Podcast series: Financing a sustainable planet

How would the world look if capital was put to work with society and the planet in mind?

This opening episode of this six-part financial podcast series with Euromoney on ‘Financing a sustainable planet’ explores where the balance should lie between profit and purpose.

The episode examines whether sustainable finance can be used as a force to combat the environmental and social challenges facing the world today.

Are we at a tipping point where we need to consider the impact on our planet before profit? And what is the true value of emerging sustainable investments? Are they going to move the needle?

Click on the link below to listen to this podcast and explore answers to these and other tough questions we all now face.

And be sure to listen out for the Standard Chartered in-house view by Daniel Hanna.

This second podcast in a six-part series with Euromoney explores ways in which emerging markets are funding and developing critical infrastructure in harmony with the UN’s sustainability goals.

The green bond market soared in 2018, particularly in Asia, which saw the world’s highest growth rate – and the highest number of new issuers. And despite being the world’s biggest contributor to CO2 emissions, China issued a huge USD34 billion in green bonds in 2018 – demonstrating a remarkable change of outlook.

While green bonds are demonstrating the way forward in socially responsible investments, they still only represent a fraction of the overall bond market. This podcast examines how we can drive this to a more meaningful contribution.

Click below to listen to the podcast – and be sure to listen out for our in-house view by Daniel Hanna.

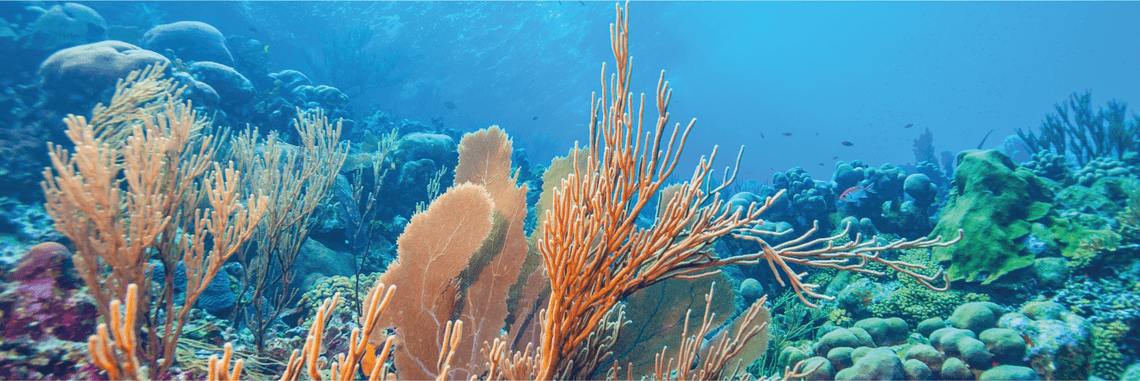

Private capital is finally being used to fund sustainable blue bonds

There is no debate – humanity is damaging out seas. Overfishing has devastated marine ecosystems, and increased carbon emissions have driven sea temperatures to record highs. By 2030, 90 per cent of coral reefs will be threatened with extinction.

We need to do something to avert this crisis. This podcast – the third in a series of six on sustainable financing with Euromoney – explores whether blue bonds can draw sufficient investment into ocean conservation.

And in his in-house view, Daniel Hanna discusses the challenges we faced in developing the world’s first blue bond — our Seychelles Blue Bond.

Click below to listen to the podcast.

Mobile technology is transforming refugee aid payments – and changing lives

New people are displaced around the world everyday – ruining livelihoods and shattering families. The world’s displaced population – 85 per cent of which live in developing countries – relies heavily on financial aid.

This is not just for basic needs – programmes to bring greater financial inclusion to refugees are helping more and more individuals acclimatise to a new, economically-productive way of life.

This podcast – the fourth in a series of six on sustainable financing with Euromoney – assesses the scale of the task at hand – and what is and can be done to ensure refugees are returned to dignity, stability, and eventually prosperity.

Click below to listen to the podcast – and be sure to listen out for our in-house view by Karby Leggett.

The new reality of energy transition is both a challenge and opportunity for the hydrocarbon industry

The criticality of reduced energy intensity is widely accepted. Energy players are as such feeling the pressure from all angles – and especially from governments who themselves are under pressure from a surging global activist movement that calls for green energy to become common place. Energy transition is, therefore, very much a reality.

The podcast examines the case study of Danish energy company Ørsted, and its huge transition to a renewably-sourced energy generator. The episode considers what the industry can learn from the Ørsted story, and expands to look at how financial markets can support a transition towards low carbon.

Listen out for our ‘in-house view’ by Daniel Hanna.

Global cities are fragile engines of growth. Climate-resilient infrastructure can help combat threats faced.

Cities across the world are growing at an unprecedented rate. By 2050, an estimated two out of three people will live in urban areas. The pressure on such cities and the resulting implications for our climate are of increasing concern.

The final podcast in this six-part series on sustainable finance looks at how the development of climate-resilient infrastructure will be essential in fighting the increasingly-common issues of water shortages, pollution and more.

In the ‘in-house view’, James Cameron showcases some of the climate-resilient infrastructure projects in which we have invested. These are already helping cities around the world address the consequences of climate change.

Sustainable Finance | Commodities | E-commerce | Fin Tech | Financial Institutions | Government | Healthcare | Infrastructure | Manufacturing | Oil & Gas | Power & Utilities | Real Estate | Technology | Africa | Americas | Asia | Europe | Middle East | Podcasts