-

Sustainability

Innovation in service of our markets

We’re developing new ideas and solutions to mobilise capital to where it’s needed.

The opportunity in our markets

Accelerating progress against climate, biodiversity and development goals requires a step change in emerging market financing. It’s in these markets that there is the greatest potential to deploy innovative approaches at scale, to help deliver sustainable, inclusive growth. But the flow of capital to these markets isn’t matching the size of the opportunity.

We advocate in service of our markets and apply our innovative mindset to unlock this capital and drive economic inclusion.

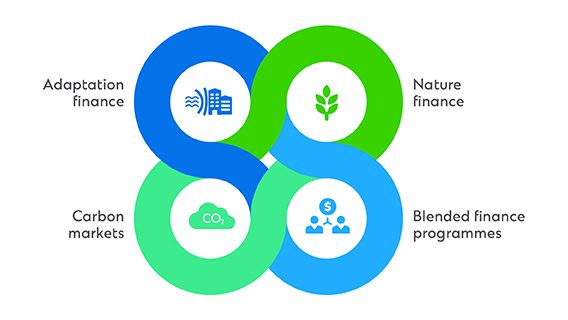

Our Innovation Hub model

We use our dedicated Innovation Hubs to look at challenges in our markets through a different lens and find breakthrough solutions for our clients and communities.

Each Hub focuses on a theme where we have a core competency and which is especially relevant to clients in our markets.

Discover our Innovation Hubs

Watch the videos to learn more about each theme.

Adaptation finance

There is an urgent need to unlock adaptation finance to build shared societal resilience, especially across our footprint. Hear about the risk and opportunity that adaptation represents for our clients and communities.

Blended finance programmes

Scaling the capital needed to meet global sustainability goals cannot be delivered through public financing alone. The private sector must step up, including in markets historically considered too risky for high levels of investment. Hear how we’re leveraging blended finance to close the financing gap.

Nature finance

Nature is one of our greatest assets and an essential part of solutions which tackle climate change. With a footprint that represents some of the richest biodiversity in the world, learn how we’re working to preserve, restore, and enhance nature through innovative finance.

Carbon markets

A high-integrity carbon market, combined with corporate commitments to cut emissions and robust reporting, can accelerate global progress towards net zero. Hear about the impact high-quality carbon credits can deliver in underfunded markets.

Our latest work

Delivering adaptation finance

We’re putting adaptation finance on the global agenda.

The adaptation economy

As a first mover on adaptation, we’ve set out the case for adaptation finance for our markets in our Adaptation Economy report.

Adaptation and resilience finance

We launched the Guide for Adaptation and Resilience Finance, a practical roadmap for investment.

Advancing the agenda globally

We are a signatory and Co-Chair of the Adaptation Finance Working Group under the United Nations Environment Programme Finance Initiative.

Scaling carbon markets

We’re ensuring high-integrity, scalable carbon markets develop to help support climate mitigation.

A leader in carbon markets

Our teams have deep expertise in carbon markets development, engaging across several global initiatives which drive capacity-building efforts to help scale these markets.

A breadth of services

To support global net zero strategies, we offer our clients trading, advisory, financing and risk management services grounded in deep expertise and credibility.

Piloting a new approach

In partnership with CUR8, UNDO and British Airways, we delivered a global first transaction, demonstrating how we can scale finance for carbon removals.

Bridging the sustainable development finance gap

We’re leveraging blended finance to mobilise private capital at scale in support of a just transition in emerging markets and developing economies.

Why we need country platforms

A programmatic approach to blended finance could help bridge the global sustainable development financing gap. But, what are country platforms?

Our role in the JETP process

We are dedicated to supporting the Just Energy Transition Partnership (JETP) process, and are pledging to at least match initial donor funding for Indonesia and Vietnam.

A blended finance leader

We have been identified as a leading blended finance bank across emerging markets and developing economies by Convergence for more than five years.

Shifting financial flows towards nature

We’re catalysing and incubating opportunities to shift financial flows towards halting and reversing nature loss.

A debt conversion for nature

We acted as the sole lender and deal manager in a debt conversion for nature with The Bahamas, unlocking USD124 million for marine conservation over the next 15 years.

Solutions for the real ocean economy

Our report explores ocean-focused innovations, technologies and financial mechanisms to support the transition of the blue economy.

New investor opportunities

We are identifying new, innovative opportunities for global investors which support wider development goals, such as the opportunity in seaweed.

Contributing to the wider sustainability ecosystem

Our senior leaders are involved in a number of global partnerships and initiatives that seek to enhance the sustainability ecosystem. These range from those that support the development of voluntary carbon markets and foster innovative conservation finance solutions, through to those building social resilience to support the UN Sustainable Development Goals.

See some of the initiatives we participate in.

Supporting economic inclusion and entrepreneurship

We work with our clients and suppliers, as well as global and local partners, to advance economic inclusion in our markets – with a focus on women.

Driving finance to women-led SMEs

In 2023, Standard Chartered became the first global signatory of the We Finance Code, a commitment – led by the World Bank – to help drive more financing to Women-led SMEs around the world. As part of our commitment, we will be helping drive peer learning across our markets on this topic.

Supporting women entrepreneurs

Through SC WIN, we aim to provide female entrepreneurs with tailored financial solutions, business education and opportunities to connect with like-minded entrepreneurs so they can successfully grow their businesses. The programme is currently available in India, Malaysia, Kenya, Singapore and Hong Kong and is set to launch in further markets in 2024.

Growing diverse supply chains

In partnership with WEConnect International, we are launching a first-of-its-kind financing facility designed to foster the growth and development of WEConnect’s women-owned business members in emerging markets and offer its member buyers supply chain finance solutions to support their commitments to diversity in their supply chains.

Futuremakers

Futuremakers is a global initiative which empowers young people to find employment, create jobs, and transform their communities.

Standard Chartered has an important role to play in supporting our clients, sectors and markets to deliver net zero, but to do so in a manner that supports livelihoods and promotes sustainable economic growth. We provide financial services to clients, sectors and markets that contribute to greenhouse gas emissions however we’re committed to managing our environmental and social risks and to becoming net zero in our financed emissions by 2050.