The Mid-Corporate Journey to Resilient Growth

On New Year’s Eve 2019, global GDP growth stood at 2.9 per cent after almost a decade of positive growth, however there were signals, following events such as environmental disasters, financial crises, social and trade tensions, that this trend would soon be disrupted.¹ Historically, the attitude following disruptive events (such as the global financial crisis) has been focused on ‘recover to be able to continue as before’. The corporate world was, by and large, geared towards growth and profitability in normal times and managing costs in challenging periods. Resilience measures have often been deprioritised, being perceived as costly, time consuming and an impediment to growth. However, as the COVID-19 pandemic spread and held the world in its grip, it became more apparent that disruption has already become a part of our lives.

Mid-corporates, due to their size or role in the value chain, are especially vulnerable to disruption. In a survey* conducted with 205 mid-corporates, over 60 per cent of C-level executives indicated that the current COVID-19 crisis impacted their business by causing a 20-50 per cent reduction in monthly revenues, with majority of respondents foreseeing it will take 6-12 months to recover from this disruptive impact. Therefore, whilst building resilience may initially lower their levels of profitability, it will ultimately better prepare them for a new post-COVID-19 world and enable them to successfully weather future storms. Whereas this world is expected to be shaped by disruption, it will also be an opportunity for new profitable growth through innovation and transformation.

There is growing consensus that recovery from the COVID-19 crisis will not bring the world economy back to where it was at the end of 2019, due to lingering economic and employment uncertainties driving apprehensive consumers to prioritise saving over consumption. To survive and flourish, mid-corporates will need to strengthen and develop new, differentiated capabilities and resulting propositions; all through the lens of resilience and growth.

Resilience, defined as the ability to limit the impact of disruption and recover quickly, will need to be built into their business models to allow flexibility for accommodating and weathering future disruptions in their pursuit of profitable growth. Our survey indicated that over 70 per cent of mid-corporate executives selected ‘making their operations more agile and flexible’ as most relevant to their company’s growth priorities at present compared to before the start of the COVID-19 crisis.

Instead of viewing resilience as a cost, as it has been traditionally perceived, companies (especially mid-corporates) now need to fundamentally shift their mind-set and focus on building resilience upfront, considering it an investment that will deliver sustainable growth and profitability in the longer term. However, building resilience must be considered as a journey.

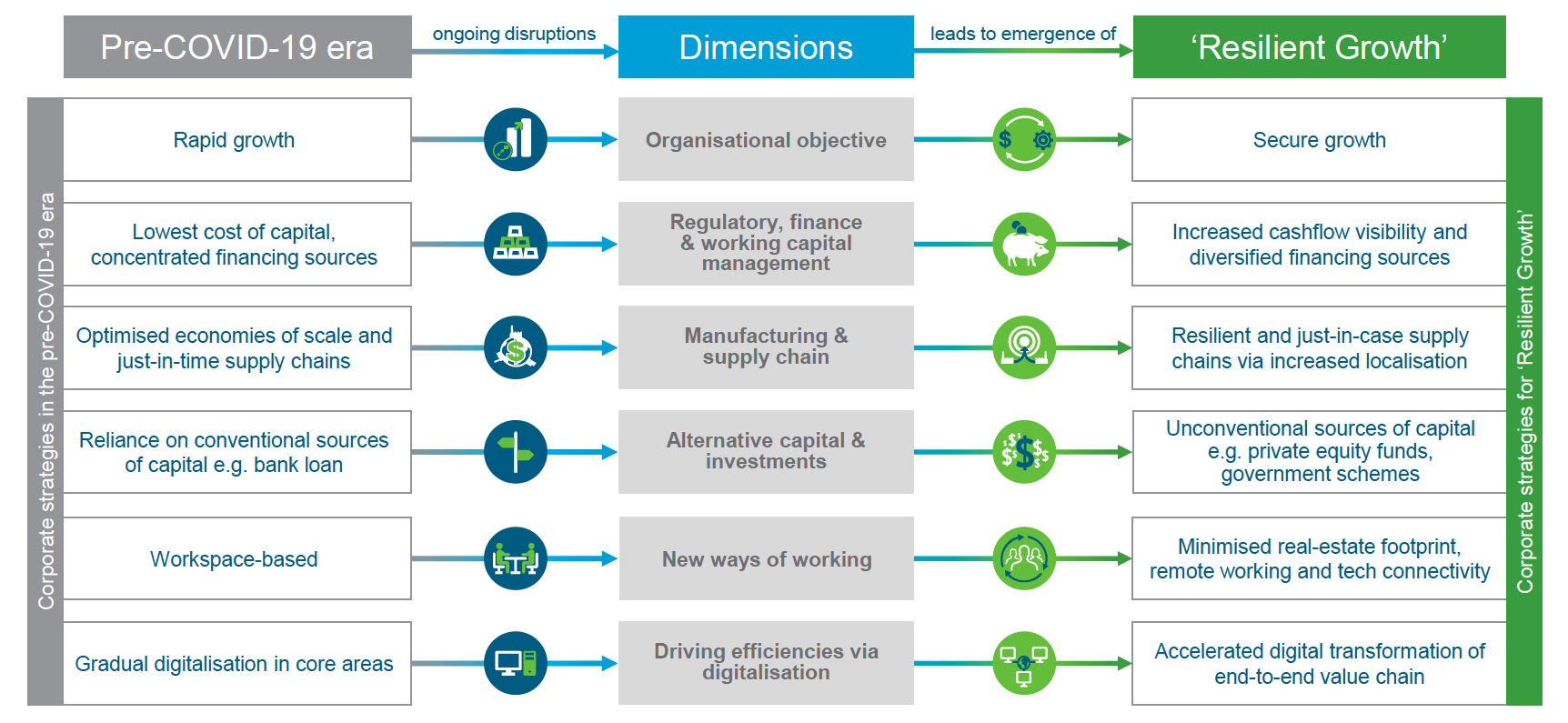

Figure 1: Major shifts in a new world

As mid-corporates emerge from the lockdown restrictions, they must be cognisant that their recovery from this crisis will be a long-term journey, involving a series of defined stages (see Figure 2) which will enable mid-corporates to achieve resilient growth. This is akin to running a marathon with distinct milestones along ‘the road to Resilient Growth’, where companies move towards resilience through the adoption of capabilities that will minimise the impact of future disruptions and yet still facilitate profitable growth.

Figure 2: The road to resilient growth

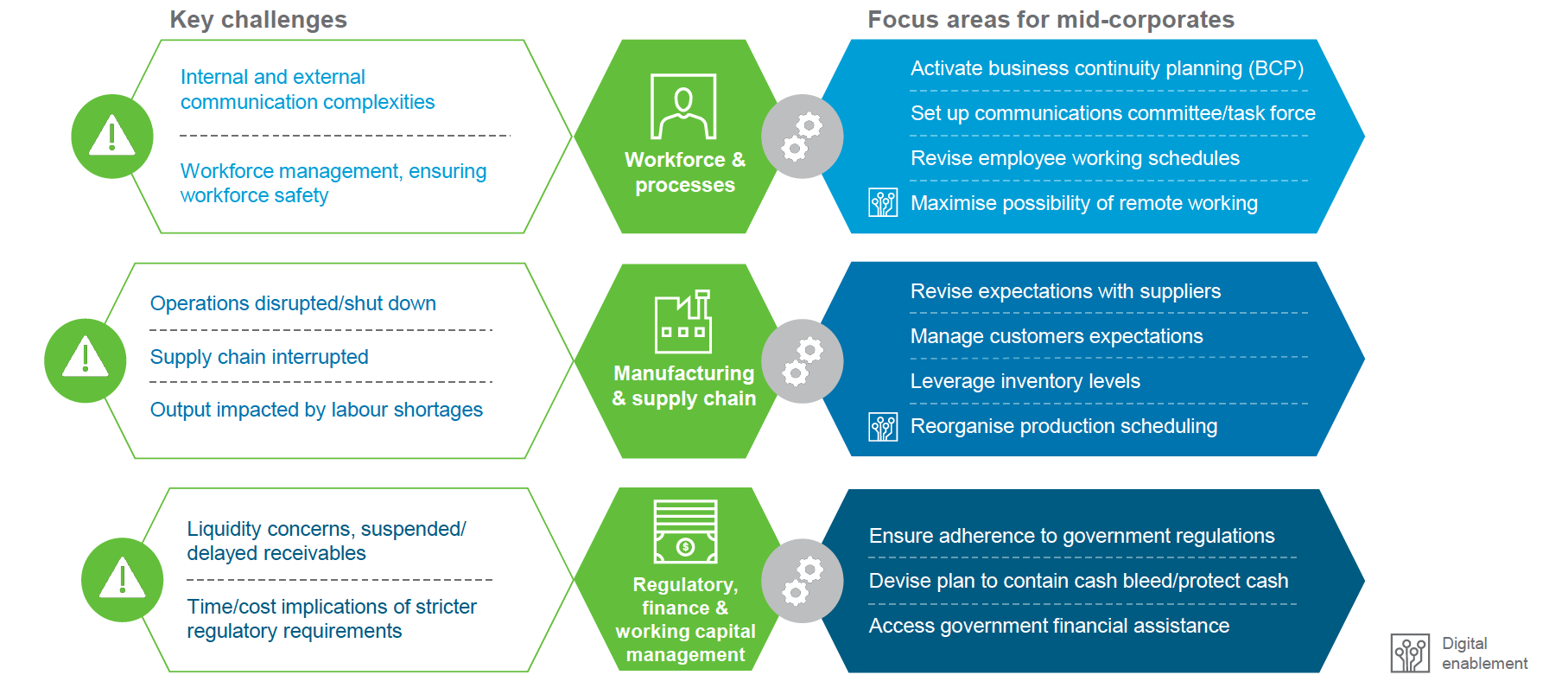

As the COVID-19 pandemic spread across the world, governments imposed urgent restrictive measures (Immediate Response Stage) requiring companies to immediately adhere to new regulations. Delayed or suspended receivables have led to significant liquidity issues, compelling mid-corporates to focus on transactional short-term measures to protect their cashflows, such as reorganising production schedules, rebalancing resources (labour and materials) and managing employees’ and customers’ expectations through clear and regular communications. With the exception of digital tools for remote working, few of these new resilience measures have been embraced at this stage.

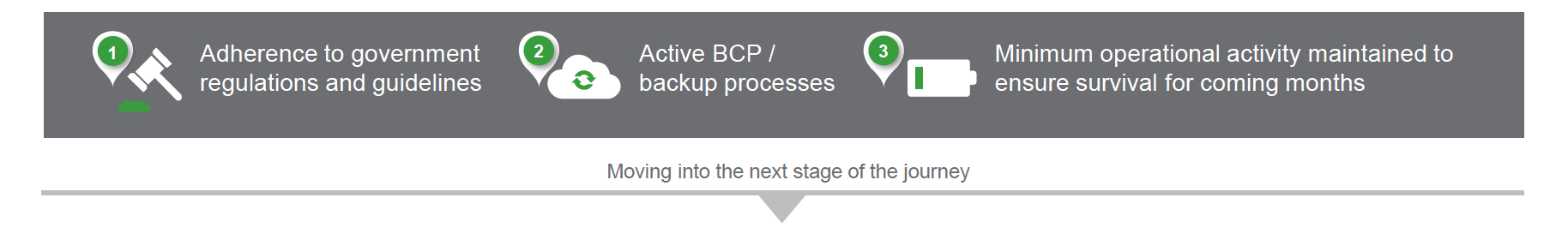

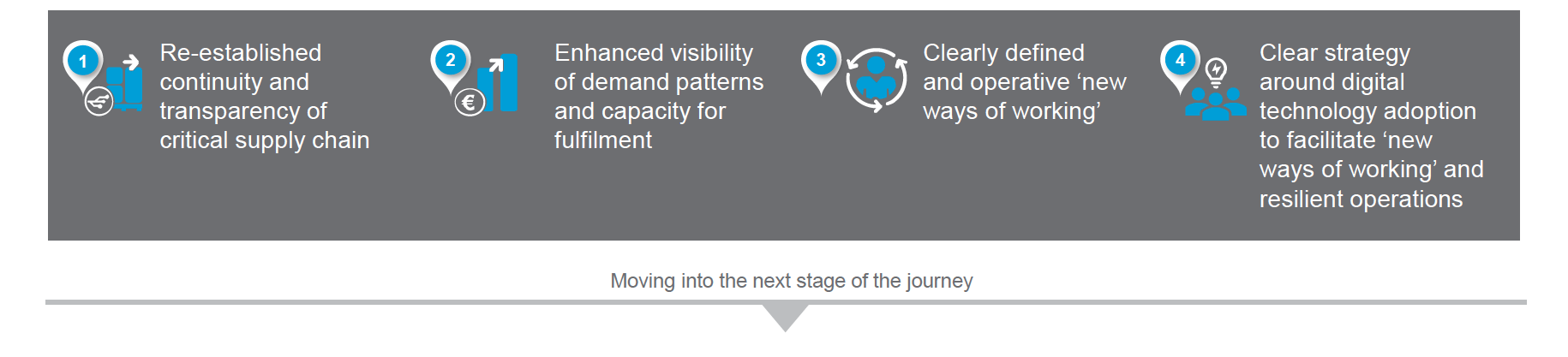

It is critical for mid-corporates to successfully meet certain ‘exit criteria’ upon completion of each stage in order to be adequately prepared for the next stage of the ‘Road to Resilient Growth’. Before governments start easing restrictive measures, mid-corporates must ensure they have fulfilled the following criteria:

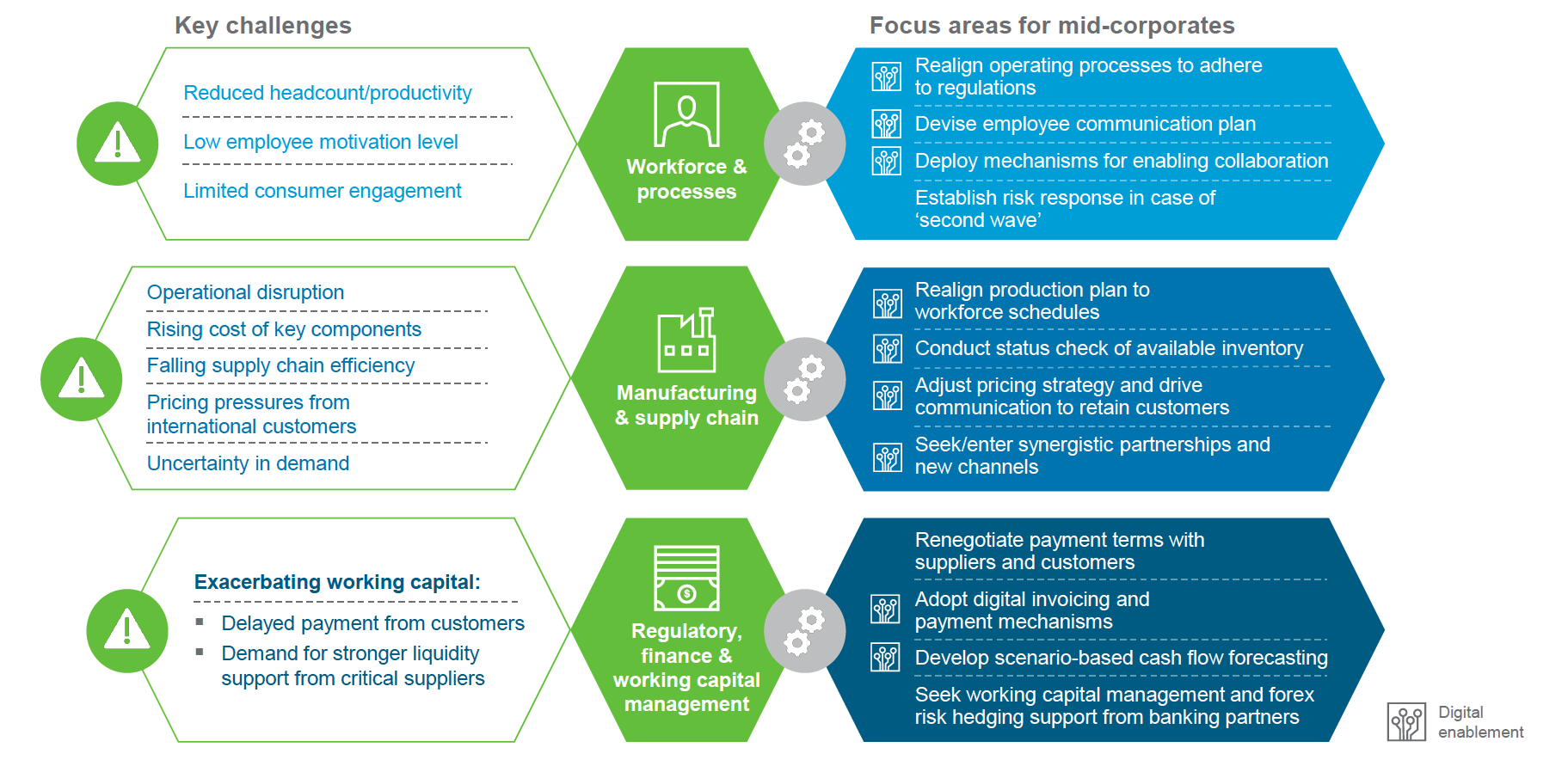

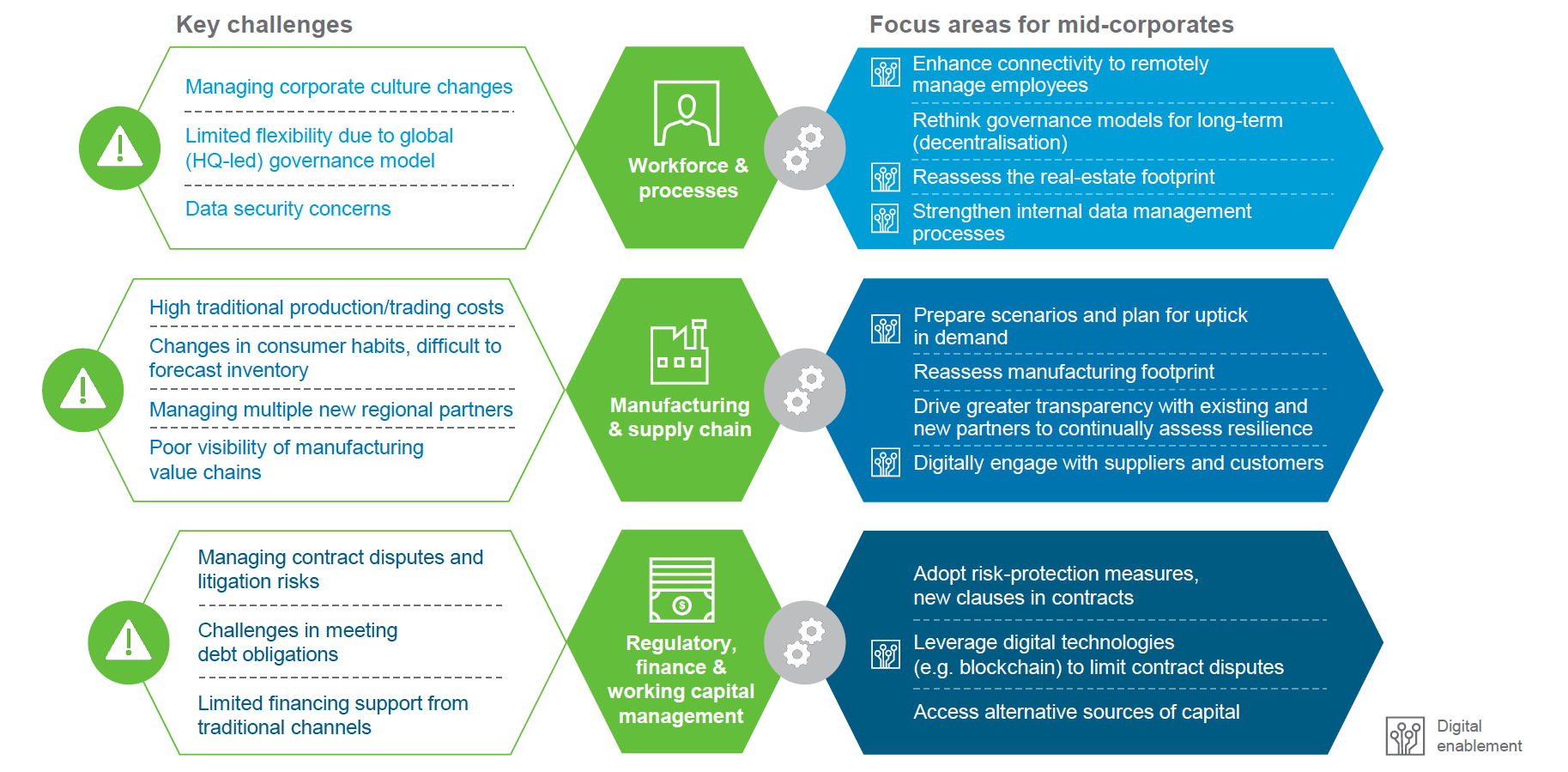

With the lifting of lockdown measures, many companies would now be exiting the Immediate Response stage, having adhered to government regulations throughout the lockdown period, and are now backing up their active business continuity planning (BCP) processes and focusing on preserving their businesses whilst establishing a measure of stability in the near term. In this Preservation and Stability stage, mid-corporates will aspire to reinstate critical operational activities and reframe processes to ensure business continuity and viability, whilst continuing to adhere to regulations (e.g. safe distancing measures). Some of the key critical success factors for Stage 2 include:

This stage is typically considered to be successfully completed when the following criteria have been met:

Whilst seemingly far off, stability and growth will return, with the pace being different for each business, industry and economy. Following a broader reopening of economies, companies can expect to progress towards operating at full capacity, with planning done on a longer term (monthly/yearly) basis. There needs to be a strong and sustained focus on resilience in order to drive sustainable and profitable growth in the longer term. Some of the key critical success factors for Stage 3 include:

Mid-corporates will be ready for the new world once they have a well-defined resilient growth strategy incorporating:

Companies across the world are now emerging from the lockdown and moving into the second stage of the journey – preserving operations and re-establishing stability. Mid-corporates that have successfully minimised pressures on revenue to increase their cashflows, and reorganised their operations to reflect current capacity, will be best placed to build greater resilience which will be essential in their journey towards ‘Resilient Growth’.

Future topics of the Road to Resilience Series will include action-oriented insights on Regulatory, Finance and Working Capital Management, Alternative Capital and Investments, Manufacturing and Supply Chain, New Ways of Working, and Driving Efficiencies via Digitalisation.

Watch now

[iframe title=”Video” width=”800″ height=”450″ scrolling=”no” marginheight=”0″ marginwidth=”0″ src=”https://www.youtube.com/embed/I9MowjQLe7A?showinfo=0&rel=0″]

¹ Survey commissioned by Standard Chartered in June 2020 and conducted with 205 mid-corporates (annual revenue USD100m-500m) based in Mainland China, Hong Kong, Singapore, Malaysia and India

² Standard Chartered Global Research, ‘COVID-19 – Impact on global supply chains’, May 2020. Read a summary article on supply chain resilience for more information.

*International Monetary Fund, World Economic Outlook, April 2020

This material has been prepared by PricewaterhouseCoopers Consulting (Singapore) Pte Ltd. (“PwC”) at the request of Standard Chartered PLC and its affiliates (“SC Group”) in accordance with the agreement between PwC and SC Group. Other than to SC Group, PwC will not assume any duty of care to any third party for any consequence of acting or refraining to act, in reliance on the information contained in this report or for any decision based on it. PwC accepts no responsibility or liability for any use of this report by any third party, including any partial reproduction or extraction of this content.

It is not independent research material. This material has been produced for information and discussion purposes only and does not constitute advice or an invitation or recommendation to enter into any transaction or to subscribe for or purchase any products or services and should therefore not be relied upon as such. It is not directed at Retail Clients in the European Economic Area as defined by Directive 2004/39/EC, neither has it been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The information herein may not be applicable or suitable to the specific investment objectives, financial situation or particular needs of recipients and should not be used in substitution for the exercise of independent judgment.

Some of the information appearing herein may have been obtained from public sources and while PwC and SC Group believe such information to be reliable, it has not been independently verified by PwC or SC Group. Information contained herein is subject to change without notice. Neither PwC nor SC Group is under any obligation to update or revise the information contained herein. Any opinions or views of PwC or SC Group or any other third parties expressed in this material are those of the parties identified. PwC and SC Group do not provide financial, accounting, legal, regulatory or tax advice. This material does not provide any investment or tax advice. Please note that (i) any discussion of U.S. tax matters contained in this material (including any attachments) cannot be used by you for the purpose of avoiding tax penalties; (ii) this communication was written to support the promotion or marketing of the matters addressed herein; and (iii) you should seek advice based on your particular circumstances from an independent tax advisor.

While all reasonable care has been taken in preparing this material, PwC, SC Group and each of their affiliates make no representation or warranty as to its accuracy or completeness, and no responsibility or liability is accepted for any errors of fact, omission or for any opinion expressed herein. You are advised to exercise your own independent judgment (with the advice of your professional advisers as necessary) with respect to the risks and consequences of any matter contained herein. PwC, SC Group and each of their affiliates expressly disclaim any liability and responsibility for any damage or losses (including, without limitation, any indirect or consequential losses or damages) you may suffer from your use of or reliance on this material or as a result of any information being incorrect or omitted from this material.

Any financial projections or models included in this material are based on numerous assumptions regarding the present and future business strategy of the entities to which such projections or models relate and the environment in which such entities may operate in the future. These future events are not a guarantee of future performance and are subject to certain risks, uncertainties and assumptions.

SC Group or its affiliates may not have the necessary licenses to provide services or offer products in all countries or such provision of services or offering of products may be subject to the regulatory requirements of each jurisdiction. This material is not for distribution to any person to which, or any jurisdiction in which, its distribution would be prohibited.

The SC Group may be involved in transactions and services with clients or other persons who are, or may be, involved in the transactions that are referred to in this material or who may have conflicting interests with you or any other person. The SC Group’s ability to enter into any transaction (or to provide any person with any services) will be subject to, among other things, internal approvals and conflicts clearance.

The distribution of this material in certain jurisdictions may be restricted by law and therefore persons who receive this document or any Information should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of any such jurisdiction. No liability to any person is accepted by SC Group or PwC in relation to the distribution of this document or the Information in such jurisdictions.

The distribution of this material in any other country locations may require suitable disclosures to be made by the SC Group. Should you receive this material in such other country location, please contact the relevant SC Group member.

Copyright in this document and all materials, text, articles and information contained herein is the property of SC Group or its licensors (save for any copyright in materials created by any identified third parties which remain vested with the respective third party), and may not be copied, distributed, adapted, translated or otherwise used (in whole or in part) without the prior written consent of SC Group.

Copyright © 2020. SC Group. All rights reserved.