MiCA: A bank’s blueprint for digital asset success

Regulators craft crypto rules to protect consumers and ensure stability. As adoption grows in Europe, crypto custody is crucial for trust and security.

Since its launch in 2009, Bitcoin – and cryptocurrencies in general – have aroused both mistrust and excitement. The former because of its price volatility, the association with illicit activities and a lack of regulation and the latter from its value proposition associated with the decentraliation and its potential for high returns. With a market capitalisation of USD3 trillion as at 17 February 2025, crypto has become an essential part of the financial system.

It is against this backdrop that regulators, whose mission it is to protect consumers and ensure the financial stability of the economy, have decided to work on regulations linked to cryptoassets. At the same time, the adoption of cryptoassets in the European continent has grown, whether its tokenisation through the experiments of the European Central Bank or cryptocurrencies with products such as ETPs. With increasing focus in this asset class in the region, crypto custody becomes an essential cornerstone to ensure trust, security and adoption.

Why MiCA?

In 2019, Facebook announced the launch of Libra, a new digital currency. The project was ambitious and aimed to create a digital currency that could be used across Facebook’s platforms (e.g., WhatsApp, Instagram, Messenger) and beyond, with backing from a coalition of major companies, including Uber, PayPal, and Mastercard. Libra was designed to be a stablecoin, pegged to a basket of fiat currencies (like the US dollar, euro, and others) to maintain stability.

Libra was a catalyst to attracting the attention of politicians and regulators. Crypto regulation was becoming a necessity, and at a European level to ensure homogeneity and make Europe even stronger.

Following a consultation, in September 2010, the European Commission adopted the digital finance package, which included the pilot scheme for security tokens, MiCA (Markets in Crypto Assets) and DORA (Digital Operational Resilience Act). The aim of the digital finance package was to boost competitiveness and innovation in the financial sector, while guaranteeing the security of consumers and the stability of players.

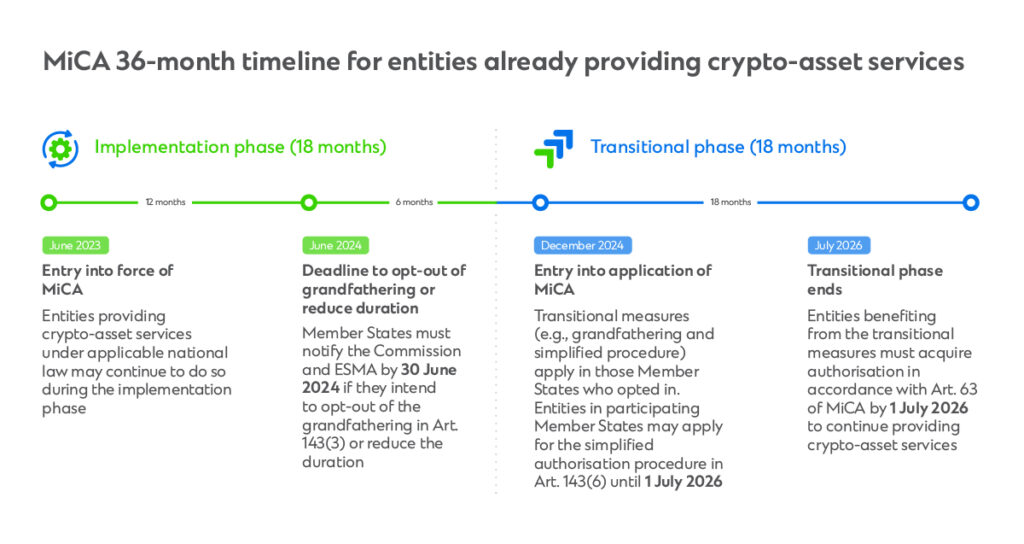

On 9 June 2023, the regulation on Markets in Crypto-Assets (MiCA) was published in the Official Journal of the EU.

MiCA in a Nutshell

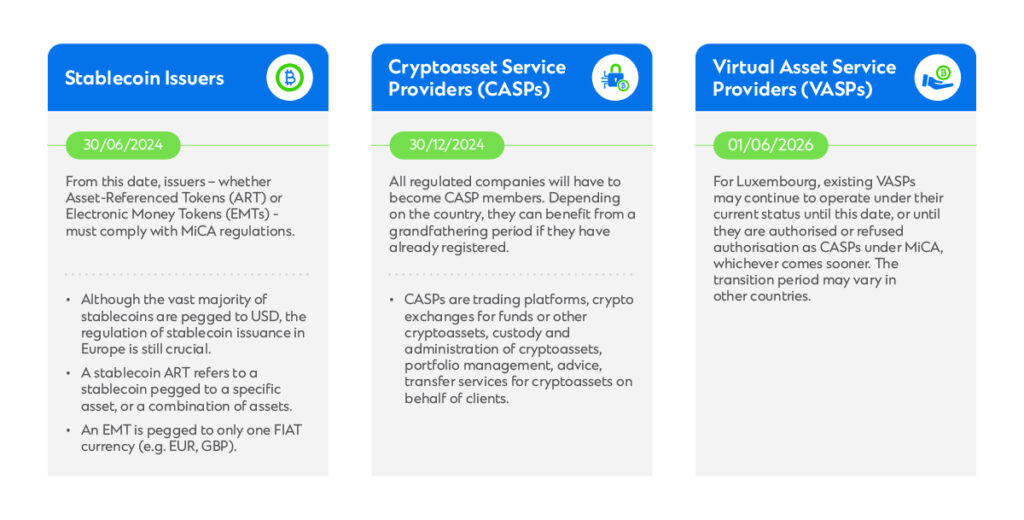

The MiCA regulation lays down a series of requirements and obligations that players will have to follow. It has its own calendar:

To operate within the European Union, it is imperative to obtain this license, which will be issued by the competent authorities of the member state. This means that non-EU companies will have to set up an entity within the European Union to serve their customers. Providing crypto services across the EU market will only be possible under the fully fledged MiCA license, while entities remaining within their local regime will be restrained to the domestic market. As part of the registration process, the regulators will ask, among other things, about the business model and scope of crypto services.

Companies will need to set up an appropriate governance structure. Governance will have to describe the roles and responsibilities of the stakeholders involved. Internal audit mechanisms must be put in place to guarantee MiCA licensing. Beyond governance, the qualifications of the management team will need to be aligned with the organisation’s ambitions. Qualifications, experience, and track record will be monitored.

Depending on the service provided, CASPs will need to have a minimum capital. Crypto custodians will therefore need to have a minimum capital required of EUR125,000, while for trading platforms it will be EUR150,000.

To guarantee maximum security for customers, their accounts must be segregated from those of the CASPs. All these elements will have to be documented in the form of a procedure, including a cybersecurity policy. It will also be necessary to draw up a business continuity plan. Customer complaints need to be documented.

Compliance with Anti-Money Laundering and Counter-Terrorist Financing requirements is also a cornerstone of the filing. Non-Fungible Tokens (NFT) and the Decentralized Finance (DeFi) are out of scope.

MiCA, a strategy accelerator towards Web3

The implementation of MiCA requires a clear regulatory framework. To serve customers in Europe and seize opportunities linked to the world of the web3, banks are going to have to make a strategic shift. As far as CASPs are concerned, crypto custody can be seen as an extension of the traditional custody business, with a strong risk and cyber-security component. To position themselves in this rapidly changing world, banks are faced with an innovation dilemma and will have to choose between creating their own solutions, developing a partnership to co-build, acquiring a solution, or deciding not to position themselves at all.

MiCA will require financial institutions to invest in and manage these innovative projects, which are an opportunity to create new services and acquire new customers.

It is in this context that Standard Chartered, a leading international bank, has chosen Luxembourg to obtain its Virtual Asset Service Provers (VASP) registration. The choice of country is also crucial for the bank, given the varying transition periods adopted by member states, and how a Bank may benefit from the financial ecosystem of the chosen country.

MiCA is a major opportunity for banks to position themselves in a promising asset class for which future generations are assuming increasing importance. Banks can continue to play their roles as trusted partners, while accelerating innovation. The future of crypto is now. It is up to the financial institutions to grab the opportunities and create the future of banking.

For more insights on MiCA, read Zodia Custody’s report, MiCAR: The Institutional Playbook for Europe’s Digital Asset Market.

Explore more insights

Can tariffs stem fading US exceptionalism?

We still have a bias for US assets, although it is increasingly important to diversify into other markets, espec…