Have rate increases impacted corporate balance sheet

Rates outlook has made corporates cautious, but it may have been overdone. SC’s analysis of 900+ large global corporates across 18 sectors examines further.

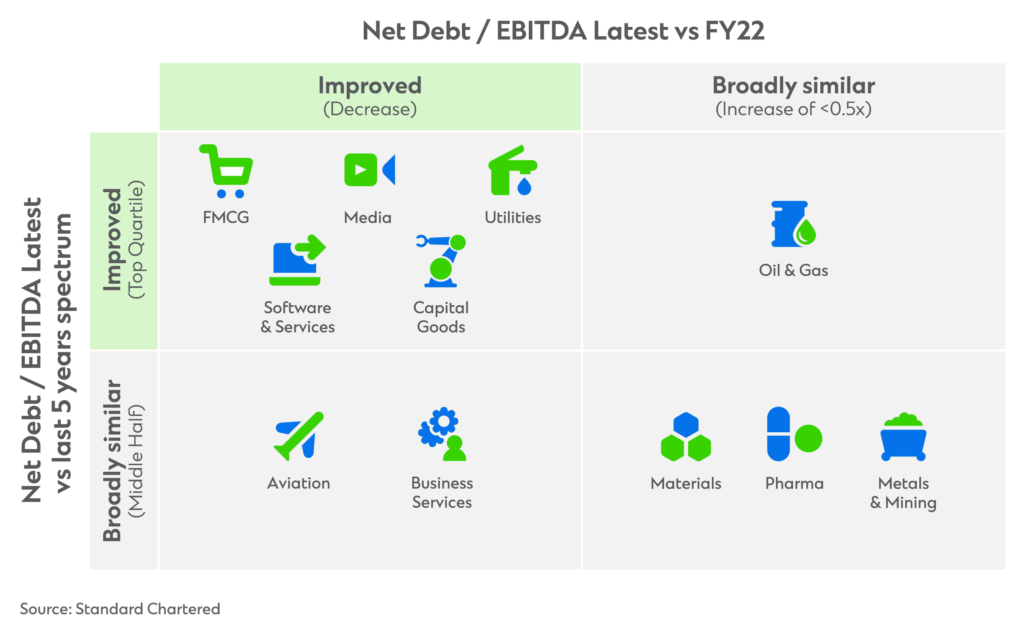

Indebtedness remains in check: Leverage stable notwithstanding rate increases

Despite increasing interest rates, our analysis of the largest publicly listed companies across 18 sectors suggests balance sheets did not take a turn for the worse last year. Only the transportation & logistics and chemicals sectors saw net debt/EBITDA deteriorate. Taking a five-year view, which factors in the disruption from the pandemic, only five sectors have leverage in the bottom quartile within this period, compared to five in the top quartile and six remained around the average.

That is not to say there was no impact as interest cover capacity contracted for almost all sectors. Yet the rate of contraction was not as bad as one might expect. Only the capital goods, pharmaceuticals, and business services sectors posted interest contractions exceeding 50 per cent. Most sectors saw a more modest 20 per cent and 50 per cent contraction, and the remaining sectors fared better or even improved. This underscores well-structured balance sheets that many corporates enjoy these days.

As a result, credit profiles remained strong. In fact, the proportion of investment grade (IG) ratings for the aviation, capital goods, commercial real estate, software & services, technology hardware, and transport & logistics sectors increased over the last year. Only non-food retail recorded a shift down the rating curve with more sub-IG credit ratings.

Are corporates too cautious on M&A?

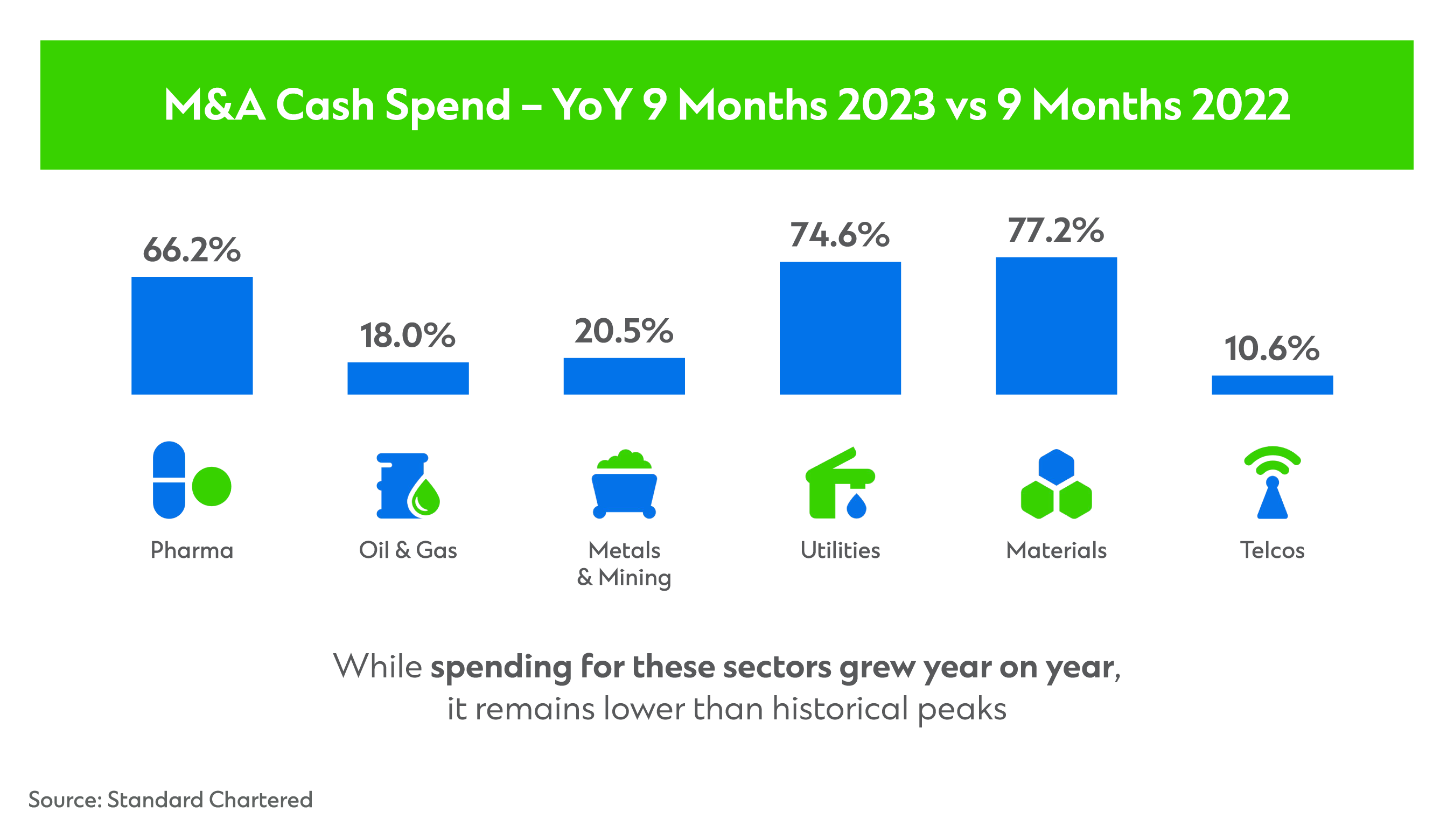

Of the 900+ companies that Standard Chartered analysed, Merger & Acquisition (M&A) cash spending remained subdued in 2023. Corporates spent around 23 per cent less in the first three quarters of 2023 compared with the previous year, perhaps deterred by high interest rates and sticky valuation premia. Many of those who did spend used equity financing despite meaningful debt-capacity.

A few standout sectors including pharmaceuticals, fast-moving consumer goods (FMCG), and materials notched mega deals. Industry tailwinds and strong liquidity/credit profiles underpinned M&A activity across those sectors. The oil & gas (O&G) sector also saw some activity albeit many via all-share deals.

While prudence prevailed amid higher rates, companies across almost all sectors we covered have headroom in their balance sheets. Which begs the question: how cautious is too cautious?

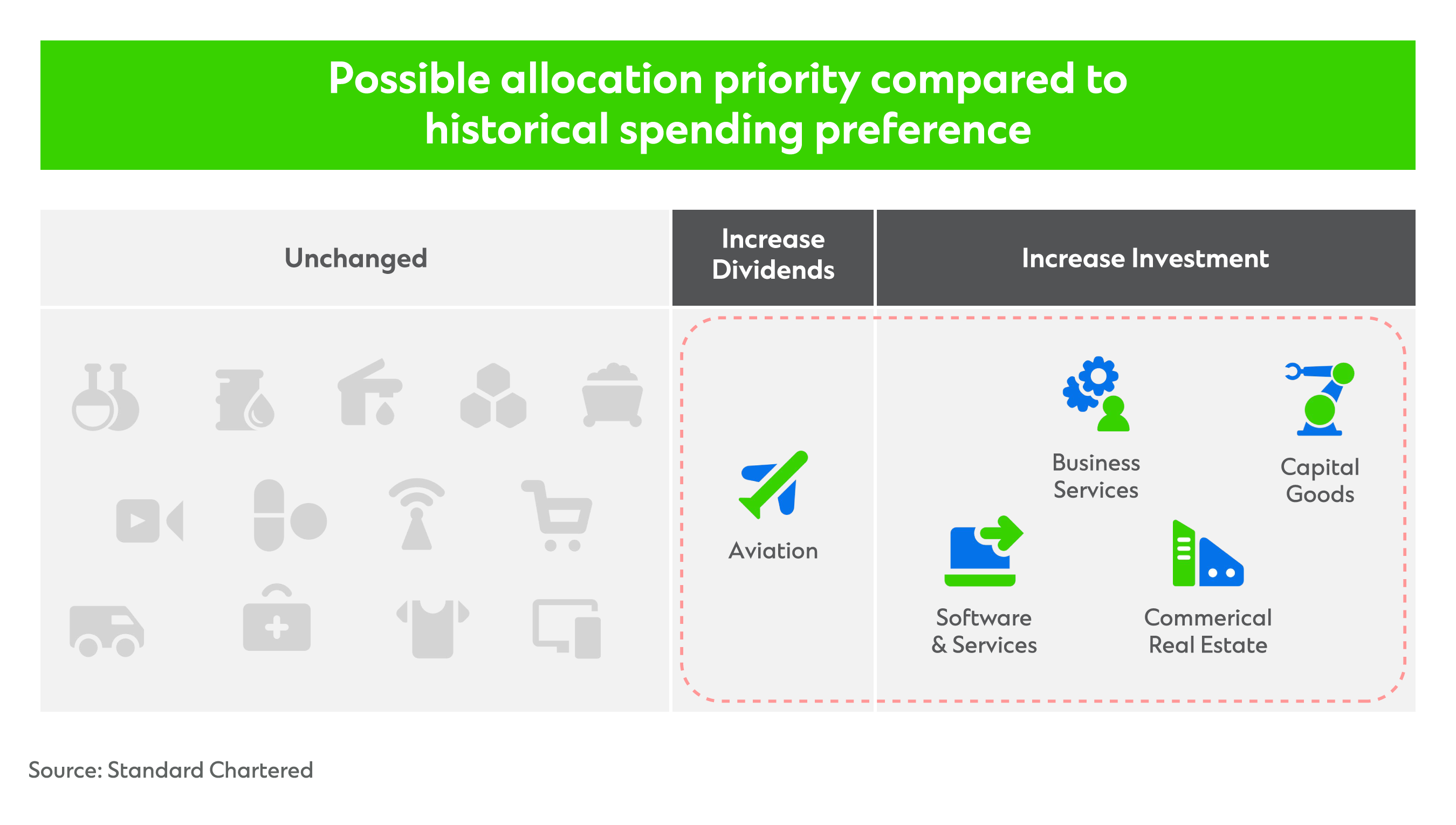

What to prioritise: Balance sheet headroom, investment, or returning cash to shareholders?

Does it pay to preserve balance sheet headroom? Our analysis shows the opposite.

Several sectors can arguably improve their valuations by adjusting their capital allocation strategy to pursue greater shareholder distributions or embrace an investment-led approach focused on business growth, organically or inorganically.

Our research shows that 12 sectors benefit from prioritising an investment-led capital allocation, four of which have historically preferred to return capital to shareholders instead. Only the transportation & logistics and aviation sectors benefit from prioritising shareholder distributions.

Our research also shows that there is a generally positive relationship with leverage whereby equity investors assigned higher valuation multiples to companies with above-average leverage in most sectors.

Trade cycle deterioration presents an opportunity

On the flip side, working capital days have seen a second consecutive year of deterioration, underscoring the need for continuous monitoring of this crucial part of the balance sheet.

This is predominantly driven by higher levels of inventory and longer receivable days, so it may be useful to look beyond payables. Greater efficiency would allow companies to channel capital towards driving future growth.

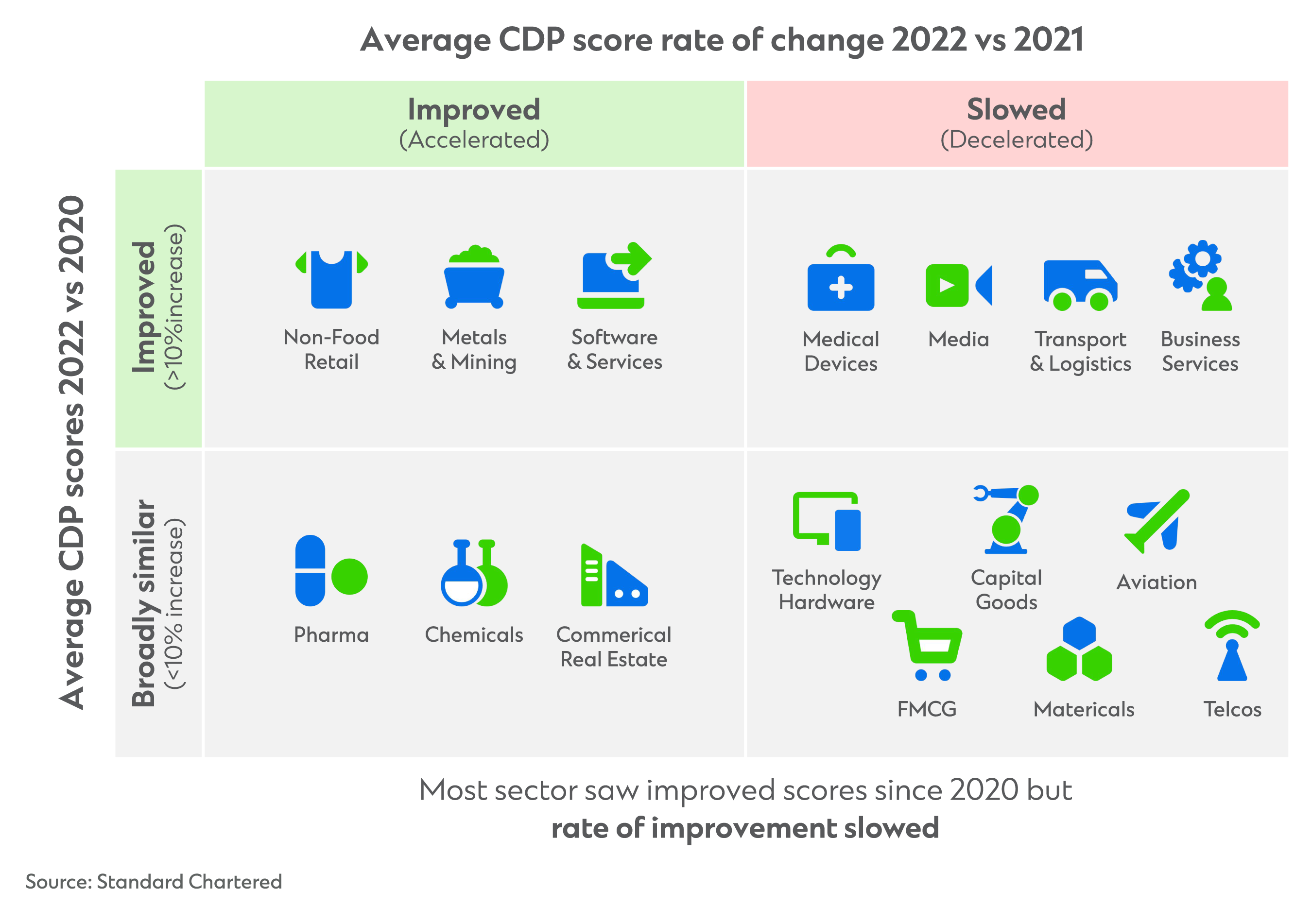

Changes in climate change score performance

By contrast, latest data on climate change score performance (based on Carbon Disclosure Project) improved across most sectors in large part due to stronger disclosures.

However, the rate of improvement is slowing, and further improvements will arguably prove more expensive and harder to come by in the future. Challenges around ESG are especially relevant for North America, where ESG scepticism continues to polarise the investment community, and improvement in the average CDP climate change scores noticeably slowed.

Perhaps the additional balance sheet headroom will prove useful in further enhancing ESG performance.

What does this mean for financial strategy review?

All told, companies should focus on optimising their balance sheets, pursue strategic or value-accretive M&A and/or organic investments, and refocus on working capital in 2024.

While geopolitical uncertainties around the globe and several major elections make that daunting, Standard Chartered is uniquely positioned to advise corporates how to achieve this, while making sure their capital structure remains strong and future-ready, in line with best practices. Our unique global reach, local knowledge and broad product suite can also compliment decisions made through such reviews.

Shoaib Yaqub is the Global Head of Capital Structure & Rating Advisory team at Standard Chartered

View detailed analysis (including sources, assumptions and methodology) here

View CSRA team contacts here

View data book here

Find out more about Standard Chartered news and insights on our website.

Explore more insights

Programmable payment workflow creates new industry standard

We worked with Trafigura to transform the way payments are processed, establishing a new industry standard.