Partners in Singapore unite on cleaner shipping

The shipping industry drives global trade and has long helped to accelerate the growth of maritime hubs like Singapore. The Lion City is the busiest container transhipment port globally and is consistently ranked as the world’s leading port, and top maritime centre, by the Xinhua-Baltic indexi.

Yet, while shipping continues to be vital to economies worldwide, there is an urgent need for the sector to reduce its carbon footprint. Shipping accounts for close to three percent of global carbon dioxide (CO2) emissions each year. If the industry was a country, it would be the world’s sixth biggest CO2 emitterii. Recent estimates note that shipping uses about 300 million tonnes of oil to produce 12.6 exajoules of energy, releasing more than one gigatonne of greenhouse gas emissions.iii

While the International Maritime Organization (IMO) has a deadline of 2050 to reduce the sector’s CO2 emissions by 50 percent from 2008 levelsiv, the stark reality is that the industry lacks a clear plan on how to achieve thisv. Consensus on the best zero-carbon fuel source for large cargo vessels remains elusive, with hydrogen, methanol, ammonia and electrification all being considered as possible alternatives. In the meantime, liquified natural gas (LNG) is a commercially available fuel that is now well-established within key shipping markets, including Singapore, as an important stepping-stone for an industry with a significant emissions challenge.

Seaborne trade accounts for 80 percent of global tradevi. Shipping, by its nature, is a highly fragmented industry: it is estimated that the top ten shipping companies contribute less than 20 percent of total capacity globally. Likewise, given that vessels depend on their host nations for fuel supply, they are subject to the energy policies of individual markets.

Standard Chartered has played an integral role in our decarbonisation journey and shares the same drive and commitment as Hafnia-CSSC partnership in creating a more sustainable industry.

As the maritime industry seeks to wrestle with this emissions challenge, more shipowners, lessors and operators are opting for LNG dual-fuel vessels over traditional bunker fuel ships. Dual-fuel engines are unique because they can operate on either conventional fuels, or methanol or gas fuels, a flexible option that is more environmentally friendly than alternatives.

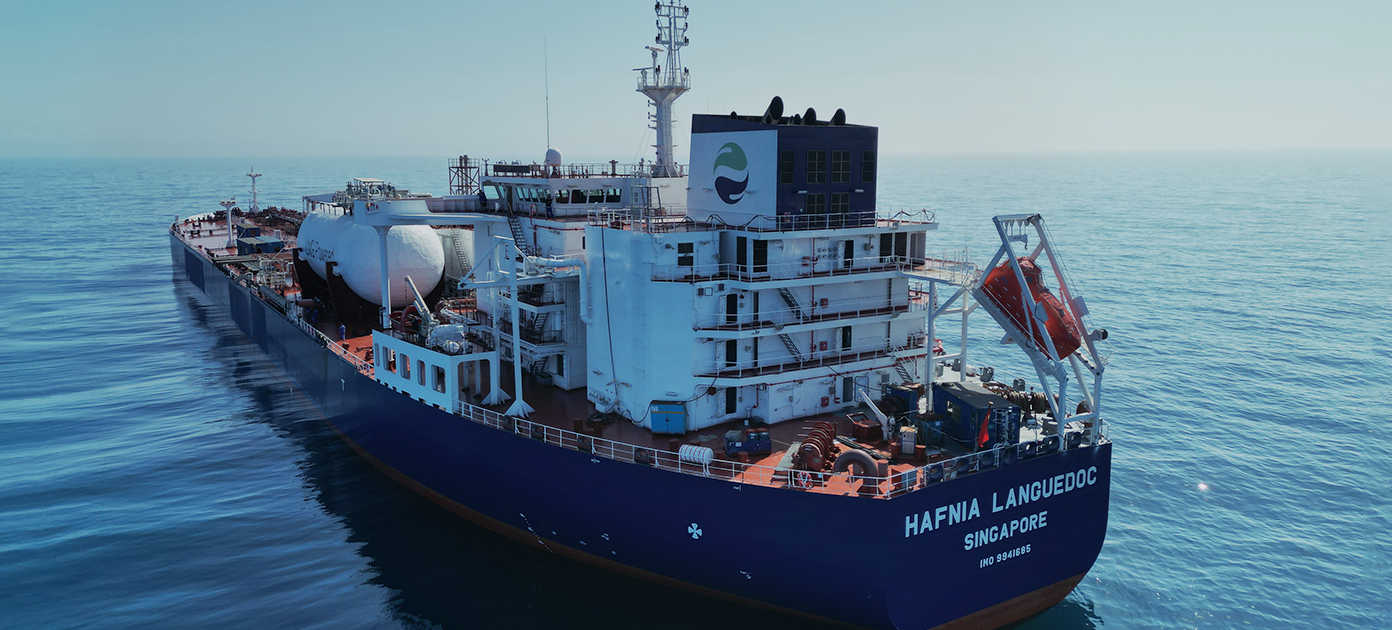

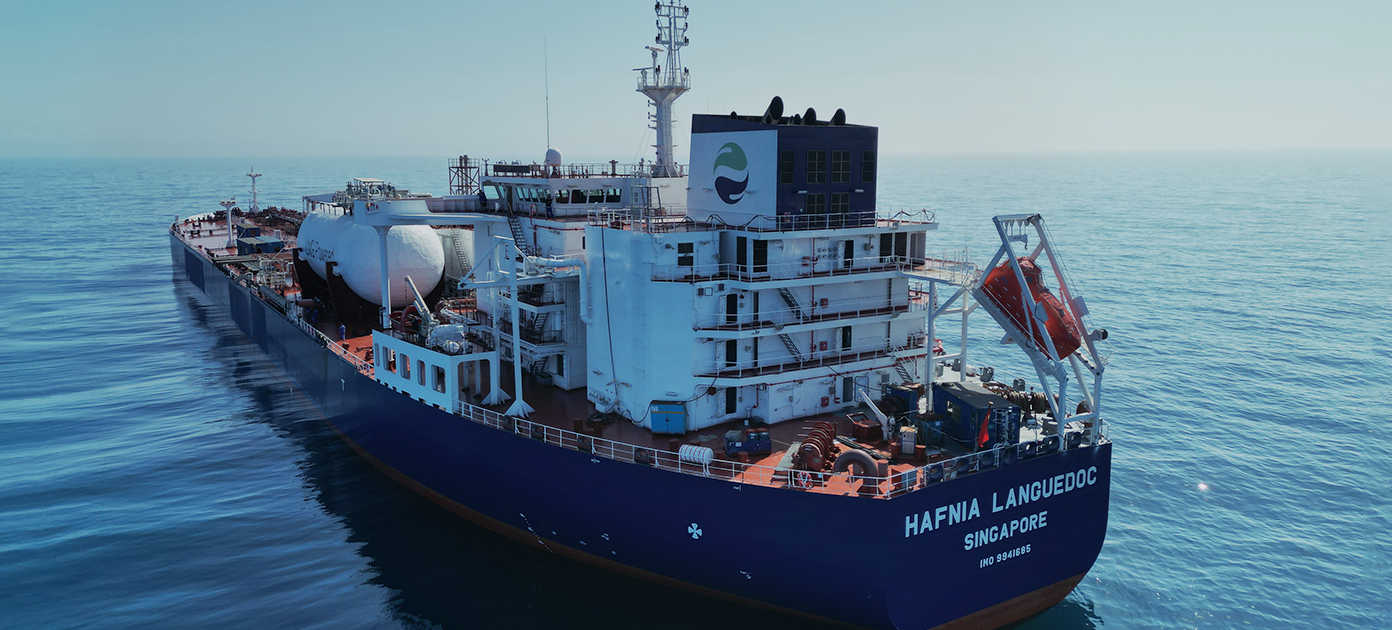

In support of this, Vista, a joint venture (JV) between Hafnia and CSSC Shipping Hong Kong (CSSCHK), recently ordered its first pair of LNG-dual fuelled vessels with delivery expected in 2023. To finance the vessels, Standard Chartered was appointed to lead a USD89.6 million sustainability-linked term loan facility.

Spread over a ten-year period, the funds will be used to finance two LNG dual-fuelled LR2 product tankers, due for delivery later this year from Chinese shipbuilder Guangzhou Shipyard International. The vessels are the first pair of LNG dual-fuelled vessels in the Vista fleet, which will be chartered to CSSA Chartering & Shipping Services, the shipping arm of Total SEvii, for a seven-year period.

Standard Chartered played a lead role as facility coordinator, sole sustainability coordinator, mandated lead arranger, and facility and security agent. This latest arrangement represents the continuation of a close relationship with the two JV partners, dating back to 2014.

This landmark deal is the first sustainability-linked shipping financing that Standard Chartered Bank Singapore has structured. As a potential game-changer for shipping, it is seen as the first in what is expected to be a series of similar financial arrangements in the Lion City.

“This facility allows both companies in the JV to transition their shipping businesses to alternative fuels, a process with clear appeal for investors with energy transition agendas,” says Freddy Ong, Head, Client Coverage, Singapore, Corporate, Commercial and Institutional Banking, Standard Chartered. “As Hafnia continues to transition its fleet to LNG dual-fuelled vessels, we are hopeful that similar deals will be executed in the near future.”

The sustainability-linked loan is tied to two key performance indicators (KPIs). First, targets are set to the annual efficiency ratio of the vessels, measured by the amount of CO2 emissions per one tonne of cargo over one nautical mile (gCO2/t-nm), a widely-used metric in shipping. The second KPI is sulphur oxide emissions intensity, measured using the amount of sulphur found in the fuel received by each vessel, as per IMO standards, and audited by the Recognised Organisations (RO) code.

We’ve been partnering Standard Chartered since CSSCHK was established in 2015. The bank has been our first choice from the start, and we look forward to greater cooperation together in the near future.

According to Li Jun, Chief Financial Officer at CSSC (Hong Kong) Shipping Company Limited, the ship leasing space is now more challenging than ever, with new players in the market further heightening the level of competition. “The shortage of berths in the shipyard and the high cost of ships have increased the pressure and risks for companies to vigorously expand their shipbuilding businesses.”

With JVs like Vista, and through partnering operators such as Hafnia, CSSC had helped the industry take a positive step forward. “Through this cooperation, we can make greater use of our respective advantages in financing, ship management, and transportation,” she adds.

Perry van Echtelt, Chief Financial Officer for Hafnia notes that financing in the shipping industry today is more regulated, given the heightened focus on ESG and an increasingly complex geopolitical landscape. “For shipping companies to successfully gain access to funding, it is necessary to be transparent on reported decarbonisation efforts,” he notes.

These demands call for close and transparent partnerships. “Lending partners need to have a strong knowledge of our market, given the fact that shipping operates in a volatile environment. It is therefore important that there is a strong understanding on returns, capital structure, and balance sheet management in the long run,” van Echtelt adds.

Standard Chartered is committed to deliver meaningful impact in our footprint markets of Asia, Africa and the Middle East. This means seeking to support sustainable economic growth, expanding renewables financing, and investing in sustainable infrastructureviii. This aligns with Vista’s commitments towards sustainability via its decarbonisation strategies. These include compliance with the IMO’s decarbonisation targets, vessel optimisation initiatives, and low-emission vessels.

“We feel Standard Chartered and the Hafnia-CSSC partnership share the same drive and commitment in creating a more sustainable industry,” van Echtelt enthuses. “The bank has played a very integral role in our decarbonisation journey, and we have been able to work together to develop well formulated emissions related KPIs for this loan facility, which are both ambitious and aligned with the IMOs decarbonisation targets.”

According to Li, CSSCHK and Standard Chartered are already “old friends” who understand each other very well. The bank issued CSSCHK a USD96 million sustainable development shipping finance loan in 2021. “Standard Chartered was the company’s first choice for this loan, and we hope to have more cooperation with the bank in the future.”

The deal’s financier is equally as excited about its impact, as well as the industry’s future trajectory. “Decarbonisation is taking centre stage on the business agenda of our maritime clients” says Abhishek Pandey, Global Head of Shipping Finance for Standard Chartered. “By helping finance their carbon reduction strategies, Standard Chartered has a critical role to play in enabling Hafnia and CSSC on their transition journey.”

i https://standard-chartered-ca.altis.dev/en/feature/future-growth-maritime-singapore/

iv https://www.imo.org/en/MediaCentre/HotTopics/Pages/Reducing-greenhouse-gas-emissions-from-ships.aspx

vi https://www.hellenicshippingnews.com/shipping-fragmentation-importance-deprioritise-decarbonisation/

vii https://totalenergies.com/media/news/news/total-becomes-european-company

viii https://standard-chartered-ca.altis.dev/uk/sustainability/