-

SME Banking

Take your business further

Banking for SMEs backed by innovative online platforms, an international network and inclusive financing

Fuel your business growth with comprehensive banking solutions

Innovative solutions

Manage transactions easily with a choice of bank accounts, payroll services, instant payments and collections capabilities

International network

Expand your business with the network that connects you to the world’s fastest growing markets

Inclusive financing

Seize opportunities with funding options that keep pace with your growth, including a dedicated programme supporting women-led SMEs

Online Banking

Make payments, track your business transactions and gain real-time insights, even while you’re on the move, with our award-winning online and mobile banking.

Cash Management

Make your cash-flow management easy with a full range of domestic and international payments and collections solutions. From a choice of bank accounts to payroll services and instant payments, you can stay in control.

Supply Chain Financing

Enjoy faster payments, lower administration costs and more partner loyalty with packaged finance facilities based on your partnerships.

Protection and Insurance

Manage your business contingencies with a team of Insurance Specialists who, together with our selected Insurance Partners, deliver insurance solutions underwritten by the respective insurers.

Trade Financing

Confidently trade internationally with access to a comprehensive range of trade finance solutions and team of trade specialists in over 50 markets.

Foreign Exchange solutions

Meet your hedging needs and funding requirements such as remittances, payment of trade bills, fund transfers and more.

Investment and wealth

Access timely global market insights to help you identify investment opportunities from our expert team of investment strategists and advisors.

Business Loans and Working Capital

Maximise growth opportunities, manage day-to-day operations and navigate unexpected challenges with a range of credit facilities. Enjoy competitive interest rates and a variety of repayment options across solutions from overdrafts and unsecured business loans to property financing.

Women-led businesses

Access tailored financing, insights and networking opportunities designed to support female entrepreneurs with the Standard Chartered Women’s International Network.

Relationship Managers

Streamline your finances and achieve your business goals with help from our Relationship Managers. Backed by teams of specialists they are committed to understanding your unique needs and offering tailored finance solutions

Global insights for SMEs to inform international growth opportunities

China SME Confidence Index

Gain insights into the latest dynamics impacting SMEs in one of the world’s largest economies

Business Outlook

Read how the global economy is expected to be a soft landing, with risks in our latest Global Economic Outlook 2024 report

Global Market

OutlookAccess our perspective on individual wealth opportunities with the latest Global Market Outlook from our Chief Investment Office

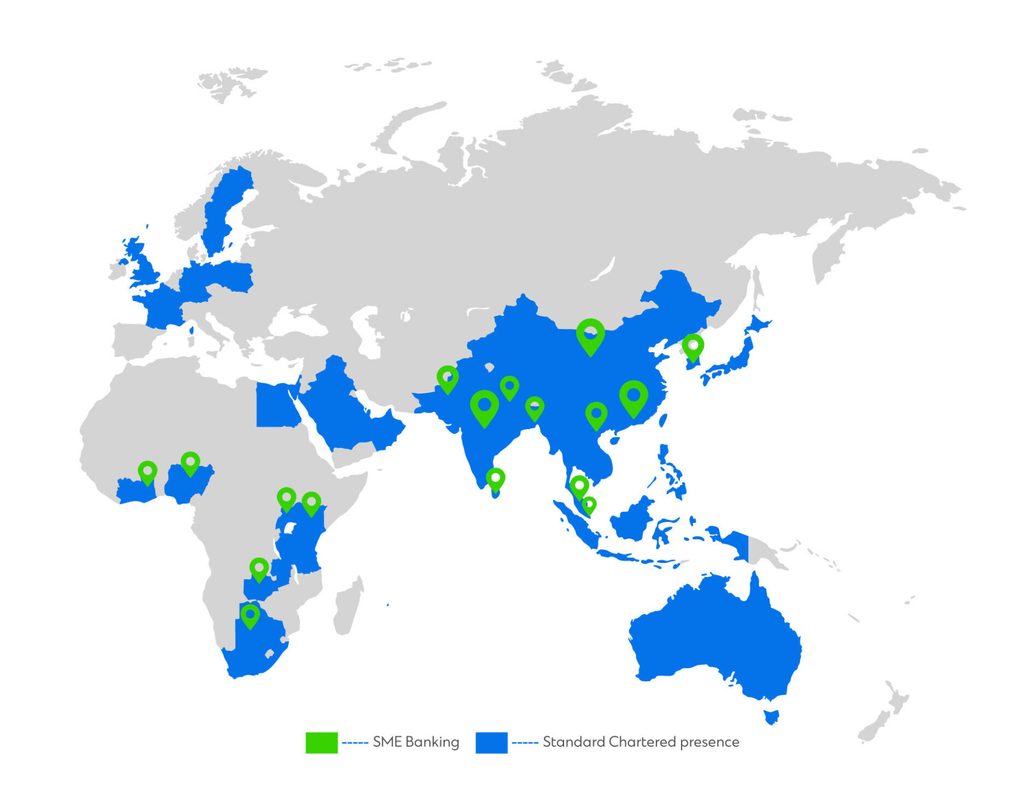

A banking network placed to support your business

With comprehensive SME Banking services in 18 markets, we support our clients

across 52 markets with a unique heritage across Asia, Africa and the Middle East

Additional banking services

Corporate and Investment Banking

Solutions for businesses with turnover of USD $100M and above per year

Private Banking

Grow and protect your wealth with Standard Chartered Private Banking

Wealth Solutions

Explore our expert insights, analysis and wealth solutions