Why digital supply chain finance could be a game changer

Digital solutions have the potential to bridge the trade finance gap – but only one in five businesses are using them. How can we incentivise adoption?

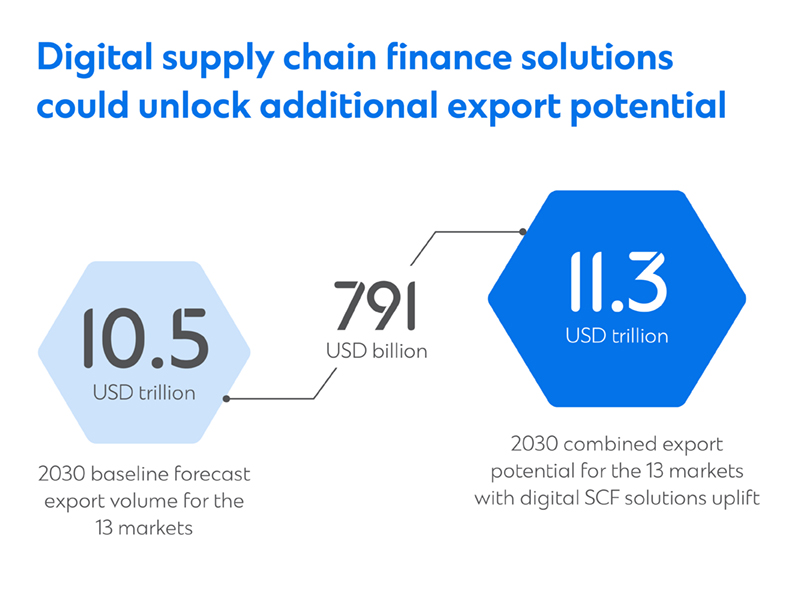

Adopting digital supply chain finance (SCF) solutions could boost trade in Asia, Africa and the Middle East by 7.5 per cent to USD11.3 trillion by 2030, bridging the trade finance gap and making global trade more sustainable, inclusive and transparent.

The Asian Development Bank estimated that the global trade finance gap reached USD2.5 trillion in 2022, due to macroeconomic factors, geopolitical tensions and increase in rejection rate of trade financing requests. SMEs are disproportionally affected when it comes to rejected applications, compared with multinationals and large corporations.

The trade finance gap exacerbates inequalities and increases supply chain fragility. When SMEs are unable to secure the capital they need to weather disruptions or fulfil orders, the global flow of goods is disrupted, negatively impacting trade and economic growth.

Our Future of Trade report shows that digital SCF solutions can improve SMEs’ access to trade and working capital and can unlock USD791 billion of additional export in 13 key markets[1].

With more SMEs onboarded to such solutions, organisations purchasing goods can diversify their supplier base and improve supply chain resilience. In addition, this enables tracking of ESG-aligned sourcing and commercial behaviour across the entire supply chain.

Although digital SCF solutions have wide-ranging benefits, they are currently underutilised. Our survey with over 100 business leaders shows that they express strong interest in such solutions, but only 18 per cent of them have implemented digital SCF solutions.

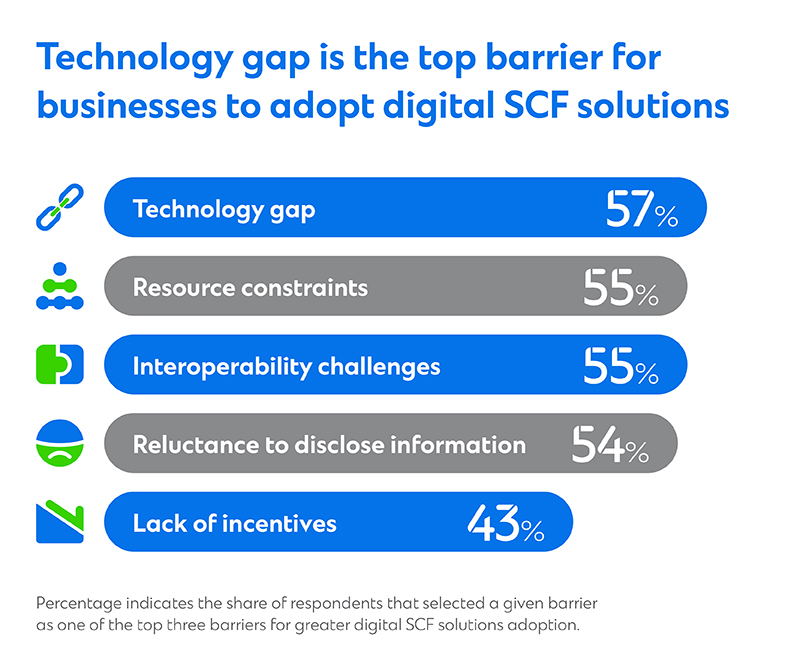

Among the barriers, almost six in 10 business leaders cited technology gaps as the key inhibitor to wider adoption. 55 per cent of respondents also feel that there are limited resources available to adopt and maintain SCF solutions, and face challenges when integrating this with existing systems. Additionally, 43 per cent of business leaders cited that there is a lack of external incentives for businesses to adopt SCF solutions in their organisation.

Currently, tracking the supply chain carbon footprint – an attractive add‑on for digital SCF solutions – is not directly and widely incentivised. Legislations that encourage businesses to track and report the direct and indirect emissions could be a necessary incentive to promote greater adoption of SCF solutions.

Besides legislation, governments could directly address other key barriers to adoption of digital SCF solutions, by providing businesses with much-needed subsidies and technical assistance.

Multinational businesses should take up the mantle in leading SCF solutions adoption in the business community and leverage their position in their supply chains to drive positive changes.

Only through close public-private partnerships, can digital SCF solutions be extensively adopted in markets around the globe and the technology benefits realised.

[1] Bangladesh, Mainland China, Hong Kong, India, Indonesia, Kenya, Malaysia, Nigeria, Saudi Arabia, Singapore, South Korea, the UAE and Vietnam.