The appeal of infrastructure investment in dynamic markets

Infrastructure investment is a priority sector.

A greenfield financial smart city in Gujarat, India. A 2,000-km road along the coast of Sumatra, Indonesia. The expansion of a demonstration area for automated driving in Beijing, Mainland China. Today, the term ‘infrastructure’ covers everything from traditional road and rail to digital data hubs and projects supporting the energy transition.

This re-defined asset class stands out in our research, with more than half of western financial institutions (56 per cent) citing infrastructure as a priority area for both current and future investment and business development. Today’s dynamic markets are driving this prioritisation, requiring substantial improvements to their transportation, energy, and communications systems in order to support rapid urbanisation and ongoing economic growth. Global infrastructure spending is predicted to top USD9 trillion by 2025, with the Asian market predicted to represent almost 60 per cent of that spend.

Political and currency stability are two key factors in dynamic market infrastructure investment

The USD26 trillion funding gap

Yet, in Asia alone, an estimated USD26 trillion must be invested annually to 2030 if the region is to maintain its growth momentum and develop an adequate response to climate change. This funding gap represents a significant opportunity for investors, explains Alper Kilic, Global Head of Project and Export Finance at Standard Chartered. “The newer dynamic economies will clearly require substantial financing – even more so when you weave in the impact of climate change,” he emphasises. And there’s only so much that can be provided by governments or supranationals through bi-lateral loans. “Institutional money needs to do its bit – and it does – we need more of that capital diverted to these economies,” he states.

Key to attracting private-sector capital is the innovative structures which rely on the quality and cash flows of the assets financing, such as public-private partnership (PPP) mechanism, which addresses the increased risk associated with investing in a dynamic market environment. PPPs and similar ring fence financing structures offer government incentives and relieve investors of some of the financial onus through risk sharing. Moreover, they offer stable long-term returns through structured revenue streams. The fact that revenue derived from infrastructure is often linked to inflation (while mostly in Developed Markets) offers an additional benefit for investors.

Although these types of financing structures have traditionally helped build airports, utilities and railroads, new areas such as renewable energy installation and digital infrastructure are rising in prominence. Kilic expects cleantech and digital connectivity to continue to dominate the investor agenda. “The global market for key mass-manufactured clean energy technologies is expected to be worth more than USD600 billion by 2030,” he says. “Given the increasing adoption of cloud computing, artificial intelligence and 5G in dynamic markets, data centres are likely to receive substantial financing from investors and ‘hyperscalers’, the large cloud service providers.”

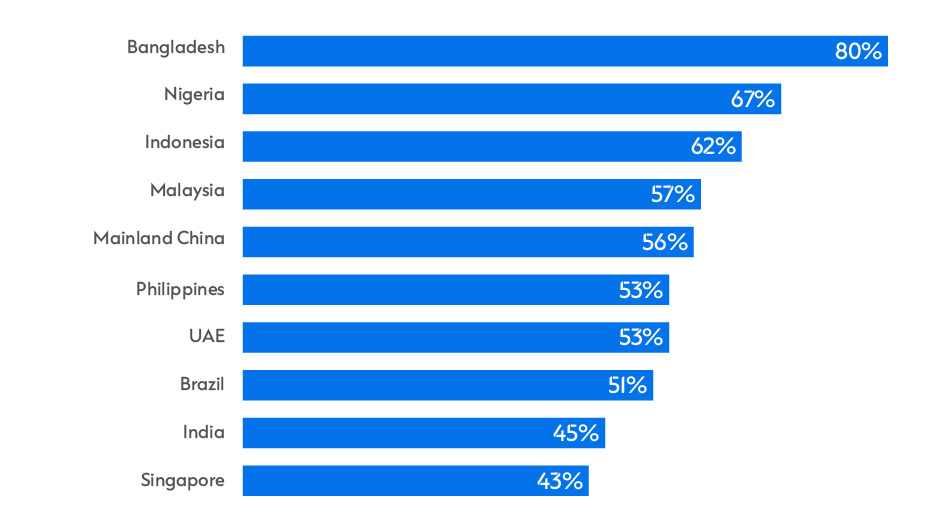

Recent research conducted by Standard Chartered, and based on a survey of 400 banks, investment managers and asset owners headquartered in Europe and the Americas, has found that executives rank infrastructure highly in their priority investment markets. Eighty per cent of those with plans in Bangladesh and around three in five of those with plans in Nigeria and Indonesia cite infrastructure as a promising sector, while more than half of those with plans in Indonesia, Malaysia, Mainland China, the Philippines, the UAE and Brazil say the same.

Fast-tracking sustainability

As dynamic markets demand investor focus on their infrastructure needs, they offer opportunities to fast-track solutions to some of the challenges that today’s developed markets face, notably the ‘greening’ of legacy infrastructure. As Anne Hiebler, Global Head of M&A at Crédit Agricole CIB, notes, sustainability and resilience are commonly embedded into dynamic market project specifications at inception: “In mature markets, in order to make infrastructure sustainable, you have to make a transition and shift your strategy, while, in a dynamic market, you go in with your sustainability criteria directly from the beginning,” she says.

India, which ranked behind only Mainland China as an investment and business development focus in our survey, is combining new infrastructure (or significant upgrades) with smart and green tech. This is all part of a massive investment drive in infrastructure in a country that aspires to developed-nation status by 2047.

Kilic points to India’s business-friendly reforms and innovative projects as a plus when it comes to attracting investment. “What we’re seeing in India is a favourable environment that’s being created with stable politics but, equally, an infrastructure build-out and a financial system that’s necessary to support foreign direct investment,” he says. “The Gujarat International Finance Tec-City – or GIFT City – a smart city built as a financial hub with modern infrastructure focused on energy efficiency and green credentials, is a great case in point.”

Infrastructure challenges: the long view

Some of the challenges that infrastructure investors face are related to a combination of the inherently long-term nature of the sector and the demand for large, upfront investment. Understandably, this injects a measure of caution into some markets. Political instability, for instance, can lead to project delays or cancellations and, consequently, is cited as the second-most important criterion for respondents when they are considering investment destinations. In addition, many dynamic markets have volatile currencies, complicating financial planning and potentially compromising returns, should the local currency depreciate. Then there is the expertise required to execute highly technical projects, which leads respondents to single out quality of workforce as their top selection criterion.

“Political and currency stability are two key factors in dynamic market infrastructure investment,” confirms Kilic. “It’s also about having strong corporate governance and ensuring that your investments are safe. Dynamic economies need to be on the front foot and very clear about the risks.”

This is where PPP schemes, as well as other types of innovative project financing structures,can mitigate the risks associated with infrastructure projects in dynamic markets, with regional development banks and international financial institutions such as the World Bank and the International Finance Corporation stepping in to provide financing and underwriting services. Another fundamental component of PPPs is the symbiotic exchange of technical knowledge and skills between public and private entities, supporting the successful implementation of the project.

Financial institutions can gain much from investing in infrastructure, which, in turn, can deliver substantial economic, social, and environmental benefits for dynamic markets. Kilic highlights the role of multilateral agencies, Export Credit Agencies, banks and investment firms in supporting PPPs to facilitate a just transition for dynamic markets. “A just transition requires a large ecosystem to work together to ensure that the funding gets where it’s needed most,” he says. “There is clearly a need for the financial sector to catalyse, standardise and democratise sustainable finance.”

Public and private entities should consider investing as much as possible in the new infrastructure that will make dynamic markets an engine of benefit, financial and otherwise, to society as a whole.