Pharma companies have USD250 billion to invest in growth

Strong growth prospects drive valuation, a balanced capital allocation policy is critical.

Major pharmaceutical companies have a combined USD250 billion in debt capacity – within their current credit ratings – that they can deploy towards the next phase of growth.

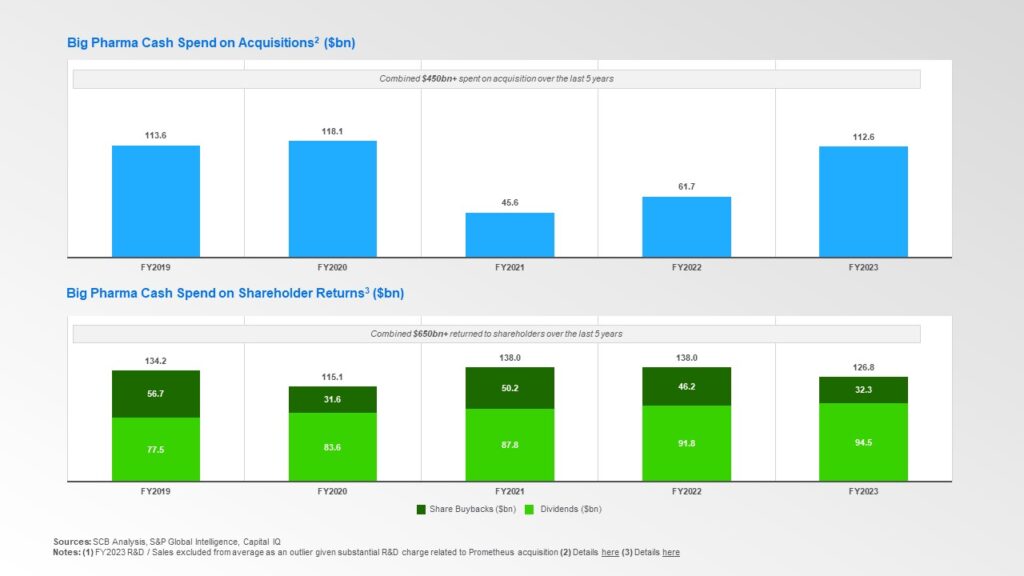

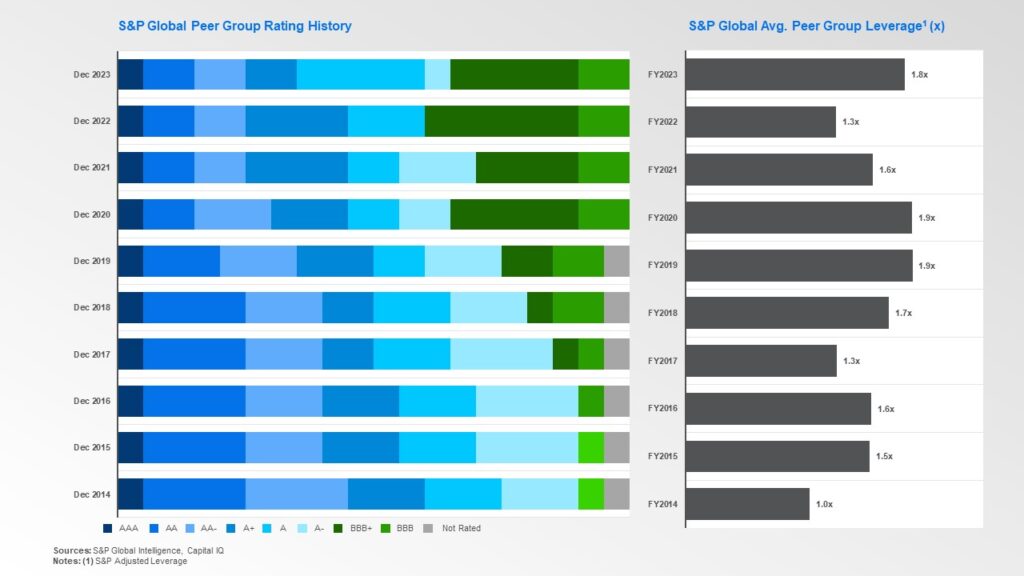

Over the past decade the sector has become increasingly comfortable with the idea of using balance sheets to drive growth; our research shows a gradual credit rating deterioration which has created opportunities to bolster R&D spend, explore inorganic business development and return capital to shareholders.

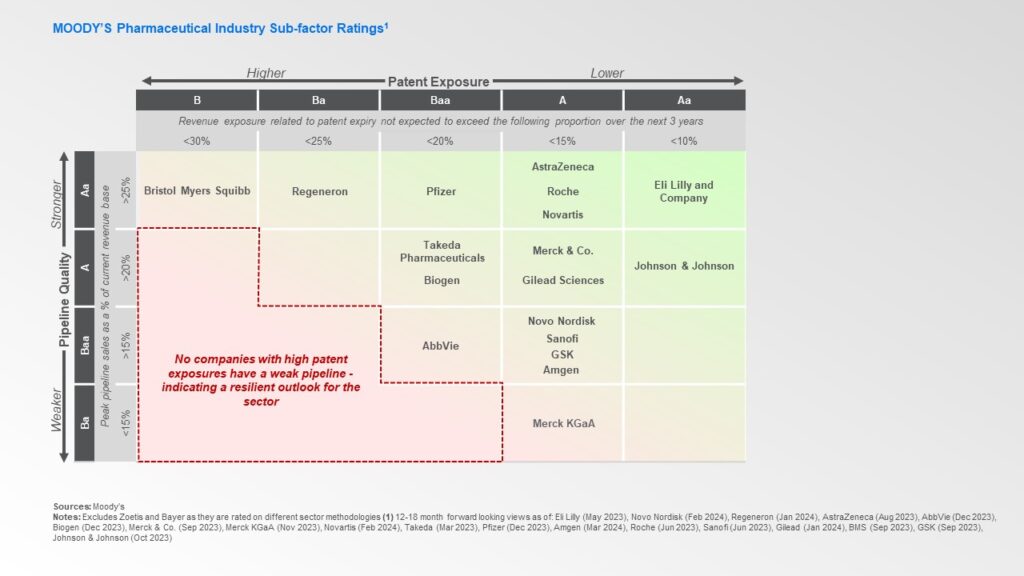

We believe that this trend is set to continue, with most companies committed to building robust pipelines in the face of impending patent cliffs and as they diversify their business into higher growth markets.

Untapped debt capacity

With several blockbuster products at risk due to upcoming patent expiration, we may see companies continue to flex their balance sheets and take advantage of opportunities in areas such as weight-loss, oncology and immunology.

We expect this to spur more acquisitions, joint ventures and partnerships. What’s important is having the right strategies in place to optimise balance sheets to support this growth. These include diversifying investments, reassessing credit profiles so as not to overstretch, and improving working capital management.

How have ‘Big Pharma’ debt profiles evolved?

Most companies have robust pipelines and continue to invest in them, which means the majority are resilient even as drugs come off patent.

What’s more, the shape of the balance sheets of large pharmaceutical companies has fundamentally changed over the past decade, with sector leverage increasing from around 1.0x to 1.8x. This strategy made sense given the previous interest rate environment and the high cost of equity.

What was primarily an ‘A’ rated sector a decade ago, has more than a third of companies in the ‘BBB’ space today with a combined USD250 billion untapped debt capacity at current ratings, and even more headroom if downgrades are accepted.

Should balance sheet capacity be used to drive more growth?

As Big Pharma pursued inorganic growth opportunities, they embraced more flexible financial policies to fund their ambitions. What’s unique is the industry’s willingness to lever up as long as it means they can secure their acquisition targets.

This stance highlights a permanent shift in the industry’s priorities, where strategic growth opportunities take precedence over the highest possible credit ratings.

Even so, the higher-for-longer interest rate environment raises questions about the long-term viability of debt-financing acquisitions. Higher borrowing costs increases the challenge of managing the financial burden of debt servicing – and pharmaceutical companies should carefully evaluate the potential returns and synergies against the costs.

(View large thumbnail here)

How can pharmaceutical companies get the most from their balance sheets?

- As patents expire, it is crucial to develop a compelling investor story that evolves alongside these changes. The loss of patent protection can significantly impact revenue streams, requiring companies to proactively redefine their credit profiles and reassess their optimal leverage levels. Companies must take a proactive approach in defining their long-term financial policies and determining the optimal size of their balance sheets. Clear communication can help build investor confidence, positioning pharmaceutical companies for long-term success.

- To optimise balance sheets, companies should consider diversifying funding sources, arguably beyond the deep US markets to regions like Europe or even Asia and the Middle East. Equity is an expensive way for pharmaceutical companies to raise money and there is appetite in these markets for their debt.

- Enhancing the efficiency of working capital is another aspect of prudent financial management, and supply chain financing can play a key role here. By leveraging supply chain financing solutions, companies can reduce the strain on their working capital requirements.

Helping unlock pharma’s potential

There’s significant scope for pharmaceutical and life sciences businesses to unlock growth opportunities through investment – and to fund this by issuing debt. With the right guardrails in place, companies can redefine their credit profiles, optimise their balance sheets and make their working capital more efficient.

As the pharmaceutical industry navigates the challenges and opportunities of the coming years, it will be crucial to make the best of their balance sheets and use this room for manoeuvre to drive growth, innovation and value.

Standard Chartered as a partner

With a global presence and expertise in balance sheet structuring and financial policy analysis across many regions, Standard Chartered is well-positioned to provide guidance in these areas and others. Our team can provide guidance as pharmaceutical companies pursue large, transformative acquisitions whilst keeping in mind the broader credit narrative and limitations.

Some of the critical considerations for the next growth phase are: is the balance sheet ready? Is the capital allocation policy fit for purpose? What should the long-term credit story be?

We have the unique capability to help corporate determine an optimal capital structure that aligns with their strategic objectives while considering the potential impact on their credit story and investor base.

Get in touch with our team

- Shoaib Yaqub, Global Head, Capital Structure & Rating Advisory, Shoaib.Yaqub@sc.com

- Jong Boo Yoo, Regional Lead, Americas, Capital Structure & Rating Advisory, JongBoo.Yoo@sc.com

- Farabee Chowdhury, Director, Capital Structure & Rating Advisory, ChowdhuryKhalid.Farabee@sc.com

- Su-Lin Watson, Managing Director, Global Head, Healthcare Sector, Sulin.Watson@sc.com