Press release

Almost 80% of affluent Asians see travel as ideal retirement lifestyle

Standard Chartered study reveals aspirational retirement plans among respondents, but many challenged by lack of financial knowledge

Singapore – Affluent consumers across Asia have big plans for retirement but feel they lack the financial knowledge and investment advice to make sufficient returns on their investments, finds a new independent study commissioned by Standard Chartered.

The study of 1,000 economically active affluent individuals aged 35 to 59, across five markets – China, Hong Kong, Malaysia, Singapore and Taiwan – offers new insights into retirement aspirations. Travel tops the list of retirement goals in all markets, but the study also reveals significant differences in approaches to retirement planning.

Leisure travel stands out as top retirement lifestyle

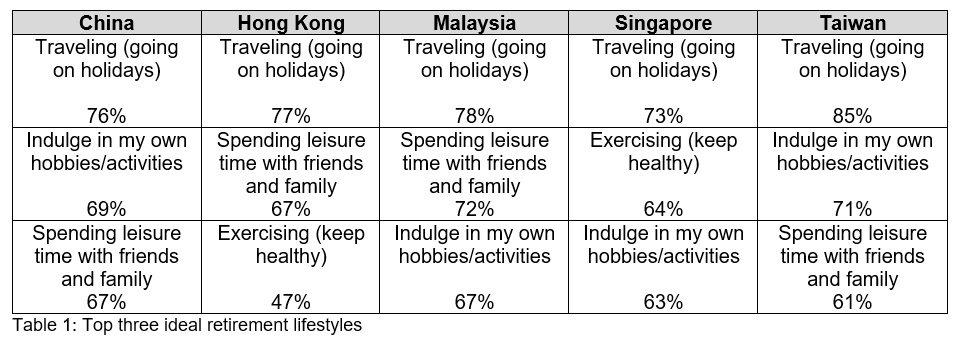

When asked about their ideal retirement lifestyle, around 77% of the respondents identified leisure travel as their top priority. There is also a strong focus on keeping healthy by staying active and exercising among respondents in Singapore and Hong Kong.

Challenges to retirement planning

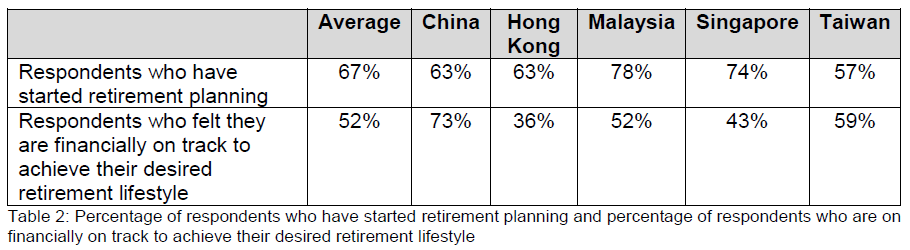

On average, 67% of respondents indicated that they have started retirement planning, with Malaysia and Singapore ahead of their peers. Despite this, only slightly more than half of those surveyed felt that they were financially on track to achieve the retirement lifestyle they desire.

When it comes to retirement planning, affluent consumers across China (60%), Taiwan (55%), Malaysia (55%) and Singapore (53%), flagged insufficient awareness of the investment opportunities that generate adequate returns; while the unfavourable global financial climate was top of mind for those in Hong Kong (50%). Other challenges highlighted included a lack of financial knowledge and trusted financial advisors.

Fernando Morillo, Global Head Retail Products and Segments at Standard Chartered, said: “While people in our markets are accumulating more wealth they are also living longer. When you combine this with increased cost of housing and education, and a greater appetite for leisure and travel, it’s clear that retirement savings needs to increase. Making the right financial decisions has never been more important but, as our retirement study clearly shows, many consumers feel they lack the financial knowledge to invest.

“We want to ensure that all our clients have the knowledge to make informed decisions to grow their wealth and realise their dreams. This is why we provide them with unbiased information and relevant advice, so they can make their money work harder to be able to achieve their life goals and retire comfortably.”

Visit our Retirement Survey 2019 site or download the full report.

For further information please contact:

Josephine Wong

Group Media Relations

+65 6596 4690