Brazil beckons

Why international investors are prioritising market opportunities in Latin America’s largest economy.

Global attention is turning to Brazil. Hosting its first-ever G20 summit – in November 2024 at Rio de Janeiro’s Museum of Modern Art – highlights the country’s growing prominence on the world stage.

This has not gone unnoticed by international investors. In our 2024 survey of 400 banks, investment managers and asset owners headquartered in Europe and the Americas, 25 per cent of respondents state they have plans to invest or grow businesses in Brazil over the next 12 months. Among the global markets covered in our survey, only Mainland China and India recorded more interest from international investors.

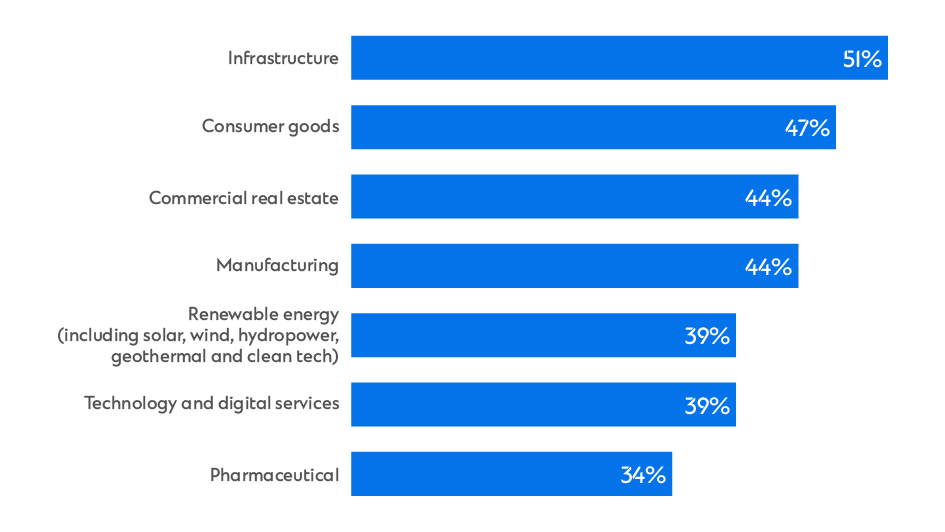

Brazil is best known for its natural resources and commodities market but investors are now looking at a wider range of market opportunities. More than half (51 per cent) of survey respondents are excited by the investment potential of Brazilian infrastructure, and 47 per cent feel that way about the country’s fast-growing consumer goods sector.

Western investors investing in Brazil are keen to explore opportunities in infrastructure and consumer goods*

*Percentage of respondents rating each sector among their top three areas of interest for investment or business development. Source: FT Longitude/Standard Chartered, Future powerhouses: How western financial institutions are banking on dynamic markets, 2024

Sustainable infrastructure a strong focus

“Brazil remains an important exporter of commodities, but its next phase of growth is going to be different,” says Germana Cruz, CEO and Head of Coverage for Brazil at Standard Chartered. “Following the G20, Brazil is also hosting the next global climate change summit, COP30, in 2025. Sustainability is becoming an ever more important area of opportunity and focus for investors.”

In 2021, research from the Carbon Trust, a UK-based think tank, valued the sustainable infrastructure opportunity in Brazil at GBP495 billion (USD644 billion) over the next two decades. It says there is huge potential in areas that include renewable energy, low-carbon telecommunications infrastructure, clean urban transport and sanitation.

President Luiz Inácio Lula da Silva, who returned to power in elections in Brazil at the end of 2022, has promised to champion the environment in the country that’s home to the world’s largest rainforest. Brazil already leads the G20 in its use of renewable energy, which provided 89 per cent of its power in 2023. Recent government measures have enhanced Brazil’s appeal as a prime destination for sustainable investments, making the country more attractive to foreign investors focused on sustainability.

As the Brazilian economy grows, it will also need to invest in more traditional infrastructure – building new roads, for example, and developing the country’s seaports and airports as its export activities continue to expand. This evolving landscape presents a unique opportunity for international investors to play an important role in Brazil’s progress by partnering with local businesses in domestic industries such as construction to build these vital hubs and networks.

Brazil remains an important exporter of commodities, but its next phase of growth is going to be different Germana CruzCEO & Head of Coverage, Brazil

Germana CruzCEO & Head of Coverage, Brazil

The allure of consumer goods

Brazil’s consumer goods sector, meanwhile, is also exciting investors. This is not just because economic sentiment has improved in Brazil during 2024 – McKinsey has reported that optimistic Brazilian consumers are now planning to spend more on both essential and discretionary goods. It’s also because the demographic backdrop offers strong opportunities. With about 215 million people, Brazil has the second largest population of any country in the western hemisphere. More than half of the population are considered to be active consumers – a high proportion for a dynamic market – and this is set to grow 9 per cent by 2030.

Leveraging digitalisation is an important part of the consumer story in a country where internet and mobile penetration rates are currently high: 86 per cent of Brazilians have an internet connection. Brazil’s e-commerce sales are forecast to reach nearly USD500 billion in 2026, making it the fastest-growing e-commerce market in Latin America.

A booming fintech centre

Brazil is also emerging as an important global hub for financial technology (fintech) businesses. As of 2023, the country boasts 722 registered fintechs, positioning itself as the leader in Latin America’s burgeoning market of over 3,000 companies.

Foreign exchange is a good example of a sector where nimble fintechs have seized an opportunity. “Brazil’s central bank tried to simplify FX regulation two years ago, but traditional players still face high costs, particularly for small transactions such as retail purchases,” says Cruz. “Fintechs have taken advantage, facilitating a better customer experience and capturing a great deal of that business.”

Digital financial services, including mobile wallets, are reshaping Brazilians’ daily payment habits: 44 per cent of e-commerce payments are made using alternative methods. Local solutions such as PicPay are enabling fast, low-cost transactions for a wide range of users, including the country’s estimated 10% of adults that are unbanked.

Leaders in Brazilian fintech include Nubank, the largest fintech bank in Latin America, which has 93 million customers in Brazil alone. Like other fast-growing fintechs, Nubank is seeking international expansion opportunities, working with partners across Latin America but also in new regions such as Africa, according to Cruz.

Challenges easing

In the past, potential investors may have had the perception that Brazil is a country of political instability, high inflation and red tape. “There is still an idea that Brazil’s regulatory framework needs to protect national industry,” says Cruz. “And that regulation is still paperwork-heavy.”

But President Lula’s administration aims to make the country friendlier to international investment and simplify the complex tax system. “The main goal over the next three to four years is to have a single national tax,” says Cruz. “That would be a big victory for both domestic industry and overseas investors in Brazil.”

The other area to watch, according to Cruz, is the performance of the US economy: Brazil’s fortunes are still closely linked to those of its North American counterpart. “We still import large quantities of American goods, paying in dollars,” says Cruz. “So a strong dollar will make imports more expensive.”

Seizing the Brazil opportunity

Like other dynamic markets, Brazil has its challenges. But with the right support from partners, investor appetite and confidence will continue to grow. The country recognises the importance of diversifying its economy and is interested in working with a wide range of investors who can support its strategic goals. The region is also well-positioned for companies looking to diversify and secure their supply chains. For these reasons, Brazil’s investment potential is increasingly attractive.