Belt and Road: Keeping commodities moving

By combining infrastructure links with a vision for reduced friction in the movement of goods, the Belt and Road Initiative (BRI) is set to transform trade between Asia, Europe and Africa.

The huge physical scope of BRI means that within ten years or so, it will cover about a quarter of all goods and services traded globally, with enormous implications for the movement of commodities. By increasing connectivity, making borders more permeable and supply chains more efficient, trade costs between the countries involved could be cut by as much as 50 per cent, with the knock-on effect increasing world trade by an estimated 12 per cent.

The fall in costs will vary according to location. BRI aims to dissolve current blockages on world trade routes, meaning that Eastern Europe and Central Asia, which currently have poor transport links and high border costs, will be the main beneficiaries. Areas with well-developed trade links such as the EU will see comparatively smaller improvements, while countries that provide links between BRI corridors could significantly expand their role in world trade.

The Middle East, thanks to its geographical location between Europe, Africa and Asia, is ideally placed to capitalise on the BRI. The United Arab Emirates (UAE) is already China’s second-largest trading partner and plays a key role as a hub for Chinese products, with bilateral trade worth USD60 billion last year. The country’s ports receive many goods that are re-exported to Africa and Europe, and BRI is providing opportunities to expand this trade.

In June 2018, China’s president Xi Jinping visited the UAE to sign various deals covering infrastructure and oil. The UAE is already the Middle East’s largest container handler, and together with China is helping to build and operate a new terminal and a manufacturing zone at Khalifa Port, the Emirates will be primed to further develop its hub status.

China will not only use BRI infrastructure to export goods but also to streamline its access to commodities. Chinese companies have recently acquired a 12 per cent stake in Abu Dhabi’s onshore oil concession and a 10 per cent stake in two offshore concessions.

For oil producers, BRI will not only reduce export costs, but will also improve access to vital imports and technology. Dubai port operator DP World facilitated the first direct freight train from Britain to China in April 2018, offering a route that is faster than sea cargo and cheaper than air. Such links are particularly useful for time-sensitive goods including fashion and components for high-tech products. The UAE has already begun capitalising on its status as a BRI hub. In early 2018 it signed partnership agreements with Kazakhstan, which has its own blossoming trade gateway under the BRI.

As BRI infrastructure projects are completed, the flow of materials is increasing, and the pattern of the global commodities trade is changing. Economic development associated with the new infrastructure will trigger increased demand for energy and copper. According to BHP Billiton, the world’s largest miner, BRI will increase annual global demand for steel by around 150 million tonnes.

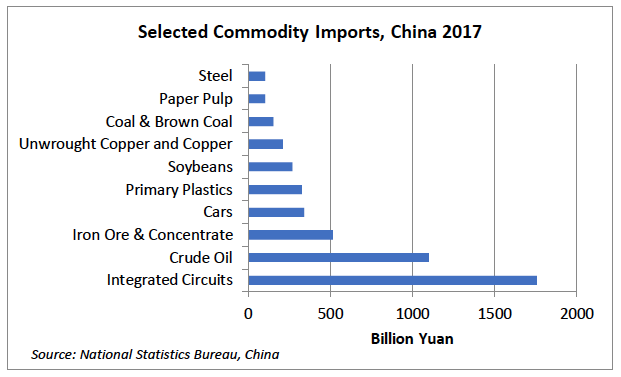

The Chinese government is expanding and opening up its commodities markets, thereby increasing the country’s role in global trade. As the world’s second-largest oil consumer and biggest importer, China is already influential in setting the pricing benchmark for crude and can be expected to increase that influence in the global pricing of various other commodities.

With BRI enabling the physical delivery of more commodities to China at a faster pace and lower cost, the expansion of Chinese commodity markets should accelerate. Plastics and soybeans are among the new contracts expected to feature on Chinese futures markets, while a decline in trade volumes might be expected at competing exchanges such as the London Metal Exchange and Singapore’s SGX.

Within the next year, China is expected to start allowing more international participation in its commodity futures trading. Access to trade in more commodities could generate rewards for those equipped to do business in China, particularly the growing crude oil market. The Chinese government has indicated it will grant a three-year income tax waiver to foreign investors trading in Chinese crude oil futures. This is likely to attract international traders and refiners and independent investors.

For many Chinese companies, BRI is the state-sponsored version of a strategy that has served as a successful business model over the past two decades. By founding production bases and extending supply and distribution lines across the world, businesses are able to increase their options and potentially minimise the risks associated with periodic policy changes, resource shortages or natural disasters.

In June 2018, Jing Qian, vice president of the world’s biggest producer of solar panels, Jinko Solar, told a Bloomberg conference in Shanghai that, like many Chinese firms, her company used global sales, marketing and manufacturing to scatter risk by deploying a supply chain around the world. Ms Qian said this strategy would help to minimise the disturbance caused by the US-China trade war.

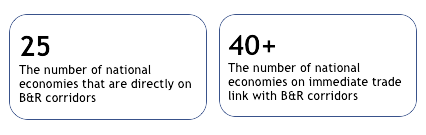

The BRI should help many other companies adopt similar strategies, not only in China. New supply chains and trading opportunities can shelter consumers from protectionism and cyclical challenges. In South-east Asia for example, landlocked Laos has large bauxite deposits and flourishing coffee plantations but has arguably long been hampered by a lack of affordable export routes. The railway being built from China’s Yunnan province to the Lao capital of Vientiane will not only connect Laos to the Chinese market and other countries along the six BRI corridors, but also to economies with immediate trade links to these corridors (see table), boosting trade options and increasing consumer choice.

Source: United Nations Economic and Social Commission for Asia and the Pacific

A similar scenario can be expected across BRI zones. Countries directly on the corridors will see immediate benefits from investment in infrastructure. However, the advantage of being able to move commodities more efficiently will be available to every nation with a link to the BRI network.