How specialised workforces are an asset for dynamic markets

Human capital is a key index of opportunity when it comes to investing in dynamic markets.

Human capital is a key index of opportunity when it comes to investing in dynamic markets. From Brazil to Mainland China, India to the UAE, the quality of a market’s workforce is the most important factor for western financial institutions participating in our research, which assessed their appetite to invest or expand their businesses in new destinations.

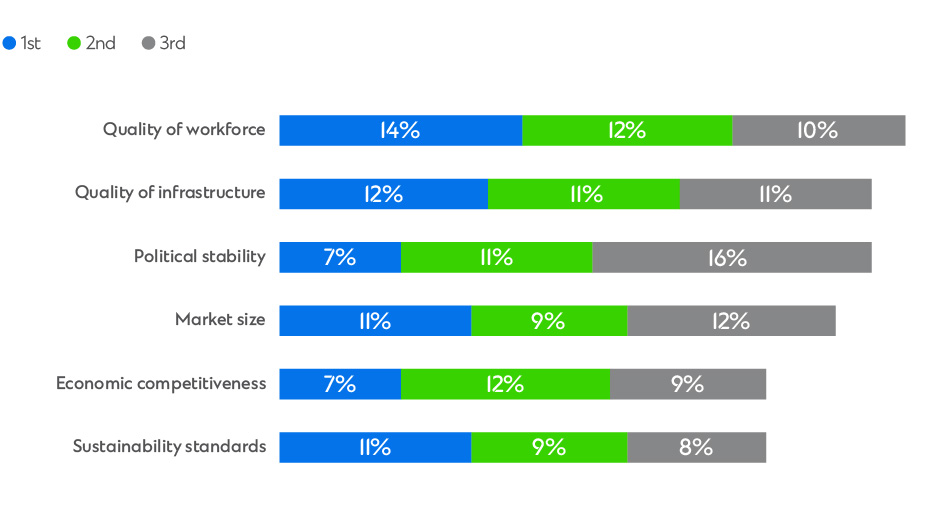

Surprisingly, most rank workforce considerations well above market and economic competitiveness. But issues around human capital can also present a barrier to investing in dynamic markets. Concerns about sourcing the required skills is second only to innovation-related imperatives – two issues that are intrinsically linked.

A market’s high-quality workforce is a key asset to attract investment or new business from western financial institutions*

*Top 3 factors prioritised by financial institutions when considering investment or business development destinations. Source: FT Longitude / Standard Chartered, Future powerhouses: How western financial institutions are banking on dynamic markets, 2024

As a sector gains momentum its key skills grow organically

Human capital conditions differ widely across dynamic markets, where the possibility of developing skill sets through education and training varies according to the status of each economy.

“Market by market, industry by industry, and also point-in-the-cycle by point-in-the-cycle, plugging the skills gap depends on the specifics of what you’re looking to achieve,” suggests Chris Clube, Co-Portfolio Manager, Global Emerging Markets Equity Fund and Senior Analyst at Federated Hermes. Skills growth can happen organically as a sector builds momentum, Clube believes: “Specialised workforces tend to develop themselves. First of all, you have one great company and then you have its suppliers, and then they’re all hiring people.”

Vivek Bhutoria, Co-Portfolio Manager, Global Emerging Markets Equity Fund and Senior Analyst, Asia ex-Japan at Federated Hermes, points to the growth of the IT sector in India. “It started as a way to provide low-cost outsourcing,” he notes. “Now, if you look at Indian IT companies, the sector generates almost USD300 billion in [annual] revenue and it’s one of the largest employers in the country.” Echoing Clube’s point on organic growth, Bhutoria adds that the opportunities in the burgeoning IT sector drive take-up of specialist IT training.

Investing in skills boosts top-line economic potential whilst providing future-fit careers to individuals Julie EverittHead of HR, Europe & Americas

Julie EverittHead of HR, Europe & Americas

Seizing the workforce opportunity

Dynamic markets are increasingly deploying targeted education and training measures to equip workers with the most sought-after skills, often in strategic sectors, in which a country sees a unique opportunity to attract investment. Highly skilled workforces are more productive and innovative, and this enables scalability – all high on the agenda for financial institutions in 2024. These, in turn, offer a competitive advantage to those markets that boast specialised skills, with the development of a ‘virtuous circle’ that attracts yet further investment.

Focusing on enhancing skills can also unlock win-win scenarios for both individuals and organisations around the world, explains Julie Everitt, Head of HR, Europe & Americas at Standard Chartered. “Globally, the world of work as we know it is changing rapidly,” she says. “This is driven primarily by increasing uncertainty and the speed of change brought on by technological advances. Investing in skills boosts top-line economic potential whilst providing future-fit careers to individuals.”

Dynamic markets, from global fintech hub Singapore (which consistently ranks highly on education) to Mainland China, which is taking the lead on solar, for example, have harnessed the recognised skills of their respective workforces to position themselves as competitive players in global industries.

Mainland China, which tops the list of investor investment destinations identified in our report, has since 2019 invested USD4 billion–6 billion annually in clean energy R&D, including the solar industry. “Whether it’s polysilicon, solar panels, solar wafers or solar cells, a large part of manufacturing capacity sits in China,” confirms Amit Goel, Lead Portfolio Manager, Global Emerging Markets Strategy at Fidelity.

Universities and technical institutes across the country offer training in solar technology and sustainable engineering, up to degree level. This large pool of experts has been key to attracting investment from multinational corporations seeking to tap into Mainland China’s manufacturing capabilities.

Elsewhere, Brazil (a priority destination for 25 per cent of respondents), with its huge swathes of fertile land and a workforce trained in agritech and agro-engineering, has become a leader in agribusiness, embracing innovation in precision agriculture and biotechnology. This, in turn, has encouraged multinationals to invest in Brazilian R&D and production facilities.

The UAE (which 20 per cent of respondents selected) has prioritised aerospace and aviation. Specialised educational institutions, such as the Emirates Aviation University in Dubai, serve the training needs of an industry that has become a major contributor to national GDP. The UAE’s success has helped attract foreign investment, including in fields such as aerospace engineering, aircraft maintenance and logistics, with global players setting up regional hubs or becoming partners in locally led research. The increased connectivity also has a positive knock-on effect on tourism.

Translating competitiveness into value

Competitiveness and value creation are very much tied to human capital, as Fidelity’s Amit Goel explains. “Whenever we are investing at country or company level, we are looking for competitiveness. This comes from the skill set of the people,” he says. “But we are equally looking at the culture and governance aspect, which will translate that competitiveness into value. So, we need both: competitive businesses and people who can translate that competitiveness into value for shareholders.”

Our research points to clear advantages for those dynamic economies that can harness their favourable demographics to build a highly skilled, specialised workforce. Such a resource would mean they could not only fill skills gaps immediately but also establishes a foundation for sustained economic development, giving a competitive edge in the global marketplace.

“If you have the right educational framework, the right skills, the right culture and the right incentive structures, you can create a lot of competitive businesses globally,” Goel says.

Effective educational systems, targeted training programmes, and proactive government policies are all keys to developing the most sought-after skills, which drive sectoral growth and innovation – and, ultimately, create the competitiveness that will attract investors.