Eyes on the prize: Why funding balance sheet efficiency is key for 2022

The COVID pandemic and associated supply-chain stress of last year have put corporates under pressure to reinforce balance sheets and squeeze everything they can from the assets at their disposal.

This has paid off: our bottom-up analysis of 700 constituent companies in S&P’s Global 1200 index over the past five years shows that by the end of 2020, seven of the 16 sectors assessed had their best year since 2016 in terms of working capital efficiency. By September 2021, 12 sectors were at their strongest.

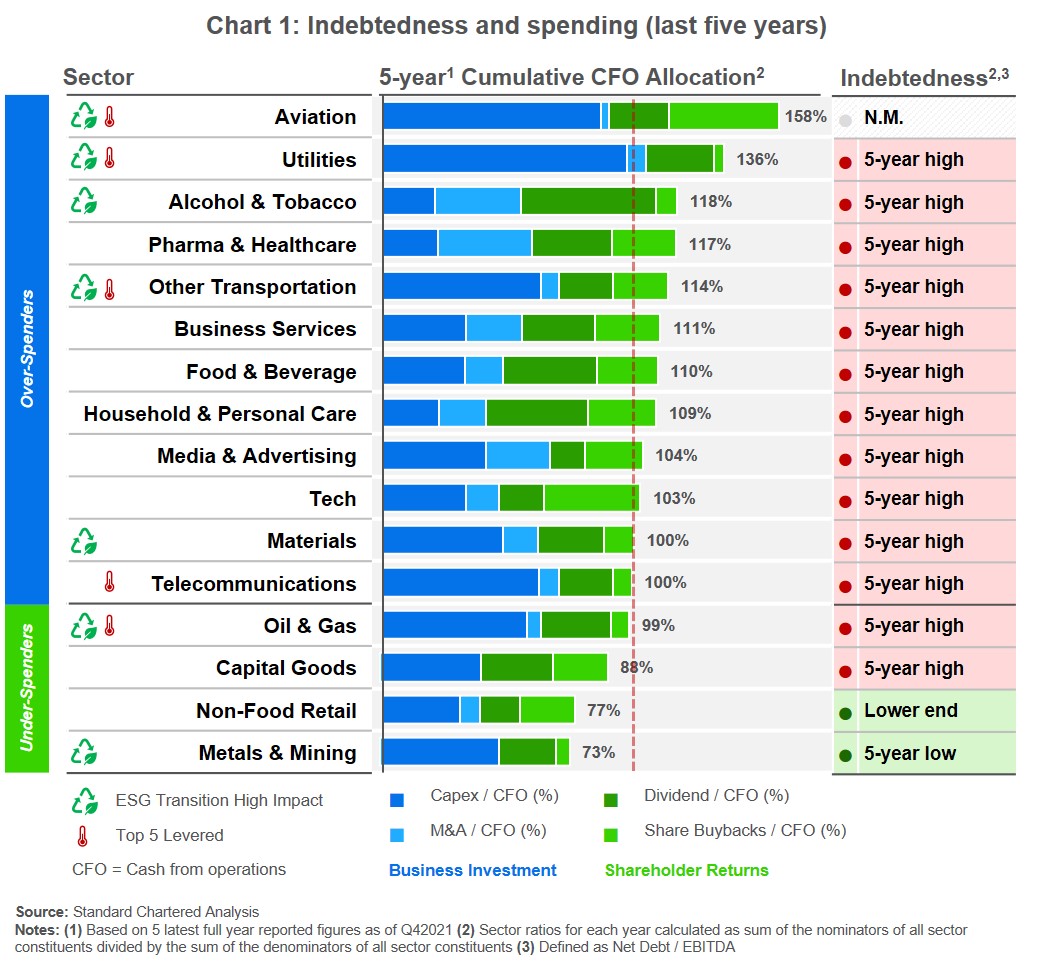

This is impressive. But our analysis also showed that pressing investment needs and the impact of COVID have put pressure on credit profiles, as indebtedness has peaked for 13 of the 16 sectors – with many sectors continuing to deliver higher shareholder returns. In this environment, the capital structure challenges facing C-suite executives are only likely to intensify.

Greater indebtedness means most sectors start 2022 in a position of greater stress than in 2016. Our analysis shows that 12 sectors spent more cash than they generated (Chart 1). That isn’t sustainable indefinitely.

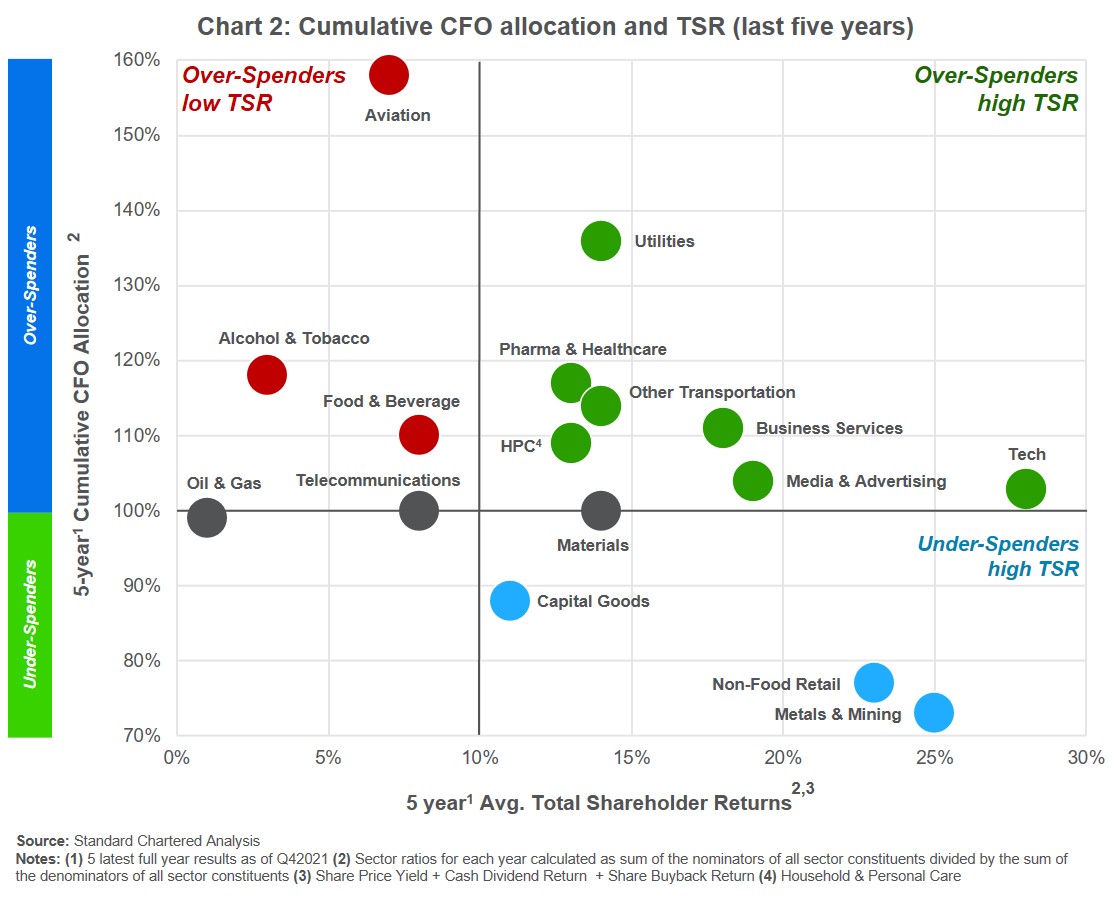

To be sure, the over-spenders mostly generated value. Looking at total shareholder returns (TSR), which comprises share price yield, dividends and share buybacks, the message is positive: In most cases, overspending boosted TSR to more than 10 per cent annually (Chart 2).

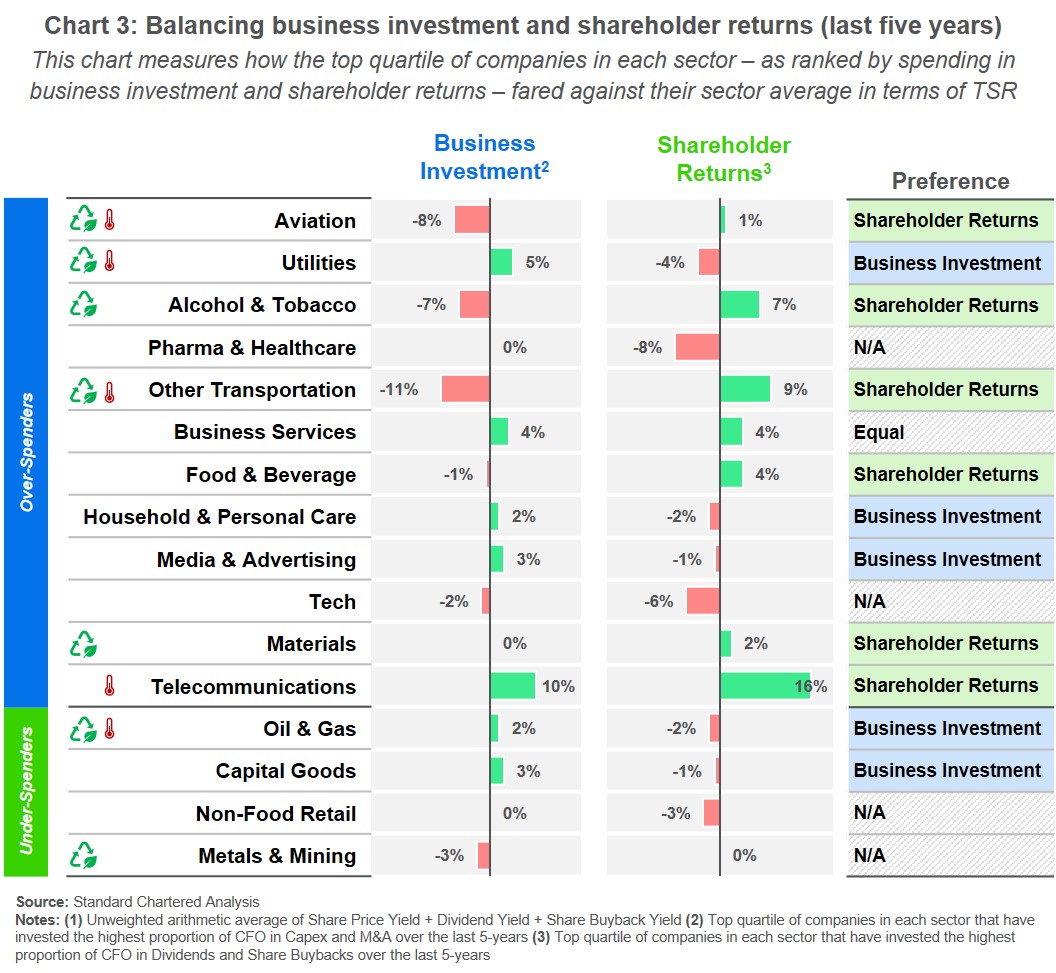

For some sectors, accelerating environmental, social and governance (ESG) capex costs have dictated a tilt towards business investment, but our analysis shows this hasn’t come at the cost of TSR (Chart 3).

The top quartile of companies in sectors like utilities, capital goods and oil & gas that invested heavily in the business in light of structural change (i.e., the ongoing energy transition) saw an outperformance compared to the sectoral average TSR. More mature sectors with fewer organic growth opportunities, such as food and beverage or telecommunications, saw a strong preference for shareholder returns.

In this context, balancing the need to invest in the business with returning cash to shareholders remains fundamental. The tactics that individual C-suite leaders feel are suitable aren’t the point: these will vary by company and must fit with their broader strategies.

What is increasingly important is that firms seeking to be the exception in their sector – for example, an F&B firm prioritising investment over shareholder returns – must have a robust justification for going against the crowd, or risk being punished by the market.

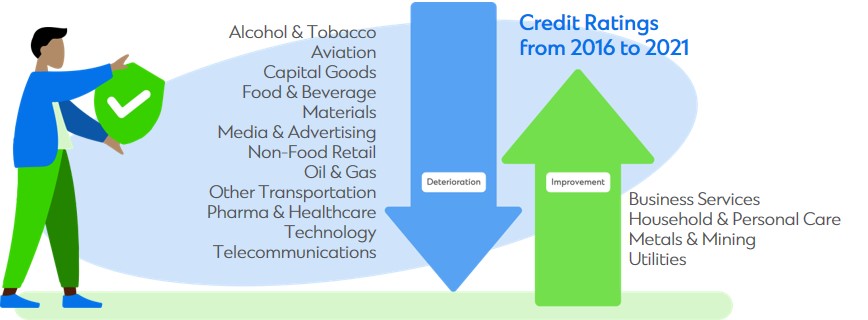

In addition, funding decisions are complicated by an evolution in the global profile of corporate debt. An analysis of S&P’s ratings distributions since 2016 shows that 12 sectors have seen a deterioration in credit quality while four sectors have moved up the ratings curve.

These dynamics have led to an increased concentration in the ‘BBB’ band, implying that a lower credit rating is evidently more acceptable now than in 2016. Corporates may be taking greater risk, but still enjoy lower debt-servicing costs. However, this isn’t new: data analysis over the past 20 years shows a gradual decrease in the cost of debt and in its quality.

Nevertheless, levered companies will need to diversify their debt to make their growing funding bases defensible and add tenor to provide some degree of insulation against the risk of rising interest rates. Additionally, the dozen sectors that are over-spenders need to balance investments with debt repayment, or unlock capital on their balance sheets to ensure they don’t shift further down the credit spectrum.

That brings us back to our working capital findings. While 12 of the sectors are at their strongest point since 2016, it is clear that firms can’t relax and risk a return to inefficiency. Doing so could prove catastrophic.

Efficiently managing cash will remain strategically crucial through 2022, due to increased pressure on the balance sheet and as the focus on supply-chain sustainability gets sharper. The balancing act of investing in the business or returning cash to shareholders will get more challenging in an era of accelerating ESG transition and greater market volatility.

As low-carbon investments grow, funding diversity and structured debt will be critical in relieving some of this pressure. Other options include disposals, and green and off-balance-sheet financing for projects.

Whatever the approach taken, corporates will need to deploy an array of tools to manage the capital structure challenges that 2022 will bring – and to maintain a laser-like focus on working capital efficiency.

For more information, contact us:

Capital Structure Advisory team

Special thanks also to Farabee Chowdhury, Ahad Kalim, Carolyn Liao and Lucy Tyler for their contribution to this analysis.