Connecting capital to where it’s needed most

Trillion-dollar funding gaps are exacerbating global challenges: the infrastructure financing gap stands at USD15 trillion; the transition to net zero requires an extra USD3.5 trillion every year, and a USD4 trillion annual investment gap threatens to thwart the sustainable development goals (SDGs).

With most of these gaps in the global south, it’s vital that as we advocate a better model of globalisation that addresses this disparity.

“It is critical that we connect global capital, at scale, to sustainable development opportunities in developing markets,” says Simon Cooper, CEO, Corporate, Commercial & Institutional Banking and CEO, Europe & Americas, Standard Chartered.

Nowhere is this more evident than in projects that have sustainability at their core. Channelled to the right opportunities, global capital can drive growth across borders and bridge funding gaps in critical areas from the net zero transition and critical infrastructure to the United Nations’ SDGs.

“The overriding aims are to catalyse, standardise, and democratise access to sustainable finance,” says Cooper. “And this requires collaboration between the public and private sectors.”

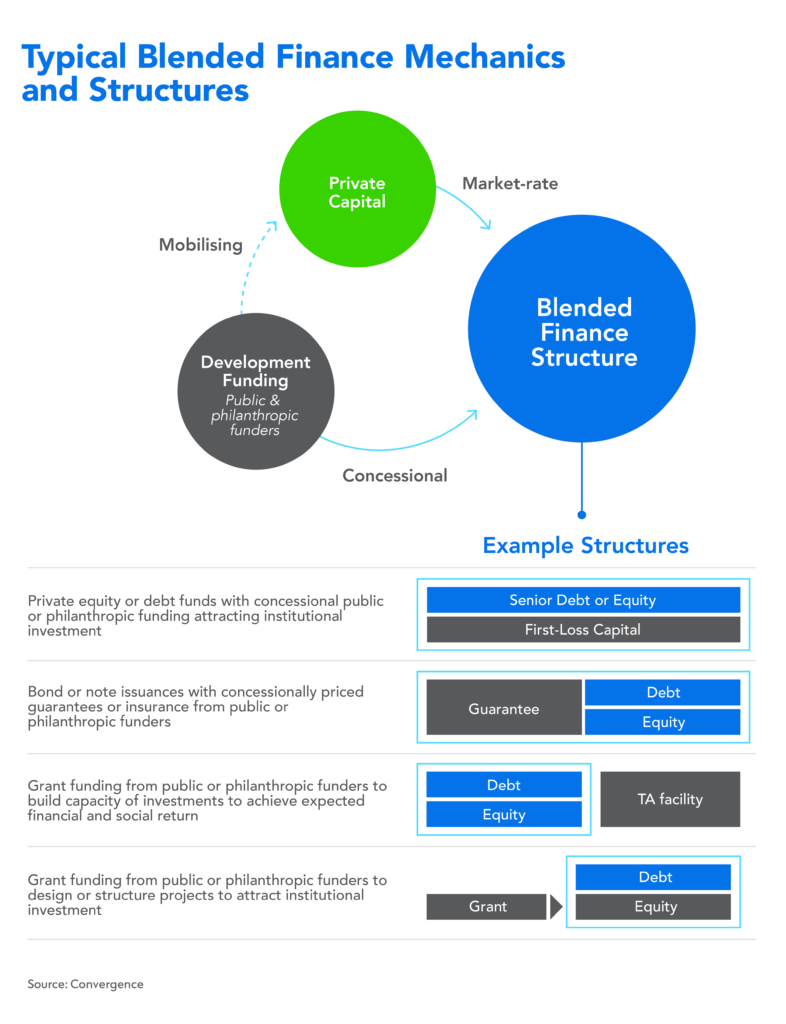

Sustainable investment projects in developing countries and frontier markets often struggle to offer risk-return profiles that attract a broad range of investors. Part of the solution lies in blended finance — a structuring approach that enables public and private investors with different objectives to invest alongside one another in sustainable projects.

Blended finance addresses investors’ concerns in two ways. One is through concessional capital by which public or philanthropic investors provide funds on below-market terms within the capital structure to lower the overall cost of capital or to provide private investors with an additional layer of protection. The other comes in the form of guarantees or risk insurance in which public or philanthropic investors provide credit enhancement through guarantees or insurance on below-market terms.

This creates investable opportunities in emerging markets. For example, in 2022, Standard Chartered coordinated and structured EUR1.24 billion in Export Credit Agency (ECA) backed financing to develop high-speed railway infrastructure in Türkiye. The result will be a 200km high-speed rail link that connects the cities of Bandirma and Osmaneli in the industrial north-west. The deal brought together three ECAs along with an engineering company.

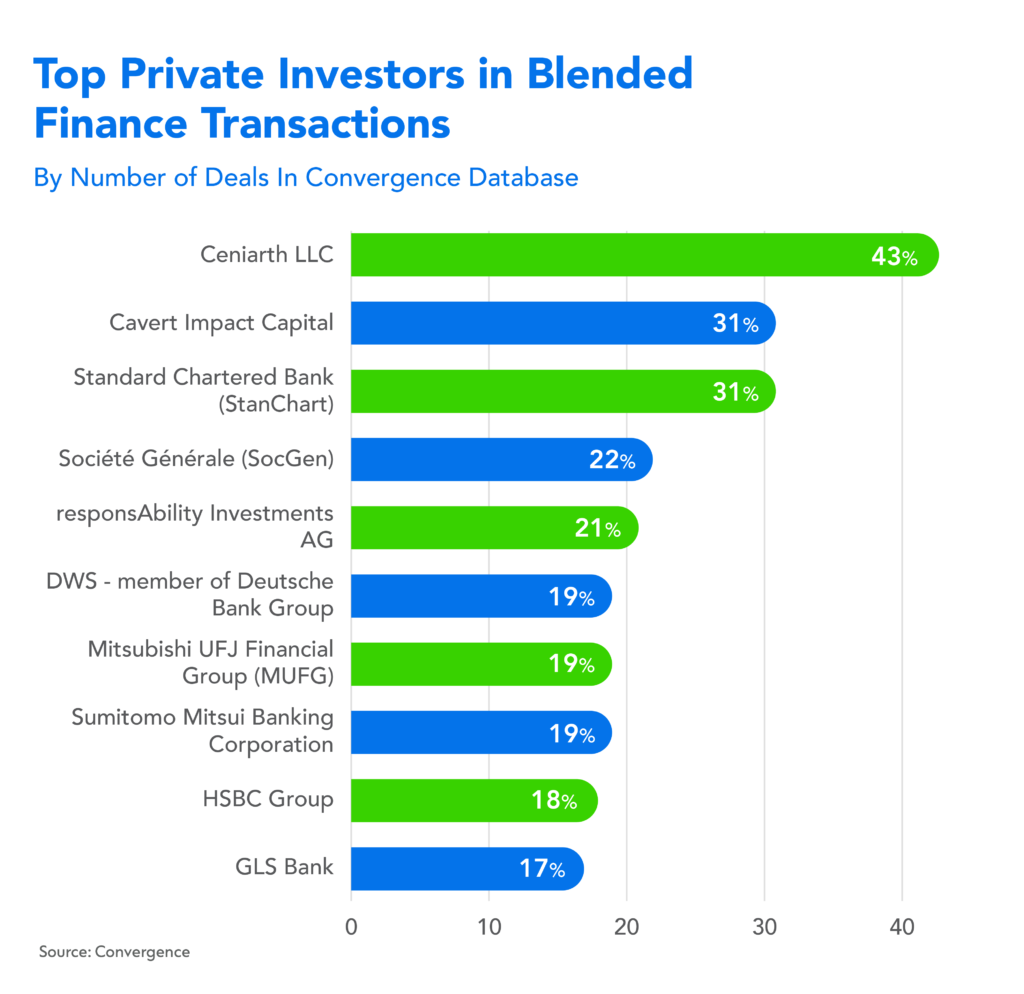

“Blended finance makes it possible for everyone to play a role in closing critical funding gaps and accelerate important transitions in emerging markets,” Cooper says. “It’s a matter of connecting where capital is raised to where it’s needed. That’s why we’ve partnered with Convergence, which is a global network for blended finance.”

While the power and potential of blended finance is clear, aggregate financing levels declined in recent years. Around USD14 billion was invested into climate blended finance transactions between 2019-2021, less than half of the USD36.5 billion invested between 2016-2018.

According to Convergence, a lack of bankable investment opportunities with appropriate risk-adjusted returns is the leading barrier to more systematic participation in climate blended finance deals. Other barriers include the lack of tools to measure and report climate impact as well as liquidity restraints in emerging markets.

“In order to scale blended finance to the size of the challenge, we need better governance and stronger regulation,” Cooper adds. “That means ensuring sound economic rationale for using concessional capital, commercial sustainability, high ESG standards across the project, transparent conflict management and other enhancements to reassure investors.”

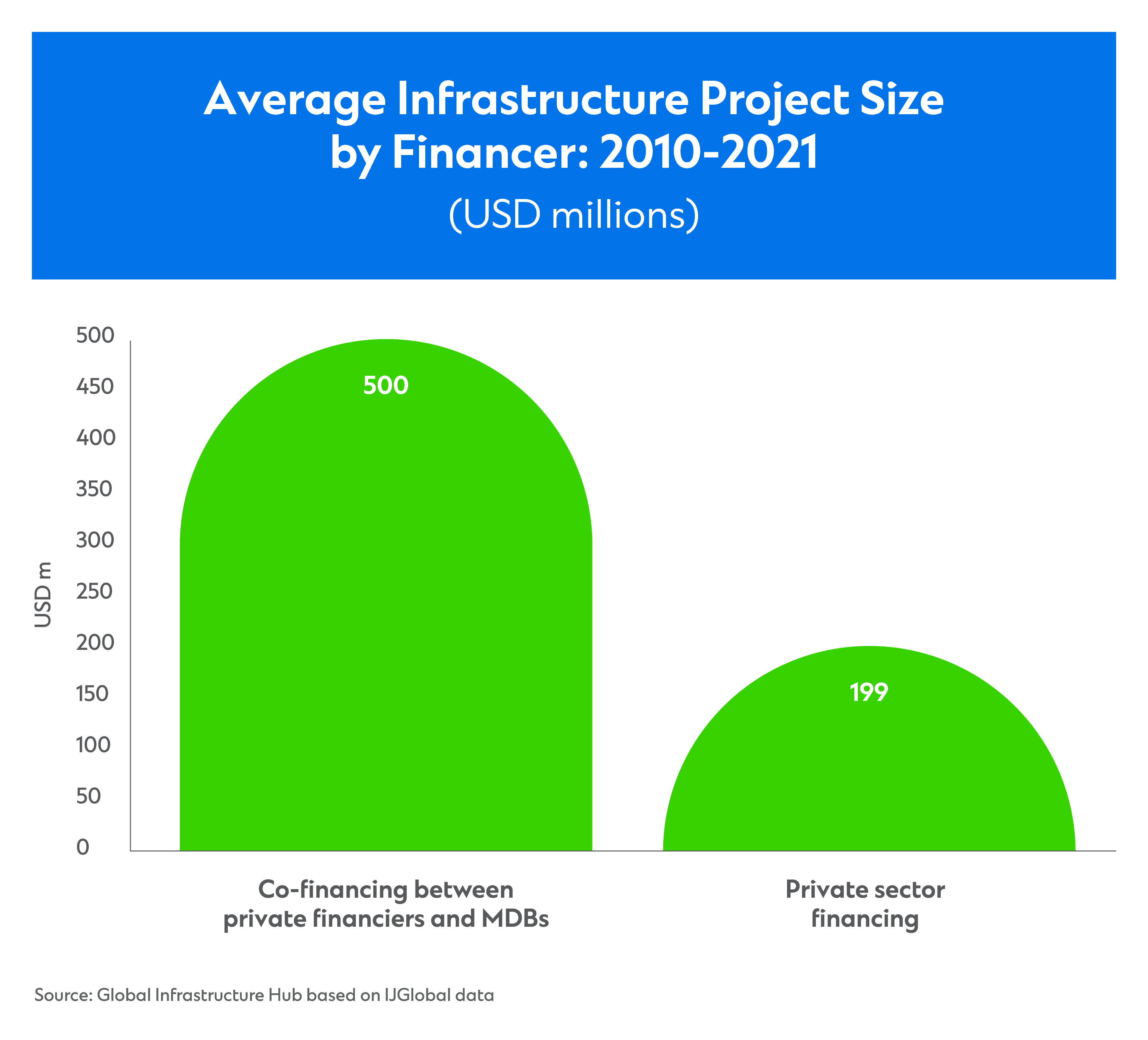

Multilateral Development Banks (MDBs) can help mobilise private capital. Their participation in project funding signals viability, stability and creditworthiness, which helps reduce risk and attract more private capital. MDB participation also enables cheaper and longer-term financing, which is critical for emerging markets – especially those most in need of infrastructure investment.

Data from the Global Infrastructure Hub show that 27% of private investment in infrastructure in middle- and low-income countries involved an MDB as a co-financier in 2021. Those transactions were larger than transactions financed by the private sector alone because MDB participation helps reduce risks associated with larger projects. In short, MDBs can help accelerate blended finance deals.

In 2022, for instance, the European Bank for Reconstruction Development (EBRD) arranged two syndicated loans worth USD520 million to build two wind power plans with a total capacity of 1GW in Uzbekistan. The project will help progress a long-term decarbonisation strategy that the EBRD developed with the government of Uzbekistan. Standard Chartered financed the deal alongside a German development finance institution, a French development agency, and other banks.

“That project showed both the power of blended finance and the role that multilateral development banks can play in galvanising private capital to fund clean energy projects,” Cooper says. “We must change this from the exception to the norm.”

Conservative risk appetite has limited the potential, with MDBs using concessional financing to mitigate their own risks rather than to mobilise third-party financing from private investors. Much of that to maintain their credit ratings. As US Secretary of Treasury Janet Yellen said in October 2022, we need MDBs to consider adopting stronger targets for mobilizing private finance and deploying a larger range of financial instruments and innovations.

“The global flow of capital will remain central to globalisation,” Cooper adds. “And the partnership between public and private institutions will help ensure that more people benefit and that capital flows are directed to where they will have the greatest impact.”

Produced by Bloomberg Media Studios in partnership with Standard Chartered.