Press release

Our study reveals social mobility is booming across Asia, Africa and the Middle East

Emerging affluent enjoying impressive earnings growth, and higher levels of education, employment and home ownership than their parents

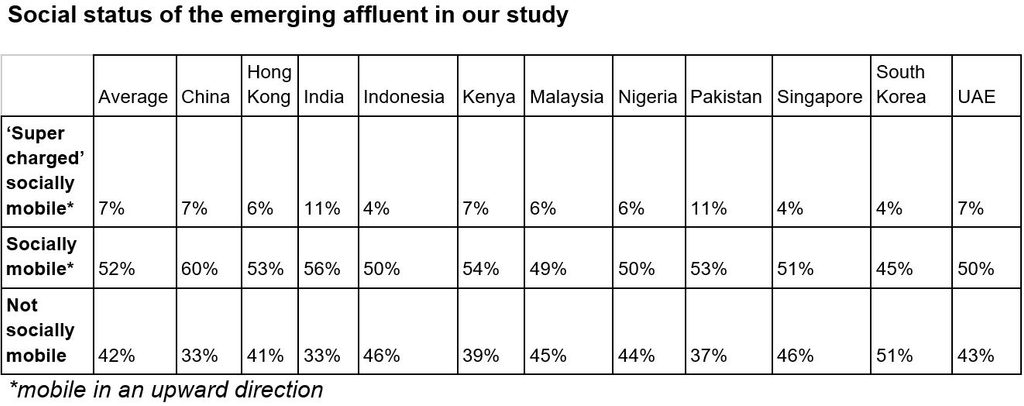

More than half (59%) of emerging affluent consumers in Asia, Africa and the Middle East are experiencing upward social mobility, a new Standard Chartered study shows. Of these, 7% are enjoying ‘supercharged’* social mobility, not just relative to the previous generation, but compared to the rest of the socially mobile.

The Emerging Affluent Study 2018 – Climbing the Prosperity Ladder – examines the views of 11,000 emerging affluent consumers – individuals who are earning enough to save and invest – from 11 markets across Asia, Africa and the Middle East.

The socially mobile in the study have had impressive earnings growth, with over a third (35%) enjoying a salary increase of 10% or more in the past year, and more than a quarter (28%) seeing their earnings jump by 50% or more in the past five years.

The socially mobile are also better educated and achieving higher levels of employment and home ownership than their parents. 85% went to university, compared to half (50%) of their fathers and 41% of their mothers; and three-quarters (75%) are in management positions or running their own businesses compared to 52% of their fathers and 34% of their mothers. Meanwhile, 88% of the socially mobile own their own home, compared to 78% of their parents.

Levels of optimism among the emerging affluent are even higher than the reality, with 70% believing they are in a better financial position than their parents compared to the 59% in the study that are actually socially mobile.

Of the markets in the research, China and India lead the way; in both countries 67% of their emerging affluent consumers are social mobile. Pakistan is not far behind with overall social mobility of 64%.

Unsurprisingly, upward social mobility in Asia’s more developed markets is not quite as high as the emerging markets in the study, given their maturing economies. In Hong Kong 59% of the emerging affluent are socially mobile, and Singapore is close behind (55%). South Korea is the only market in the research where less than half of the emerging affluent qualify as socially mobile, sitting just slightly lower at 49%.

Of the other markets in the study, most of the emerging affluent are socially mobile in Kenya (61%), the UAE (57%), Nigeria (56%), Malaysia (55%) and Indonesia (54%).

The study also reveals that more than two-thirds (69%) of the emerging affluent believe effective wealth management holds the key to greater social mobility. Investing in financial products is helping them to keep moving up the ladder, with more than half (56%) of the emerging affluent saying that this is their strategy for meeting their financial goals and increasing their wealth.

Other findings from the study, now in its fourth year, include:

Digital dividends: technology holds the key to financial success

Nearly two-thirds (65%) of the emerging affluent say their familiarity with digital tools has been vital to their personal success. The same number say online banking makes them feel that they have more control over their money and investments, and 61% say digital money management has helped them get closer to achieving their financial goals.

On-demand advisors alleviate risk aversion

The emerging affluent are comfortable going online for financial advice, with more than half (56%) saying they would invest in financial products online if an on-demand adviser was available. Risk is not a problem for the emerging affluent if strong rewards are possible: 53% would accept a high level of risk for a high level of return when investing their money in online financial products.

The rise of the financially digitally savvy

The emerging affluent who are digitally savvy** are more confident and proactive about using technology to manage their money, and more prosperous overall. Two-thirds (66%) of the digitally savvy say they feel affluent compared to half of those who are not, and they are 10% more likely to be close to meeting their top saving goal. Digital savviness also goes hand-in-hand with improving their social status: 62% who are digitally savvy are socially mobile, compared to just half (50%) of those who are not.

Ben Hung, CEO of Retail Banking & Wealth Management, Standard Chartered, said:

“Emerging affluent consumers are on an upward social trajectory: they are outstripping their parents’ success in education, careers and home ownership. As their ambitions and aspirations grow, they’re demanding convenient financial services and digital technology to broaden their access to money management and advance their financial wellbeing. It’s an exciting journey where they are not only improving their own lives, but they are also fuelling growth in some of the world’s most exciting markets.”

For further information please contact:

Stephanie Batot

Director, Business Communications (Retail Banking)

Standard Chartered

+65 65960166

Stephanie.Batot@sc.com

Note to Editors

- *For the purposes of this study, ‘supercharged’ is defined as individuals who are demonstrating extreme positive mobility by advancing their position further and faster than the rest of the socially mobile, resulting in a very significant gap between their parents’ situation and their own, and a strong increase in earnings

- ** For the purposes of this study, ‘digitally savvy’ is defined as the frequent use of a variety of digital products and services and confidence in using them

- The survey markets: China, Hong Kong, India, Indonesia, Kenya, Malaysia, Nigeria, Pakistan, Singapore, South Korea, the UAE

- In charts, due to the rounding of decimal places, displayed figures may not always add up to 100%