Tech needs to be bolder on investments

Tech hardware firms may be sitting on too much cash. Using this liquidity for investments will be important.

Digital devices and the tech hardware and components that drive them are increasingly becoming the beating heart of the digital economy. But is the tech hardware sector working on its cash and capital as smartly as the products it puts in our hands?

We’ve analysed the sector over the last six years (2018–2023) to assess how effectively companies manufacturing everything from semiconductors to smartphones are managing their balance sheets, investments and overall capital structures.

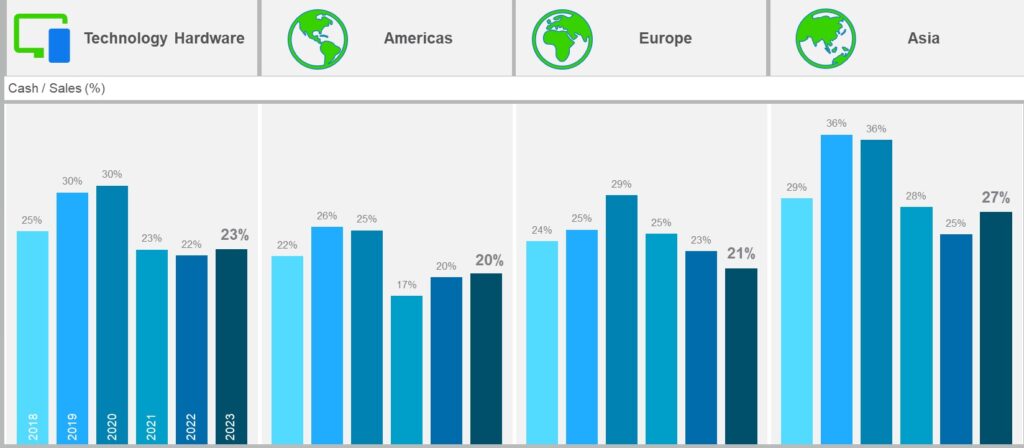

Asia still sitting on inefficient liquidity levels

For most of the corporate world, optimisation of excess liquidity on the balance sheet has been a positive development since COVID era buffers were put in place, and the tech hardware sector is no different. Asia, however, is still lagging, despite marginal improvement.

As the chart above shows, the cash holding on the balance sheets of tech hardware companies in Asia grew to 27% in 2023. While that’s down from the peaks during the pandemic, it is still out of line with the general sector trajectory and the historically lower levels held by corporates in Europe and the Americas.

This high level of liquidity adds to the inefficient use of the balance sheet. It’s being driven by an element of traditional conservatism on investment strategy, coupled with limited investment opportunities, whether organic or inorganic. Share buy-back programmes have also lagged other regions, but that is not rare for Asia.

Perhaps it’s time for a bolder approach to investments to use this excess liquidity?

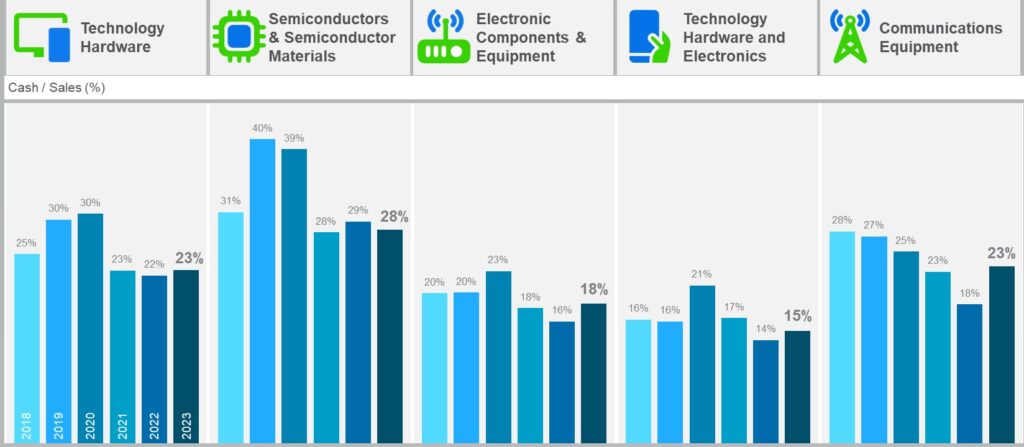

In terms of sub sectors with the broader technology hardware space the semiconductor segment stands out, as detailed in the chart below.

This sector has a higher level of liquidity than the average – but this may have been accumulated during the high growth period, when supporting a developing and rapidly growing business was key. It may now be wise to revisit these levels.

Is this the right time to set much more efficient balance sheet policies?

We believe it is. For example, the more mature technology hardware and electronics sector operates at a significantly efficient 15% cash-to-sales ratio, allowing increased balance sheet flexibility.

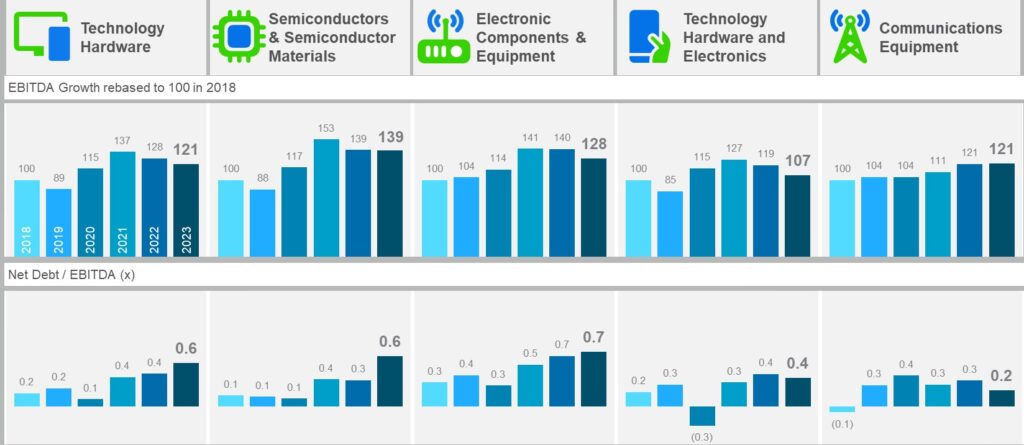

Indebtedness is manageable despite rate squeezes

Debt levels remain stable despite rate rises and consistent spending over recent years. Some segments standout, like the communications equipment sector, which shows a 21% increase in EBITDA between 2018 and 2023 with a current net debt-to-EBITDA ratio of just 0.2.

Similarly, the semiconductor industry has seen earnings growth of 39% over the same period with a net debt-to-EBITDA ratio of 0.6.

We don’t see red flags in the balance sheets, but a level of over-caution may lead to missed opportunities.

Can a better use of balance sheet and indebtedness accelerate value creation?

The valuation multiple suggests so. Our analysis across various corporate sectors showed a generally positive relationship of valuation and leverage as equity investors assigned higher valuation multiples to companies with above-average leverage.

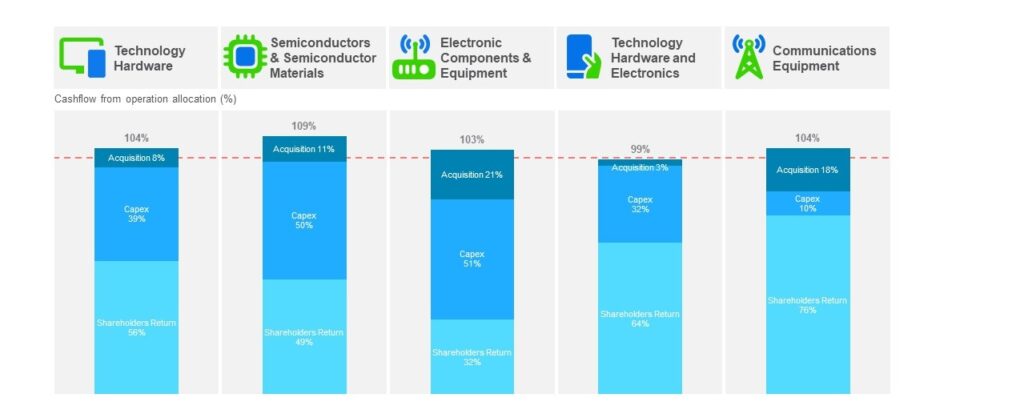

Capital allocation: Is it time to shake off the shackles?

Capital expenditure (Capex) looks strong with a manageable level of acquisitions across most segments in the broader Technology Hardware sector. Electronic components and equipment companies are leading the way, along with the semiconductor industry.

While it is promising to see all cash flow from operations being spent during the past six years, when considered alongside a starting point of a relatively under-levered balance sheet, as well as a significantly higher earning profile, this is still quite conservative.

There is room for the sector to be bolder.

Time to rethink financial policy

The global tech hardware sector is in a good place, but businesses need to take advantage ahead of the next economic cycle. Rates will likely fall, and opportunities exist for growth via investments.

Is your financial policy fit for purpose, especially as you assess if you need to pivot your capital allocation strategy towards even higher investments? Could higher leverage help drive growth and valuation?

Standard Chartered is uniquely equipped to assist corporations in achieving their objectives while ensuring the resilience and adaptability of their capital structure, in accordance with industry best practices. Our extensive global reach, local expertise and comprehensive suite of products are valuable assets that complement and enhance the outcomes of your strategic reviews.

Get in touch with our team

- Shoaib Yaqub, Global Head, Capital Structure and Rating Advisory, Shoaib.Yaqub@sc.com

- Andrew Leung, Executive Director, Capital Structure and Rating Advisory, Andrew.Leung@sc.com

- Fengze Zeng, Director, Capital Structure and Rating Advisory, FengZe.Zeng@sc.com

Explore more insights

The appeal of infrastructure investment in dynamic markets

Infrastructure investment is a priority sector.