Driving FDI in emerging economies

Roberto Hoornweg, Co-Head of Corporate & Investment Banking, explains how innovative financing strategies are bridging infrastructure gaps in emerging markets and connecting global capital to high-impact projects.

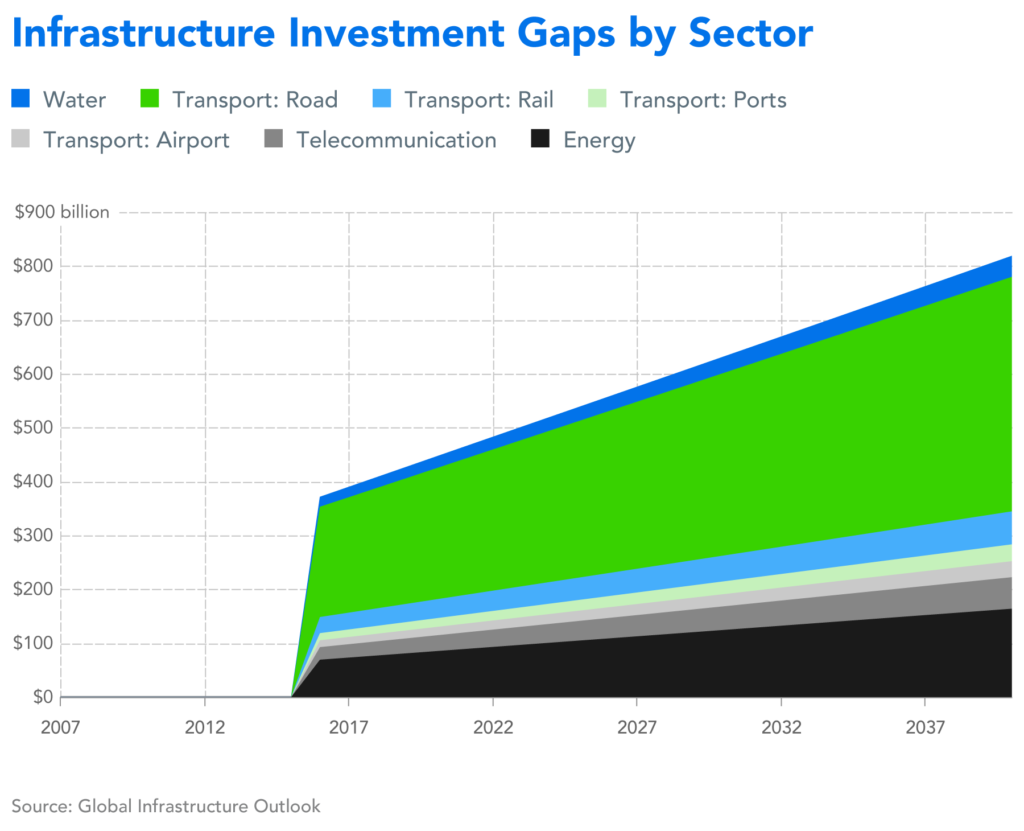

By 2040, the world will face a USD15 trillion infrastructure gap — the equivalent to leaving one in six projects unbuilt. Yet this crisis offers investors a chance to meet urgent needs while unlocking transformative financial and societal returns.

The need for infrastructure investment is most acute where both the potential and the challenges are greatest: in 2023, low- and middle-income countries saw a 5 per cent drop in private infrastructure investment even as demand rose.

According to Roberto Hoornweg, Co-Head, Corporate & Investment Banking at Standard Chartered, the largest gaps are in markets, where risks like political instability, regulatory barriers and liquidity constraints often deter investors.

“Each region faces unique challenges, but the demand is unmistakable,” he said. “This need is already catalysing transformative projects, even in the most challenging markets.”

Catalysing investment: strategies for high-risk markets

Addressing this imbalance is essential for sustaining economic growth and improving quality of life. Yet political instability and project-related risks often deter investment, leaving critical projects underfunded.

One notable success story is the USD533 million Tashkent Riverside project in Uzbekistan, led by Saudi-listed ACWA Power. The greenfield development includes a 200MW solar plant and Central Asia’s largest battery energy storage system designed to stabilise the Uzbek grid.

“This was our first transaction in Uzbekistan, a market with an element of challenge, including a lack of precedent for large-scale project financing,” said Hoornweg. “We structured the deal from the ground up, using our relationships and expertise to transform a complex project into a bankable opportunity.”

By matching clients from established economies like Korea, Japan and Saudi Arabia with projects across regions such as the Middle East and Africa, the bank facilitates investments that address critical infrastructure needs. This cross-border approach builds on Standard Chartered’s long-standing presence and expertise in key markets.

The strategy also involves providing financial advisory services, structuring contracts and tapping diverse liquidity pools to make deals viable.

“The Tashkent Riverside project demonstrates how the right investment can bridge infrastructure gaps,” Hoornweg said. “By channelling resources into high-impact projects, we’re enabling not just economic growth, but potentially long-term resilience.”

Unlocking tomorrow: innovations in capital flow

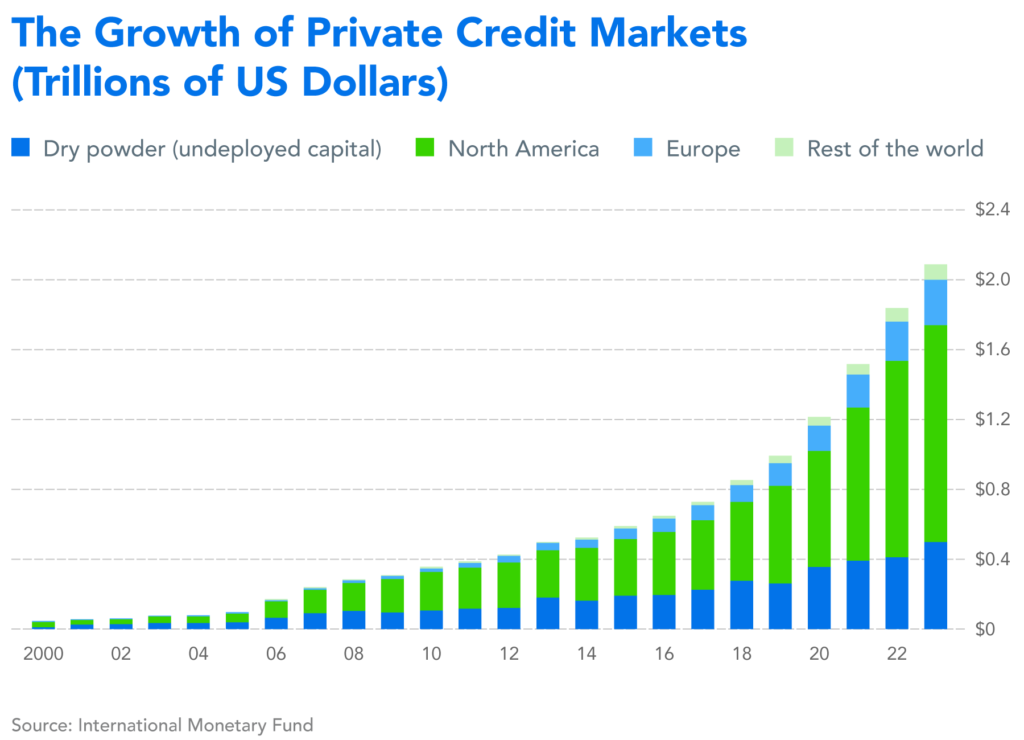

Catalysing FDI hinges on unlocking diverse sources of capital. As traditional banking markets face constraints, private credit and export credit agencies (ECAs) are stepping in to fill the gap.

Private credit is becoming a cornerstone of infrastructure financing in emerging markets. In 2023 alone, it raised USD20 billion for infrastructure projects, with firms like Blackstone and BlackRock driving the expansion.

“Private credit has reached USD1.7 trillion and is expected to double by 2027.” Hoornweg said. “It’s a vital source of liquidity, especially for infrastructure in emerging markets, where traditional banks often shy away from long-term commitments,” Hoornweg said.

With its flexibility and appetite for projects like renewables, data centres and clean energy, private credit offers a compelling solution for bridging the infrastructure funding gap.

Meanwhile, ECAs remain indispensable in high-risk markets, providing long-term financing and risk guarantees that make large-scale projects viable. In 2023, ECAs facilitated USD80 billion in global trade and infrastructure financing, actively supporting projects in regions like Africa and Central Asia.

“We’ve seen ECAs become game-changers in emerging markets, offering guarantees and concessional financing to offset political and country risks,” Hoornweg explained. “In Uzbekistan, we worked with Multilateral Investment Guarantee Agency (MIGA) to secure 95 per cent political risk cover, which was critical for attracting private sector funding.”

ECAs not only mitigate risks but also reduce the cost of capital, fostering public-private partnerships that unlock transformative investments. One such success is the EUR1.24 billion financing for Turkey’s Bandirma-Osmaneli high-speed railway, facilitated by Standard Chartered in partnership with UK Export Finance (UKEF). The project will enhance regional connectivity, reduce travel times and improve trade routes across key industrial areas.

Investors are looking for opportunities and there is no shortage of projects — driven by everything from the global energy transition to the increasing need for data centres in response to the surge in AI. However, delivering the right risk profile on infrastructure projects is crucial to attracting investors.

“We’re bringing together private credit, ECAs and multilaterals to unlock transformative projects in the most challenging regions,” Hoornweg said. “No single funding source is enough — collaboration is key.”

Explore more insights

The appeal of infrastructure investment in dynamic markets

Infrastructure investment is a priority sector.