Mobilising retail investor capital for climate action

Climate change continues to dominate the global agenda, but are we taking enough action?

Faced with rising global temperatures and increasingly frequent extreme weather, climate adaptation and mitigation will continue to have urgent focus.

Financing our collective response is a critical challenge: overall climate mitigation and adaptation face an annual funding gap of trillions of dollars. Institutional capital is often the focus when mobilising funds to bridge this gap – the scale and power of retail investor capital is a lesser-known opportunity.

Our survey of 1,800 retail investors in 10 growth markets across Asia, Africa and the Middle East reveals that USD3.4 trillion of capital could flow into climate investments. This means there is an opportunity to facilitate investor access to more opportunities matched to their interests, provide more transparent and standardised measurement of their investment impact and clearer information about any risk and return trade-offs in sustainable investing.

An overwhelming majority of investors expressed interest in climate investing – renewables, energy storage and efficiency, resilient infrastructure and biodiversity are among the high-priority themes on their agenda.

We need to ensure wealth management product offerings cover these emerging themes, as investor interests evolve.

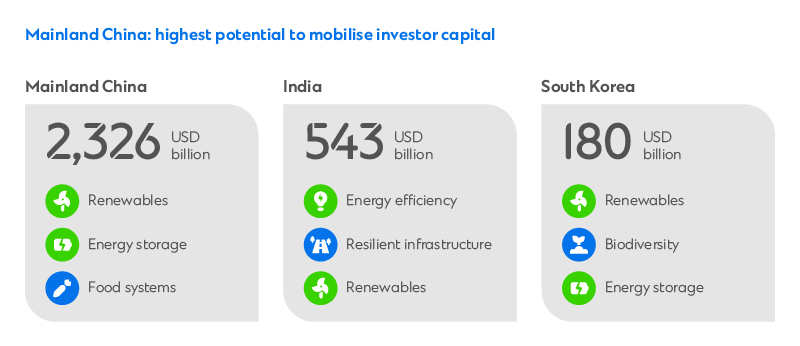

Our deep dive into markets revealed the potential for retail capital mobilisation is highest in Mainland China at USD2.33 trillion, followed by India at USD543 billion and South Korea at USD180 billion. In Mainland China, the top theme of interest was renewables, while energy efficiency received the most attention from investors in India.

However, there is a critical disconnect between interest and action: almost all investors say they are interested in climate investing but only around 20 per cent are willing to allocate significant funds into it.

Overcoming this continued challenge – which our research reveals annually – requires collective action from the industry including banks, asset managers, regulators and policymakers. High on the agenda is the need to improve and harmonise reporting standards.

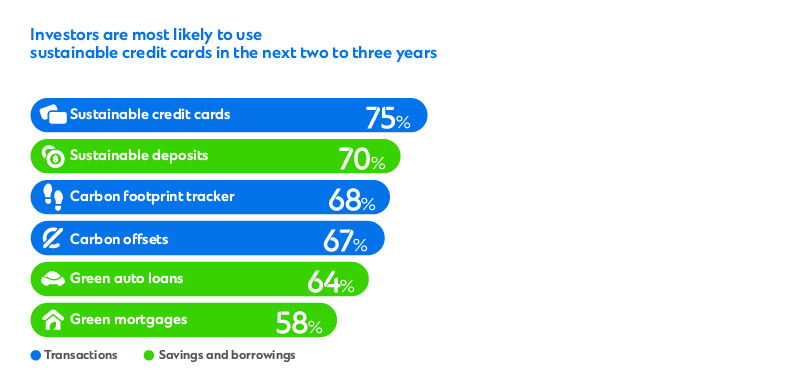

Encouragingly, individuals are not just looking at sustainable investing, but also in making their entire interaction with the financial system more sustainable. They indicated high interest in sustainable banking products such as green mortgages, deposits and credit cards.

At Standard Chartered, we look forward to working with our clients to match their investments to their themes of interest, so they can help finance solutions for a more sustainable future.

We hope the industry can benefit from our research insights, as climate investing progresses into a more mainstream asset class.