We can’t let the threat of terrorism halt the flow of aid money

In a crisis, money matters: for water, food and shelter, for people fleeing war or famine, or for medical supplies in dealing with an epidemic. Yet getting money to the frontline when people are suffering is becoming harder.

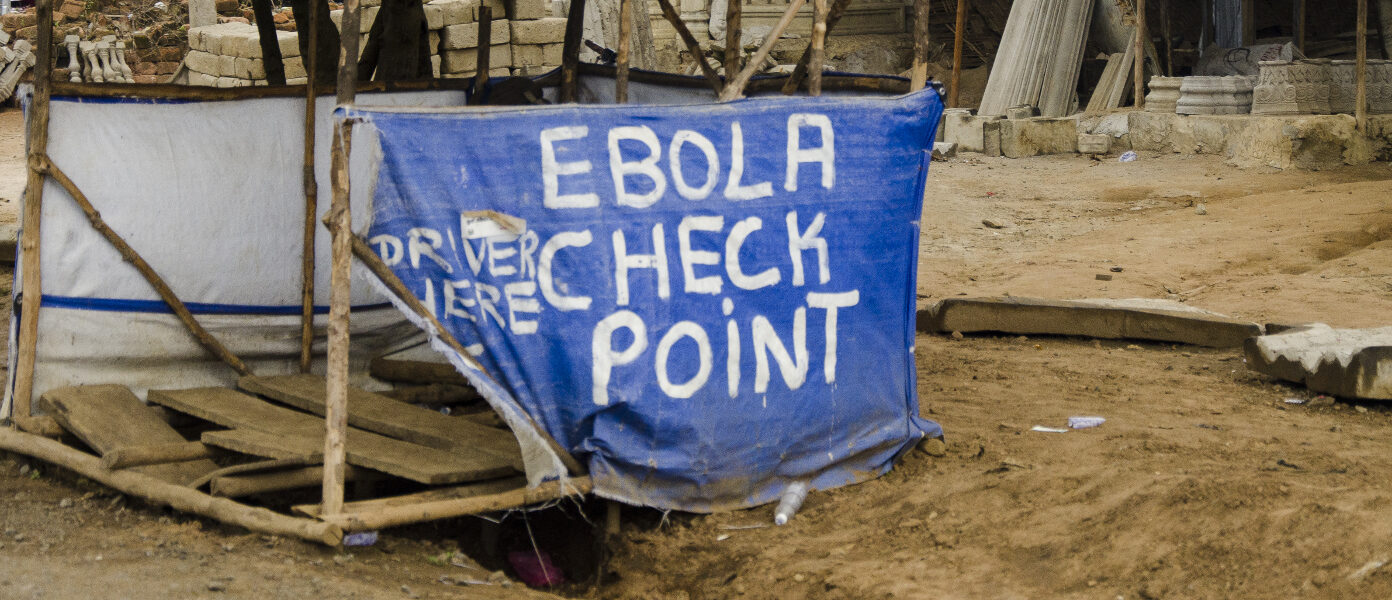

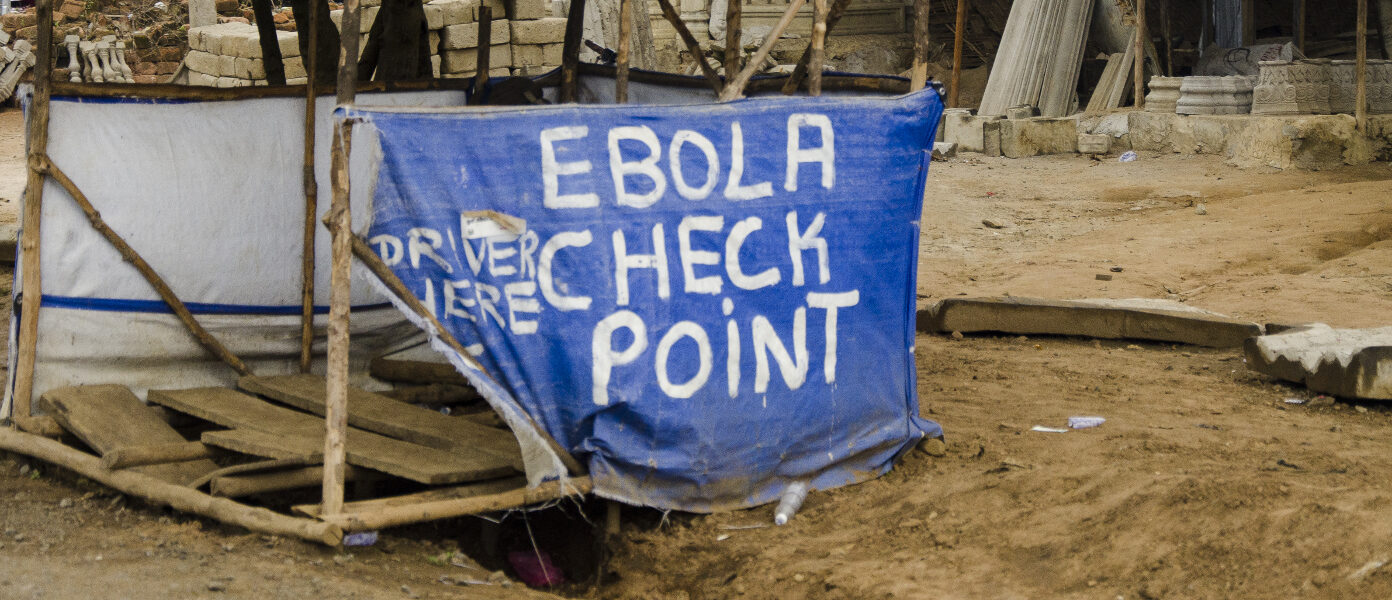

The problem was highlighted when Ebola broke out in west Africa. At Standard Chartered, we handled cash transfers for many charities working in Sierra Leone as well as multilateral organisations like the UN. At the height of the crisis, Ebola infections were doubling every two weeks. Money needed to be moved quickly from central treasuries to aid workers on the ground.

We worked closely with development partners, regulators and local governments to ensure funding got through. But it wasn’t easy, and we wanted to move faster. Any kind of delay in these situations can be a matter of life and death.

Yet, as the world faces the most widespread humanitarian crisis since the Second World War, two-thirds of charities working internationally are experiencing difficulties sending money to where it is needed. This is not a new phenomenon. A 2015 report by the UK’s opens in a new window Charity Finance Group found that most charitable organisations encountered similar problems.

“A few rogue institutions are creating a perception that the charity sector is vulnerable to financial crime”

At the heart of this challenge are the unintended consequences of regulations designed to prevent terrorists and criminals from accessing the financial system.

While the vast majority of charities are well run and do legitimate and often life-saving work, a few rogue institutions are creating a perception that the sector is vulnerable to financial crime. The UK Charity Commission reported this year that the number of “allegations of abuse of charities for terrorist or extremist purposes” has trebled in just three years.

As a global institution that has banked charities and aid agencies for decades, we have faced extremely difficult decisions. In recent months, we have intervened to ensure a British charity could repair water pumping stations for clean water in Syria, and a non-profit could keep its educational operations going in Sudan.

Yet it is not always straightforward. Earlier this year, our compliance teams reviewed a request to transfer millions of dollars to a charity based in Iraq. The charity was not our client, but a customer of one of our correspondent banks making a payment through our network. The purpose was described as children’s clothing and medical supplies. On the face of it, the payments looked legitimate. The charity was not on any sanctions list. Yet further investigation suggested the organisation was probably supporting a terrorist group. We prevented the transfer, and alerted the authorities.

“Financial institutions must support clients who have the right intentions but not yet the right tools, knowledge or experience”

Faced with similar decisions, others in the financial industry have chosen to avoid risk by dropping charities as clients. This strategy, known as ‘de-risking’, may become necessary if clients or partners cannot comply with our standards or – for some institutions – if the hazards involved are deemed too great.

After working in emerging markets for more than 150 years, we want to find a different way; we want to ensure the safety of the financial system and prevent financial exclusion.

Banks needs to continue investing and automating financial crime controls and compliance processes to make the financial system a hostile environment for criminals and terrorists. To prevent aid getting blocked, financial institutions also need to help the development community understand what regulators and banks expect when it comes to mitigating financial crime risks.

Education is vital: institutions must support clients who have the right intentions but not yet the right tools, knowledge or experience. Standard Chartered has actively supported this, partnering with the World Bank, InterAction and NGOs such as World Vision to launch the first financial crime risk management academy for charities, and making our internal compliance courses available to clients online for free.

“We are supporting efforts to create a database of compliance information to streamline banking requests”

In terms of practical solutions, the aid community is also doing its bit. World Vision has created an initiative that enables other charities to benefit from its risk management expertise. And we are supporting efforts to create a database of compliance information to streamline banking requests, and talking to regulators about how humanitarian aid can be disbursed to established charities more quickly during crises.

The Bank of England Governor, Mark Carney, recently warned the G20 that the number of banks de-risking was impacting developing economies. Fluctuating aid flows highlight the human cost of this trend, but we believe that when crisis strikes, banks, charities, and regulators are committed to finding new ways to get money where it is most needed.

This article first appeared on Guardian Global Development.