Tackling human trafficking in the supply chain

Two of our teams in charge of helping tackle human trafficking spoke with RESPECT – the Responsible and Ethical Private Sector Coalition against Trafficking – about how we’re tacking the insidious crime. Below is their interview in full.

The biggest impact we have is through the business we finance’, recognises Standard Chartered’s position statements, which set out the environmental and social expectations the bank has for its clients. The Environmental and Social Risk Management (ESRM) and Financial Crime Compliance (FCC) teams play a pivotal role in ensuring that Standard Chartered manages this impact in order to fulfil its brand promise – ‘Here for good’.

The Environmental and Social Risk Management Team ensures the bank’s financing decisions are in accordance with its position statements which set out the environmental and social standards it adheres to. These apply globally and across industries, although the team apply a scaled approach dependent on the client, and focus predominantly on Corporate & Institutional Banking (CIB).

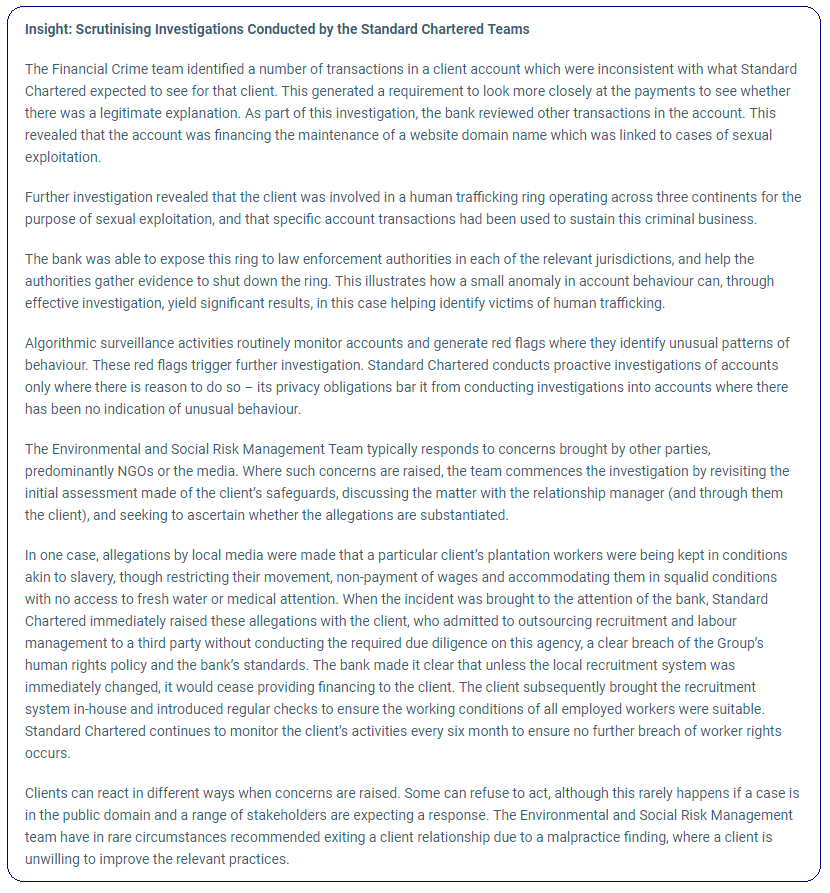

In the context of human trafficking, the Financial Crime Compliance team seeks to understand how the illicit proceeds of human trafficking present a threat to the bank, and how this threat manifests as risk in different types of clients. The team then proactively investigates this risk.

We work with Governments, NGOs and other policy makers to deepen the understanding of how human rights violations can pose a risk to business, and to build partnerships which improve the quality of life for victims of crime, particularly where those victims might be linked to its customers or live in communities where it has a significant presence.

We are bound by the UK Modern Slavery Act, and publishes an annual Modern Slavery Statement on its website. A key initiative the bank points to in this statement is revising contract templates for all new suppliers to include express obligations to address modern slavery in their supply chains, including revising contracts with high value suppliers to include specific obligations to address modern slavery in their supply chains.

Our newly revised Supplier Charter sets out the principles and behavioural standards which it requires suppliers and their approved subcontractors to adhere to, and guides the questions posed to suppliers at on-boarding. This charter includes questions derived from International Labour Organization conventions and seeks to identify what safeguards clients have in place to mitigate the risk of human rights violations in their supply chains. This set of questions is asked on-boarding of new suppliers which have gone through a tender process. Standard Chartered also conducts periodic screening of all its suppliers to check for adverse media related to Modern Slavery.

2018 sees the start of a wider Supply Chain Management programme to embed Third Party Risk into its supplier processes. The bank will be using automation to help define which suppliers are considered high risk based on geography and category, and will have procedures in place on how high risk suppliers should be managed.

We’re also subject to statutory ongoing obligations to monitor transactions to identify whether there is any indication that the client is involved in criminal activity, and report any suspicions to the authorities. As the bank is legally required to monitor the handling of illegal proceeds, and human trafficking is a predicate offence which generates illegal proceeds, it has a legal obligation to look for proceeds of human trafficking.

We use a number of international standards to shape its policy in relation to its own, and its clients’, respect for human rights (set out in full in its Human Rights Position Statement) These include the following sector specific standards: (i) Thun Group of Banks – The Guiding Principles: an interpretation for banks; and (ii) International Finance Corporation (IFC) Performance Standards.

In addition, the bank has signed up to the UK Living Wage charter, to help promote fair pay across its workforce and its suppliers and is taking steps to ensure all staff across its 63 markets are paid a living wage.

The privacy obligations under which banks operate can make investigations difficult. Privacy concerns in some countries can prevent us from sharing information regarding suspicious behaviour with other financial institutions. Where transactions to a Standard Chartered account are part of a chain of transactions, some with other financial institutions, it can be difficult to piece together a complete picture as the bank cannot speak with the other banks in the chain.

A further complication is posed by the fact that it can only share information about suspicious activities with the authorities of the jurisdiction in which the relevant activity has taken place. Where the suspicious activity takes place in more than one jurisdiction, as in the case of cross-border rings, we are required to break the story down into chapters, deliver each to the authorities of the relevant country and hope that they can spot the need to liaise with the authorities of other countries. In some situations, there may be insufficient evidence to prosecute in one jurisdiction alone, meaning that if the authorities do not identify the cross-border links the investigation may fail. This need to deconstruct investigations by jurisdiction in order to report suspicions to national authorities, and the need to rely on authorities to reconstruct the full picture, is a significant inhibitor in concluding transnational investigations.

Further, it can be difficult for the bank to determine the predicate crime triggering the suspicious transactions it has identified. As Standard Chartered analyses the proceeds of crime, it can be hard to distinguish the predicate crime. It is thus key for the bank to develop an in-depth understanding of the different ways in which proceeds of crime behave dependent on the base crime, and how these proceeds move in different jurisdictions. Even where the predicate crime is the same, it is important to grasp the varying forms such crimes can take. In the case of human trafficking, the indicators of labour exploitation in an agricultural context differ significantly from those suggesting sexual exploitation – seeking to find the same indicators in each context is unlikely to be successful. We must appreciate the different ways in which these crimes manifest themselves, and translate this understanding into an ability to track such indicators through movements and flows in account behaviour.

We’re currently working with an NGO to develop a debriefing model, including a series of questions related to financial activity, for the NGO to pose to human trafficking or modern slavery victims it comes into contact with. This will help it understand at what point and through which processes money has changed hands between victim and criminal group, and explore how such transfers can be spotted in a bank account. Understanding how money behaves in these crimes is beneficial to both banks and law enforcement.

A pilot modern slavery risk assessment with key suppliers seeks to understand the risk landscape from both a UK and global perspective. Given that certain jurisdictions and sectors present higher risk, we’re segmenting our supplier base in order to conduct this analysis. This seeks to enhance its ability to identify risks, and mitigate them by adopting controls in it supply chain.

We’re designing a training package for frontline staff in jurisdictions which pose a high risk of human trafficking. In many of these jurisdictions, the bank/client relationship continues to be intensely personal – most transactions take place face to face and deposits and withdrawals are primarily undertaken over the counter. The training focusses on identifying behavioural indicators which suggest a client may be a victim of human trafficking, and ensuring all staff are empowered to escalate concerns. This training will target staff working in branches, relationship managers and other personnel who may visit the relevant client’s business at some stage in the relationship. It seeks to complement the red flag training already embedded within the financial crime teams, and ensure staff at all contact points between client and bank are sufficiently informed to identify irregularities.

Standard Chartered is part of the European Bankers Alliance Against Trafficking, launched in 2015 by a number of leading financial institutions in Europe. These institutions are pooling resources to refine their expertise in using financial data to identify irregular banking transactions that could identify criminal activity.

This article first appeared on the RESPECT’s website. RESPECT is an initiative founded by theGlobal Initiative, Babson College’s Initiative on Human Trafficking and Modern Slavery and IOM