Five cleantech trends for 2023

A look into the cleantech shape shifters for the year and the opportunities they present to investors.

The global energy transition is firmly underway. Yet the odds that we’ll meet key climate goals outlined in the 2015 Paris Agreement are fading. If the current rate of carbon emissions continues, there’s a 50 per cent chance the world will breach the 1.5°C warming threshold by the end of this decade. It’s against that backdrop that we look at the cleantech trends set to shape 2023. Among them, new supply chain partnerships, faster industrial decarbonisation, green shoots on green hydrogen, the rollout of gigafactories and more. While each trend touches on a different part of the transition, they all have one thing in common: each presents a multi-billion-dollar opportunity for investors.

The year of supply chain partnerships

Geopolitics and energy security concerns are leading governments to embrace policies that incentivise the onshoring or near-shoring of clean energy supply chains. While such policies will cause increased supply chain fragmentation, they will also drive partnerships as foreign investors / strategics seek local partners when establishing new facilities.

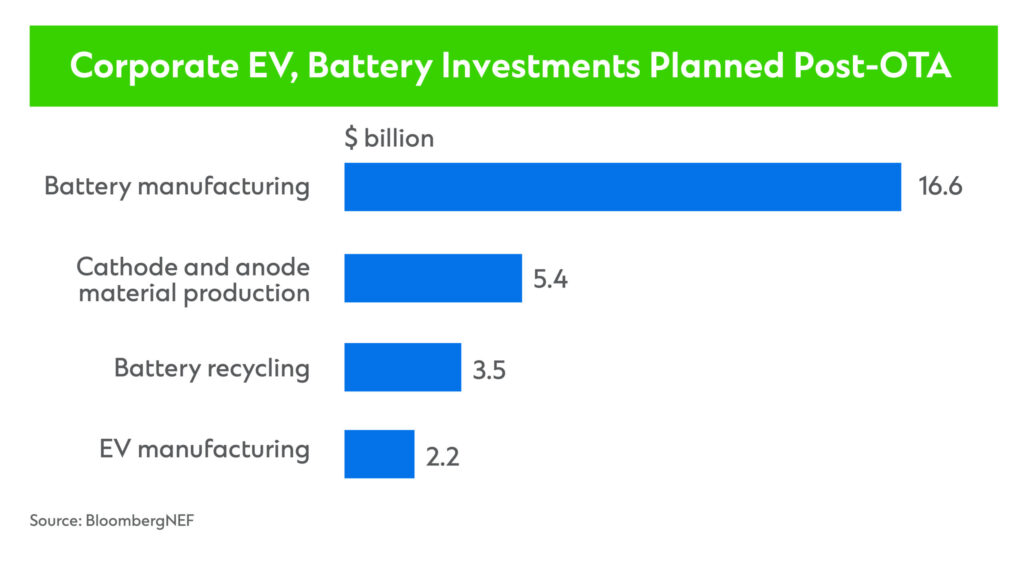

The US Inflation Reduction Act earmarked USD60 billion for domestic clean energy manufacturing to promote manufacturing independence and bolster energy security. Asian battery manufacturers are partnering with US automobile OEMs to set up or expand their battery manufacturing capabilities in the US. For instance, GM and LG Chem recently announced a joint venture to build EV battery manufacturing plants in Ohio and Michigan.

Elsewhere, the global energy transition has given rise to new partnerships such as those in mineral-rich Indonesia. Indonesia is planning policy support to realise President Joko Widodo’s vision of having an end-to-end EV supply chain onshore instead of just exporting battery raw materials. In 2022, South Korean battery cell manufacturer SK On announced plans to build a nickel production facility in Indonesia. LG Energy Solution broke ground on its Indonesian nickel processing plant last year. Likewise, expect Saudi Arabia to take more steps to develop a local supply chain post recent announcements to develop a USD900 million battery chemicals complex.

The dawn of industrial decarbonisation

Heavy industry presents one of the biggest challenges to our global net zero ambitions. While the world still hasn’t found a silver bullet, cross-industry collaboration and developments in global carbon markets are encouraging signs.

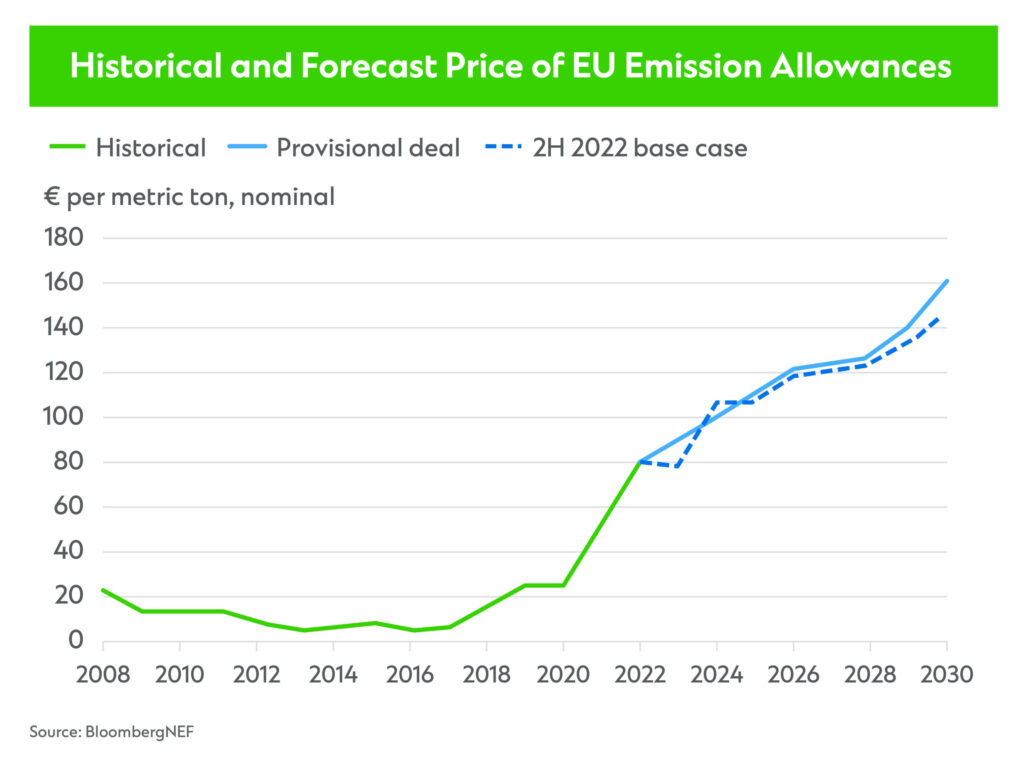

Lawmakers in Europe reached a deal in December that will strengthen and expand the European Union’s carbon market. The deal extends emissions trading to heating, transport and shipping. It also accelerates the pace at which companies are obligated to reduce pollution. With carbon prices forecast to reach 160 euros by the end of this decade, heavy emitters have a greater incentive to decarbonise than ever.

Emitters and investors are indeed taking notice. Global investment firm KKR, for instance, invested USD400 million in Serentica Renewables – a decarbonisation platform from India’s Vendanta Group that provides clean energy solutions for large-scale industries. In Australia, BHP took a stake in I-ROX to speed development of a technology that could help decarbonise steps of the mineral extraction process. And in Europe, TotalEnergies partnered with Holcim to study methods to fully decarbonise a cement production facility in Belgium. These investments are the first in a slew of large decarbonisation initiatives we are expecting to play out in the coming months.

Gaga for gigafactories

As the demand for electric vehicles grows, so does the demand for the batteries that power them. By 2030, global EV battery demand will reach 3.5TWh, according to BloombergNEF’s Economic Transition Scenario – more than four times greater than the 806GWh of lithium-ion battery manufacturing capacity as of end-2021. Catering to this demand would require gigafactories to be built at speed and scale.

Currently, China dominates the battery manufacturing sector. However, the Inflation Reduction Act seeks to strengthen the battery supply chain in the US, with tax incentives that could reduce the capital costs of energy projects by as much as 30 per cent.

BloombergNEF estimates that at least USD80 billion will be committed to North America’s battery supply chain in 2023. Already, some companies that were previously considering Europe for lithium-ion gigafactory projects are now looking to the US, while those with existing plans are doubling down. Turkey’s Kontrolmatik Technologies, for instance, increased the output for its planned energy storage gigafactory in the US by 50 per cent just a day after the law was signed into effect. Data from BloombergNEF show post-IRA commitments to the North American EV supply chain reached nearly USD28 billion by 14 December 2022.

Other markets could benefit. Latin America, for instance, is home to the world’s largest lithium stores. As the world’s battery makers move to the US, they may look to meet a growing share of their lithium needs with Latin American exports. Meanwhile, Europe could struggle as rising energy prices already have auto and battery makers questioning the feasibility of building gigafactories in the region.

Mixed outlook for funding: Petro dollars helping light up a tricky market

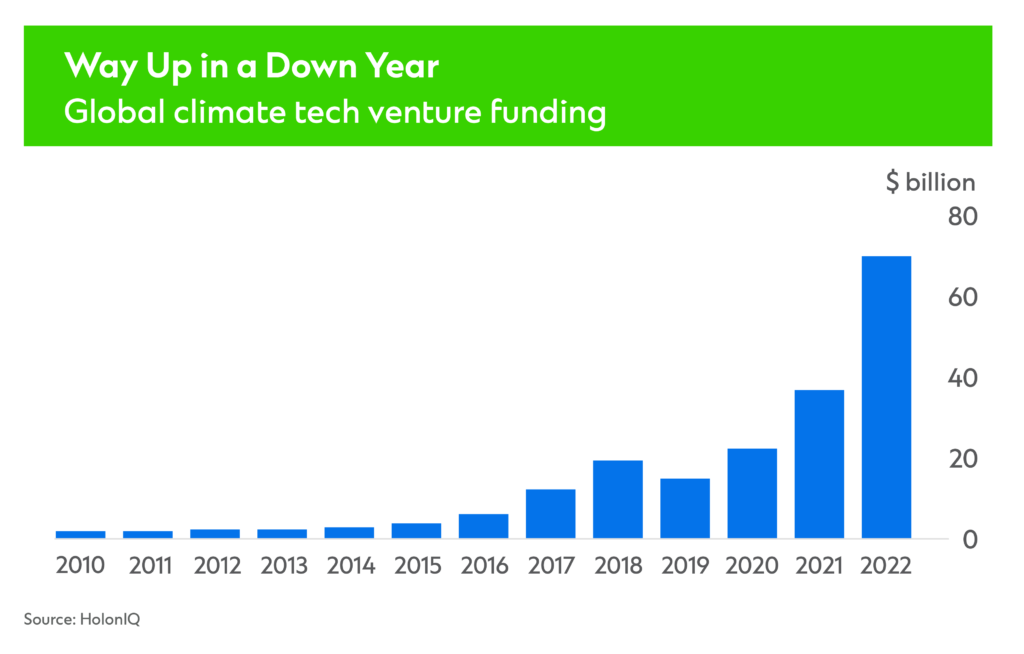

Climate tech saw an 89 per cent year-on-year increase in venture funding last year. Investment totaled USD70.1 billion, led by the US, China and Europe. With most capital deployed into startups, venture funding could spur a wave of new innovations and solutions across renewable energy, storage, mobility, the built environment and more.

However, increased macro uncertainties impacted the valuations as well as appetite for (lower quality) assets towards the end of last year. In particular, startups with promising early-stage technologies are finding it more difficult to raise funding, while late-stage startups with quality assets and cash flow find funding less challenging. One key variable to watch this year will be the likely peaking in interest rates, which can help revive animal spirits once again.

One key bright spot in a rather cautious investor base remains the Middle East. Middle Eastern countries are flush with cash after oil prices touched their highest levels since 2014 last year. In turn, they are keen to invest some of this windfall in the clean energy technologies of tomorrow. The region’s governments are making some of the world’s biggest bets on renewables, CCUS and hydrogen. Saudi Arabia aims to build 54GW of renewable energy capacity by 2030, while the UAE is eyeing 100GW of renewable energy capacity by 2030 at home and abroad. Masdar, the UAE’s flagship clean energy company, is investing in a USD10 billion hydrogen venture in Egypt. ACWA Power, a Saudi utility, is eyeing multi-billion-dollar green hydrogen projects in Egypt, South Africa and Thailand. All this is going to mean significant activity on the M&A front as well as greenfield development side emanating from the Middle East.

Hydrogen: Finally moving from hype to reality

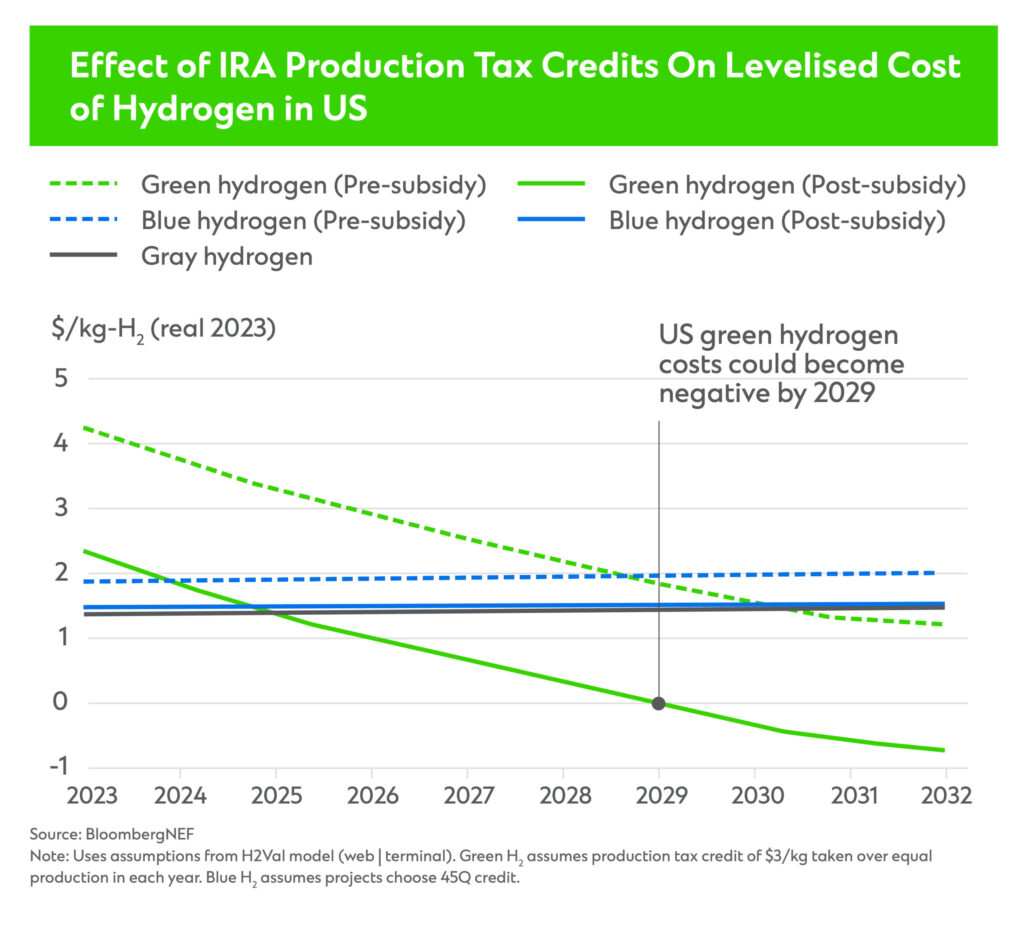

This could be the year that we see hydrogen finally gain traction. Sustained progress in the hydrogen market seemed to have stalled in 2022 due to lack of viable offtake options despite significant developer interest and capital availability. The key catalyst will come this year in the form of policy. According to BloombergNEF, 35 countries have a hydrogen plan and 17 are preparing one. The US Department of Energy, for instance, aims to reduce the cost of hydrogen to USD1/kg by 2031. And the Biden administration’s 2022 IRA offers up to USD3/kg in tax credits for low-carbon hydrogen production in a bid to make green hydrogen cheaper than grey hydrogen.

The EU outlined its hydrogen strategy in 2020, and delivered 20 key action points by Q122. Among them are efforts to increase investment, scale infrastructure and boost demand. And China unveiled its hydrogen strategy in early 2022, outlining a phased approach to developing a domestic hydrogen industry and manufacturing capabilities by 2035.

Another catalyst comes from a seemingly unlikely source: major oil companies. Many are making large-scale investments in green hydrogen. BP, for instance, will lead and operate the Asian Renewable Energy Hub in Western Australia. Upon completion, the hub is expected to be capable of producing around 1.6 million tonnes of green hydrogen or 9 million tonnes of green ammonia, per annum. Elsewhere, China Petroleum & Chemical Corp (AKA Sinopec) is building the world’s largest green hydrogen project. Due to go live in mid-2023, the project covers the full scope of H2 supply, from solar-powered electrolysis to transportation of H2 via a self-developed pipeline.

Produced by Bloomberg Media Studios in partnership with Standard Chartered.

Explore Industries in Transition

How Sustainability-Linked Loans can contribute to greening t…

Companies are increasingly embracing sustainability-linked loans to overcome sustainability challenges. Find out…