Press release

Standard Chartered accelerates API adoption with launch of new Open Banking Marketplace

Enhanced plug-and-play platform focuses on user experience with reduced implementation time by streamlining business-to-bank collaboration

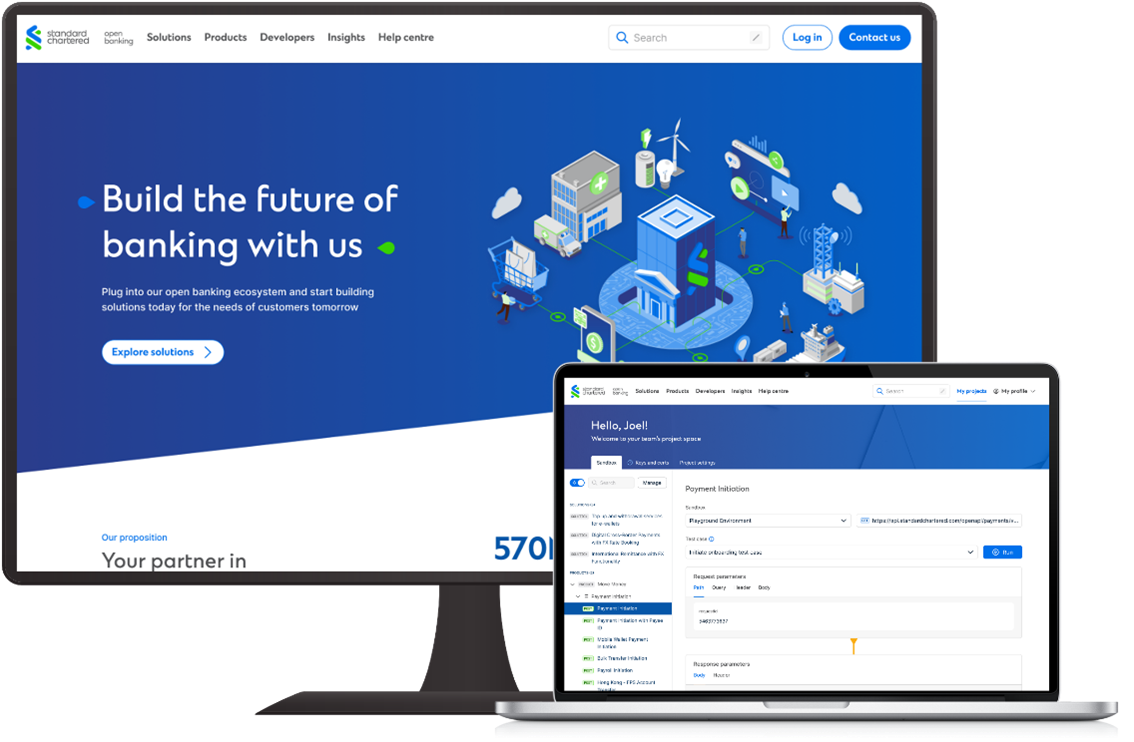

Money20/20 Asia, Bangkok – Standard Chartered today announced the launch of its new Open Banking Marketplace, a one-stop platform that enables both existing and prospective clients to discover, identify, and test application programming interfaces (APIs) that best meets their business objectives in a sandbox environment. With the objective of streamlining business-to-bank collaboration, corporates who are keen to partner with the Bank in their digital transformation can benefit from a shorter discovery and implementation process, by allowing their developers to start coding and plugging into the Bank’s open banking ecosystem to simulate the experience almost immediately1.

In embracing the future of banking, Standard Chartered has been focused on enhancing its open banking capabilities through the sharing and use of APIs. The Open Banking Marketplace builds on an earlier iteration of the Bank’s aXess platform that was launched in 2019 – which was part of a broader initiative targeted at the developer community to boost its open banking capabilities – and offers a richer user experience with the aim of accelerating open banking adoption by making it easier for corporates to tap into the applications required.

Besides the ability to access a growing suite of more than 100 ready-built API products from cash and FX to trade and securities, users of the platform can also enjoy other unique features such as:

- Browse and filter solutions tailored to their industry across 33 markets globally, including manufacturing, fintech, technology, e-commerce and more;

- Create a project space and conduct testing with their team in an upgraded simulator environment which allows them to write and test production-ready code; and

- Explore new developer guides such as API technology documents and tutorials on the Bank’s security protocols and authentication.

The Open Banking Marketplace also features past use cases and client stories specific to each API product, offering insights on replicable solutions and tangible outcomes that illustrate how Standard Chartered’s open banking solutions can provide value-add to businesses – especially useful for stakeholders beyond those in the developer community.

“Open banking has been a transformative force over the last decade, with APIs playing an important role in enabling corporates to build future-proof propositions that meet the needs of the evolving digital economy. What is needed to further its adoption is a shift in focus towards a better user experience – one that is less technically focused and offers simple, plug-and-play solutions,” said Mark Willis, Standard Chartered’s Global Head of API & Open Banking Ecosystems, Digital Channels & Data Analytics. “Accelerating on our commitment to drive innovation by partnering with developers, corporates and fintechs to embark on this transformation journey, we are excited to introduce our new and revamped Open Banking Marketplace that provides a comprehensive, user-friendly interface to help them make informed and timely decisions when assessing and implementing the use of APIs within their business environment. The initial feedback from our clients and partners have been extremely positive – through the various resources available on the platform, we hope that more of them can draw inspiration from the other organisations who have successfully tapped into our suite of API products to realise their business objectives.”

Watch this video to find out about the Open Banking Marketplace: https://www.youtube.com/watch?v=G8J1HZ9fWxs

1 Interested parties need to register for an account on the Open Banking Marketplace, subject to the Bank’s review and approval. The account will allow users to plug into a simulator environment that aims to closely replicate the experience as closely as possible.

For further information please contact:

Josephine Wong

Group Media Relations

+65 6981 1514