Beyond the pandemic: why the pharma sector needs to focus on working capital

Authors:

COVID-19 has had a profound impact on the world and continues to do so to this day. Not only has the pandemic transformed the way we live, work, travel and interact, it has also created numerous challenges for many businesses around the world.

Global pharmaceutical companies were no exception; although sales of vaccines and therapeutics for COVID-19 have been an unexpected windfall for the industry, we have also seen a slowdown in R&D and bottlenecks in the global supply chain.

With the kind of operating margins, balance sheet strength, and cash on hand that companies in other sectors could only dream of, the pharma industry has historically had little need for working capital optimisation strategies. Times are changing, however.

Over the past five years, the pharma industry’s net working capital has grown 31.4% to approximately 26% of sales. This amount of working capital could have funded approximately one third of the total capex (US$181bn) during the same period.

Looking ahead, there remain numerous challenges that may stress even the most solid balance sheets, putting tied-up capital at a premium.

As drug makers respond to the pandemic by developing vaccines and therapeutics, many are losing exclusivity on blockbuster drugs over the next five years, with approximately US$236bn of sales at risk1. For companies that rely predominantly on prescription drug sales, replenishing the pipeline will be a crucial pillar of growth.

One means of doing this is via research and development (R&D). Already operating in an R&D intensive sector – second only to the aviation and space industry – pharma companies are set to boost R&D spend even further especially in areas such as oncology and immunity, with outflows now expected to double to 4.3% CAGR between 2021 and 2024.

While developing new products to boost growth is one option, others will look to M&A to secure a more stable future, as in the case of AstraZeneca’s US$39bn acquisition of Alexion, which strengthened the British-Swedish company’s immunology offering, or Gilead’s US$21bn acquisition of Immunomedics, which bolstered its cancer drug pipeline.

According to PwC estimates, as of December 2020, the industry had 6% less capital that could be directed toward M&A versus 2019, and finding enough firepower to fuel new growth may become increasingly challenging.

Despite these pressures, investors will expect the industry to continue delivering strong returns. As sales growth normalises following a bumper 2020, pharma companies may seek to preserve the value they have created while at the same time executing new transformational strategies.

Cost-cutting measures alone are unlikely to release the levels of cash needed. However, by pulling the right levers to optimise working capital, companies can focus on their capital allocation priorities – enabling them to meet the challenges of 2021 and beyond.

Research based on pharma and healthcare companies in the S&P Global 1200 Index with a market capitalisation greater than US$10bn demonstrates the different cash conversion cycle (CCC) pressures faced by companies in different geographies.

While overall, CCC days expanded in 2020 due to the impact of COVID-19 on pharma supply chains, companies in Europe and North America saw respective increases in days inventory outstanding (DIO) of four and two days as higher stock held pushed up working capital requirements. In the Asia Pacific (APAC) region, meanwhile, a days sales outstanding (DSO) increase of nine days was the main driver as conventional collection practices contributed to longer payment terms.

“Across every metric, there is a meaningful gap between best and worst performers. Raising the average performance level of pharmaceutical companies to that of the sector leaders presents significant opportunities for capital release,” says Ashutosh Kumar, Global Head of Working Capital Solutions at Standard Chartered.

Source: Company Reports and Announcements, Capital IQ, SCB Analysis

Raising the average performance level of pharmaceutical companies to that of the sector leaders presents significant opportunities for capital release.

Ashutosh Kumar, Global Head of Working Capital Solutions, Standard Chartered

As the pharmaceutical industry is a capital-intensive industry characterised by big upfront costs and a lengthy wait to see a financial return, it is unlikely that drug companies can achieve similar working capital positions to the consumer goods or technology industries. Nonetheless, significant opportunities exist to unlock cash that could be productively re-invested into the business towards value generating initiatives like R&D – without needing to access additional funding or put cash flows under pressure.

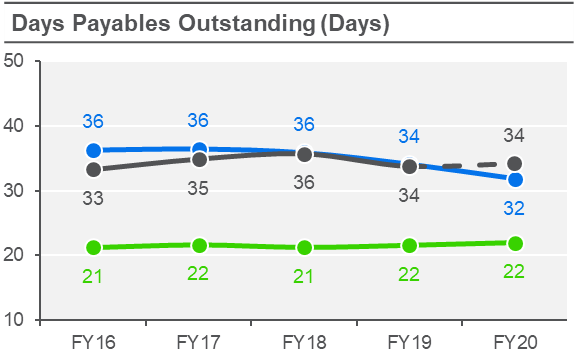

One of the most relevant working capital levers for the pharmaceutical industry today is in DPOs. Compared to other industries, the average DPO in pharma is low, at 22 days for North America and 34 days across APAC and Europe. Within those figures, there is also substantial variation, with a delta of over 40 days companies in APAC. By increasing their DPO, companies can hold onto cash longer and deploy released cash where it’s needed.

Source: Company Reports and Announcements, Capital IQ, SCB Analysis

Note: APAC FY20 includes LTM numbers due to timing of financial year ends

While this can be achieved by working with suppliers to extend payment terms, a preferable option is the implementation of a supply chain finance programme, which ensures suppliers have the working capital finance they need while also enabling buyers to benefit from extended payment terms.

Global supply chains, already reeling from the US-China trade war and economic instability, have been stretched thinner still by the pandemic. This unprecedented situation challenges the “just-in-time” model, and as companies move to “just-in-case” scenarios, stock level are rising.

“As companies seek to move inventory closer to their end consumers in order to guard against localised disruption within supply chains, their distributors will need working capital to take up the additional inventory,” says Kumar. “With solutions such as distributor finance, based on the strength of their relationship with the manufacturer, these distributors can receive steady and assured funding to support their working capital needs, while manufacturers save costs by converting receivables to cash on time.”

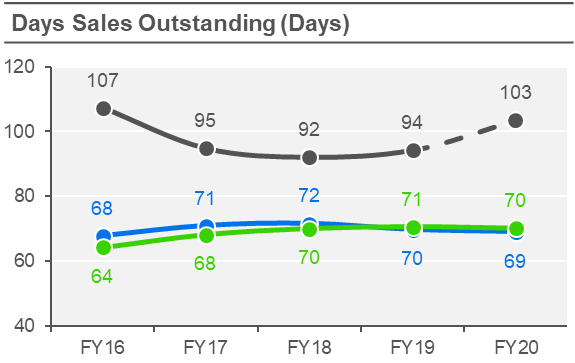

The changes to working practices brought about by COVID-19 have stressed accounts payable processes, and this has brought about a concomitant rise in DSO. This issue is particularly acute among APAC companies, where DSO surged by nine days to 103 days in 2020 – more than 30 days greater than in Europe or North America.

Source: Company Reports and Announcements, Capital IQ, SCB Analysis

Note: APAC FY20 includes LTM numbers due to timing of financial year ends

For many companies, taking control of DSO starts by automating the invoicing and collection process. This helps to reduce friction with buyers as well as increase visibility, particularly for remote teams.

To minimise DSO further, companies can also take advantage of receivables financing, which allows them to monetise their receivables while mitigating the counterparty risk, thus releasing cash as well as managing the risk on their balance sheet.

Bespoke working capital management strategies are available to help improve performance, and these have been successfully used by companies across a number of different industries for many years.

To gain a leading edge in this challenging business environment, pharmaceutical companies have a tough task ahead of them. Closing the gap between sector leaders and laggards in cash conversion metrics will be vital to drive future top-line growth, and treasurers can achieve this by proactively intensifying efforts to optimise working capital, in collaboration with their banking partners.

1 Based on Evaluate Pharma estimates

Note

Days Sales Outstanding (DSO) = {[(Trade Receivables Beginning of Year + Trade Receivables End of Year) / 2] / Sales} x 365

Days Inventories Outstanding (DIO) = {[(Inventories Beginning of Year + Inventories End of Year) / 2] / Sales} x 365

Days Payables Outstanding (DPO) = {[(Trade Payables Beginning of Year + Trade Payables End of Year) / 2] / Sales} x 365

Cash Conversion Cycle (CCC) = DSO + DIO – DPO

For more information, contact us:

| Capital Structure Advisory Shoaib Yaqub Jong Boo Yoo | Working Capital Solutions Ashutosh Kumar |