Press release

Is USD1 million enough?

New ‘wealth expectancy’ measure reveals six out of 10 people in fast-growing economies will fall short of their wealth aspiration

London – Standard Chartered’s new Wealth Expectancy Report 2019, which examines the saving and investment habits of 10,000 emerging affluent, affluent and high-net-worth individuals (HNWIs) across 10 fast-growing economies, reveals a universal challenge: people’s aspirations outstrip their ‘wealth expectancy’, or their total net wealth at age 60.

The report finds that on average across China, Hong Kong, India, Kenya, Malaysia, Pakistan, Singapore, South Korea, Taiwan and the UAE, nearly six out of 10 people are facing a wealth expectancy gap of 50 per cent or more. This highlights the difference between the wealth that individuals with disposable income to save and invest can expect in retirement, and what they say they need to live comfortably.

Even with a global average wealth expectancy of more than USD1 million, most are at risk of not being able to afford the retirement lifestyle they aspire to. The problem is most acute among the emerging affluent: with an average wealth expectancy of USD420,000, 62 per cent will fall short of their aspiration by at least half. For the affluent with an average wealth expectancy of USD821,000, more than half (53 per cent) face a wealth expectancy gap of 50 per cent of more. 46 per cent of the HNWIs will not meet their aspiration by at least half, at a global wealth expectancy of USD2,022,000.

59 per cent of respondents in this study rely primarily on savings accounts to achieve their top three financial goals, potentially missing out on higher-return investment solutions to drive up their wealth expectancy. Only 37 per cent use stocks or equities and only 36 per cent invest in mutual funds or unit trusts, showing that available wealth management options are significantly underutilised.

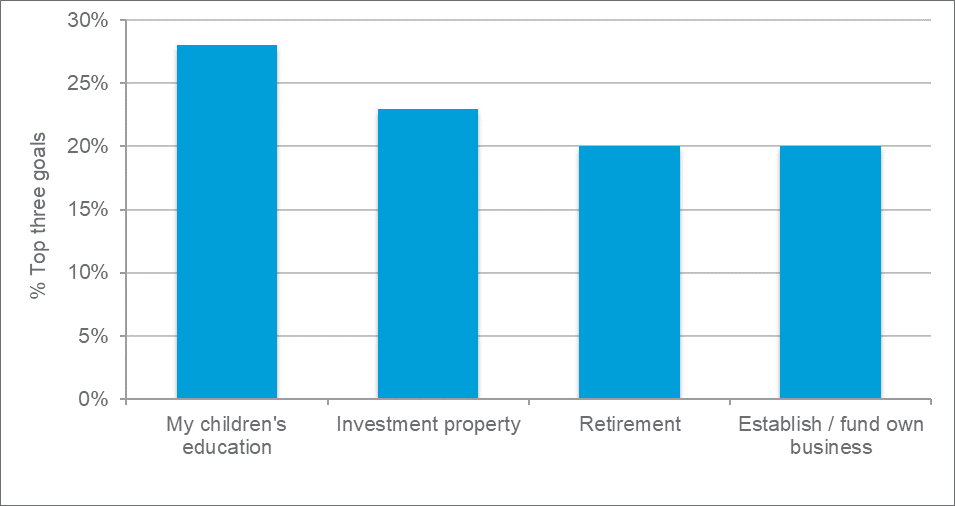

While retirement is among the top goals people are working towards, funding their children’s education is the highest priority for savers, with 28 per cent putting this as one of their top three financial goals. This is followed by investing in property (23 per cent), retirement (20 per cent) and establishing or funding their own business (20 per cent).

Digital access is making wealth management simpler and more accessible. At 61 per cent, most savers believe being able to manage their investment products online has given them the confidence to invest in products that they would not have considered previously. 40 per cent use their bank’s website or mobile app, while one-third use online investment portfolio apps, online-only banks and online stockbrokers to help them meet their financial goals.

The report also finds that digital is age agnostic, with older age groups almost as likely to use solutions such social trading networks to achieve their financial goals.

For savers, closing the wealth expectancy gap is not just about earning more money, but about making their money work harder. The study reveals people with similar incomes face wealth expectancy gaps of varying sizes.

Fernando Morillo, Global Head of Retail Products and Segments at Standard Chartered, said:

“Identifying as high net worth or affluent now is not an indicator of being able to achieve your wealth aspiration in future. With 56 per cent of savers in our study looking set to be disappointed with their financial situation when it comes to retirement, the time to take action is now. Financial institutions have an important role to play, starting with an understanding of their clients’ needs, so that they can educate and empower them to manage their wealth in line with their aspirations”.

The Standard Chartered Wealth Expectancy Report 2019 is available to download at: https://av.sc.com/corp-en/content/docs/wealth-expectancy-report-2019.pdf

Notes to editors:

The Standard Chartered Wealth Expectancy Report 2019 uses a blend of opinion research into the financial situation and behaviours of 10,000 wealth creators across China, Hong Kong, India, Kenya, Malaysia, Pakistan, Singapore, South Korea, Taiwan and the UAE, and a proprietary economic model that considers other macroeconomic factors such as GDP growth and interest rates, to calculate how much the wealth creators are set to be worth at their wealthiest, assumed to be age 60. This wealth expectancy figure is then used to calculate how much individuals can live off each month throughout their retirement. Unlike traditional measures of prosperity, such as GDP or life expectancy, Wealth Expectancy offers a more nuanced measure of prosperity that individuals have the power to change.

For further information please contact:

Josephine Wong

Group Media Relations

+65 6596 4690