Global trade: Is it time for optimism?

By Chidu Narayanan, Economist, Standard Chartered

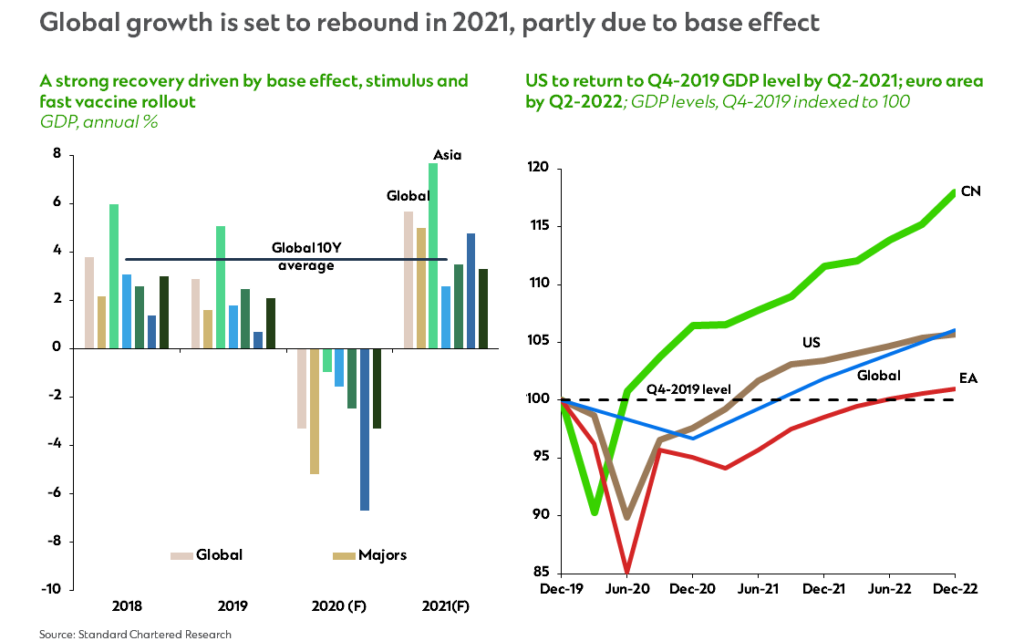

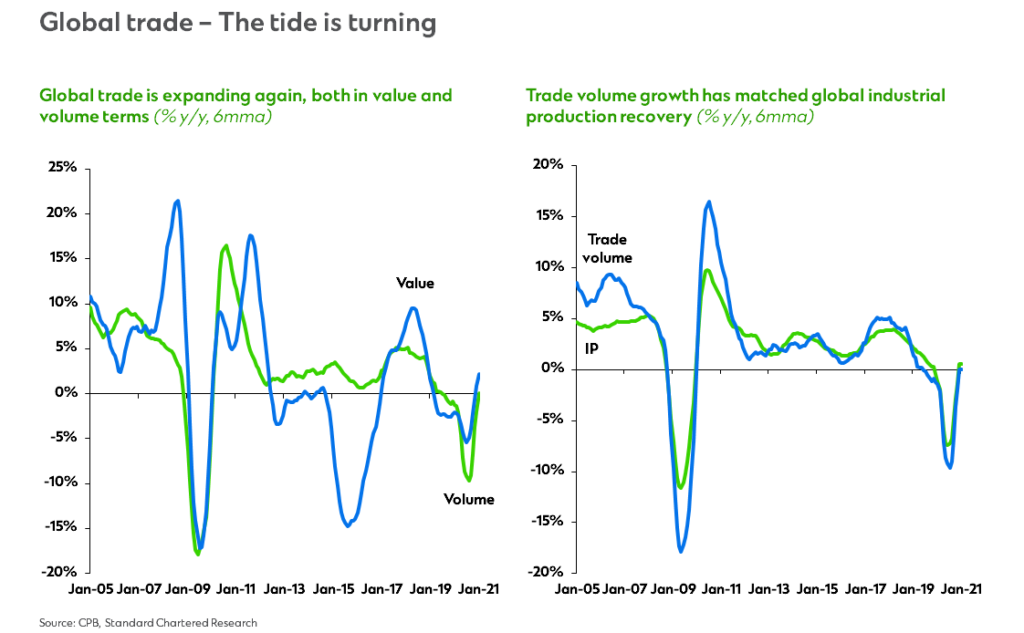

The pandemic triggered the worst global recession since World War II,1 shrinking the global economy and pushing trade volumes down for the first time since the 2008-09 financial crisis. Yet the recovery has been as quick and sharp as the decline that preceded it2.

The remarkable rebound is being led by the United States and China. Sentiment is buoyant as accommodative fiscal and monetary policy continues to provide substantial stimulus to the global economy, and as vaccine rollout gathers pace. While all of this is cause for optimism and hope after an extremely challenging year, here’s why we believe that the recovery is durable despite the challenges it is likely to face in the months ahead.

Global trade is expanding again, both in value and volume terms, and Asia’s exports have grown rapidly – driven in particular by demand from the US. The rapid pace of recovery has been made possible by substantial fiscal stimulus, Federal Reserve monetary support and widespread vaccinations. China is building on its strong performance in 2020, when it was the only major economy in the world to expand, growing 2.3%.3

External demand remains resilient across the board, pointing to strong growth in global exports in the first half of 2021. Over the next three months, we expect to see a rapid increase in global trade, supported by a favourable base effect: The second quarter of 2020 saw a massive contraction in business activity as lockdowns strangled commerce. This would boost global trade for the second quarter of 2021 by 8.3% YoY – even if global demand and trade volumes remained at Q3-2020 levels.

Higher demand fuelled by the resumption of economic activity (albeit still below pre-COVID levels) could boost trade volumes further. This demand boost is reflected in in the rise in crude oil prices, which averaged about $42 per barrel in the first half of 2020 and currently stand close to $70.

Crucially, PMI data show business sentiment and industrial activity picking up in both the US and China. Economic activity in the US is back to pre-pandemic levels, while China is now doing better than it did in 2019. This trend is likely to continue for the rest of 2021, which means the near-term outlook is highly optimistic.

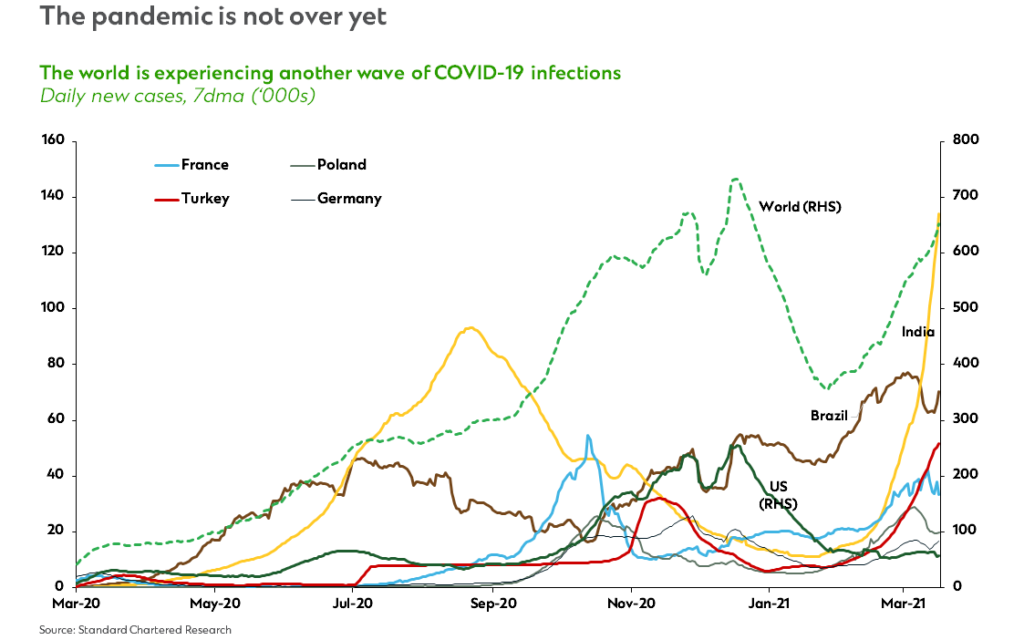

However, it’s important to remember that business activity could quickly fizzle if sentiment sours, which is a clear risk if vaccine rollouts around the world run into problems or if caseloads continue to rise. And if, as recent reports suggest, the current surge in infections in some countries is linked to vaccine-resistant variants,4 hopes of a quick return to “business as usual” will fade. This is a major downside risk to beware of.

While China and the US use their economic heft to drive the world’s recovery, inflation is a risk that will need to be carefully monitored and managed over the medium term.

Currently, inflation is in check as large parts of the global economy remain below pre-pandemic activity levels. Central banks around the world are not too concerned about a near-term rise in inflation driven by base effects and pent-up demand. While consumption has increased, homebound consumers are spending less than before, and companies concerned about overcapacity are reluctant to invest fresh capital.

Markets, however, remain concerned that inflation could increase rapidly as business activity ramps up to pre-pandemic levels, and as consumers and corporations resume spending the cash they have saved following months in lockdown. We don’t expect this scenario to unfold over the next year, but it bears monitoring over the medium to long term5.

Another challenge we envision over the medium term is the growing rift between the world’s haves and have nots. The pandemic has further widened this longstanding divide – a trend highlighted by the stark differences in various countries’ access to vaccines.6

The pandemic has also exacerbated existing issues like the rise of protectionism and nationalism and helped to catalyse slow-moving developments that have the potential to transform global trade over the long term.

While trade is linked to macroeconomic trends, it is also usually impacted by geopolitics. As countries increasingly turn inward, we could be looking at a regionalisation of the global supply chain.

Companies had already started to re-evaluate their supply chains long before COVID-19, in response to rising labour costs in Asia’s production hubs, the US-China trade dispute, and rapid advances in technology-aided manufacturing7. They are now increasingly considering moving production closer to their main markets.

What this will mean in practice is a shift from long-established transcontinental networks serving a global customer base to production linkages that rely more on geopolitical alliances and regional partnerships aimed at serving local markets – whether in the Americas, Europe, Asia or Africa. Companies also expect such regional supply chains to enhance their response times to changing trends by bringing them closer to consumers in specific markets, while providing a hedge against broader geopolitical turmoil.

Yet another trend that we expect to influence global trade over the long term is the ongoing effort by companies to overhaul their inventory management systems. We are seeing a shift in inventories away from highly efficient but vulnerable ‘just-in-time’ systems to a more capital-intensive ‘just-in-case’ model. This is further supported by a growing desire by companies across industries – again, catalysed by the pandemic – to invest resources in being prepared to handle future crises8.

Overall, as we look ahead to the rest of 2021 and beyond, we believe the tide is turning for global growth and trade. But we must recognise that a sustained global economic recovery will ultimately depend on the world’s successful management of the pandemic.

2 Global trade – Reasons for optimism in 2021

5 COVID-19 – Inflationary or disinflationary?

6 https://www.unaids.org/en/resources/presscentre/featurestories/2021/march/20210310_covid19-vaccines

7 https://www.sc.com/en/navigate-the-future/robotics-future-of-low-cost-manufacturing/

8 COVID-19 – Impact on global supply chains

Financial Markets Insights

Turning expertise to actionable insights. Explore our views on what to watch out for in today’s Financial Markets.

Learn more

Trade & Investment | Commodities | E-commerce | Fin Tech | Financial Institutions | Government | Healthcare | Infrastructure | Manufacturing | Oil & Gas | Power & Utilities | Real Estate | Technology | Africa | Americas | Asia | Europe | Middle East | Articles