-

Sibos 2022 with Standard Chartered

Tomorrow’s banking

The world’s real economy is in the midst of an historic shift because flows, business models and places where tomorrow’s goods and services will be exchanged, are changing.

At Standard Chartered, we are gearing up for ‘Tomorrow’s Banking’. Along the way, we are forging partnerships with financial institutions, fintechs, service providers and clients to help support and be of service to you.

We are excited to be sharing our outcomes, learnings and insights from this journey with you at Sibos.

Insights to inspire

Enjoy thought leadership exploring ‘Tomorrow’s banking’ – and take a new look at digitalisation, innovation, sustainability, and financial crime and compliance. Enjoy our experts’ insights and perspectives on subjects that matter to you, your clients and your business.

Tomorrow’s banking: Creating opportunities for sustainable growth

To support the real economy and provide an enabling environment for businesses to grow, it’s time to bring forth the future of banking, harnessing emerging technologies to create new opportunities for sustainable growth.

Evolving banking for the digital economy

To deliver the efficiency, transparency and experience that new-age, digital-first and digital-only companies of the future demand, banks need to evolve in lockstep.

How banks can channel finance for a just transition everywhere

With the right approach, banks can help support a just transition enabling economic development to continue at pace while securing the future of the planet.

Solving for real-world challenges through banking innovation

What do CBDCs, digital assets and tokens mean for financial institutions and how can they be safely put to work for the real economy?

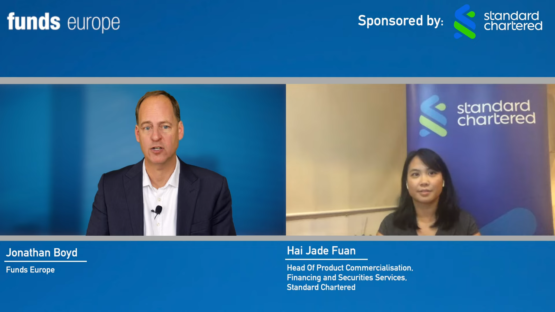

Asia zeros in on ESG

What is driving investor demand for ESG, and how are service providers responding to it?

Innovating for clients: Understanding the value of data and digitalisation

Uncover insights into the provision of data through digital solutions in both emerging and developed markets, the shift towards omni-channel solutions, and how it all comes to life through real-world client examples.

Moving the dial on financial crime

Banks and their fintech partners share responsibility for driving risk out of the system. But how best to go about it? By taking a radical new approach. Read more to find out how.

Shaping securities services for tomorrow’s world

How does the securities services industry strike the optimum balance across emerging markets, technology and talent management for a better tomorrow? Find out in our latest edition of The Custodian.

Bankable Insights – Sibos 2022 edition

From digitalisation, sustainability, innovation and talent to financial security and compliance, read expert insights on how to navigate tomorrow’s banking.