Press release

Some 68% of HNW investors want to help create a better future through sustainable investing

Returns take a backseat as investor motivations evolve

24 June 2019, Singapore – High-net-worth (HNW) investors in Asia are expected to increase their investment allocation in sustainable investments to almost 20%, bolstered by a growing desire to create a better future through their investment dollars, according to the 2019 Asia Sustainable Investing Review1 conducted by Standard Chartered Private Bank.

This year’s survey of HNW investors continued to track the three investor archetypes – Altruists, Value Seekers and Unengaged – in China, Hong Kong, Singapore and India. The survey examined patterns in their engagement in sustainable investing, motivating factors and what is holding them back, compared with 2018.

The study revealed that investors’ knowledge about sustainable investing continues to improve. In Asia, now almost 30% of investors can correctly define it, up from 20% in last year’s survey. Similar to 2018, Singapore continues to have the highest number of HNW investors (43%) in Asia who are knowledgeable about sustainable investing. In China and Hong Kong, there were improvements of 5% and 15% in understanding from last year to 18% and 27%, respectively.

Value Seekers remain dominant sustainable investor type

The growing social conscience of HNW investors across archetypes is reflected in their top motivation: “Create a better future” (81% for Altruists and 63% for the Value Seekers). Within the Altruists and Value Seekers, we uncovered a new sub-category of Aspirants, investors who claimed to be engaged in sustainable investing, but have not started yet.

The evolution of sustainable investing follows a pattern

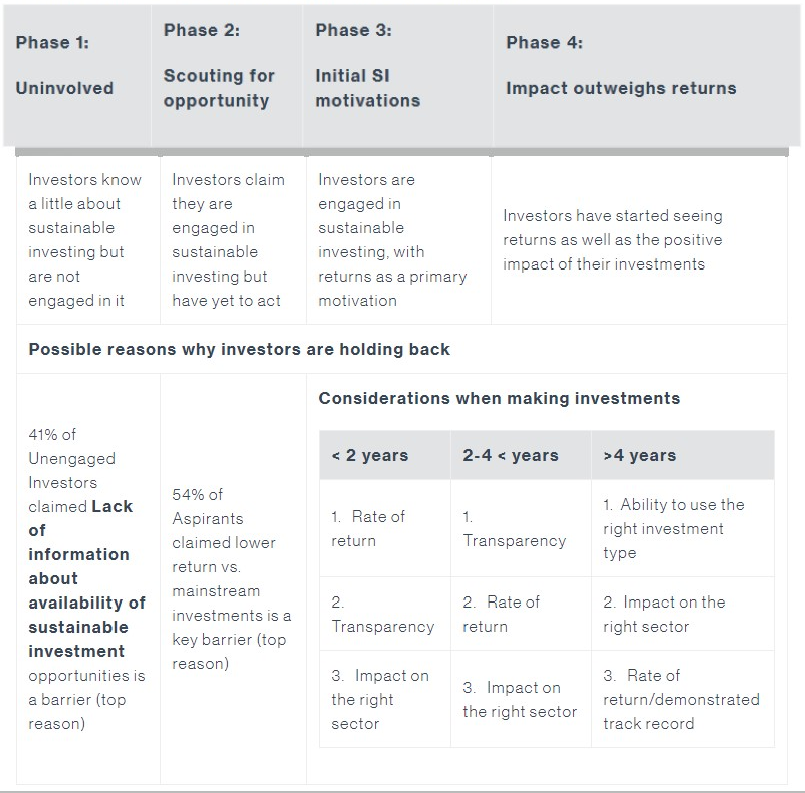

Compared with 2018, this year’s survey highlighted a pattern of evolving investor behaviour, as they progress along their sustainable investing journey. It also uncovered some of the factors investors consider as they mature in their use of sustainable investments.

Investors are keen to engage, but some are still holding back

Sustainable investments now make up around a fifth of Asian investors’ investment funds; in China, a majority of respondents have already allocated between 25% to 50% of their funds to sustainable investments.

Investors are also increasingly keen to support the Sustainable Development (SDGs) goals with their funds, to bridge the annual funding gap of USD2.5tn in developing countries. Altruistic investors are most motivated by energy and climate issues (22%), while Value Seekers are most motivated by health and education goals (12%).

Despite the willingness to engage in sustainable investing, there remain some barriers holding investors back. In Asia, 41% of the Unengaged cited ‘Lack of information about sustainable investing opportunities’ while 40% of the Aspirants echoed this view as the top reason for not engaging in sustainable investing. Overall, 46% of investors in Asia felt that a ‘Demonstrated track record of positive financial returns’ would help increase their engagement with sustainable investing.

Didier von Daeniken, Global Head, Private Banking and Wealth Management at Standard Chartered said: “It is encouraging to know that investors have more access to information on sustainable investing. Nonetheless, some misconceptions still exist, and this is where banks play a crucial role to educate and help investors overcome their barriers to investing for impact. Our Impact Philosophy offers clients a structured way to invest towards causes they are passionate about, as well as to understand the risks and returns of potential opportunities. We are committed to helping investors use their funds to bridge the annual USD2.5tn funding gap required to achieve the SDGs.”

Standard Chartered Private Bank has launched a range of solutions to provide clients the opportunity to make both financial and social impact. In Q3 this year, the bank will incorporate Environmental, Social and Governance (ESG) scores into its wealth management investment advisory trade notes for equities. This will allow clients to build in ESG considerations into their equity investments.

1This second annual survey covered 416 high-net-worth individuals with a minimum of USD1m in investments, residing in four Asian markets – China, Hong Kong, Singapore and India.

For further information please contact:

Valerie Tay

Private Banking and Wealth Management Communications

Tel: +65 6596 9284

Standard Chartered Private Bank

Standard Chartered Private Bank provides private banking services to clients across Asia, Africa, the Middle East and Europe, through onshore booking centres in Singapore, Hong Kong, Dubai, India, London, and Jersey. We also offer global Trust and Fiduciary capabilities through our Singapore centre.

Our aspiration to be the private bank of choice among generations of entrepreneurs is built on Standard Chartered’s inherent strengths: a heritage of some 160 years in international banking, a presence in 60 of the world’s most dynamic markets, and a strong understanding of growth markets. Through our global team of around 1000 employees, our relationship managers, investment advisors and product specialists have a deep understanding of our footprint markets and client needs, enabling them to connect our clients to an extensive range of wealth opportunities across our network.

For more information, please visit https://www.sc.com/en/banking/banking-for-individuals/private-banking/

Appendix

What investment vehicles are gaining popularity?

Investors are also evolving in their choice of sustainable investment solutions, with the use of equities, direct investments and discretionary portfolios with ESG focus on the rise among investors.

| Investment type | Equities | Direct Investments | Discretionary portfolios with ESG focus |

|---|---|---|---|

| Altruist |

44% (2019) 41% (2018) |

49% (2019) 38% (2018) |

54% (2019) 36% (2018) |

| Valued Seeker |

57% (2019) 49% (2018) |

52% (2019) 40% (2018) |

33% (2019) 26% (2018) |

Where are the investment dollars going?

Investors are increasingly keen to support the SDG goals with their funds, helping to bridge the annual funding shortfall of USD2.5tn. Altruistic investors are most motivated by energy and climate issues, while Value Seekers are most motivated by health and education goals.

| SDG | Altruist | Value seeker |

|---|---|---|

| Good health and well-being | 8% | 17% |

| Affordable and clean energy | 22% | 8% |

| Quality education | 8% | 12% |