Tech treasurers weigh dividends after mega-cap initiations

Fast-growing technology firms historically pump profits back to fuel expansion. Recently, however, many are paying dividends, with more considering the move.

Fast-growing technology companies historically pumped profits back into the business to fuel more expansion. Most shunned paying dividends to shareholders, a use of capital seen as a sign of slowing growth. But the tide started turning in 2024 for Big Tech, with Google parent Alphabet, Facebook parent Meta and Salesforce all initiating dividend payouts.

- “We landed on a modest dividend and for us that opened new tools for returning capital,” said one NeuGroup member at a company that initiated a dividend this year after what they said was “a long journey.”

- Smaller tech companies are taking notice. A member of NeuGroup for Tech Treasurers said, “We’re taking a fresh look at our share buyback strategy, but with mega-techs recently issuing dividends, that’s worth the conversation.”

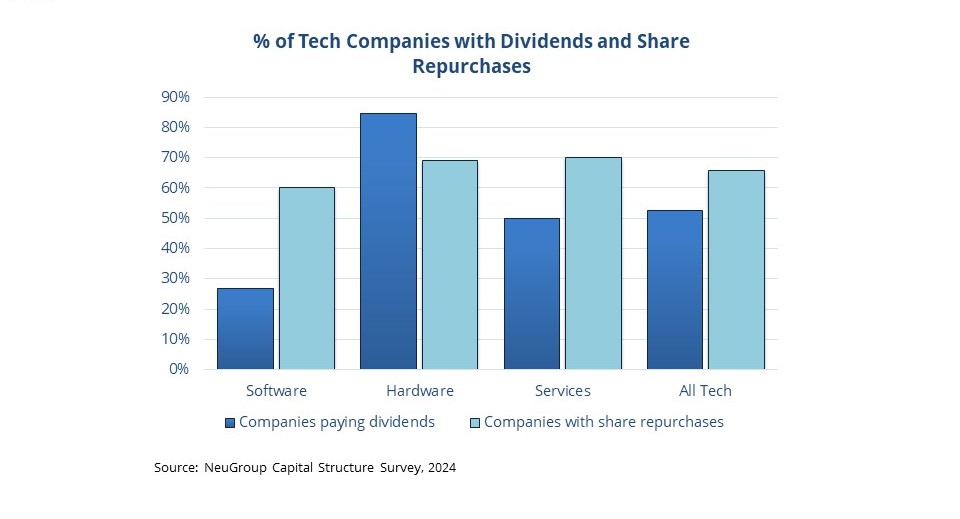

NeuGroup’s Capital Structure Survey—conducted in mid-2024 and sponsored by Standard Chartered—reveals it’s a conversation that has already taken place at a majority of tech firms. As the chart below shows, more than half (53 per cent) of the respondents pay dividends. (That aligns closely with the S&P 500 Index, where 54 per cent of all information technology companies pay dividends.)

Reality check

It’s important to note, though, that while dividend payments are gaining traction in tech and are paid by the majority of respondents, tech firms remain less likely than other industries to pay a dividend: 64 per cent of the 129 companies surveyed in all sectors (44 in tech) reported paying dividends; 70 per cent of non-tech companies pay dividends.

- The chart shows that a higher percentage of tech companies engage in share repurchases than pay dividends (66 per cent vs 53 per cent). Hardware is the exception, where 83 per cent of respondents pay dividends compared to 69 per cent for share repurchases.

- This in part reflects the established nature of many hardware firms, though even high-growth semiconductor companies are using their free cash flow to return capital to shareholders via dividends.

The cash catalyst

Strong cash flow and relatively low leverage are fueling much of the increased activity and interest in tech dividends. “Cash reserves for tech companies have grown disproportionately,” said Shoaib Yaqub, Global Head of Capital Structure & Rating Advisory at Standard Chartered. “This is a key driver for dividend payments.”

- According to Standard Chartered, technology firms in the S&P 500 held an average of $6.6 billion in cash and short-term investments, totaling over $427 billion collectively in the first quarter of 2024.

- “While the broader tech sector struggled with operating costs at the beginning of the year, there is no doubt the sector remains very lowly levered,” Yaqub added. “So I see dividend initiation as a step in the right direction—this is just good corporate finance.”

The valuation situation. Factoring in lofty stock market valuations—high price/earnings ratios—is also smart for companies evaluating shareholder return strategies. One NeuGroup member noted that while buybacks can be value accretive for the corporation, they “can also be destructive depending on price. We wanted to explore the other tools. We looked at regular and special dividends.”

- Another member is weighing the ideal level of dividends and buybacks as its stock price has jumped during the bull market. “We’re hesitating to buyback too much,” he said. “We have always had a dividend, but we’ve kept it at a manageable level. We want to benchmark—should we focus more now on the dividend than repurchases?”

Starting Slowly. Tech firms typically initiate dividend payments cautiously, resulting in relatively modest yields. The majority (60 per cent) of dividend-paying tech companies surveyed by NeuGroup reported yields of 1.5 per cent or lower, a far bigger proportion than the 36 per cent for non-tech companies. That’s consistent with the S&P 500: tech firms have an average dividend yield of 1.5 per cent, compared to 2.24 per cent for non-tech.

Among the factors explaining lower tech yields are a long-held belief that dividends are a long-term commitment that can’t be reversed without sending a very bad signal to investors. “Dividends are a much more permanent layer of capital return and we started small so we can build over time,” one member explained.

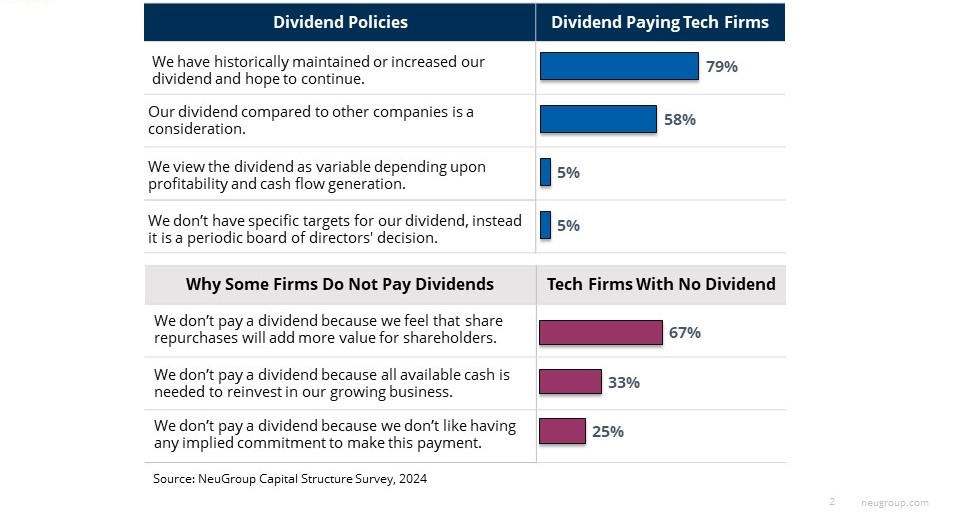

- The perceived permanent nature of the payouts is widespread: As the table below shows, 79 per cent of dividend payers surveyed cited a commitment to maintaining or increasing their dividend (see table).

- Looked at another way, once you initiate a dividend you don’t lower it when times are tough. Just 5 per cent of survey respondents that pay them said dividends were variable based on profitability.

Benchmarking

Companies tailor their capital return strategies to their individual business models and stages of maturity. As one member remarked, “What’s interesting in my mind is that there is no one right answer.” That said, the survey shows companies that pay dividends benchmark against their peers and the overall S&P 500. The table shows that 58 per cent of dividend paying technology firms said benchmarking against peers is a key consideration.

That also goes for balancing dividends and buybacks. As one member of NeuGroup for Mega-Cap Treasurers put it, “Looking at peers is important to find the balance of dividend and share repurchase because that is how shareholders look at fair compensation.”

Looking ahead

Analysts and investment bankers agree that share repurchases will remain the dominant method for returning capital among tech companies for the foreseeable future. One factor: They see less chance for a higher excise tax on buybacks under the incoming Trump administration. More importantly, growth investors continue to place a high priority on buybacks.

- The survey showed that 67 per cent of tech companies that do not pay dividends prefer share repurchases because they add more value to shareholders. Shoaib Yaqub at Standard Chartered notes that “over the past 10 years, total shareholder returns in tech have been highest among other corporate sectors primarily through underlying share price growth and significant buybacks.”

- Buybacks are also seen by most corporates as providing more flexibility than dividends. According to the survey, 77 per cent of tech companies that repurchase stock say the top diver of their policy is that they view share repurchases as variable depending on how much excess cash remains after all other needs.

- Yaqub expects that perception to change as more tech companies initiate and raise dividends. “I think there is still a view that dividends are sticky, and buybacks are not. I don’t think this is correct anymore—try reducing buybacks and shares will crash similar to if the dividend is cut.”

- Along with that realization, he says, it’s also becoming clear more tech companies need to find a place for dividends in their capital structures. “It’s time to have a core level of dividend and use the untapped balance sheet a bit more.” And more companies may want to pay dividends with excess cash if inflation starts creeping up amid a tariff war, he says. “Cash on the balance sheet in inflationary environment is value-destructive.”

Explore more insights

The appeal of infrastructure investment in dynamic markets

Infrastructure investment is a priority sector.