Press release

Affordable and clean energy tops list of Sustainable Development Goals supported by wealthy investors

26 March 2019, Singapore – Investors in global financial hubs Hong Kong, Singapore, UAE and the UK are increasingly moving towards sustainable investing, with their funds supporting five key United Nations Sustainable Development Goals (SDGs), according to a new survey by Standard Chartered Private Bank1. Affordable and clean energy tops the list of SDGs receiving funds from high-net-worth (HNW) and affluent investors, followed by Clean water and sanitation. Investors also expect improvements to the measurability of impact from sustainable investing. Standard Chartered Private Bank has launched the Impact Philosophy, offering HNW clients a robust roadmap for using their resources to drive impact, measured in line with the global Impact Reporting and Investment Standards (IRIS).

Driving private capital towards the SDGs

The SDGs currently face an annual funding shortfall of USD2.5tn, according to the United Nations Conference on Trade and Development World Investment Report 2014. Yet with growing awareness of these global challenges, more investors are looking to channel their money to effect positive change. The survey revealed the goals that resonate most with the social conscience of investors are mostly around social and environmental impact, with Affordable and clean energy emerging as the top SDG concern, followed closely by Clean water and sanitation.

Figure 1: Top 5 Sustainable Development Goals of interest

| SDG | Affordable & Clean Energy | Clean Water & Sanitation | Good Health & Well-being | Zero Hunger | Climate Action |

|---|---|---|---|---|---|

| Overall Interest |

37% | 35% | 33% | 30% |

29% |

| Highest Interest |

Hong Kong: | UK: 45% | UAE: 40% | Singapore: 35% |

Hong Kong: |

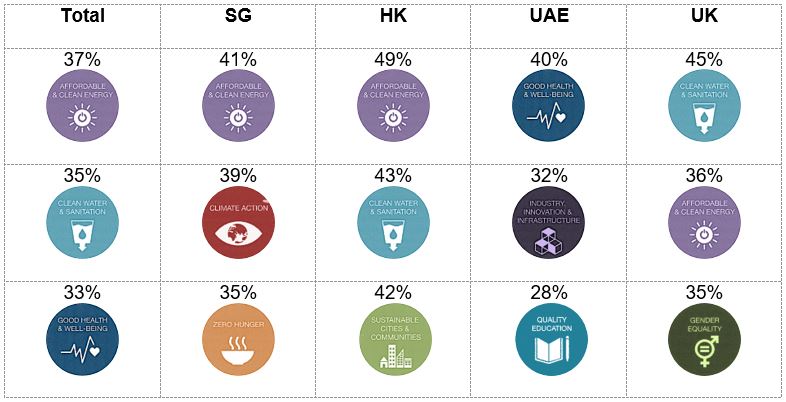

Figure 2: Top Sustainable Development Goals of interest in each market surveyed

| Top SDG | Affordable & Clean Energy | Affordable & Clean Energy | Good Health & Well-being | Clean Water & Sanitation |

|---|---|---|---|---|

| Market | Hong Kong: 49% | Singapore: 41% | UAE: 40% | UK: 45% |

*See Annex for top SDG interests by market

The survey also highlighted the increasing ability of private capital to help bridge the SDG funding gap by mobilising the over USD5.4tn in private investible funds across these markets. Approximately 17% of funds from high net worth individuals (HNWIs) surveyed in Hong Kong, Singapore, UAE and the UK are already allocated to sustainable investments, with as much as 22% for HNWIs with assets under management (AUM) above USD10m.

The power of philanthropy

Currently, 16% of AUM from the HNWIs surveyed is allocated towards philanthropy. While they are looking at increasing their allocations to philanthropy, 84% of these HNW investors are open to shifting their funds from philanthropy to sustainable investing. This points to a potentially significant source of future funds flow to be unlocked, provided investors can be assured that the organisations they support are dedicated to making a social impact and able to show results.

Investors want robust measurement of their impact and highlighted some preferred metrics to track their contribution to the SDGs:

- Affordable and clean energy: Reduction in energy consumption through conservation and efficiency initiatives (44%) ranked the top metric, followed by an increase in the number of households provided access to energy by the organisations they support/invest in (32%)

- Clean water and sanitation: Increase in access to basic services such as water, education and healthcare (52%), increase in volume of waste water treated (32%) and the organisation they support/invest in employing management practices for water quality protection (16%)

- Good health and well-being: Increase in access to basic services such as water, healthcare and housing (54%), followed by an increase in the number of certified and trained caregivers employed (27%)

Looking ahead, investors highlighted the following additional SDGs which could interest them over the next three years:

| SDG | Zero Hunger | Affordable & Clean Energy | No Poverty |

|---|---|---|---|

| Overall future interest | 27% | 24% | 18% |

| Markets that ranked this SDG top 3 | Singapore, UAE, UK | Singapore, Hong Kong | Singapore, Hong Kong |

Didier von Daeniken, Global Head, Private Banking and Wealth Management at Standard Chartered, said: “The financial system has the potential to be a major catalyst in the sustainability revolution. With the risks from major challenges, such as climate change and lack of access to healthcare, becoming ever clearer, our clients are looking to play a more active role as responsible global citizens. Our new Impact Philosophy offers a structured roadmap to help them mobilise their capital towards achieving the Sustainable Development Goals.”

Standard Chartered’s Impact Philosophy

In response to client feedback and growing interest in the measurement of impact outcomes, Standard Chartered Private Bank has launched an Impact Philosophy framework along with a sustainable and impact investing offering to clients.

While there is a growing interest in sustainable investing, many HNWIs are held back by the lack of information on avenues that match their interest and the relatively few established ways to measure the impact of their investments. Bolstered by the Bank’s open architecture approach, clients can access unbiased information and the most relevant solutions to translate their passion into action.

The Impact Philosophy has a strong focus on measurement: it is underpinned by the Theory of Change, which in the context of sustainable investing, aims to map out what a particular investment does and how it leads back to a desired outcome, providing clients a robust roadmap for success and measurement based on the global IRIS. Clients receive an Impact Profile report outlining a range of solutions –from traditional investing portfolios and philanthropic opportunities, to sustainable and impact investing opportunities.

For more information on our Impact Philosophy, please visit our Sustainable Investing page.

1The survey, conducted by Agility, covered 421 affluent and high-net-worth individuals in Hong Kong, Singapore, UAE and the UK, with a minimum of USD1m in investments, who are currently engaged in sustainable investing.

For further information please contact:

Valerie Tay

Private Banking and Wealth Management Communications

Standard Chartered Bank

+65 6596 9284

Note to Editors

Standard Chartered Private Bank

Standard Chartered Private Bank provides private banking services to clients across Asia, Africa, the Middle East and Europe, through onshore booking centres in Singapore, Hong Kong, Dubai, India, London, and Jersey. We also offer global Trust and Fiduciary capabilities through our Singapore centre.

Our aspiration to be the private bank of choice among generations of entrepreneurs is built on Standard Chartered’s inherent strengths: a heritage of some 160 years in international banking, a presence in 60 of the world’s most dynamic markets, and a strong understanding of growth markets. Through our global team of around 1000 employees, our relationship managers, investment advisors and product specialists have a deep understanding of our footprint markets and client needs, enabling them to connect our clients to an extensive range of wealth opportunities across our network.

For more information, please visit: www.sc.com/privatebank

General Disclaimer

Standard Chartered PLC, the ultimate parent company of Standard Chartered Bank, together with its other branches and subsidiaries form the Standard Chartered Group. Standard Chartered Private Bank is the private banking division of Standard Chartered. Private banking activities may be carried out internationally by different legal entities and affiliates within the Standard Chartered Group (each, an “SC Group Entity”) according to local regulatory requirements. Not all products and services are provided by all branches, subsidiaries and affiliates within the Standard Chartered Group. Some of the SC Group Entities only act as representatives of the Standard Chartered Private Bank, and may not be able to offer products and services, or offer advice to clients. They serve as points of contact only.

In Singapore, Standard Chartered Private Bank is the private banking division of Standard Chartered Bank, Singapore branch (Registration No. S16FC0027L) (GST Registration No.: MR-8500053-0).

In Hong Kong, Standard Chartered Private Bank is the private banking division of Standard Chartered Bank (Hong Kong) Limited (“SCBHK”), a subsidiary of Standard Chartered PLC. SCBHK has its registered address at 32/F, Standard Chartered Bank Building, 4-4A Des Voeux Road Central, Hong Kong and is regulated by the Hong Kong Monetary Authority and registered with the Securities and Futures Commission to carry on Type 1 (dealing in securities), Type 4 (advising on securities), Type 6 (advising on corporate finance) and Type 9 (asset management) regulated activity under the Securities and Futures Ordinance (Cap. 571) (CE No. AJI614).

In Jersey, Standard Chartered Private Bank is the Registered Business Name of the Jersey Branch of Standard Chartered Bank. Standard Chartered Bank, Jersey Branch is regulated by the Jersey Financial Services Commission. The principal place of business of the Jersey Branch of Standard Chartered Bank is: 15 Castle Street, St Helier, Jersey JE4 8PT.

Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC 18. The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority. The Jersey Branch of Standard Chartered Bank is also an authorised financial services provider under license number 44946 issued by the Financial Sector Conduct Authority of the Republic of South Africa.

In the United Kingdom, Standard Chartered Bank (trading as Standard Chartered Private Bank) is an authorised financial services provider (licence number 45747) in terms of the South African Financial Advisory and Intermediary Services Act, 2002.

Standard Chartered Bank is incorporated in England with limited liability by Royal Charter 1853 Reference Number ZC18.The Principal Office of the Company is situated in England at 1 Basinghall Avenue, London, EC2V 5DD. Standard Chartered Bank is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and Prudential Regulation Authority.

Standard Chartered Bank, Dubai International Financial Centre having its offices at Dubai International Financial Centre, Building 1, Gate Precinct, P.O. Box 999, Dubai, UAE is a branch of Standard Chartered Bank and is regulated by the Dubai Financial Services Authority (“DFSA”). This document is intended for use only by Professional Clients and is not directed at Retail Clients as defined by the DFSA Rulebook. In the DIFC we are authorised to provide financial services only to clients who qualify as Professional Clients and Market Counterparties and not to Retail Clients. As a Professional Client you will not be given the higher retail client protection and compensation rights and if you use your right to be classified as a Retail Client we will be unable to provide financial services and products to you as we do not hold the required license to undertake such activities.

For Islamic transactions, we are acting under the supervision of our Shariah Supervisory Committee. Relevant information on our Shariah Supervisory Committee is currently available on the Standard Chartered Bank website in the Islamic banking section at: https://www.sc.com/en/banking/islamic-banking/

ANNEX

Top 5 Sustainable Development Goals currently supported across the markets