-

Events

Standard Chartered at AFP 2024

Visit us at booth #1809. Use our Discount code AFP2024PARTNER150 to register today.

Join us and thousands of corporate treasury and finance professionals from all over the world to gain valuable knowledge, inspiration and connections.

Our speakers

Standard Chartered experts join other industry thought leaders on the AFP stage. Attend their sessions for practical insights on tomorrow’s banking.

Anand Natarajan

TMT and Fintech Head, Cash Sales, Americas

Simplifying the world of cross-border payments

Panelists: Saif Ashraf, Lead, New Business Treasury Implementations, Google and Christopher Mager, Senior Director, B2B Connect, Visa

Date: 21 October (Monday)

Time: 08:30 AM CST

Room: 106 ABC

Jessica O’Keefe

Manager to the Regional Head of Transaction Banking Americas

The ROI of DEI: Harnessing data analytics to create inclusion

Moderator: Dave Wexler, Business Development Executive at West Monroe

Panelists: Lynne Walker, Founder and Managing Member, Connect Consulting and Sassan Parandeh Treasurer, ChildFund International

Date: 21 October (Monday)

Time: 10:30 AM CST

Room: 202 ABC

Our delegates

Visit Standard Chartered Booth #1809 and connect directly with our delegates.

For media inquiries, please contact Sammi He at +1 862 448 8488, or Sammi.He@sc.com

Network with us

Meet us at AFP 2024 in Nashville, TN

Booth #1809

Win a LFC Jersey

Monday, 21 October and Tuesday, 22 October at 3:30 PM

Q&A with LFC Legend

Monday, 21 October at 3:00 PM with LFC Legend Sami Hyyphia

Meet a LFC Legend

Stop by for an autograph session on Monday, 21 October 10 – 12 PM and 2 – 3 PM

Cash and Liquidity Management Guide for Corporates

The increased need for visibility, control and liquidity optimisation across entities and geographies remains a top priority for corporate treasurers. We’re worked with PricewaterhouseCoopers Singapore to produce a 2024 guide and provide you with an overview of the considerations for each market covered.

Real Time Treasury

Trade Track-It

Looking for a faster, smarter and easier way to check the status of your trade transactions? With Trade Track-It, you can – anytime, anywhere. A digital tool that gives you real-time end-to-end visibility.

Payouts-as-a-Service

Introducing Payouts-as-a-Service, a bank-grade fintech solution by Standard Chartered that allows digital businesses to seamlessly manage one-to-many payments to parties in their ecosystem.

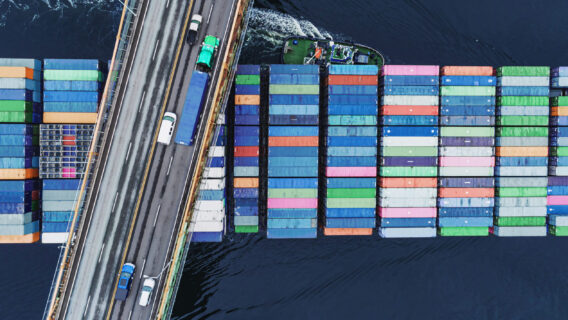

Payments industry

Partnering with the right bank could buoy fintechs’ ambitious expansion plans across high-potential markets. Seize emerging market opportunities in the payments industry.

Sustainability

The sustainability commitment paradox

Do you really need to trade off financial returns for a positive impact on sustainability? Find out. Download our report.

Deepening sustainability with DLT

Exploring innovations in supply chain payments.

Committing to sustainability goals

Learn how South32 was able to diversify its treasury investment portfolio and increase short-term liquidity, whilst optimising return on cash.

Your Climate Risk partner

Climate risk assessments support Sustainable Finance solutions and help identify climate-related risks and opportunities.

Critical indicators

Critical indicators of sustainable supply chains. More than ESG.

Financing the transition to net zero

Zeronomics – With time running out, can large companies reach the Paris Agreement goal of net-zero carbon by 2050? Read our interactive report.

Carbon Dated

What are the rewards – and potential risks – for suppliers as multinationals start decarbonising their supply chains? Read our interactive report.

Sustainable trade financing with Standard Chartered

Taking sustainability beyond the physical supply chain to include financing is why we’ve developed our sustainability-linked financing solutions, underpinned by certification ranging from Fairtrade Bonsucro to USDA Organic and validated by Sustainalytics, a global leader in ESG and Corporate Governance. Let our Sustainable Finance and ESRM teams provide you with expert advisory to help you achieve your sustainability goals.

Digital innovation

Banking on dynamic markets

What do investors think of the growth opportunities in dynamic markets? Our research shares insights to help make informed decisions.

Guide to payment regulations

Understand the impact of regulations related to the provision of payment and e-money services in this guide, jointly developed in partnership with Allen & Overy.

Reinventing the buy/sell experience

Leveraging payment, collections, and escrow solutions from Standard Chartered, WTX.com – backed by Daimler Truck – now offers an online platform for buyers and sellers of used trucks across the world to transact with ease, convenience, and confidence.

B2B e-marketplaces

Unlock your e-marketplace potential to reinvigorate your B2B business. Get access to platform technology leaders like KI Group and payment fintechs like Tazapay, leverage a suite of modular and configurable solutions to collect, hold, and pay, or co-create with us to embed financing and scale your business. Speak to us today.

Transaction banking solutions

Marketplaces and platforms need to collect, hold and distribute funds seamlessly. Watch to find out how we can help your business enable next generation commerce.