Q&A: ASEAN’s digital payments ecosystem

It is never easy to make predictions, especially given the current pace of change in technology and innovation. But one thing is certain, business models will continue to evolve. Corporates will strive for greater operational and financial efficiency as they enhance their ability to get in front of consumers’ needs and expectations.

The world of digital payments in the next five or 10 years will achieve the next generation of borderless. It could even go beyond contactless transactions and we could just think payments into existence. A thought process could generate a payment. How do we get from here to there? Ankur Kanwar, Head of Cash Products, Singapore and ASEAN, Standard Chartered Bank shares his prognosis on the future of ASEAN’s digital payments.

Q1. In a perfect world, how will a regional digital payment ecosystem look like in ASEAN?

This perfect world would be completely borderless, where regional digital payments are instant and happen at the click of a button or even self-generated, supported by rich data analytics. This regional digital payment ecosystem would also be connected to the rest of the world and carry out transactions in a similar way.

Powered by API, real-time information exchange and real-time payments infrastructure combined with ISO 20022 which creates a common language and model for payments data across markets, can make digital payments a reality for everyone.

Scenario 1: A corporate authorises a payment through its Enterprise Resource Planning (ERP) system. The payment details are instantaneously sent to its banking partner through real-time connectivity with information on each transaction without relying on clunky batch payment files. Next the banking partner would instantly release funds to the beneficiary bank with rich Management Information Systems (MIS). All of these done within seconds and completely digital.

Scenario 2: A company distributes its products through a distributor-retailer model. As soon as goods fall below a certain threshold with any specific distributor, an auto-trigger to re-order the products is sent to the company. Immediately after the goods are shipped to the distributor, a request-to-pay instruction based on the credit terms is sent to the collecting bank which would auto-debit the distributor’s account on the payment due date. From auto-ordering goods to invoice settlement, the process is fully automated, powered by digital payments and real-time connectivity.

Scenario 3: A consumer with a Singapore bank account shops in Thailand. The consumer pays for his purchase by scanning a QR code at the storefront. Funds in SGD from the Singapore bank account are immediately debited and credited into the Thai merchant’s banking account in THB. Instant, safe and transparent.

Q2. Why would this be a game changer for corporates and consumers in ASEAN?

When achieved, corporates and consumers in ASEAN can look forward to seamless and cashless cross-border payments in their local currencies.

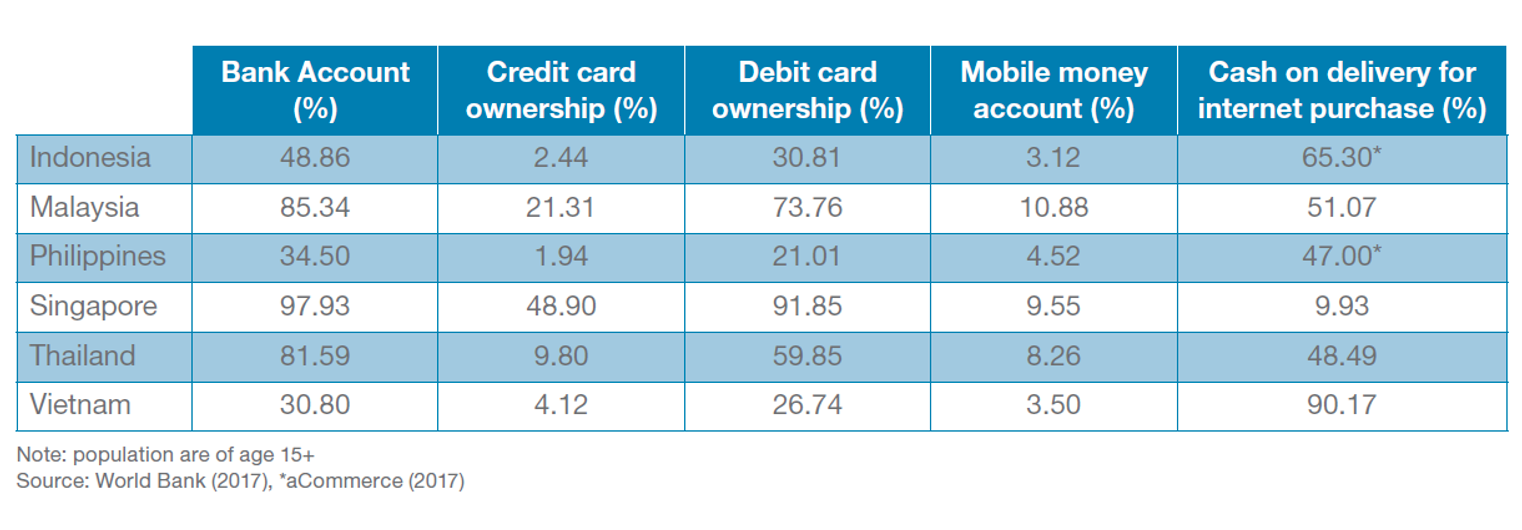

Traditionally, the region has relied heavily on cheques and cash, with payments across the ASEAN markets fraught with inefficiencies and restrictions. For instance, cash on delivery for online purchases is still the most popular mode of settlement in some of the ASEAN markets (see table below).

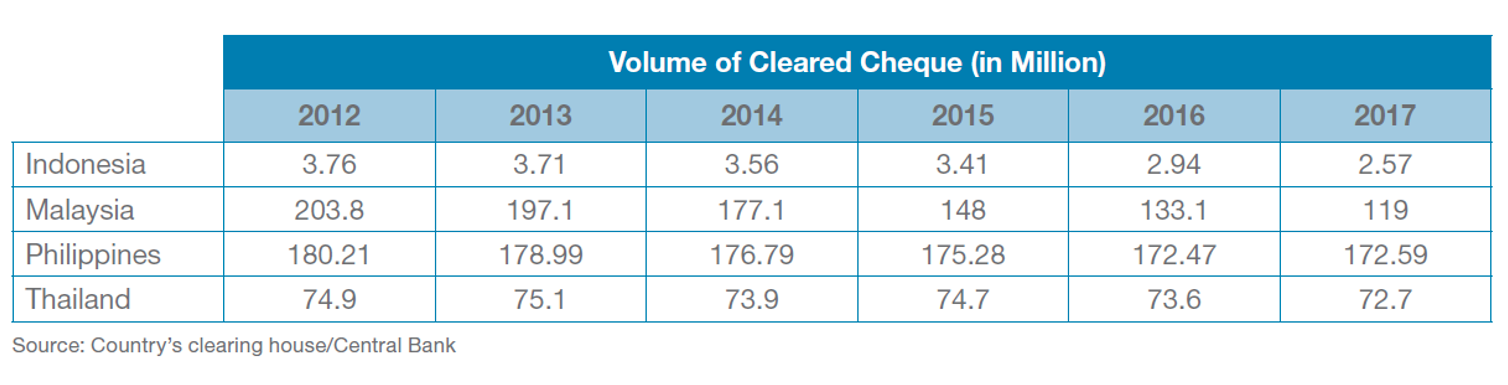

The volume of cheques issued in many ASEAN markets has also remained in similar levels in recent years (see table below). Payments have been subjected to FX fluctuations, varying regulatory restrictions on currency conversion and transfers, and different clearing cut-off times in the various markets. There is also a lack of a clearing mechanism similar to that of the Single Euro Payments Area (SEPA) in which cross-border transfers are made no different from domestic transfers.

An integrated digital payments ecosystem will enable corporates and consumers to transact anywhere within ASEAN the same way they do in their local market, saving costs and time.

Use cases:

Q3. Where are the gaps? What are some of the roadblocks that need to be cleared?

While markets are launching a variety of digital payments solutions (e.g., Corporate PayNow in Singapore, Indonesia’s Espay, Vietnam’s VN Pay) to get ahead in the cashless race, there remain some challenges that businesses need to overcome. Concerns about hefty set-up costs and tedious implementation processes could deter corporates from adopting digital payments. Businesses have also been slow to embrace the e-payments concept because of their relatively low transaction limits.

These roadblocks are increasingly being removed by regulators, financial institutions, and Fintech players. ASEAN governments and financial institutions continue to work together towards a similar agenda: enhancing the e-payments infrastructure, reducing costs (e.g., waive transaction fees for domestic digital transactions), and engineering a shift towards digital payments (e.g., increase the costs of processing cheques). While there have been bilateral discussions to develop QR payments, a comprehensive multilateral cross-border concerted approach now needs to be in place. International financial institutions and technology firms can also play a bigger role to facilitate instantaneous cross-border digital transactions.

Ultimately, demand will remain a key driver. Businesses need to view implementation costs as an investment to build efficiency and enhance customer service for longer-term growth and profitability. Only if corporates embrace industry changes and adopt new technologies to enhance their business processes and customer experience, will we be able to broaden the adoption of digital payment solutions.

Q4. How can companies, big and small, in ASEAN prepare themselves and maximise benefits from a digital payments transformation?

Keeping abreast of development in digital payments methods is key to swiftly adapt and respond to customers’ ever-changing needs and preferences. The act of balancing seamlessness and security will remain top business priorities.

Leveraging on experience from peers in the industry or from a different country or region can help corporates leapfrog development hurdles. Partnering digital advisory service providers will help these businesses better assess their needs and solutions.

While COVID-19 continues to be a prolonged health and economic threat, the outbreak has highlighted the growing importance of digital transformation for all businesses, big and small. The digital payments trend will only accelerate, so it is always better to be ahead of the game than being a laggard.

Use cases: