Using blockchain to fight financial crime

There’s been a lot of hype about blockchain technology, the most famous example of which is the cryptocurrency, Bitcoin. Media, think tanks and strategy consultancies have suggested that it will transform everything – from banking, to government, even to our identities.

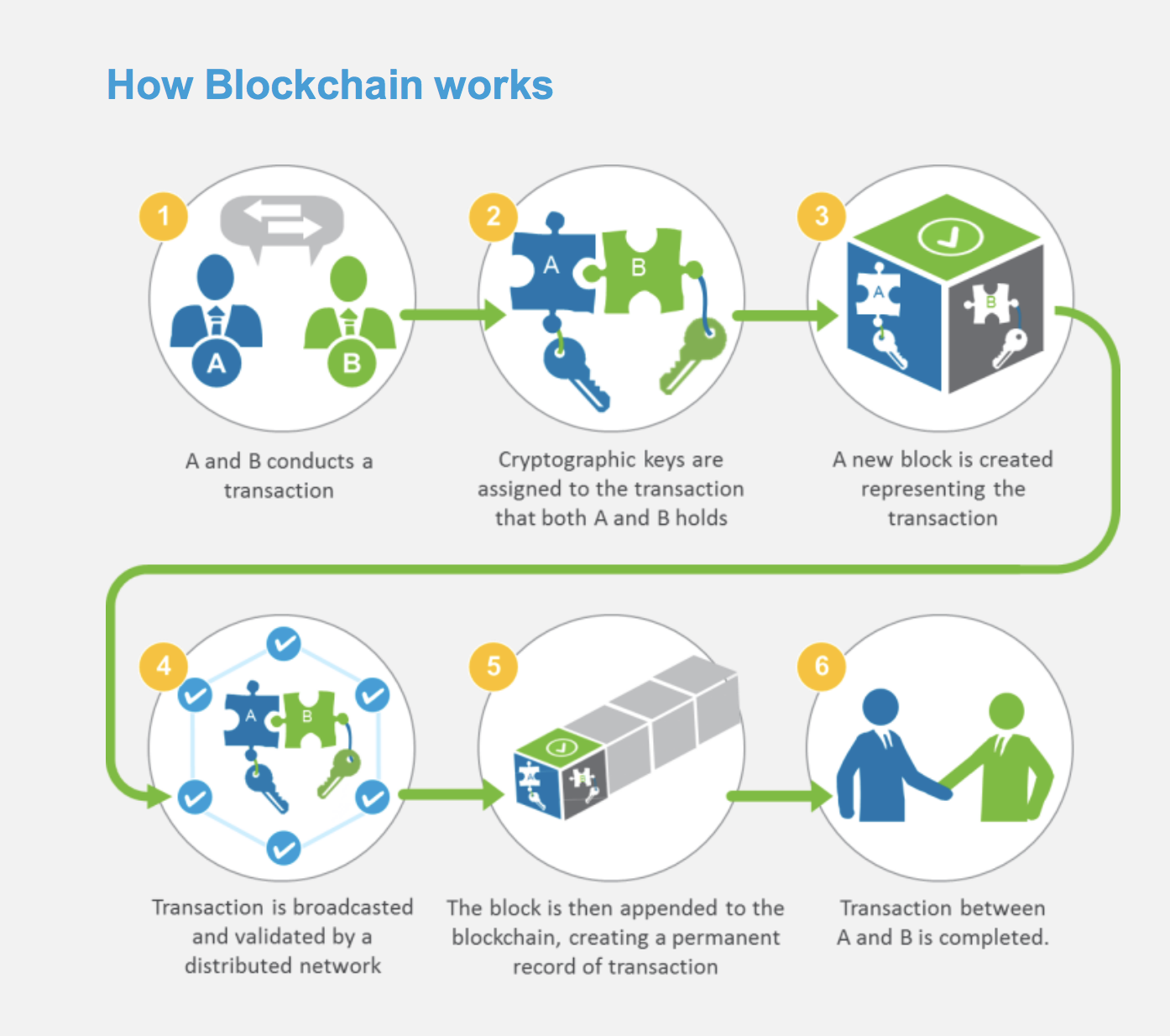

It’s easy to see why people are excited by its potential. Its core premise of a distributed ledger database for recording transactions brings unprecedented traceability at unprecedented speed.

Some in the industry have compared its arrival to the discovery of penicillin; it is hoped blockchain can cure many social ills, in the financial sector and beyond.

In the financial world, the most probable near-term applications of blockchain technology are in the areas of post-trade settlements – especially for loans, Credit Default Swaps (CDS) and securities – trade finance and in-time international payments.

The idea that new blockchain applications will operate without banks playing a major role is not likely

Some fear that banks might be under threat of being crowded out of this space by new entrants, but the idea that these new blockchain applications will operate without banks playing a major role is not likely.

In the wake of 9/11, banks have been tasked with stepping up their ability to keep the financial system safe from terrorists, traffickers and other criminal activity. Vast sums are spent to develop and maintain sophisticated anti-money laundering (AML) programmes to meet complex Know Your Customer (KYC) requirements.

The cost of putting these in place means they’re not going to be replicated by start-ups. And the alternative – allowing an ‘unpermissioned’ space to develop, free of these AML/KYC requirements – is unlikely to win support from the public policy makers and standard setters, supervisors and regulators by whom they were introduced and who enforce them vigorously.

At Standard Chartered, we see blockchain as a huge opportunity. In 2016 we completed the first real-time cross-border payment for businesses with another major correspondent bank.

This involved teaming up with fintech start-up Ripple, which provides a blockchain platform for enterprises. Normally this payment process takes up to two days, but the initiative saw it completed in less than 10 seconds. And that settlement time included the “full transparency of fees and FX (foreign exchange)”.

And earlier this year, Standard Chartered, together with DBS Bank and Infocomm Development Authority of Singapore (IDA) successfully completed a proof of concept delivering the world’s first application of distributed ledger technology to enhance the overall security of trade finance invoicing. Soon we will be inviting clients and other intermediaries to join this pilot.

The Bank is also part of the Hong Kong Monetary Authority’s Distributed Ledger Technology Trade Finance Working Group, which also delivered a proof of concept using blockchain in trade finance.

These trade finance pilots are a good example of how blockchain can help us break down silos. And by facilitating secure information sharing in real time, this technology can take our efforts in the fight against financial crime to the next level.

Further reading: