Five cleantech trends for 2022

COP 26 sent a resounding message: Governments, businesses and investors must act faster to combat climate change. While we’ve heard this message before, the backdrop has changed. Industry convergence, private market fund flows, hawkish monetary policy, fragmenting supply chains and rising carbon prices are now front of mind for businesses and investors alike. As the race to net zero picks up, let’s explore how these trends could shape the climate-tech space in 2022.

Once unthinkable projects and partnerships are unlocking opportunities as multiple industries converge upon renewables. Oil and gas companies are partnering with new energy companies on green hydrogen projects. Shipping companies are building wind turbine installation vessels to facilitate the offshore wind industry. And mining companies are investing in and even building renewable power generation.

Growing focus on hydrogen, for instance, continues to spur collaboration across the industry. In one example, Crosswind—a consortium of Shell and Eneco—will build and operate a 750MW floating wind farm in the Dutch North Sea.1 Scheduled to go live in 2023, the project will also weave floating solar, an electrolyzer and energy storage into the mix, using them to produce and store green hydrogen.2 In another example, Siemens Energy and Korea Gas Corporation formed an alliance to produce green hydrogen and advance its use in power generation using turbines.3

Meanwhile, ABB won a $330 million order for wind turbine installation vessels last year4—a trend that’s likely to continue with 80GW of offshore wind capacity needed every year through 2030 to get on track for a net zero 2050.5 And South Africa Mines plans to invest $2.7 billion to build its own power plants—largely using wind and solar—amid persistent power cuts.6 As the world prioritized the energy transition, all roads will converge to renewables.

Industry convergence could reshape the investment landscape. In turn, investors should look for companies with skill sets that go beyond a single specialization like wind or solar. For instance, companies that can combine their power with batteries and are able to set up green hydrogen projects by partnering with off takers, will catalyze the next wave of investment.

Investment trends among oil and gas companies drive the point. Chevron, for instance, agreed last year to acquire equity interest in ACES Delta—a joint venture between Mitsubishi Power Americas and Magnum Development that produces, stores and transports green hydrogen in the U.S.7 Broadly, 41 of the world’s largest oil and gas refiners invested a record $21 billion in clean energy last year, up 53% from the year before. Wind and solar made up majority of investment, while hydrogen and storage gained ground.

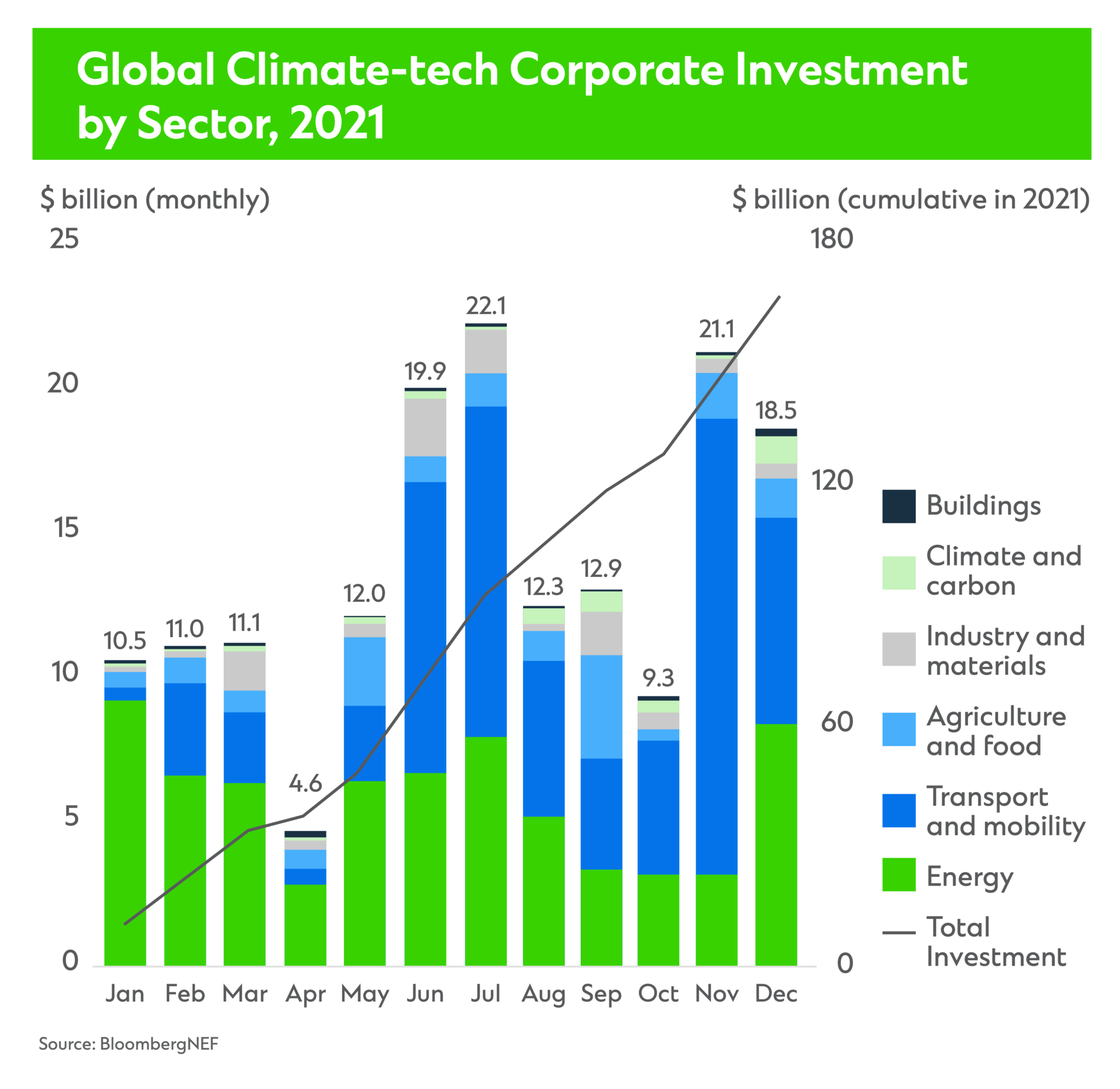

Opportunities extend beyond power generation. Climate-tech solutions for cleaner transport, buildings, industry and agriculture continue to capture investment flows. The climate-tech sector raised $165 billion in corporate finance in 2021, with transport and energy securing 82% of flows in public and private markets.8 Climate-tech start-ups accounted for $53.7 billion funds raised, much of that from venture capital and private equity firms.

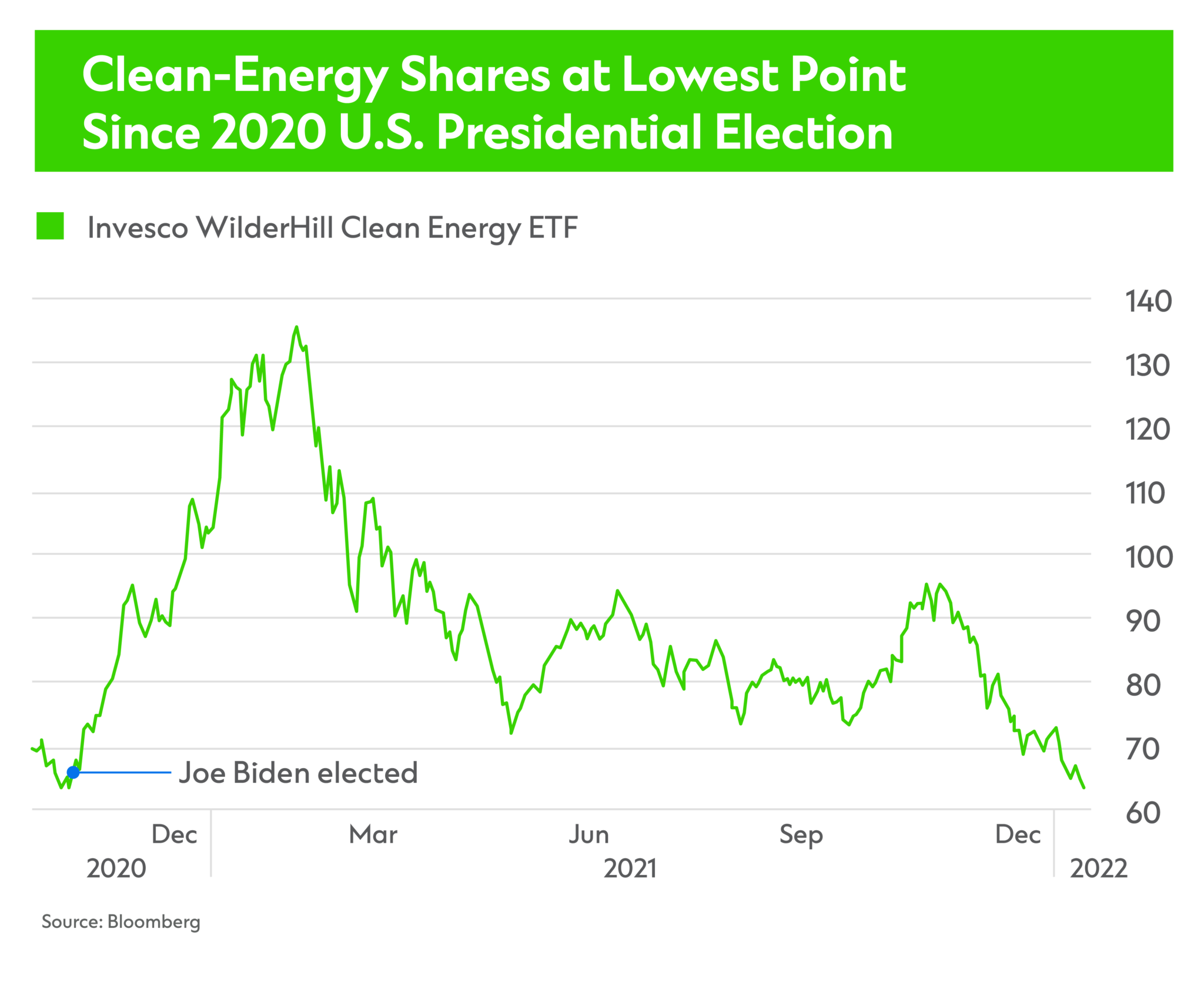

Climate-tech investment flows continue to feed fears of market exuberance. Where investors once questioned whether we’re in a bubble, they now wonder when it will pop. Hawkish monetary policy could be the catalyst.

Currently, Fed Fund Futures show the market pricing in five rate hikes this year with high chances for a sixth in early 2023. Higher interest rates could stall investment flows. As money becomes more expensive, some projects may not be viable. And refinancing might be challenging where bonds were priced at attractive levels. In turn, investors may pursue opportunities with higher credit worthiness, while weaker hands could struggle to secure the funds they need to thrive.

Breakevens present another challenge. Given that a lot of companies cover their capex upfront by borrowing, a sharp increase in borrowing costs means some companies will struggle to turn a profit.

The bubble already showed signs of popping during the most recent market rout. The WilderHill Clean Energy and S&P Global Clean Energy indexes, for instance, dropped 54% and 39% from last year’s market peaks.9 However, investor caution may be overplayed. While public pockets drove stocks and indexes to all-time highs, as we saw above there is a very large bid for these assets in the private markets. Private equity transition funds plowed billions of dollars into this space. Most of that is essentially undeployed cash. Those flows could keep the market buoyant for some time.

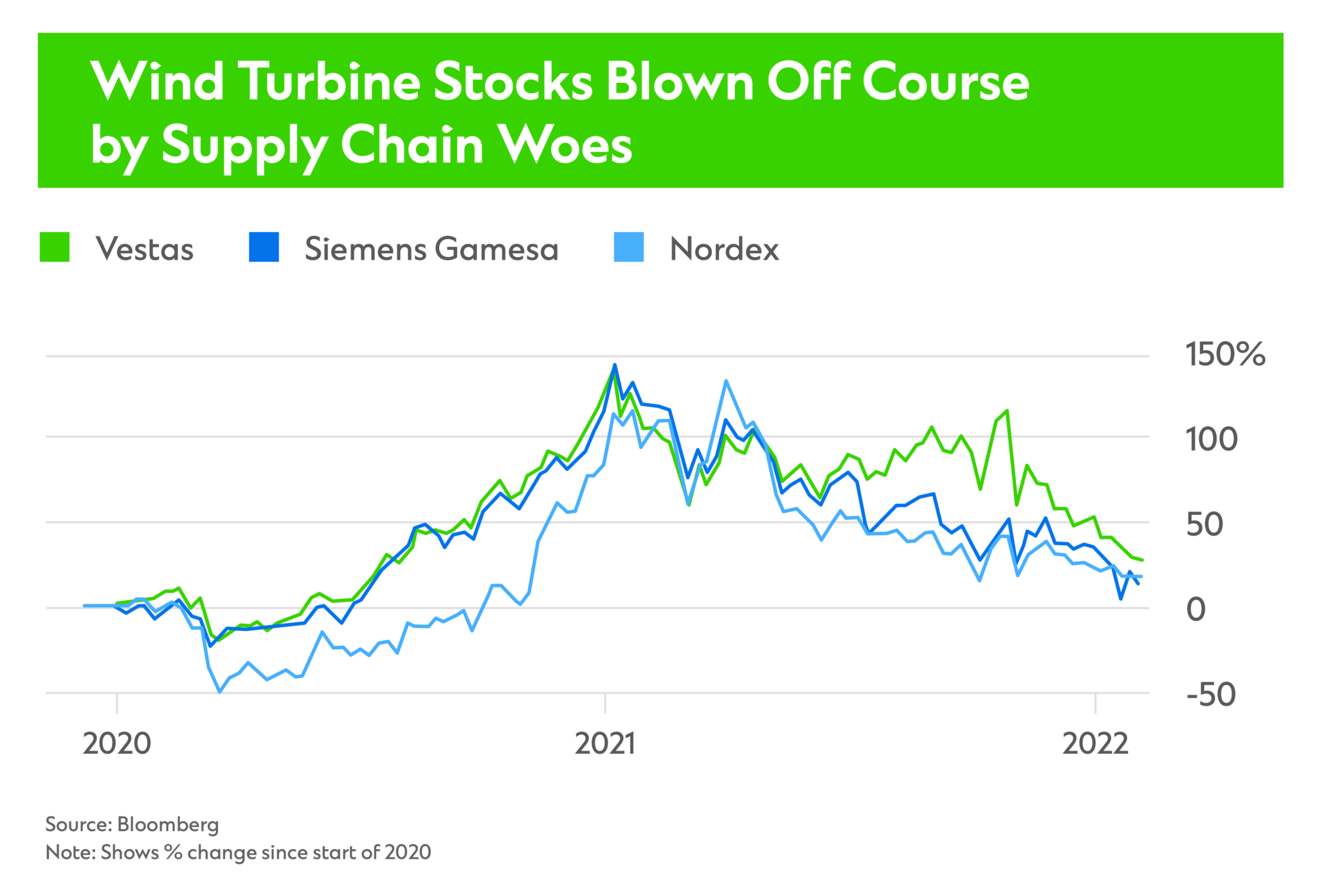

Supply chain disruptions stemming from Covid-19, geo-political tensions and resource nationalism could also prick the climate-tech bubble.

On the geopolitical front, gas disruptions due to the Russia-Ukraine conflict and relations between the U.S. and China remain in focus. President Biden approved a four-year extension of the Trump-era Section 201 tariff on imported solar equipment. China, which produces three quarters of the world’s solar panels,10 said the move would distort global trade.11 Indeed, if tariffs increase the cost of procurement, it could have a ripple effect across the industry.

Supply chain bottlenecks amid Covid-19 also threaten to drive up renewable power costs and delay projects. While the cost of utility scale solar and wind dropped 90% and 72% respectively since 2009,12 higher labor and materials costs could stall momentum. Prices for polysilicon, for instance, tripled during the pandemic,13 creating a headache for solar panel makers. And wind turbine makers struggled to breakeven as raw materials prices increase and delivery times increased as much as tenfold.14

Resource nationalism isn’t new, but it could spur new partnerships. Indonesia, for instance, banned nickel exports despite having the world’s largest stocks. In turn, EV battery makers are opening production plants. LG Energy Solution and Hyundai Motor Group, for instance, are building a battery making plant in Karawang.15 Likewise, nearshoring to reduce supply chain risks is spawning new partnerships. And Standard Chartered is financing China’s Contemporary Amperex Technology (CATL), a global leader of new energy innovative technologies, to start manufacturing facilities in Germany.

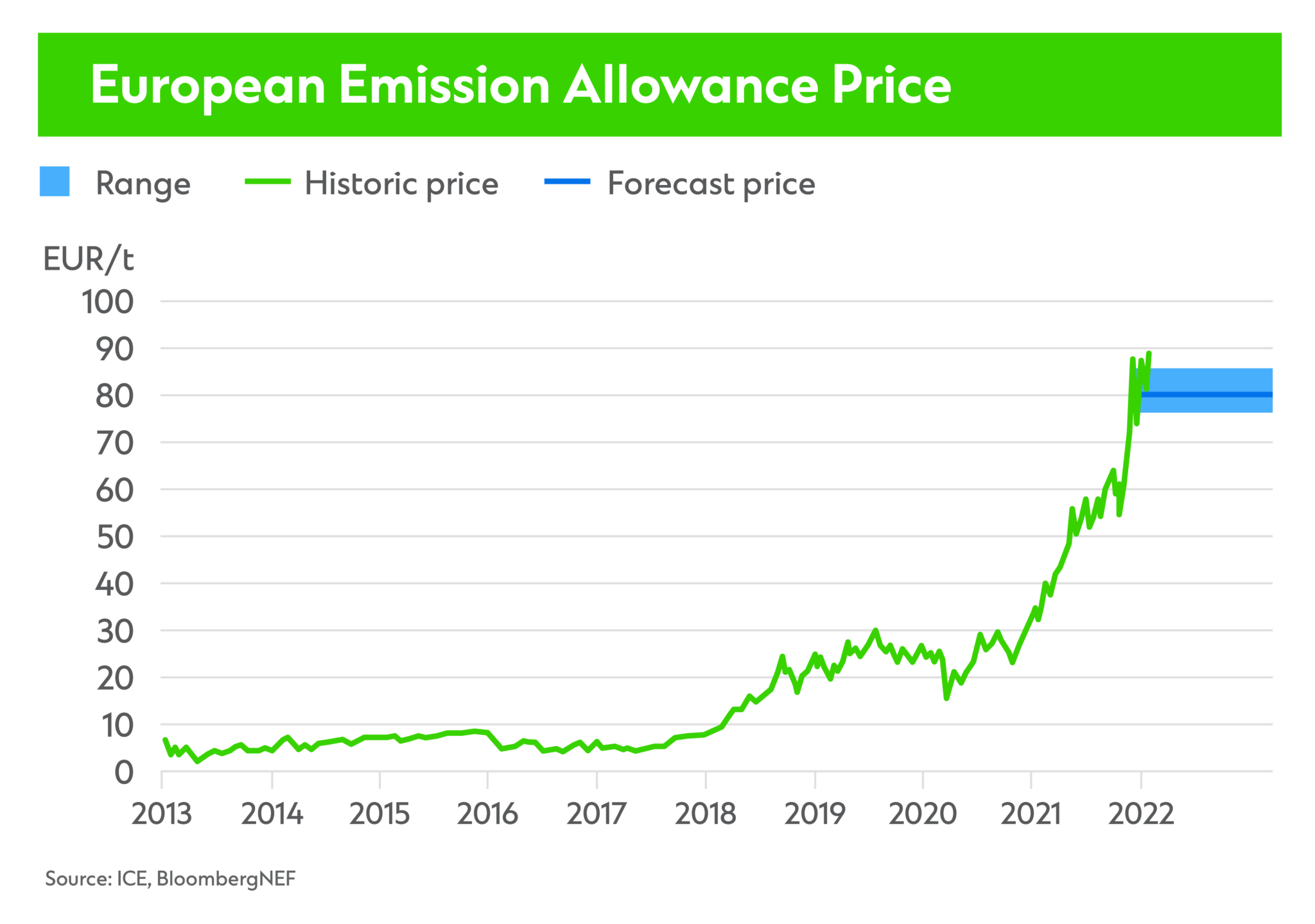

Investors should also keep an eye on carbon prices. A lack of regulatory support saw ETS carbon prices run flat for several years. Recent net zero legislation proved an accelerant. European Union lawmakers reached a deal in April 2021 to reduce greenhouse gases 55% by 2030 compared with 1990 levels, and to reach net-zero emissions by 2050.16 Prices doubled since the announcement.

Europe’s carbon market will play a central role in reducing emissions. Under proposals put forward in July 2021, the rate at which pollution caps shrink each year will increase to 4.2% from 2.2% previously.17 In turn, manufacturers, power producers, airlines and other will have to accelerate their efforts to cut emissions. Changes in the carbon market will trickle through the economy, increasing the price of everything from electricity to plane tickets.

Higher prices should push companies to embrace cleaner technologies. When low-emissions technologies were expensive, and carbon prices were low, companies had less incentive to change their ways. As carbon prices rise, and low-emissions technologies become more efficient and affordable, we’re likely to see more collaboration, consolidation and investment in climate tech, bringing us back to the first two points above.

1 Dutch Govt

2 GreenTechMedia

3 Siemens

4 Hellenic Shipping

5 IEA

6 Bloomberg

7 Chevron

8 BloombergNEF

9 Bloomberg

10 Bloomberg

11 Bloomberg

12 Lazard

13 Bloomberg

14 Bloomberg

15 Hyundai

16 Bloomberg

17 Bloomberg

With topics around urban transformation, energy transition, the future of transport and critical infrastructure across Asia, Africa and the Middle East, this content series will unearth fresh trends and showcase how we are supporting clients in the transition towards a more sustainable and inclusive future.