Consumers are set to power dynamic markets

Dynamic markets offer significant opportunities for consumer goods businesses and their investors.

Where will western financial institutions look for opportunities in 2025? New research from Standard Chartered suggests it could be the fast-growing consumer industries in developing economies that have a great deal of potential.

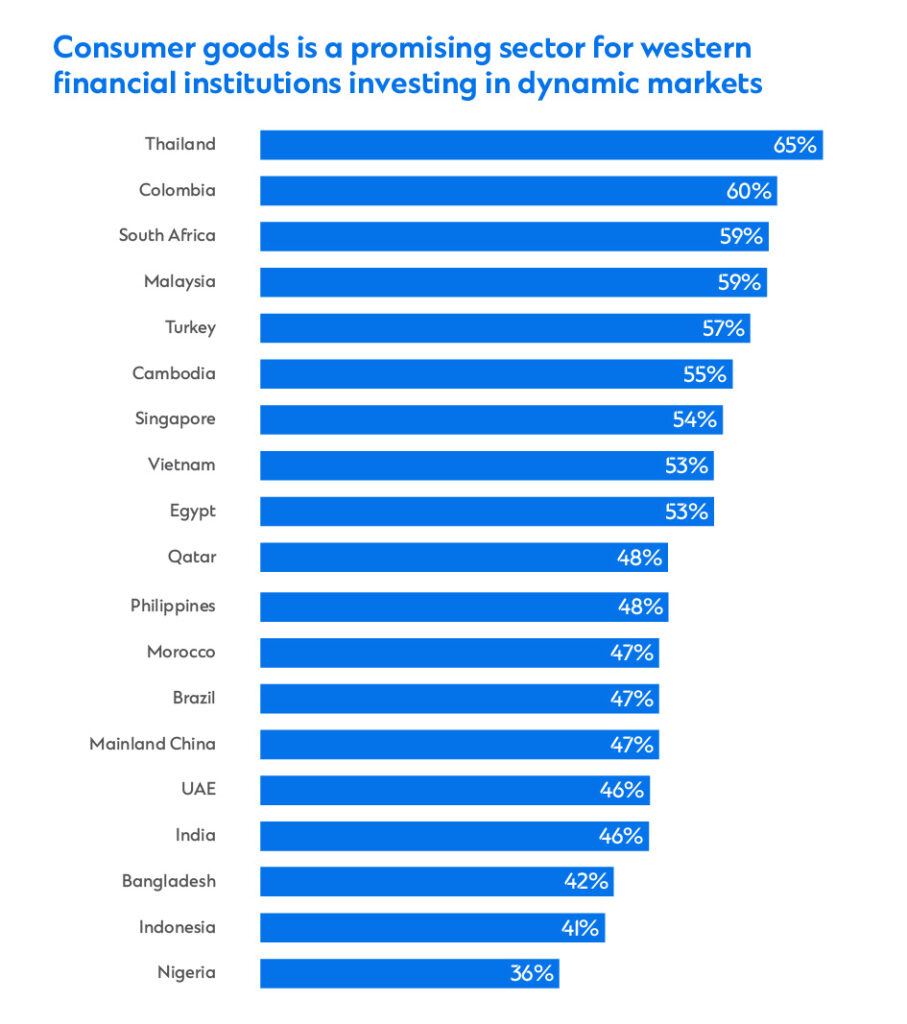

In our survey of 400 European and American banks, investment managers and asset owners, half say that the consumer goods industry is a top three priority for their future investment or development strategy. Why is it these businesses that they’re looking at in dynamic markets?

The double demographic dividend

Dynamic markets have certain fundamentals that give investors a reason to be optimistic about the future of consumer businesses. They have large populations – about 4.3 billion people in total – but it’s their demographic trends that are creating the biggest opportunities for the sector.

We’re seeing a double effect from demographics, driving demand for a wide range of consumer products – from everyday essentials to luxury goods. Caroline Eber-IttelCEO, France and Head of Client Coverage, Europe

Caroline Eber-IttelCEO, France and Head of Client Coverage, Europe

First, in many of these countries the middle class is expanding rapidly. The think tank Oxford Economics predicts that in 32 dynamic markets worldwide, the middle-class population will nearly double over the next decade to reach 687 million households. More and more of these households now have enough disposable income for discretionary spending.

Second, consumers in dynamic markets tend to be younger than their counterparts in western economies. According to McKinsey, 75 per cent of consumers in dynamic markets will be between the ages of 15 and 34 by 2030. According to the consultancy, that’s significant because younger consumers are often more optimistic and more willing to spend money on premium products and brands.

“We’re seeing a double effect from demographics, driving demand for a wide range of consumer products – from everyday essentials to luxury goods,” says Caroline Eber-Ittel, CEO of Standard Chartered in France and Head of Client Coverage for Europe. “You have a growing middle class and a growing number of younger people. These are groups that are particularly eager to consume.”

* Percentage of respondents who say the consumer goods sector in these top 20 dynamic market destinations is among their top three priorities for their future investment or business development. Source: FT Longitude/Standard Chartered, Future powerhouses: How western financial institutions are banking on dynamic markets, 2024

Some markets are especially attractive, according to Eber-Ittel. In Thailand, where 65 per cent of western financial institutions with plans in the country say the consumer goods sector is a priority area, there is a growing middle class that is sustainability- and health-minded. The same is true in ethnically-diverse Malaysia (cited by 59 per cent), where companies can apply proven marketing strategies targeting consumers from Indian, Chinese or Thai minorities.

In South Africa, which is one of the largest consumer markets in Africa and was an early adopter of e-commerce, 59 per cent of western financial institutions see an opportunity. Technology is an increasingly important driver in many African countries, and Eber-Ittel explains that the continent’s tech-savvy populations are eager to build closer digital relationships, including e-commerce and social media following, with their favoured brands.

An opportunity that comes with challenges

Dynamic markets do offer significant opportunities for consumer goods businesses and their investors, but the economic outlook remains tough. The International Monetary Fund forecasts growth of 4.2 per cent in developing economies in 2025. That’s enviable by western standards, although sluggish compared with the rapid growth these markets experienced in recent decades, when real GDP expanded at rates between 6 per cent and 8 per cent.

In some countries, meanwhile, persistent high inflation is damaging consumer spending power. Currency and interest rate volatility pose additional financial planning risks for companies. And supply chain disruptions caused by the Covid-19 pandemic and continuing geopolitical instability are another major challenge. US President Trump’s second term could reinforce this trend, particularly if the administration introduces new trade tariffs.

Many businesses are also increasingly conscious of the importance of sustainability, which may present both a challenge and an advantage for multinational firms, says Eber-Ittel. Dynamic markets’ young, middle-class consumers are more aware of environmental impacts and health concerns, and this is shaping their consumption patterns. “People are showing preferences for local products and brands due to their lower carbon footprint,” says Eber-Ittel. “And businesses face growing regulatory pressure to adopt ESG practices, supported by international players pushing for sustainable supply chains.”

Consumer goods companies must consider these global and regional trends while also managing the individual nuances of each market, where cultural preferences, distribution channels, local practices and regulatory complexities may vary enormously.

The power of partnerships

As consumer goods companies respond to these challenges, they will need support from a range of partners and stakeholders.

Policymakers in dynamic markets, for instance, will play an important role in developing the consumer goods industry. Investment in energy and transport infrastructure will allow goods to be moved efficiently. And advanced digital infrastructure will boost e-commerce and supply chain management. “Policymakers also need to improve education and training,” says Eber-Ittel. “So that companies have access to skilled workers on the ground in these markets.”

Companies’ financial backers are another important stakeholder. “Banks have a critical role to play in terms of risk management,” says Eber-Ittel. “For example, hedging strategies can help businesses to manage currency volatility. Dynamic pricing tools, meanwhile, can help them to optimise their costs.”

Consumer goods businesses that plan to grow in these markets might also need tailored financial support. For small and medium-sized companies in particular, access to finance is a critical issue. “We really want to ensure that we promote financial inclusion to support small and midcaps,” says Eber-Ittel. “And this is where we can add value based on our large network and commitment to promoting economic opportunity.”

Consumer goods businesses in dynamic markets are growing rapidly, and this is a big opportunity for financial institutions. But success will depend on strategic partnerships that provide both the right financial support and a nuanced understanding of local dynamics. With robust collaboration between businesses, financial institutions and policymakers, dynamic markets’ consumer goods sectors will be well positioned to reach their potential.