South-South Trade: A growth engine for emerging markets

South-South trade has grown considerably over the past decade and now accounts for one-fifth of global trade. Sunil Kaushal, Co-Head of Corporate & Investment Banking, highlights the economic opportunities South-South trade presents to emerging markets and the role banks play in helping to unlock this potential.

As geopolitical tensions and protectionism impact supply chains, we have seen the rapid growth of South-South trade.

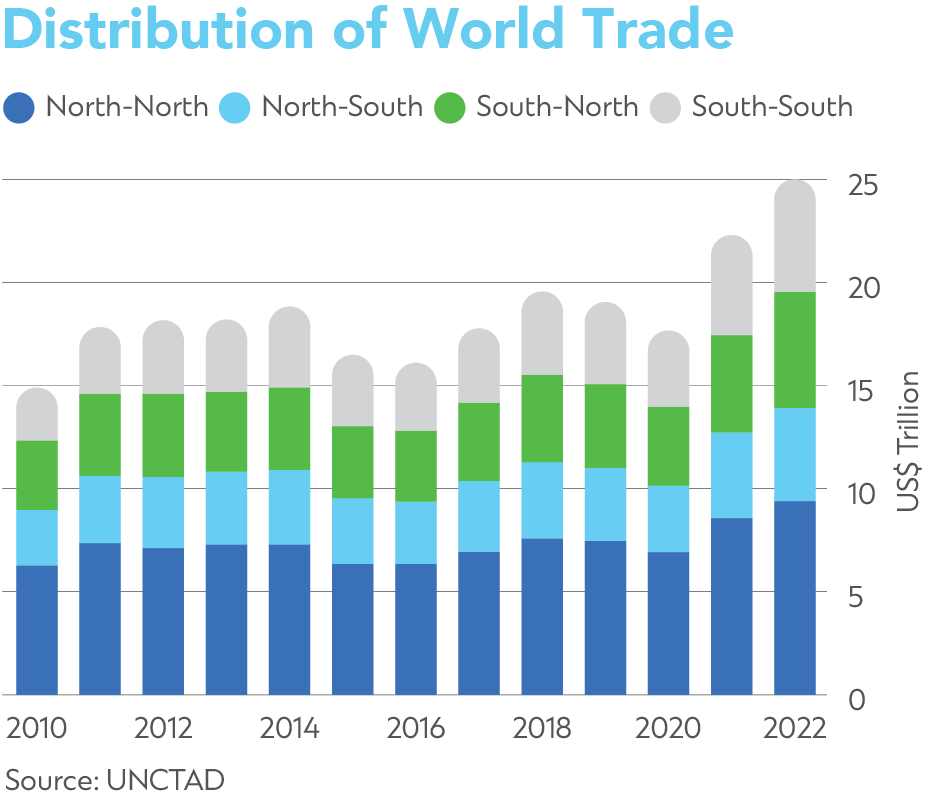

With global trade set to hit USD32.6 trillion by 2030, high-growth corridors are emerging across Asia, Africa, and the Middle East. In 2022, the value of South-South trade reached a record USD5.3 trillion, accounting for 21 per cent of global trade, up from 19 per cent a decade earlier.

The establishment of regional trade and integration agreements including the African Continental Free Trade Area and ASEAN Economic Community, respectively — both in effect for less than a decade — has facilitated trade between southern countries. In turn, South-South trade now offers emerging markets some of the greatest economic opportunities in history.

The new face of opportunity for emerging markets

By expanding trade, countries in and outside of the Global South are tapping into new markets and driving economic growth through increased production and consumption.

Over the past decade, the technology, manufactured goods and primary commodities sectors have made substantial contributions. In Africa, seven of the continent’s 10 primary export sectors depend more on continental than international markets. And in Asia, intra-ASEAN trade accounted for the largest share of the region’s trade in 2022, led by electrical machinery and fuels. China provides another great example. Often considered the manufacturing base of the world, China is increasingly setting up factories overseas, and this has been accompanied by a strong rise in sales by Chinese companies into the Global South.

Better infrastructure and lower trade barriers will unlock even faster growth; adopting digital supply chain finance solutions will enable more efficient and less frictional trade. This will help grow trade in Asia, Africa and the Middle East by 7.5 per cent to USD11.3 trillion by 2030.

The role banks play in unlocking trade opportunities

As with any growing ecosystem, maximising the potential of South-South connectivity will need collaboration from policymakers, but they cannot accelerate South-South trade alone.

Small businesses in emerging markets struggle to access affordable credit and financing necessary for trade activities. They often lack collateral or cannot meet the stringent risk assessment criteria set by financial institutions. Meanwhile, inadequate access to trade finance instruments like letters of credit, guarantees and insurance make it difficult even for multinationals to manage risks and secure trade transactions.

That’s where banks like Standard Chartered, with a global network and local market expertise, come in. Whether facilitating flows between South Asia and Africa, or intra-regionally between ASEAN markets, we provide access to and meet the trade finance needs of businesses across the Global South.

By providing our clients with better access to working capital finance and liquidity management solutions, we help them participate in cross-border trade, meet their growth ambitions and contribute to economic prosperity in their countries. This helps to bridge the trade finance gap and make global trade more transparent, sustainable and equitable.