M&A drives healthcare debt targets and liquidity policies

NeuGroup peer research finds that maintaining excess debt capacity is key to funding a growth strategy dependent on acquisitions.

Mergers and acquisitions and strategic investments are a driving force in how finance teams at healthcare companies develop a capital structure and determine debt targets and liquidity policies. That insight is among the key takeaways from NeuGroup’s 2024 Capital Structure Survey conducted by Senior Director of Research Joseph Bertran and sponsored by Standard Chartered Bank.

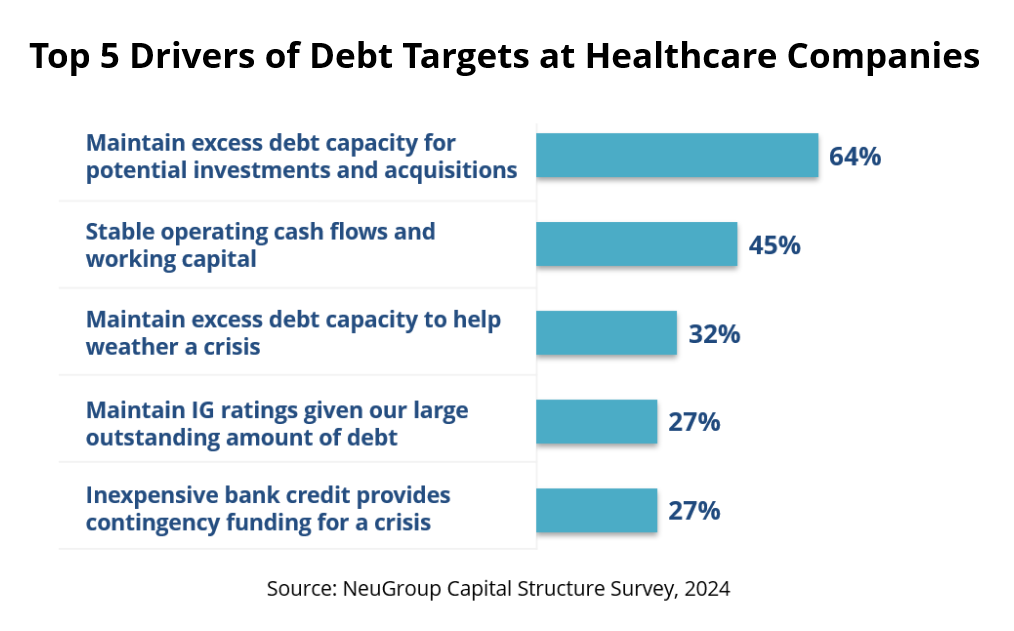

As the chart below shows, maintaining excess debt capacity for potential investments and acquisitions was a top driver of debt targets for 64 per cent of survey respondents in the healthcare space—the highest percentage of any of the answers chosen. Stable operating cash flows for working capital ranked a distant second at 45 per cent.

Let’s make a deal

“An investment driven strategy driven primarily by acquisitions has led to a greater, more efficient use of balance sheets,” said Shoaib Yaqub, Global Head, Capital Structure & Rating Advisory at Standard Chartered. “This will likely continue as long as there are meaningful investment opportunities. It is the perfect model.”

The numbers suggest healthcare companies agree: After two years of lackluster deal volume, healthcare M&A rebounded sharply in 2023, bringing the five-year total spent by 20 top companies to USD450 billion, according to Standard Chartered. “M&A remains core to the growth story of the sector, and we expect this to continue over the medium term,” the bank wrote in a recent report, “Unlocking Growth Through Investments.”

- NeuGroup’s survey revealed an interesting if not hugely influential factor in healthcare M&A: many companies reported a lower cost of equity used to compute investment hurdle rates—the return a business needs to achieve from an investment—than other industries.

- Over 70 per cent of healthcare firms reported a cost of equity of 10 per cent or less, with a third in the 6 per cent to 8 per cent range. One member explained, “Healthcare’s lower cost of equity is a function of the lower [stock] betas as healthcare tends to be a less volatile/cyclical sector and therefore is something of a safe haven in a risk- off market.”

- Indeed, more than half of the respondents reported a beta of under 0.8 used in the Capital Asset Pricing Model. While a lower cost of equity results in a lower discount rate for potential investments, strong forecasted cash flows are more important. As one member stated, “whether we will see a positive NPV on the investment” remains the key factor.

Debt and credit ratings

The acquisition boom has been fuelled by debt. The survey shows healthcare firms have higher average leverage than other industries, in part reflecting the sector’s relatively stable cash flows. Survey respondents reported a debt/EBITDA ratio of 2.4x, compared to an average of 2.2x across all sectors.

- The decision by healthcare companies to increase the use of debt in their capital structures helps explain the industry’s lower- than-average credit ratings. The survey reveals just 32 per cent of the companies surveyed are rated A or higher, compared to 40 per cent for tech firms and 41 per cent of all 129 respondents to the survey. Another 36 per cent of the healthcare companies are rated BBB and a relatively high 29 per cent are unrated.

- Standard Chartered’s report notes that “the sector has steadily moved down the investment grade rating spectrum over the past decade, with most of the downgrades driven by debt- funded M&A and a clear strategy to better utilize surplus balance sheet capacity.”

- Debt dependence ideally comes with the discipline to reduce leverage. “If you issue a lot of debt like this, the next question becomes how quickly can you delever,” one member said. “That’s where we get into capital planning of what levers do we have to pull to delever at a reasonable rate and get back to those debt to EBITDA metrics the rating agencies would expect us to be at.”

Dry powder liquidity policies

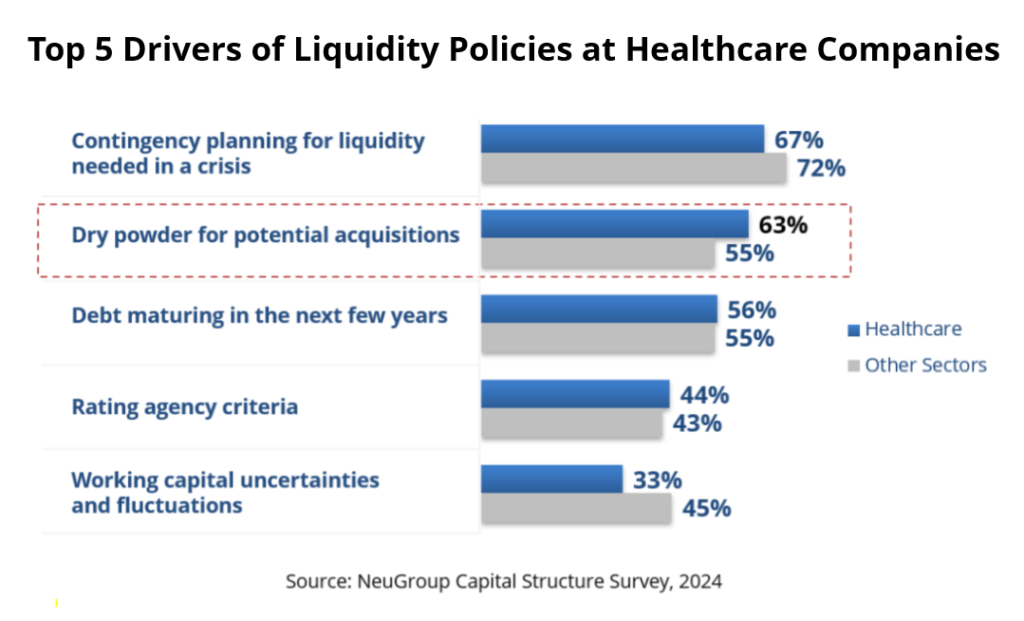

Liquidity policies further highlight the focus on M&A across the healthcare sector. While planning for crisis scenarios was the top priority, mirroring the all-industry results, stashing dry powder for investments and acquisitions was not far behind, with 63 per cent of all healthcare firms prioritizing it, compared to 55 per cent for other sectors (see chart). This focus was even more pronounced among medical device companies, where it was the top priority for 88 per cent of respondents.

Cashing in on R&D

The survey shows that healthcare companies tend to maintain cash and equivalents that exceed their cash targets. Well over half (60 per cent) reported cash balances exceeding their cash target by more than 25 per cent.

- Because spending on R&D is a major component of capital structure for pharmaceutical manufacturers that depend on intellectual property, it figures prominently in how they and medical device makers set cash levels.

- One member said in a focus group that his team uses Monte Carlo simulations at a 99 per cent confidence level to “fund all R&D and expenses.” Others mentioned using: Cash/R&D, Cash/R&D and Expenses, Cash/OPEX.

- Shoaib Yaqub at Standard Chartered said the bank helps clients determine appropriate levels of cash and liquidity. “We created a proprietary model around liquidity to press all of these together–everything you mentioned here, all together to get to a liquidity threshold,” he noted. “How much do you need in the next year, downside, working capital, also taking into account dimensions in the market and some minimum requirements that you might want to keep in mind.”

Looking ahead

A key question for pharma and other healthcare companies that are fuelling much of their growth through debt-financed acquisitions is what happens if drugs go off patent at the same time investment opportunities shrink. Indeed, the “perfect model” Shoaib Yaqub described above depends, he said, on three factors:

- Good acquisitions of a number of promising drugs, some of which are, in simple terms, hits.

- Relatively cheap debt, which is no longer as available as before but is still cheaper than equity.

- Debt capacity, which has diminished but remains robust. Standard Chartered estimated in April that balance sheet debt capacity for the 20 top companies stood at USD250 billion within current ratings.

“Some corporates are worried about an eventuality where one of their main patents expires, along with it a huge cash flow stream, and there is no new product to take its place,” Yaqub said. “Without new patent pipelines, the whole investment story changes. Lower cash flow cannot sustain the same dividends or share buybacks and so the whole capital allocation agenda will need a rethink.”

- The good news is that for most companies surveyed by NeuGroup and tracked in Standard Chartered’s report, rethinking is not yet necessary. The report found no companies with high patent exposures have a weak pipeline, indicating a resilient outlook for the sector.

- So for now, the job of capital markets teams at many healthcare companies is devoted in large part to figuring out how potential deals would be financed.

- That means managing what one NeuGroup member at a mega-cap pharma company said is “everything related to funding and what we call firepower as it relates to deal capacity. So that is start to finish, through the whole process, cash flow, forecasting, capital structure, working capital, financial policy and ultimately what the company might look like.”

The appeal of infrastructure investment in dynamic markets

Infrastructure investment is a priority sector.