We’ve tightened our financing criteria – what you need to know

In short, we’ve tightened what we will and won’t finance, raising the minimum standards required. The updates are in our refreshed public position statements, which cover new and tightened requirements, and are effective from March 2019.

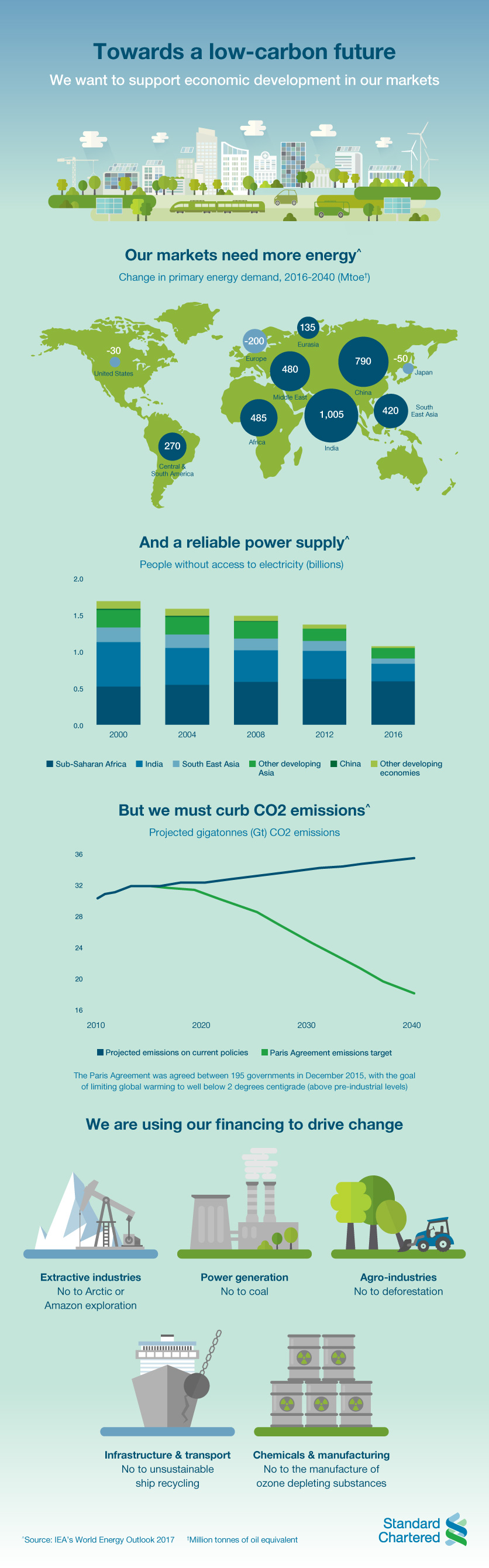

The new minimum standards cover industries that have high potential to have negative environmental and social impact. Each position statement was refreshed after consultation with a range of clients and non-governmental organisations (NGOs), and will ensure we can balance supporting our clients in undertaking their business activities and supporting economic growth. They cover: extractive industries (oil & gas, metals & mining); power generation: (nuclear power, renewable energy); agro-industries(agribusiness, tobacco, fisheries, forestry, palm oil); infrastructure and transport; chemicals and manufacturing.

The new requirements include:

See the full list of refreshed statements for more.

“The refreshed statements form part of a wider goal to increase support and funding for sustainable financing”

Our CEO, Bill Winters, on how banks can help tackle climate change, using our financing to drive change, and society’s role in meeting the Paris Agreement.

Using our financing to drive change

Our CEO, Bill Winters, on how banks can help tackle climate change, using our financing to drive change, and society’s role in meeting the Paris Agreement.

The refreshed position statements form part of a wider goal to increase support and funding for sustainable financing. For instance, as part of our opens in a new window sustainability aspirations, we’ve committed to finance and facilitate USD$4 billion toward clean technology by 2020, and we’re more than halfway to meeting that goal.

Before we provide financial services to a Corporate or Commercial Banking client, our relationship managers carry out an Environmental & Social Risk Assessment (ESRA). This allows us to evaluate their performance against our environmental and social requirements. The client ESRA is also reviewed every year. We’ll decline transactions or exit relationships where clients show insufficient intent or progress to meeting the requirements we set, as in the recent case where we decided to stop providing financing for new coal-fired power plants anywhere in the world.

Before you go, you might also be interested in the story on how we’re supporting a low-carbon future…