Business resilience during COVID-19: 5 ways we’re thinking less like a bank

Throughout history, tumultuous events have made us afraid and anxious. While fear comes from an external stimulus, we grow our anxiety in our imaginations. That’s why we are often better at reacting to fear as an outside opponent, while anxiety forces us to challenge our mindset.

Yet when we face that anxiety, chaotic times spark introspection, adaptation, and creativity. By now many of us have learned that Isaac Newton invented calculus during an outbreak of bubonic plague. William Shakespeare, meanwhile, crafted multiple plays during pandemics, including King Lear and Macbeth. How did they manage these great feats? Perhaps because dislocations force us out of our normal patterns, giving us a chance to pause, ponder — and do things in an entirely new way.

I believe that COVID-19 doesn’t have to just represent the biggest challenge to business in recent history. As we’re finding out at Standard Chartered, it can be a chance to look at the world with new eyes. But also, to take a hard look at ourselves.

Because this is not just a health and business crisis, but an identity crisis. Now, we must reappraise our habits and redesign the way we work. It’s a time to ask: what does a post-COVID bank even look like? I think it looks less like a bank, and more like a tech company. Brands who don’t ask those questions will, I think, be less valued from now on. They will react clumsily, focused purely on short-term survival rather than holistic change.

We have always been an organisation that is underpinned by three simple words: Here for good. Now is the chance for us to take this identity crisis, change ourselves creatively and evolve what Here for good means in a disrupted world. Because those simple words are an ever-changing thing. Previous generations of the Bank have responded to events in their own way. Now we’ve been handed the baton. Under our stewardship, it’s our obligation to move Here for good forward.

These are just a few of the ways I’m proud to say we’ve been striving to develop, and not just learning new ways, but unlearning bad habits.

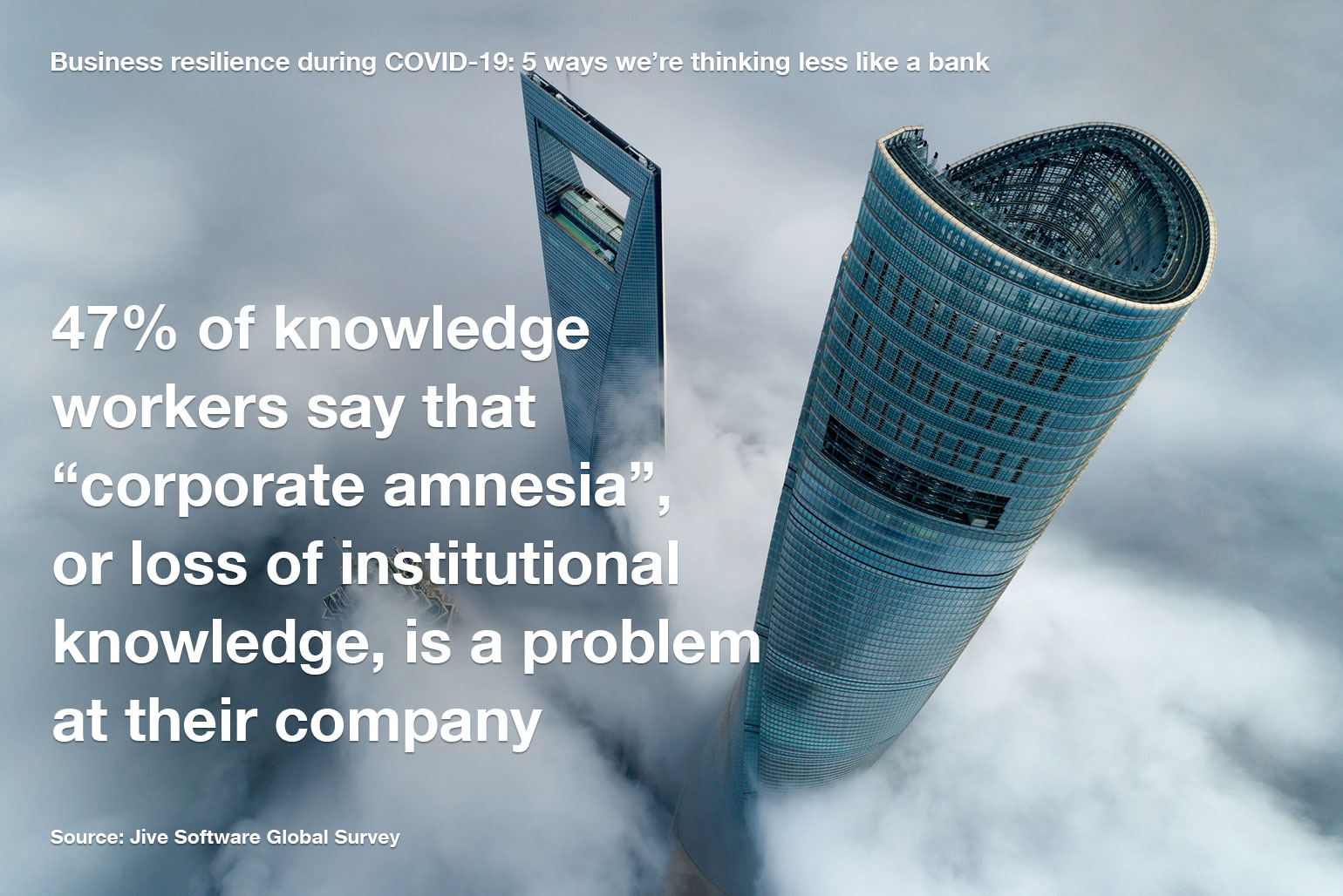

Many financial organisations can be a bit blinkered, focusing solely on the future. But now is a time to also learn from the past. Corporate memory (also known as institutional knowledge), is all the vital pieces of information held unofficially by your workforce. I think of it like a library for your business and, in times of crisis, it can be a life saver. There are two events that everyone at Standard Chartered still talks about. While they occurred before my time, I have witnessed first-hand how they have helped us during this crisis.

First were the floods in 2015 in Chennai, India, where we have our biggest centre. About 15,000 of our 86,000 employees work there. The second was the explosion in Tianjin port, China, also in 2015, which damaged our office and meant we had to invoke our Business Continuity Plans (BCP).

We learned many hard lessons from these events, around quick decision making and using the tools at hand to manage crises. Learnings like that helped us handle lockdown quite smoothly — in India, for example, we went from a zero per cent work from home rate to 100 per cent in two weeks.

But I’m particularly proud of how we’ve adapted to truly zero in on our futuristic capabilities. Faced with potentially crippling social distancing measures, our Singapore team rapidly realised that this is a chance to strengthen user adoption in our advanced technology. We’re approaching hundreds of clients to show how they can handle paperwork with us in a fraction of the time, using our new Straight2Bank NextGen platform. With manual processes, submitting an invoice financing trade application would take up to eight hours. With Straight2Bank NextGen, it takes just two hours, plus clients enjoy fast access to their financial data through a self-educating system which learns from user behaviour.

The point is, evolution cannot happen at a snail’s pace anymore. Overnight changes at a huge scale are possible. Digitisation is possible — and crucial.

The world where you have the option to become more digital, or not, is dead. Digitisation is the prerequisite. Customers will be saying, if you don’t have a really robust digital offering, I’m not even going to consider you. That’s why the uptake of our new wealth management app in China has been huge during the pandemic — customers adapt to new tools in a heartbeat. We need to be just as eager to service them with that tech. And with projects like Straight2Bank, our virtual bank and the invest from home digital system in Hong Kong, I’m excited to say that we are getting there.

And these are just the first forays into evolving digitally for our customers, profoundly changing the way we do business in the years ahead. It’s only when you fully commit to digitisation that radical change, like being able to truly apply AI and automation, can be felt — half-measures just won’t do it. I believe that this shift more than anything will take us into a new era of speed. To use an analogy: people used to think the four-minute mile was beyond human capability; a fool’s dream. Then one day, Roger Bannister ran a four-minute mile. Within weeks, that record was broken again. A mental barrier of what was feasible had been broken — and nowadays, high schoolers routinely run a sub four-minute mile.

Now, the pace at which we have had to adapt due to COVID-19 will be the new gold standard — any slower, and you’re losing the race. And once digitisation is accomplished, you can set and run towards your fresh goal. You can ask: what’s the new imperative for us now? That’s how you grow. But just like a four-minute mile, it will be fast and furious, challenging us in a very personal way as we try to live up to these complex tasks.

The other way you grow is by letting others step up. In the past banks, ourselves included, have relied on slow, measured solutions that get kicked up the hierarchy and signed off. But what has struck me is how much this crisis is an opportunity for us to boldly and proactively help clients in fresh ways. That means thinking less like an old-school bank with rigid layers, and more like a startup that trusts its talent. Recently Ben Daly, our Executive Director of Corporate and Institutional Banking, kickstarted a new stream of client communications to offer clarity where it was needed most. Conscious of how important access to financial services is to our client’s own COVID-19 BCP plans, Ben and his team have been sharing frequent country briefings with them. The briefings, he says, have given our clients insights about their markets, including any upcoming central bank restrictions or government support initiatives.

In some markets, we have seen governments completely shutting the banking system — including online banking — meaning no payments can be processed. In the case of one multinational corporation, giving their team advanced notice meant that vital payments, such as payroll, were able to be made early.

Initiatives like these have fostered stronger relationships and dialogues with our clients, says Ben. I’m particularly inspired by his belief that stepping up, particularly when things are hard, has been our way of demonstrating our commitment. It also demonstrates that when the ground is shifting, we don’t waste time pondering: we act. Ben didn’t take it slow, check in, or even ask for permission. He widened his gaze to recognise a potentially crippling problem, and improvised a solution to make a difference, quickly.

I’m excited to see projects like this brought to life and hope that this proactive mindset will become our new normal. But for that to happen, management has to loosen the reins. It’s when people feel they constantly need to ask approval from micro-managing higher-ups that execution suffers. Why? Because your teams are operating on fear, not trust, since you haven’t shown you have confidence in their instincts. Once that happens, your talent won’t even trust themselves. Now you might say that loosening the reins is dangerous. I say, it’s dangerous not to.

Many banks proudly show off deeply complex communications tools that do 10 things at once. But sometimes these tools have glaring gaps.

We knew we did not want to furlough any of our staff. But we also recognised that this is not an easy time to work from home. That’s why we developed an app called SC Connect.

We created the app because I was concerned about a “black hole” of key information. We have a wealth of useful internal systems — but none of them were designed to answer two key questions. “How are you feeling? Are you able to get your work done without too much trouble?” These are stressful times, and we need to be sensitive to the fact that most people don’t have the luxury of a nice study where they can go to work. Thanks to the app, I’m glad to say we can now send out a daily SMS to remind people to log in and give us a quick sample of how they are feeling.

It’s not particularly sophisticated, and one app is not necessarily a guaranteed solution for mental health. But it’s something we were able to do in the short term to connect with our teams. And it was created not in months or weeks, but days. It’s not quite the turnaround time that companies like Google have demonstrated (like when they uploaded a new version of their Person Finder software, a missing person’s database, 90 minutes after an earthquake devastated Japan in March 2011). But it’s a start. And it’s low barrier to entry, low cost, and when we get a better method we can update the system.

Speaking of starting: someone asked me recently, “How do we ensure our values trickle down from the executive level to the whole of our bank?”

Well for one thing, you have to change your paradigm that it all starts at the top.

As we’re seeing from tech innovators, the most creative business solutions in the world often start with the people dealing with the problem in the trenches. As a leader, you need to stop thinking that all good ideas are born at management level. You need to see what’s happening on the ground.

Find the people with the ideas which need to be heard (like our team who helped keep vital supplies going during India’s recent lockdown). You have to create an environment where there is more diverse thinking in the room. The minute it goes up the hierarchy, the idea gets diffused and put into a lifeless presentation.

In fact, in some cases, I’m probably the wrong person to make a decision. For me, it’s not thinking about it as, “I’m a leader with a great idea and I can give people permission to execute it.”

I start the other way around: I’m a leader with no ideas. In fact, I assume most of my ideas are bad ideas. Instead I set broad strategic direction, then empower those creative front liners to come forward with their idea.

I do strongly believe in one idea though: that every experience is a learning experience. Even the bad ones. If you encounter unsuccessful projects, or imperfect people, you can always reflect on the positive side.

In general humans are quite egotistical: we don’t like to be wrong. But failure creates learning moments. That can be immensely useful, if you look at failure with curiosity. We’ve known for over a year that we need to boost our conferencing and collaboration capabilities. We’ve known that spending millions of dollars a year on flights and hotels is not good for our bottom line or the environment.

It took a crisis for us to get our act together. That’s something we should have done better — but we can learn from it and emerge stronger than ever.