEA) establish an SLL worth up to USD3.2 billion, where the margin is tied to both an incentive and penalty requiring the purchase of carbon credits.6 The first of its kind for a private equity firm in the region, the SLL is subject to Sustainability Performance Targets around gender diversity and climate change that could reduce the interest rate of the loan if achieved.

“This is a fund-level facility,” says Tang Zongzhong, Manager, Sustainability & ESG Strategy, Baring Private Equity Asia. “Our funds are invested in a wide range of industries from healthcare and technology to manufacturing. Gender diversity and climate change apply to all companies regardless of industry.”

On gender diversity, BPEA will require its portfolio companies to build a stronger and more supportive environment for female talent to thrive. To tackle climate change, they will need to improve greenhouse gas emissions reporting, set climate targets, and ultimately drive emissions reduction. And at the firm level, BPEA plans to create a long-term climate strategy to guide both its corporate activities and engagement with portfolio companies.

“One innovative thing we did with this loan is establish progressive Sustainability Performance Targets,” Tang adds. “On climate change, for instance, if a company has not reported its emissions yet and does so for the first time this year, that meets the target. Once they establish a baseline, they must work towards reducing emissions in subsequent years.”

While SLL issuance of USD94.4 billion for the first four months of 2022 pales compared with USD142.1 billion for the same period last year,7 this flexible, innovative debt instrument appears on course to become a mainstay of sustainable finance.

“If you really believe in ESG, sustainability-linked loans make sense from an investment perspective,” Tang says. “What makes them attractive from a private equity perspective is the alignment of interests among the borrower, the lender and the portfolio company. It’s a perfect set-up to ensure everyone is incentivised in the right way.”

As companies around the world strive to put ESG at the heart of their operations, SLLs may prove one of the best financial vehicles to drive changes that matter.

Produced by Bloomberg Media Studios in partnership with Standard Chartered.

1 BloombergNEF

2 BloombergNEF

3 BloombergNEF

4 BloombergNEF

5 Standard Chartered

6 Bloomberg

7 BloombergNEF

With topics around urban transformation, energy transition, the future of transport and critical infrastructure across Asia, Africa and the Middle East, this content series will unearth fresh trends and showcase how we are supporting clients in the transition towards a more sustainable and inclusive future.