What is driving the global interest in Islamic Finance?

Islamic finance continues to gain momentum with borrowers and investors globally, particularly driven by an increasing understanding of the asset class, a strong alignment of Islamic Shariah core principles with ESG principles, and the continuing rise in Islamic liquidity with core, global investors. The rapid rise in Global Sukuk volumes has continued to win over non-Middle Eastern and Malaysian, non-Islamic investors, and this globalisation trend is expected to continue further on the back of the natural synergies between Islamic Finance principles and sustainability.

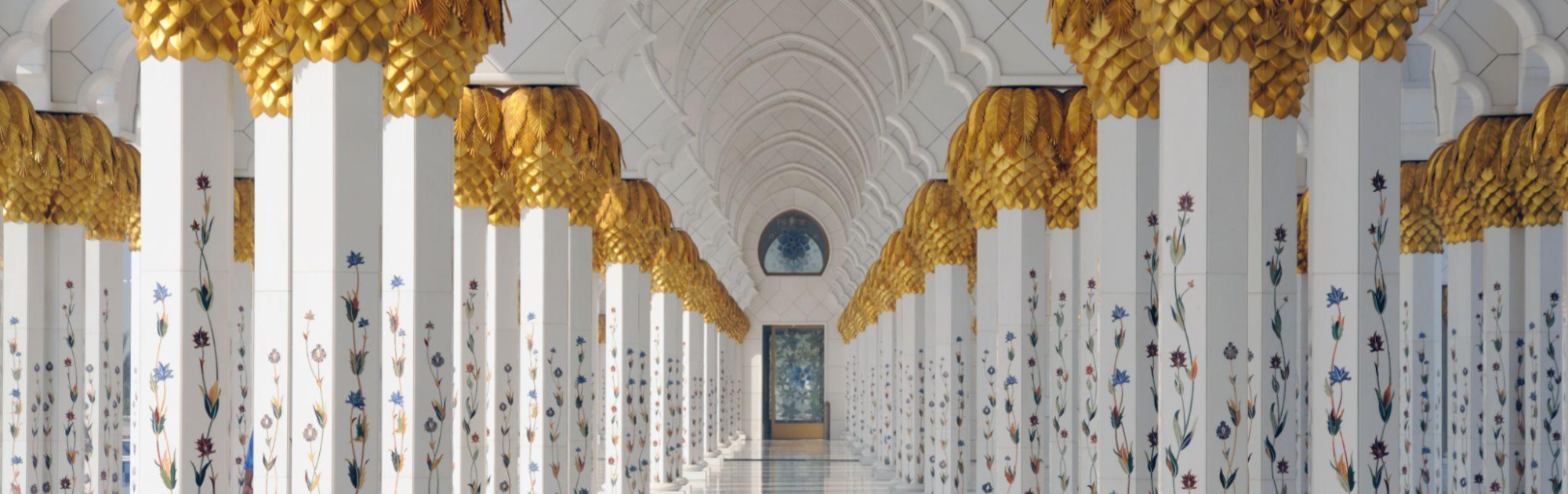

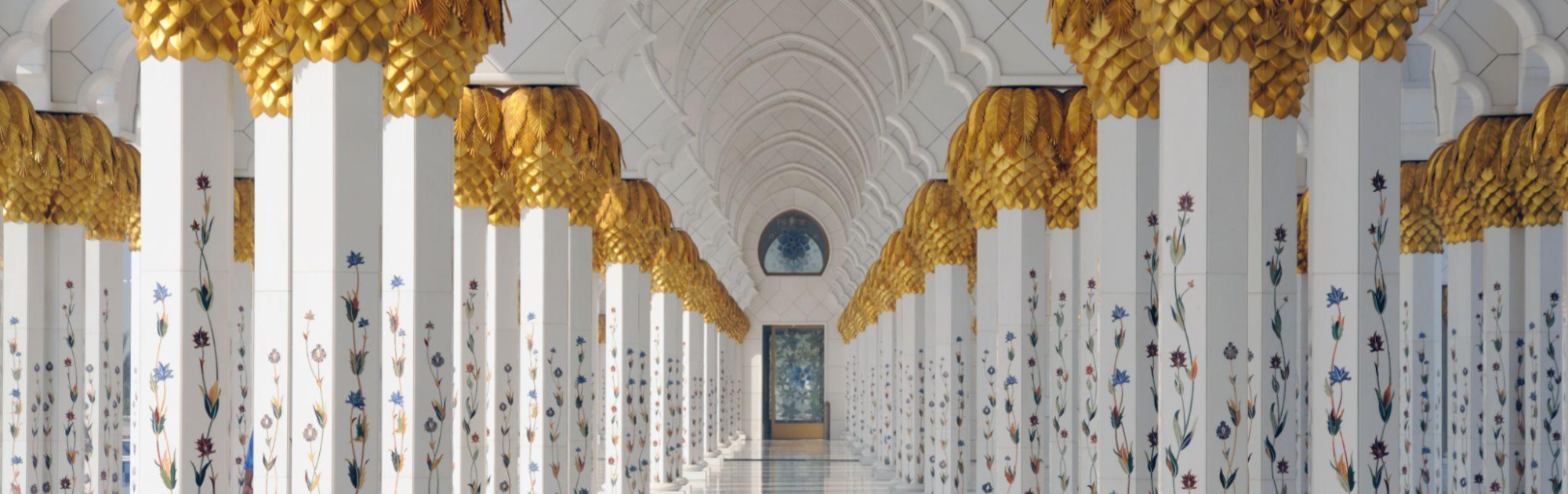

Islamic finance, or Shariah-compliant finance1, is a way to manage money in keeping with the moral principles of Islam. A central theme of these principles includes the forbiddance of ‘money to make money’ transactions, the need to share risk and the need to ensure that investments have a social or ethical benefit to society.

Malaysia, Indonesia, Bahrain, UAE and Saudi Arabia are the leading countries according to the 2020 Islamic Finance Development Report2 measured using indicators such as the quantitative development, knowledge, governance, CSR and general awareness. However, geographic diversification continues to be a core theme as the asset class grows in size and influence and spreads beyond Muslim majority countries to markets such as UK, Hong Kong, Luxembourg and South Africa. The report forecasts Global Islamic finance assets to reach USD3.7 trillion by 2024, up from USD2.9trn in 2019.

Much of that growth is expected to come from new markets such as Africa, as countries begin to put systems in place to issue Shariah-compliant sovereign debt.

“Islamic finance is gaining momentum and spreading to new territories,” says Ahsan Ali, Managing Director and Head of Islamic Origination at Standard Chartered. “The next frontier is Sub-Saharan and North Africa, and banks like Standard Chartered are at the forefront of helping many of these countries come up.”

As the asset class has evolved, so too have the product structures, becoming increasingly complex, and offering tailored features to meet the needs of a growing lender and investor base.

An increasingly popular financing product has been Islamic financial certificates, which are similar to bonds but comply with Islamic religious law, known as Sukuks3. Sukuk volumes have grown rapidly and gained substantial global acceptance amongst investors and issuers.

Unlike with a non-Islamic debt, where the debt holder’s return for providing capital to the issuer takes the form of interest, sukuk cannot bear interest. The sukuk holder’s return for providing finance is a share of the income generated by the assets.

The UK was the first western country to issue a sovereign Islamic bond4 in 2014. This year the country issued its second sovereign sukuk, selling GBP500 million to institutional investors based in the UK and in the Middle East and Asia.

Sukuk issuance is expected to power on in the second half of 2021, with low market rates and abundant liquidity. Global issuance could increase5 to USD155 billion this year, up 11 per cent compared to 2020, according to calculations by S&P Global Ratings.

And it’s not just sukuks, Islamic finance is continually evolving, enticing new kinds of investors with innovations in structuring and with regulatory developments, for example AAOIFI Shariah Standards6.

Central to that growth will be making Shariah-compliant products easily accessible and standardising compliance processes.

There is a growing demand in this space for products linked to environmental, social and governance (ESG) factors. The core building blocks of Islamic finance are already in keeping with ESG, for example the need to benefit society and to avoid potentially harmful or exploitative practices or those that cause damage to the environment.

While demand for sustainability-linked and green sukuk issuance will likely be high, volumes of Shariah-compliant instruments like this remain relatively low for the time being. The Islamic Development Bank issued a sukuk7 worth USD2.5bn this year and said it would use 10 per cent of the proceeds to finance green projects and the rest for social development programmes.

In another sign of what’s to come, this year Malaysia became the first country to sell a dollar sukuk linked to sustainability8, when it priced USD800m of 10-year sustainability Islamic finance notes.

These deals and those issued by corporates underscore the role Islamic finance can play in helping boost economic recovery after COVD-19, by helping to promote or revive the SME sector.

“Islamic Finance and the concept of Sustainable Finance have always been in harmony” says Souad Benkredda, Global Head of Strategic Investors Group Sales at Standard Chartered. “This means that leveraging the strengths of both can generate strong returns for both issuers and investors while also building a better world for all of us.”

1 https://www.bankofengland.co.uk/knowledgebank/what-is-islamic-finance

2 https://icd-ps.org/uploads/files/ICD-Refinitiv%20IFDI%20Report%2020201607502893_2100.pdf

3 https://www.accaglobal.com/gb/en/student/exam-support-resources/fundamentals-exams-study-resources/f9/technical-articles/introduction-to-islamic-finance.html

4 https://www.keystonelaw.com/keynotes/islamic-finance-in-the-uk

5 https://www.thenationalnews.com/business/2021/07/05/global-sukuk-issuance-may-hit-155bn-in-2021-sp-says/

6 https://aaoifi.com/shariaa-standards/?lang=en

7 https://www.isdb.org/news/islamic-development-bank-issues-largest-sustainability-sukuk-ever

8 https://www.bloomberg.com/news/articles/2021-04-21/malaysia-starts-marketing-its-first-ever-sustainability-sukuk

Turning expertise into actionable insights. Explore our views on what to watch out for in today’s financial markets.