Dynamic markets: All eyes on Mainland China, India and Brazil

Research shows that dynamic markets are increasingly attractive destinations for western financial institutions.

The 2007‒2008 global financial crisis shifted investor interest away from large emerging economies – otherwise known as ‘dynamic markets’ – such as Mainland China, India and Brazil. But the tide is turning and dynamic markets are now poised to outperform.

Through the 1990s and early 2000s, investors had been particularly bullish on emerging markets, presenting them as offering favourable demographics, an abundance of natural resources, and a growing number of market reforms to support investment. Combined, these factors had positioned them well to capitalise on globalisation and to demonstrate rapid economic expansion. However, the 2007-2008 economic slowdown hit these economies, feeding political instability and spotlighting weaknesses, from an over-reliance on commodities to inadequate infrastructure. A narrative of growth was replaced by one of concern and, understandably, caution.

In the subsequent years, the resilience of the US economy amid trade tensions, geopolitical challenges, and the aftermath of Covid-19 shifted momentum towards the West instead. “The US economy’s strength is supported by its leadership in cutting-edge industries and strong corporate governance, making it challenging for dynamic economies to compete,” says Angela Osborne, Head of Investors Coverage, Europe, the Americas, Middle East & Pakistan, and Africa, at Standard Chartered.

However, the tide is turning once again. “Emerging markets have underperformed developed markets for a very long period after the global financial crisis,” adds Vivek Bhutoria, Co-Portfolio Manager, Global Emerging Markets Equity Fund and Senior Analyst, Asia ex-Japan at Federated Hermes. “But we think various factors are lining up for emerging markets to outperform. And there are interesting drivers in place for the bigger emerging markets.”

The US economy's strength is supported by its leadership in cutting-edge industries and strong corporate governance Angela OsborneHead of Investors Coverage, Europe, Americas, Middle East & Pakistan, and Africa

Angela OsborneHead of Investors Coverage, Europe, Americas, Middle East & Pakistan, and Africa

Strong potential in dynamic markets

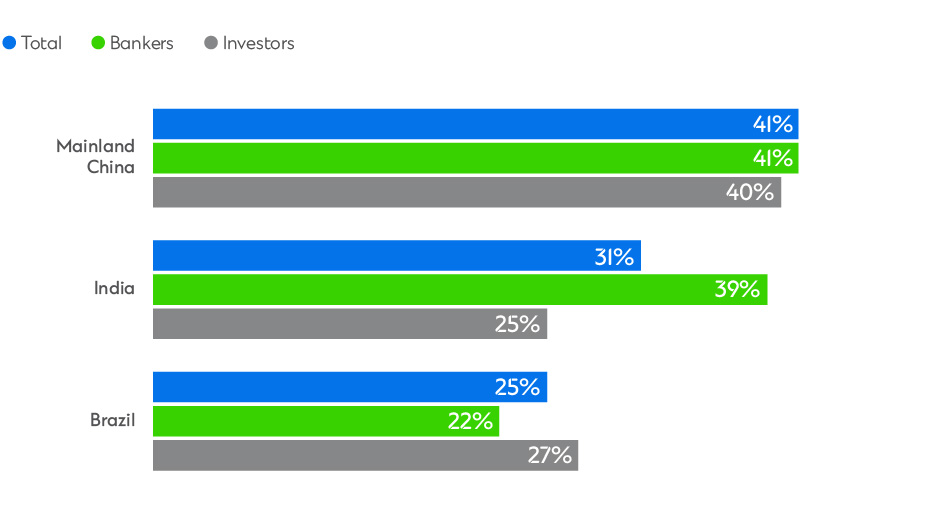

Our research shows that dynamic markets are indeed making a comeback: asked about their five priority destinations for investment or business development over the coming year, many Europe- and Americas-based financial institutions cite Mainland China (41 per cent), India (31 per cent) and Brazil (25 per cent). International Monetary Fund (IMF) growth forecasts for these markets – at 4.2 per cent for 2024, notably higher than those for developed markets, at a meagre 1.8 per cent – are clearly a big draw. The fact that these countries have strengthened their fundamentals and are implementing various regulatory reforms to improve their investment climates is also a driver.

Mainland China is the most attractive destination for western financial institutions*

* Percentages of respondents citing a country as a priority destination for investment or business development. Source: FT Longitude / Standard Chartered, Future powerhouses: How western financial institutions are banking on dynamic markets, 2024

In spite of rising interest rates, many of these economies have managed their fiscal and current-account deficits well over the past three or four years, explains Amit Goel, Lead Portfolio Manager, Global Emerging Markets Strategy at Fidelity. “A lot of emerging markets are in better fiscal and monetary shape today versus what they have been historically,” he confirms. Nevertheless, emerging markets remain a volatile asset class, with each offering a very different set of dynamics. However, for an investor, says Goel, that diversity is appealing: “It gives me a very big, fertile ground to choose from,” he enthuses. “I can really differentiate my portfolio [from the] bottom-up and choose the right stock.”

Mainland China: Still the big draw

With 41 per cent of financial institutions naming it as a focus, Mainland China is by far the most favoured investment destination in our research.

Mainland China’s immense market, established technological prowess and its role as a crucial link in global supply chains – particularly in key growth areas such as new technologies and renewable energy – keep it firmly at the centre of strategic growth plans for western financial institutions. Opportunities are clearly shifting, as the country moves up the value chain. “Investment in fixed assets and the property market have been the main drivers of China’s growth model, and that is now gradually evolving to be more service-oriented and based on high-end manufacturing,” Bhutoria elaborates.

Our research shows that investors targeting Mainland China see the most opportunities in alternative assets (infrastructure/real estate, 43 per cent). Bankers see the most appetising opportunities lying in Mainland China’s alternative asset financing (36 per cent) and sovereign debt structuring (36 per cent). We also asked financial institutions which Chinese sectors they viewed as most promising: technology and digital services (68 per cent) comes out on top, followed by manufacturing (65 per cent), unsurprisingly given Mainland China’s predominance as a manufacturer of tech components and high-demand items, from solar panels to lithium batteries for electric vehicles (EVs).

India: Policymakers eyeing ‘developed’ status

India’s vast and growing market and young population have contributed to its success in attracting foreign investment in recent years, as have reforms to its business environment, coupled with policy initiatives such as “Make in India” and “Digital India”. The government has set its sights on becoming a developed nation by 2047, a goal to which an 8 per cent annual growth target lends clarity.

With 31 per cent of financial institutions citing India as an investment and business-development focus – rising to 36 per cent among Europe-based institutions – it ranks second only to Mainland China as an attractive investment destination. “There is a lot of excitement around India,” affirms Bhutoria. “We have seen India’s weight in the Emerging Markets benchmark rise from 7-8 per cent to almost 18 per cent in the last decade.”

Political stability will play an important factor in the country’s long-term growth goals. Chris Clube, Co-Portfolio Manager, Global Emerging Markets Equity Fund and Senior Analyst, Federated Hermes, says the increased spending on infrastructure that Indian Prime Minister, Narendra Modi, initiated is underwriting a higher potential growth rate for the years ahead. “The return of the Modi government means we will probably have broad policy continuity over the coming years,” Clube suggests.

Underlining this, investors focusing on India see most opportunities in infrastructure/real estate (51 per cent). Bankers targeting the country see the greatest opportunities in listed equity issuance (36 per cent) and corporate loans (36 per cent). When it comes to the most promising sectors, manufacturing (59 per cent) comes out on top, a reflection, in part, of what India has to gain from the proliferation of ‘China Plus One’ strategies, as businesses diversify their manufacturing and supply chains to reduce dependency.

Brazil: A market with significant opportunity

The resurgence in investor interest in Brazil means it is one of just a few countries outside Asia to make it onto our top 10 investment and business development destination list. Boasting a large population, an abundance of natural resources and huge swathes of agricultural land, Brazil offers rich possibilities, suggests Clube. As such, it is seeing significant growth in agribusiness, renewable energy and technology – helped by supportive government policy.

However, Brazil remains closely tied to the commodities market that made it a popular investment choice pre-financial crisis. As a result, it has failed to make the in-roads into global manufacturing supply chains that it needs to progress its development. “Even as most other economies have opened up to the global trading system, Brazil has remained fairly closed,” says Clube. There is political instability, as well as economic volatility and complex local regulation, labour and tax laws to contend with. “It’s a fascinating country, but, from the outside, quite a complicated place to invest in,” observes Clube.

Investors targeting Brazil see most opportunities in listed equity and commodities (44 per cent each), again unsurprisingly, given the wealth of its resources. For bankers in our research, bond issuance (43 per cent) and alternative asset financing (43 per cent) rank highest. Investors see infrastructure (49 per cent) as the most promising sector, with the government ramping up interest through a number of public-private partnerships in recent years, such as the Galeão International Airport or the Porto Maravilha Urban Operation in Rio de Janeiro.

Realising potential

Clearly, the outlook for dynamic markets is positive. The financial institutions surveyed as part of our research are optimistic about the opportunities in Mainland China, India, and Brazil. However, there is a need for more investment to flow into these countries, and other dynamic markets, to fully capitalise on the available opportunities.

Despite the top 300 Investment firms globally managing USD50 trillion in assets, the investment in dynamic markets remains relatively low. According to Osborne, the growth and stability of more developed countries’ monetary policy indirectly impacts dynamic markets. “It is crucial for these more developed markets to show resurgent growth, stabilisation, and lower inflation rates to allow newer, more dynamic economies to emerge and reach their full potential.”