India’s energy transition: A major economic opportunity

India’s ambitious plan to transition to renewable energy sources presents attractive opportunities for investors.

India’s ambitious plan to transition to renewable energy sources presents attractive opportunities for investors

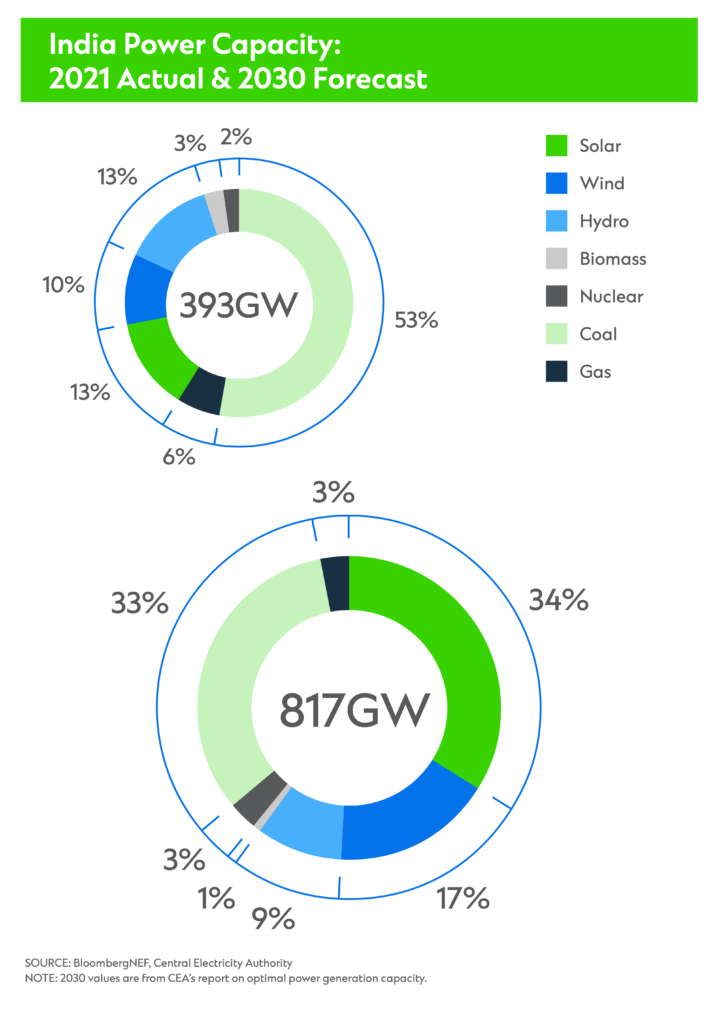

India wants non-fossil fuel power sources to provide half of its electricity supply by 2030. To get there, the country needs USD363 billion worth of investment in new power projects and batteries between 2020 and 2029 – opening vast opportunities for international investors.

As an emerging market with a large population, India’s transition to net zero carbon emissions presents challenges. Reaching its 2030 target, for instance, requires a large enough expansion to replace coal for electricity, as well as petroleum fuels used in transport with renewable power. Coal, oil and natural gas currently account for 75 per cent of energy use.

In the longer term, research from Standard Chartered pegs India’s shortfall in transition finance – the funding needed to meet climate objectives without depriving a country of its opportunity to grow and prosper – at USD12.4 trillion.

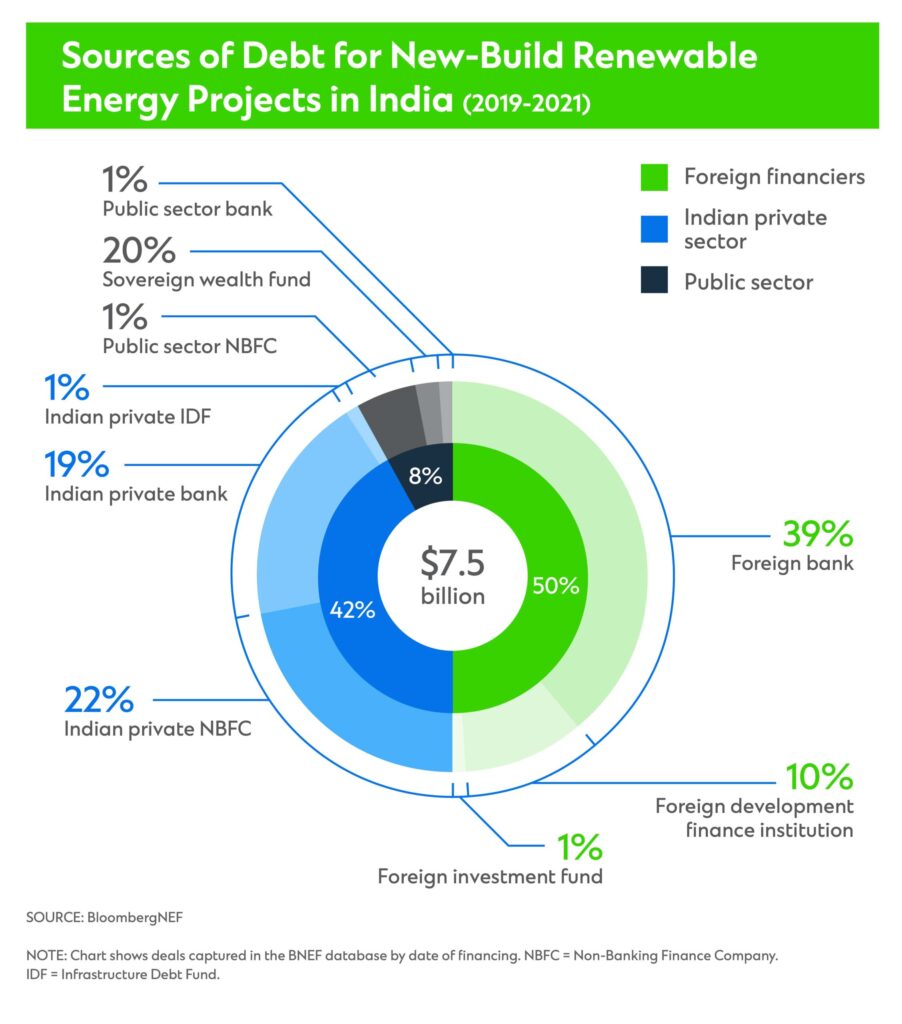

“For multinational corporations, investors and financial institutions looking for sustainable business growth, India presents an opportunity to help facilitate a just transition to net zero carbon where it matters most,” says Saif Malik, Global Head of Global Subsidiaries & Head of Client Coverage, United Kingdom, Standard Chartered. “Already, half of funding for Indian renewable projects over the past few years has come from foreign financiers. They will continue to play a vital role in the nation’s energy transition in the years ahead.”

Balancing growth and decarbonisation

Economic growth is required to improve quality of life; however, if an economy remains heavily reliant on fossil fuels, growth will be synonymous with increasing emissions. Such is the case in India, where absolute and pre capita emissions area trending upwards.

“To meet their net zero targets, all governments have to find ways to make economic growth less carbon-intensive,” Malik says. “India is the only lower-middle-income country among the five biggest global emitters. Pursuing severe emissions cuts too quickly could potentially damp growth and disrupt millions of lives.”

While India’s need for economic growth may seem at odds with emissions reduction, Malik says decarbonising presents financial benefits. It also promises to help achieve compliance with looming international regulations, such as the European Union’s proposed “Carbon Border Adjustment Mechanism,” which may consider measures to weaken economies that fail to decarbonise, or worse, exclude them entirely from global markets.

Decoupling India’s economic growth from greenhouse gas emissions is a massive, urgent project. Indian conglomerates are already tuned into this and leading the way by mobilising fast. Earlier last year, Adani Group announced a strategic partnership with Total Energies to jointly create the world’s largest green hydrogen ecosystem with an ambitious investment target of USD50 billion over the next 10 years in green hydrogen and associated ecosystem. In the first phase, the joint venture is looking to develop green hydrogen production capacity of 1 million ton per annum before 2030.

Other major Indian corporations are pushing this agenda forward. Leading companies such as Reliance, TATA, JSW Energy and NTPC Limited have also pledged large investments in renewables.

The investment opportunity

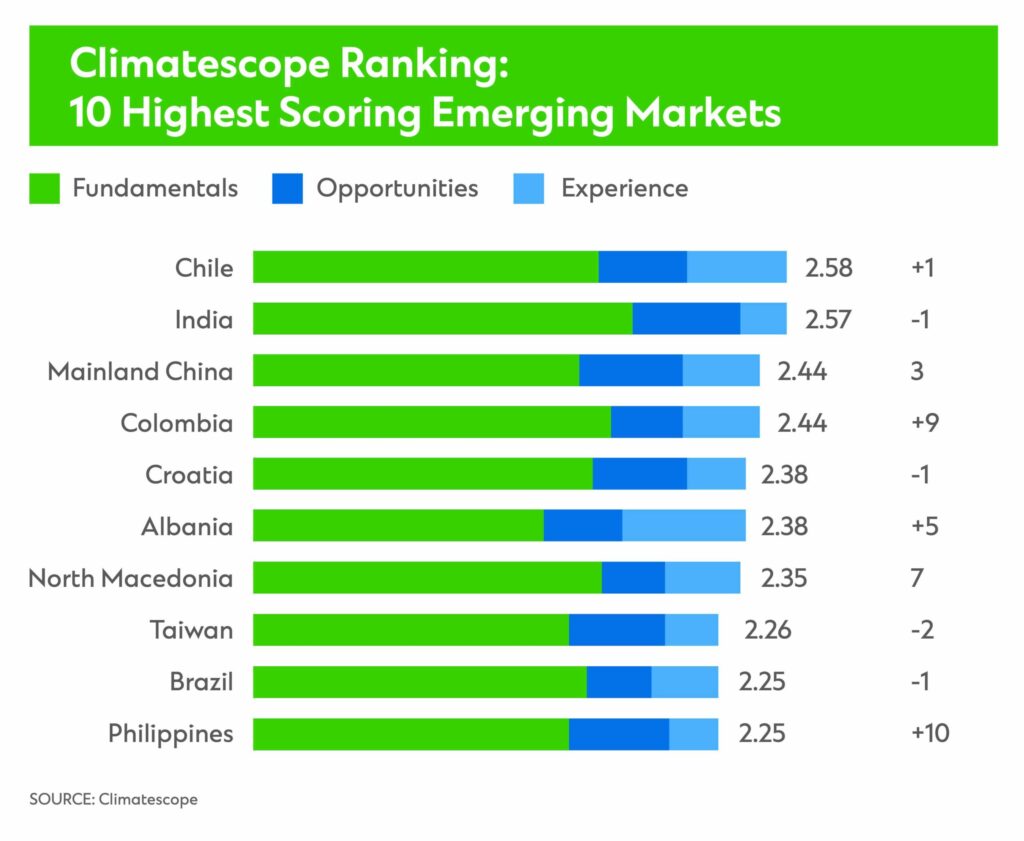

Investment opportunities abound. Climatescope’s latest report – released in November 2022 – ranked India 2nd out of 136 emerging markets in terms of attractiveness for clean power investment and deployment. The report highlighted India’s ambitious policy framework and competitive renewable energy market as boons.

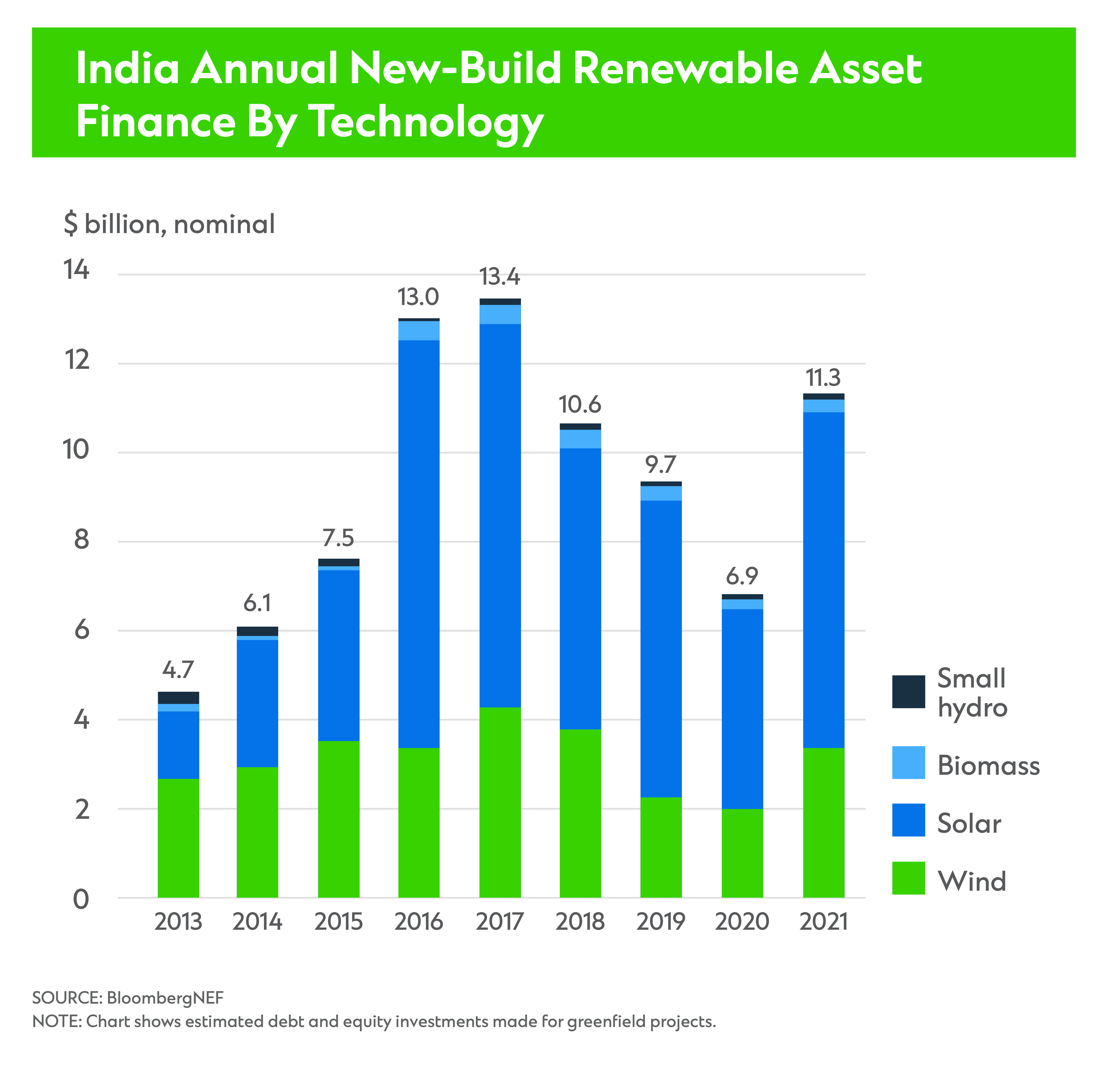

“Since 2012, the country has implemented specific and efficient policies such as auctions, renewable energy targets, and a feed-in tariff. These transparent mechanisms and ambitious targets have prompted domestic and foreign players to deploy a combined USD47 billion for clean energy assets in the past five years,” the report says.

Wind and solar are likely focal points for investors. India requires USD233 billion worth of investment across both to meet its 2030 target – three times the investment flows into new-build wind and solar from 2014-2021. Success requires scaling up financing from a variety of sources.

“We see opportunities for international investment to support this strategic shift in several areas,” Malik says. “India should consider weaning itself off coal, its number-one source of carbon emissions. Since India is a net importer of both coal and oil, exploring alternative energy sources also supports energy security, which is vital to economic productivity.”

Green bonds are the preferred route when it comes to refinancing operational projects. Once development risks are eliminated, these projects provide the low volatility and predictable cash flows that bondholders seek. Green bonds for renewables reached a new high in 2021 as more of India’s Independent Power Producers (IPPs) refinanced projects.

As the country moves towards hybrid projects that combine wind and solar with storage technology, IPPs will likely explore a host of financing options. Among them are specialised power sector lenders from both the public and private sectors, multilateral banks, international lenders and blended finance.

“This is a transformational time for India with huge opportunity for its people and its globally important economy, especially as the world still recovers from the COVID-19 pandemic,” Malik adds. “The scope and scale of this transformation present both complexity and unprecedented opportunity.”

Produced by Bloomberg Media Studios in partnership with Standard Chartered.

Explore more insights

Finance options abound as shipping advances towards net-zero

Decarbonising global shipping comes with its share of challenges, including geopolitical and technological risks…