China investments enter a new era

There have never been more foreign investors investing in China, as general optimism about the market has been boosted by the availability of clearer, simpler access channels.

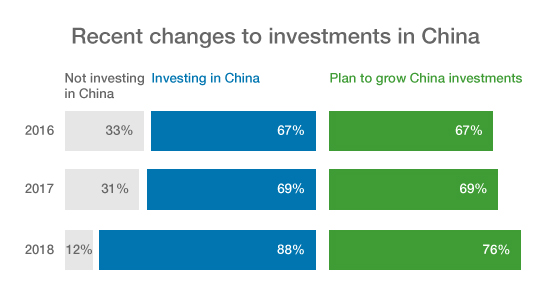

Now in its third year, our annual renminbi (RMB) survey of investors, regulators and custodians across Asia, Europe and North America shows that investor confidence about China is at its most bullish since we launched the survey in 2016, with more than four in five (88 per cent) of respondents now investing in China, up from more three in five (67 per cent) in 2016.

And positive investor sentiment is no longer concentrated in the traditional renminbi (RMB) hubs of Hong Kong and Singapore. North America has emerged as one of the most positive markets, with three quarters (78 per cent) of respondents investing in China and an overwhelming majority (87 per cent) looking to increase their exposure over the next 12 months.

As well as overall optimism, the latest survey shows that we are starting to see investor priorities shifting, with concern over regulation giving way to more practical considerations such as access to funding and account opening. This shift has been driven by the two issues that have dominated China investment this year: new access schemes and index inclusion.

The launch of the Bond Connect programme in July 2017 and continued enhancements to the Stock Connect programme have provided investors with two channels that provide a clear operational framework and swift application approvals.

By reducing concerns over safety and transparency, the mechanisms are attracting fresh interest. Both Stock Connect and Bond Connect have become core investment channels, with almost half (48 per cent) of respondents planning to use Stock Connect for future investment – up from one in five (22.3 per cent) last year – and almost a quarter (23 per cent) expecting to use Bond Connect, which has only operated for less than a year.

“For most investors, it seems the decision about whether to invest in China is no longer a question of it, but how

That said, the Connects still do not offer all the risk management tools investors require, such as the ability to hedge and delivery versus payment. These omissions continue to hamper take-up from jurisdictions with stricter regulatory oversight. For this reason, access mechanisms such as the Qualified Foreign Institutional Investor (QFII) programme and the Renminbi Qualified Foreign Institutional Investor (RQFII) programme still have a role to play in investors’ China toolbox.

Meanwhile, the inclusion of China’s A-shares into the MSCI Emerging Markets Index and the proposed entry of onshore bonds into the Bloomberg Barclays Global Aggregate Index are spurring market enhancements, as regulators and markets act to meet the inclusion criteria. Our survey suggests that index inclusion is already impacting investor behaviour, with 44 per cent of respondents investing before rebalancing.

However, there are still issues that China’s regulators need to address. At our recent roundtables with clients, it was clear that the number and variety of access schemes is starting to weigh financially and operationally on investors, custodians and regulators. Rather than welcoming further new schemes, such as the upcoming London-Shanghai Connect, the industry’s preference is for harmonisation across the existing access channels.

But for most investors, it seems the decision about whether to invest in China is no longer a question of if, but how. If the country’s regulators can iron out the remaining roadblocks, a new era of Chinese investment could really take off.